In March 2020, U.S. prime money market funds (MMFs) suffered heavy outflows following the liquidity shock triggered by the COVID-19 crisis. In a previous post, we characterized the run on the prime MMF industry as a whole and the role of the liquidity facility established by the Federal Reserve (the Money Market Mutual Fund Liquidity Facility) in stemming the run. In this post, based on a recent Staff Report, we contrast the behaviors of retail and institutional investors during the run and explain the different reasons behind the run.

Retail and Institutional Investors during the COVID-19 Run of March 2020

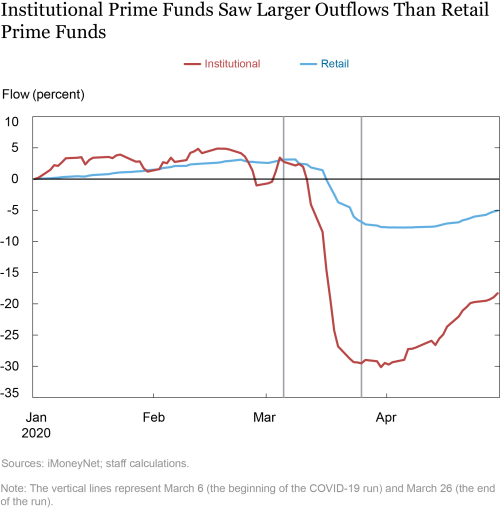

The chart below shows cumulative percentage outflows from prime MMFs offered to retail and institutional investors from January to April 2020. Institutional funds suffered larger outflows than retail ones, with outflows for institutional funds reaching 29 percent by March 26 versus only 7 percent for retail funds. The higher responsiveness of institutional investors to shocks buffeting the industry was also observed during the 2008 run, following Lehman Brothers’ bankruptcy.

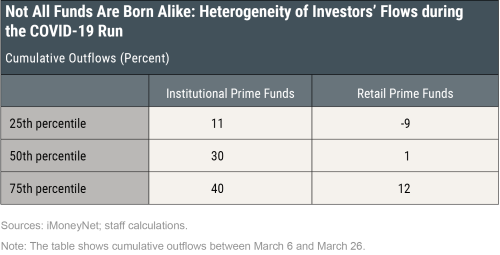

Not only did institutional prime funds suffer more outflows than retail ones, but there was also large heterogeneity within both institutional and retail funds. As the table below shows, whereas the median institutional prime fund suffered a 30 percent cumulative percentage outflow, one-quarter of institutional funds experienced outflows smaller than 11 percent and one-quarter experienced outflows larger than 40 percent. Similarly, the median retail prime fund suffered outflows of 1 percent, whereas one-quarter of retail funds experienced inflows greater than 9 percent and one-quarter experienced outflows greater than 12 percent. Understanding why some institutional and retail investors ran while others did not is the focus of our work.

Why Did Institutional Investors Run?

The 2014 reform of the MMF industry, enacted in October 2016, forced all prime funds to adopt a system of redemption gates and liquidity fees contingent on the level of the fund’s weekly liquid assets (WLA)—that is, cash, Treasuries, and other very liquid securities. If a fund’s WLA fall below 30 percent of its total assets, the fund is allowed to impose a liquidity fee of up to 2 percent on all redemptions or temporarily suspend redemptions for a period of up to ten business days. If the fund’s WLA fall below 10 percent, the fund is required to impose a fee of 1 percent, unless the board of directors determines that such a fee is not in the best interests of the fund shareholders. One concern is that a fund’s WLA may provide a focal point for investors to run, generating a so-called preemptive run; it is therefore interesting to study whether, during the COVID-19 run, investor outflows were larger in prime funds with lower WLA.

Teasing out the impact of WLA on run behavior, however, is complicated by the fact that WLA are themselves impacted by redemptions: typically, funds meet redemptions by selling some of their liquid securities, thereby reducing their WLA. In other words, redemptions may be higher in funds with lower WLA not because low WLA cause redemptions, but because redemptions lower WLA. To correct for this endogeneity problem, in the chart below, we plot fund outflows during the run (March 6-26, 2020) as a function of each fund’s past WLA level (as measured in the fourth quarter of 2019).

Each point in the chart is a fund. The left panel refers to institutional investors, the right panel to retail investors. There is strong negative relationship between an institutional fund’s WLA in the fourth quarter of 2019 and the outflows it experienced during the run. Indeed, regression analyses show that a 10 percentage point decrease in WLA in the fourth quarter of 2019 increases daily percentage outflows by 1.1 percentage points during the run; this is a very large effect considering that the run lasted approximately twenty days. Note that the relationship between outflows and WLA is not present in retail funds. Whereas institutional investors in prime MMFs were concerned about the impact of their funds’ WLA on their access to liquidity, this was not the case for retail investors.

Why Did Retail Investors Run?

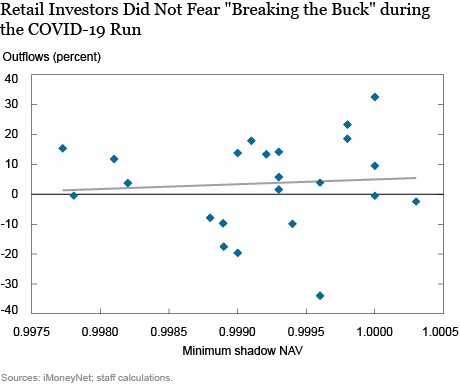

Since prime retail funds still operate with a stable net asset value (NAV), one could imagine that outflows were driven by the likelihood that a fund may break the buck (in other words, that the fund’s NAV per share may drop by more than 50 basis points), which would lead to a repricing of the fund’s shares and a credit loss for the investors. This does not seem to be the case. The chart below shows outflows from retail funds over the March 2020 run as a function of each fund’s minimum shadow NAV (the per-share NAV based on the market value of the securities in the fund’s portfolio) during the same period. Retail funds whose NAV reached lower levels during the run did not experience larger outflows.

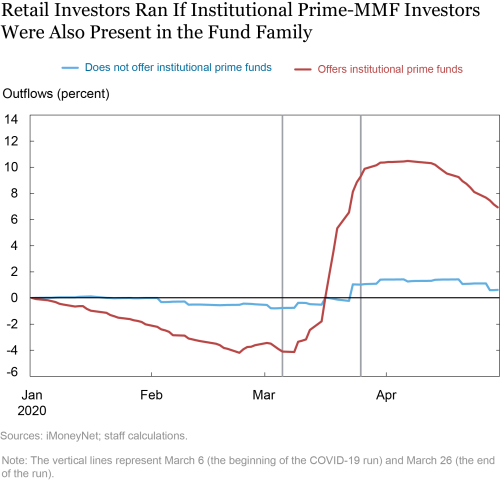

If neither WLA nor the NAV mattered for retail investors, what drove the heterogeneity of retail outflows during the COVID-19 run? The chart below shows cumulative percentage outflows from retail prime funds separately for two fund groups: those belonging to families that also offer institutional prime funds and those belonging to families that do not offer institutional prime funds. Retail outflows are concentrated in retail prime funds belonging to families that also offer institutional prime funds. Indeed, our regression analyses show that retail funds belonging to families with institutional prime funds experienced 1.4 percentage point higher daily percentage outflows during the run, a very sizable effect over a twenty-day period.

How can we explain such spillover from the institutional to the retail prime MMF sector? One possibility is that retail investors, who are generally less sophisticated, use the behavior of institutional investors in their own family as a signal, attaching to it informational value on the risk of the family’s retail funds. Indeed, not only did retail funds in families also offering institutional funds suffer larger outflows, but the size of retail outflows in these families is also positively correlated with the family’s institutional outflows. Our regression analysis shows that, during the run, a 10 percentage point daily outflow from a family’s institutional prime funds caused an additional 3 percentage point outflow in the family’s retail funds over the next five days.

Summing Up

Outflows from institutional prime MMFs during the early stages of the COVID-19 pandemic were higher in funds with lower weekly liquid assets (WLA), for which the imposition of gates or fees was more likely (consistent with the idea of preemptive runs). Retail investors did not respond to funds’ WLA or NAV but rather left funds from families with larger institutional outflows. This evidence suggests that the motivations behind the runs of institutional and retail investors are different.

Marco Cipriani is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Marco Cipriani is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Gabriele La Spada is a senior economist in the Bank’s Research and Statistics Group.

Gabriele La Spada is a senior economist in the Bank’s Research and Statistics Group.

How to cite this post:

Marco Cipriani and Gabriele La Spada, “Sophisticated and Unsophisticated Runs,” Federal Reserve Bank of New York Liberty Street Economics, June 2, 2021, https://libertystreeteconomics.newyorkfed.org/2021/06/sophisticated-and-unsophisticated-runs.html.

Related Reading

The Money Market Mutual Fund Liquidity Facility

Money Market Funds and Systemic Risk

Sophisticated and Unsophisticated Runs (Staff Report)

Gates, Fees, and Preemptive Runs (Staff Report)

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics