During the COVID-19 pandemic, many industries adapted to new social distancing guidelines by adopting new technologies, providing protective equipment for their employees, and digitizing their methods of production. These changes in industries’ supply chains, together with monetary and fiscal stimulus, contributed to dampening the economic impact of COVID-19 over time. In this post, I discuss a new framework that analyzes how changes in supply chains can drive economic growth in the long run and mitigate recessions in the short run.

Supply Chains and Productivity

Technological innovation is a key driver of economic growth. New innovations are often driven by changes in the processes and materials that firms use to make products. For example, agricultural production now uses satellites to evaluate crop yields, GPS devices for automatic navigation, and specialized computer software and hardware as well as sensors to test soil quality. Automotive manufacturing has undergone an even deeper transformation. The first commercial car designed by Karl Benz in 1885 had a body made of wood and steel. Modern car bodies are instead made up of aluminum alloys and carbon fibers. Carburetors have been replaced by electronic fuel injectors, traditional exhaust systems have been transformed with catalytic converters, and a range of electronic components, sensors, computer software, chemicals, and hydraulics have been added to improve aerodynamic efficiency and safety.

Competition and Supply Chains

Persistent changes in industry supply chains, together with the economic growth that they yield, are driven largely by competition between firms. The private sector—often in partnership with the public sector and with universities—consistently invests in research to develop new ideas, materials, and manufacturing processes.

In a recent paper, Acemoglu and Azar propose a new framework to capture how these competitive forces shape changes in supply chains. In particular, firms in this framework can choose among many different sets of potential suppliers, with each set yielding a different cost of production. Firms within an industry compete with one another on price and choose the set of suppliers that minimizes their costs. As new materials and inputs are discovered, new productivity-enhancing combinations are unlocked, and these competitive forces drive changes in the supply chain that increase aggregate productivity and GDP.

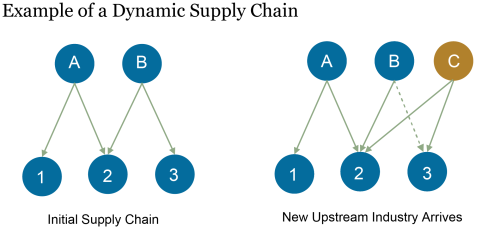

The exhibit below illustrates how supply chains for different firms can change when a new industry arrives into the market. The left panel shows two upstream industries (labeled A and B), which are suppliers to three downstream firms (labeled 1, 2, and 3). Industry A is a supplier to firms 1 and 2, and industry B is a supplier to firms 2 and 3. The right panel shows how the supply chain changes when a new upstream industry (labeled C) arrives to the economy. After industry C arrives, firm 2 reduces its costs by adopting it as an additional supplier. Firm 3 also changes its supply chain, ending its relationship with industry B and using the newly arrived industry C as its only supplier. In this illustration, firm 1 keeps industry A as its only supplier, indicating that adding industry C into the mix would not reduce its cost of production.

Industry Productivity and Aggregate Output

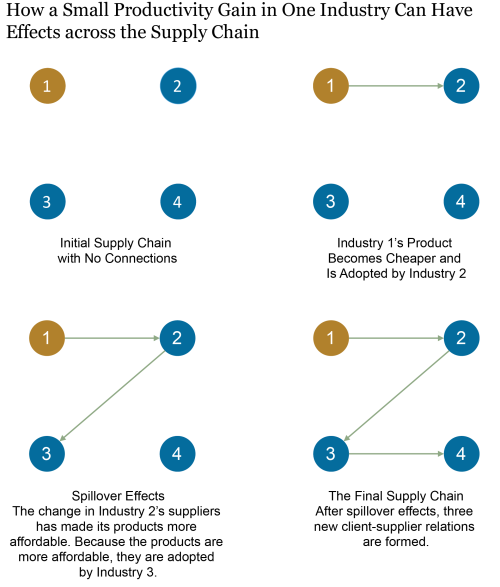

In this competitive framework, small productivity gains in one industry can have significant spillover effects on aggregate economic output. For example, consider an economy with four industries (see exhibit below). Initially, the supply chain is an empty network, so that no industries buy from each other and they all produce products using only raw materials and labor. If Industry 1 increases its productivity, its products become more affordable and are used by Industry 2 in production. This change in Industry 2’s supply chain has spillover effects on other industries. Because Industry 2 has changed its supply chain, its products are now more affordable and are adopted by Industry 3. Similarly, because Industry 3 has changed its supply chain, its products become cheaper and are used by Industry 4. We can see that, because new supplier–customer relations can be formed, a small productivity gain in Industry 1 can lead to a reorganization across the entire economy’s supply chain. Since each new customer–supplier relation can generate significant profits, GDP can increase substantially from a small improvement in Industry 1’s productivity.

This framework can be applied to the data to provide approximate estimates on how changes in one industry’s productivity will affect aggregate economic output. Using U.S. supply chain data from the Bureau of Economic Analysis, Acemoglu and Azar show that a 1 percent productivity gain in the computers and electronics sector would lead to a 0.72 percent increase in GDP, even though this sector is relatively small and accounts for only 1.98 percent of the overall economy. This effect is driven almost entirely by spillover effects: If computers and electronics become more productive, then industries downstream in the supply chain will have lower costs. When the costs of these industries’ products then decrease, it is more likely that the products will be adopted as inputs by other industries in the supply chain. In the empirical exercise by Acemoglu and Azar, the reorganization of the supply chain leads to 288 new customer–supplier relationships, and accounts for 82 percent of the overall change in GDP.

Changing Supply Chains during the COVID-19 Pandemic

During 2020, the COVID-19 pandemic collapsed the productivity of multiple sectors in the economy, including the health sector. The highly contagious coronavirus led to overrun hospitals as well as shortages in N-95 masks and other personal protective equipment (PPE). To restrain contagion, social distancing policies were introduced that limited the capacity of shops, theaters, hotels, restaurants, and schools; at the same time, the public voluntarily reduced its use of these and other high-contact services. These changes led many firms in these industries to shut down, operate virtually, or allow a limited number of customers at a time.

While, as a consequence, output decreased significantly in the first and second quarters of 2020, many industries adapted and changed their processes. In particular, health, service, and retail industries quickly adopted telecommunications and digitization in order to meet their customers’ needs while maintaining social distancing. Although data on economic activity during 2020 is still arriving, it is likely that these changes in supply chains, together with monetary and fiscal stimulus, contributed to mitigating the economic impact of COVID-19.

Pablo Azar is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Pablo Azar, “Endogenous Supply Chains, Productivity, and COVID-19,” Federal Reserve Bank of New York Liberty Street Economics, May 3, 2021, https://libertystreeteconomics.newyorkfed.org/2021/05/endogenous-supply-chains-productivity-and-covid-19.html.

Disclaimer

The views expressed in this post are those of the author and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics