In the ten months that have passed since Hurricanes Irma and Maria ravaged the Caribbean, much interest has been focused on Puerto Rico and its roughly 3.3 million American citizens, who weathered the largest blackout in U.S. history. However, far less attention has been paid to the U.S. Virgin Islands, even though St. Thomas, St. Croix, St. John, and a number of smaller islands suffered comparable devastation. This is partly attributable to their much smaller population: the U.S. Virgin Islands (“Virgin Islands”) is home to roughly 105,000 people—1/30th Puerto Rico’s population. Even so, this territory is also part of the United States and the New York Fed’s district. In this post, we examine roughly six months of economic and related data on the Virgin Islands’ economy to better ascertain the extent of disruption and subsequent recovery from the devastation of Hurricanes Irma and Maria.

A Brief Backdrop

The U.S. Virgin Islands’ economy was already weak when the hurricanes struck, though its fiscal situation was not quite as dire as Puerto Rico’s. As noted in this 2013 blog post, the shutdown of a major refinery on St. Croix in 2012 was a huge blow to the economy, further increasing the islands’ dependence on tourism. Employment fell by about 15 percent between 2011 and 2014, and had been essentially flat until last September.

Although it had been close to a century since Puerto Rico had taken a direct hit from a storm like Maria or Irma, the U.S. Virgin Islands have had more recent experiences: Hurricane Marilyn in 1995 and Hugo in 1989. In neither of those cases, though, did all three of the major islands take a direct hit. Hugo passed directly over St. Croix, while Marilyn hit St. Thomas and St. John. Unfortunately, 2017 was a different story. On September 6, Hurricane Irma passed directly over the latter (northern) islands, while St. Croix took a direct hit from Maria on September 20. Thus, the magnitude of the damage and disruption for the territory as a whole was unprecedented in recent history. Moreover, with Puerto Rico effectively out of commission after Maria, the Virgin Islands could not expect any help from the nearby island.

Assessing the Economic Effects

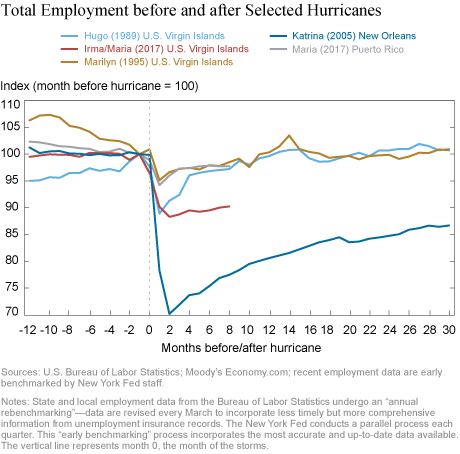

Based on the latest available data, total employment in the U.S. Virgin Islands dropped by an estimated 12 percent (4,500 jobs) between August 2017—right before Irma and Maria—and November. As of May 2018, only a fraction of those job losses (about 600) have been reversed. As shown in the charts below, the Virgin Islands’ economy appears to have been dealt a considerably bigger blow from the storms than was the case after either Hugo (1989) or Marilyn (1995)—though not nearly as severe as the 30 percent decline New Orleans experienced after Hurricane Katrina (2005). The economic effects of Irma and Maria also look substantially more severe in the Virgin Islands than in Puerto Rico, where employment fell by about 6 percent right after Maria but has since reversed more than half of those job losses.

This last fact may seem somewhat surprising, given the persistent and widespread power outage that afflicted much of Puerto Rico for months, as well as the disruption to potable running water. Moreover, in contrast with the Virgin Islands, where literally everyone lives within a few miles of the coastline, many of Puerto Rico’s communities are deep in the mountains many miles from the shore—leaving them cut off, not only from the power and water supply, but also from transportation and communications for many weeks. With this greater disruption of everyday life occurring in Puerto Rico, why would the economic effect appear considerably more severe in the Virgin Islands? A least part of the answer lies in the Virgin Islands’ high dependence on tourism.

Dependence on Tourism

Because tourism tends to be particularly sensitive to the aftermath of natural disasters, the Virgin Islands’ dependence on this industry largely explains the relatively severe economic hit. In contrast, Puerto Rico’s economy is fairly diversified, with a growing but relatively modest tourism industry.

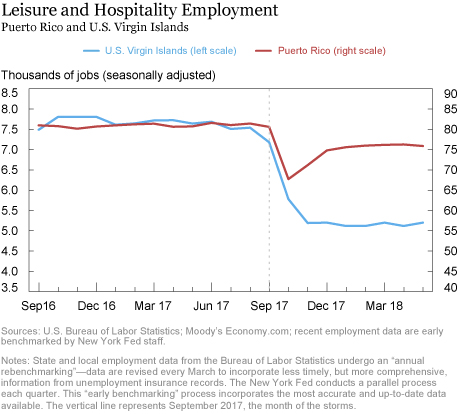

As a means of illustrating this difference, note that the accommodation industry—which represents just over 2 percent of private-sector jobs in Puerto Rico—accounts for roughly 13 percent in the U.S. Virgin Islands. As is typical following major storm-related disasters, the accommodation industry in the Virgin Islands saw a particularly steep slump after the storm: as of December, employment in that industry had fallen by 1,300 jobs, or 35 percent, comprising three in ten of the territory’s lost jobs. Employment in the broader leisure and hospitality sector—which also includes restaurants and bars but largely caters to visitors—fell by 2,200 jobs, or 29 percent, in the Virgin Islands, representing nearly half of the total job loss. It is clear that such a big hit to such an important industry would have a severe effect on the local economy. In Puerto Rico, by contrast, leisure and hospitality job losses accounted for only about a quarter of the total job loss.

This hit to the local economy was reflected in the steep fall in the number of visitors to the Virgin Islands. Most tourists arrive by cruise ships, with a smaller but still significant number arriving via plane. Prior to Hurricanes Maria and Irma, a typical four-month period would bring roughly 600 to 700 thousand cruise ship visitors to the Virgin Islands. Beginning in September, however, the number of cruise ship passengers fell sharply. From September to December 2017, only 241 thousand passengers arrived on cruise ships—a 57 percent drop from the year before.

The number of visitors arriving by air reflected a similar pattern. Air travelers tend to stay overnight and for a much longer period than cruise ship visitors, and they also tend to spend considerably more money on the islands. While the number of cruise ship visitors has been gradually trending down in recent years, arrivals via airplane have become increasingly popular and continued to rise in the first eight months of 2017. However, arrivals by air from September to December dropped precipitously, with only 53,000 people arriving via plane—as compared to an average of 208,000 arrivals in the last four months of 2014-2016.

Even if visitors wanted to visit the Virgin Islands after the destruction wrought by Hurricanes Maria and Irma, many of the hotels would be unable to house them. The hotels on the Virgin Islands have had greater difficulty than those on Puerto Rico bouncing back. In Puerto Rico, as of mid-May, an estimated 89 percent of the 149 hotels officially endorsed by the Puerto Rico Tourism Company have reopened. Around 3,800 new rooms are slated to open in the next two years. In the Virgin Islands, on the other hand, only 60 percent of accommodations were open for business, as of mid-2018. Moreover, relief workers were being housed in many of the available rooms, leaving few for conventional tourists or business travelers. Remarkably, there has been virtually no new hotel construction in the Virgin Islands for more than two decades.

Ultimately, the sharp drop in visitors affected a whole swath of industries in the U.S. Virgin Islands. The number of people dining out, going shopping, buying groceries, etc.—in effect, contributing to the local economy—contracted far more sharply in the Virgin Islands than on Puerto Rico. That’s because a much smaller proportion of consumers were permanent residents. The influx of rescue workers, such as FEMA and army personnel, utility crews, and construction workers, mitigated this effect somewhat. These people not only provided valuable help in the recovery effort but also contributed to the economy as consumers—especially at hotels and restaurants. However, there just weren’t nearly enough to make up for all the missing tourists and “snowbirds” (seasonal residents).

Looking Ahead

The main challenge for the U.S. Virgin Islands’ economy is to get tourism up and running again, at or above its pre-storm pace. The key steps in doing so appear to be twofold: restoring its capacity to accommodate overnight guests, and encouraging visitors to come. In the long-term, however, it presents this territory with a dilemma that many economies have faced: Is it best to focus resources and policy on a key industry like tourism, which brings in money from outside, or should policy place more of an emphasis on diversifying into other industries, which may be less vulnerable to the periodic hurricane?

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Jason Bram is an officer in the Federal Reserve Bank of New York’s Research and Statistics Group.

Jason Bram is an officer in the Federal Reserve Bank of New York’s Research and Statistics Group.

Lauren Thomas is a senior research analyst in the Bank’s Research and Statistics Group.

Lauren Thomas is a senior research analyst in the Bank’s Research and Statistics Group.

How to cite this blog post:

Jason Bram and Lauren Thomas, “U.S. Virgin Islands’ Economy Hit Hard by Irma and Maria,” Federal Reserve Bank of New York Liberty Street Economics (blog), July 9, 2018, http://libertystreeteconomics.newyorkfed.org/2018/07

/us-virgin-islands-economy-hit-hard-by-irma-and-maria.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics