Recent inflationary pressures in the global economy have rekindled the debate on the link between money growth and price stability. Specifically, does rapid central bank money creation resulting from large-scale purchases of government securities fuel inflationary spending by households and firms? We argue that there are many valid reasons to be skeptical about this textbook narrative. In this post, we look at the international experience with regard to asset purchases, money growth, and inflation dynamics in the pre-COVID era in an attempt to draw lessons from the recent past. Most notably, we find that the view that large-scale purchases of sovereign debt cause unmanageable inflationary pressures is not supported by the experiences of foreign advanced economies. As a matter of fact, despite the extent and duration of the quantitative easing programs in those economies, central banks faced challenges in achieving their inflation objectives.

Background

The global financial crisis of 2008-09 pushed major foreign advanced economies to reduce their official policy rates to historically low levels, and provided extensive forward guidance on how long the rates would remain at their effective lower bounds. In addition, central banks in Japan, the United Kingdom, and the euro area embraced unconventional monetary policies—including quantitative easing (QE), with purchases of long-term public debt and, in some instances, private-sector financial assets—with the objective of providing accommodation and meeting their respective inflation targets.

Indeed, the Bank of Japan (BoJ), the European Central Bank (ECB), and the Bank of England (BoE) all share relatively similar policy objectives. The Bank of Japan Act states that the central bank’s monetary policy should aim to achieve price stability, which is identified as a 2 percent year-on-year rate of change in the consumer price index. The ECB before its recent review of the monetary framework defined price stability as a year-on-year increase in the Harmonized Index of Consumer Prices (HICP) for the euro area of below but close to 2 percent. Similarly, the BoE sets monetary policy with the objective of reaching the government target of 2 percent for consumer price inflation. Moreover, all of these institutions operate within similar structural economic frameworks in which sovereign debt is issued in domestic currency and the exchange rate fluctuates freely.

Central Bank Balance Sheets and Asset Purchases

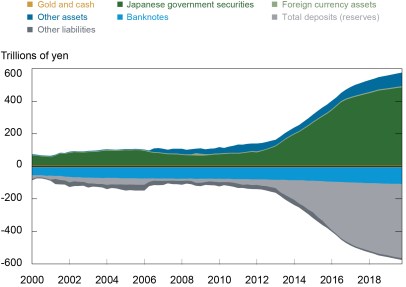

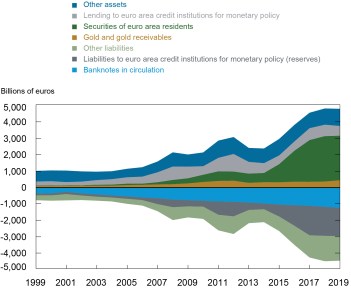

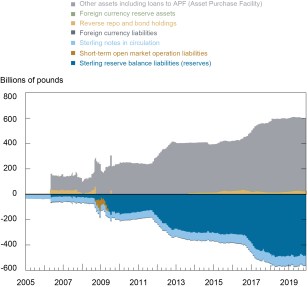

In engaging in QE operations, central banks purchase government bonds, financing the purchases by issuing bank reserves—thus increasing both the central banks’ assets and liabilities. The following charts illustrate the pre-COVID evolution of selected central banks’ balance sheets in major advanced economies.

BoJ Balance Sheet Composition

Source: Bank of Japan

ECB Balance Sheet Composition

Source: European Central Bank.

BoE Balance Sheet Composition

Source: Bank of England.

We note several similarities: First, there has been a large increase in the size of major central banks’ balance sheets. The balance sheet of the BoJ increased sixfold from the early 2000s, the ECB’s balance sheet by approximately four times since 2009, and the BoE five times starting from the pre–global financial crisis period.

Second, given the nature of the QE operations (that is, buying mainly government bonds in the secondary market), these central banks have accumulated a sizable fraction of the domestic government debt. Indeed, by the end of 2019, the BoJ held 43 percent of outstanding government debt (Japanese government bonds), the BoE held 32 percent of the debt (gilts), and the ECB held 24 percent of euro area government debt. By year-end 2019, the BoE’s holdings of gilts represented approximately 53 percent of the change in outstanding gilts since December 2008. The BoJ purchased more than the total change in national debt during the same period (namely, 158 percent), while the ECB absorbed 72 percent of the increase in euro area sovereign debt.

Finally, the increase on the asset side of the central banks’ balance sheets was mostly matched on the liability side by an increase in the stock of excess reserves of the banking sector (in other words, total deposits for the BoJ, liabilities to euro area credit institutions for the ECB, and sterling reserve balance liabilities for the BoE).

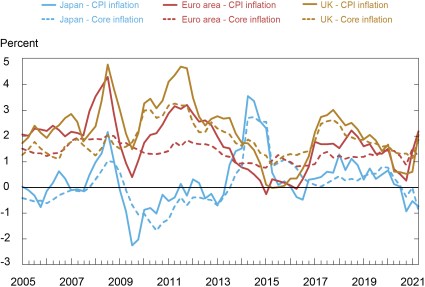

The aforementioned sizable upward changes in the share of government debt owned by central banks could point to widespread expectations of inflationary financing. Yet there were no discernible upward movements in underlying inflation, as shown in the chart below, which summarizes the evolution of inflation for Japan, the euro area, and the United Kingdom. We plot both core inflation measures and headline inflation.

Inflation for Japan, the Euro Area, and the UK

Sources: Ministry of Internal Affairs and Communications (Japan); Statistical Office of the European Communities (euro area); Office for National Statistics/Haver Analytics (UK).

Notes: Solid and dashed lines refer to overall CPI and core inflation, respectively. Inflation is calculated as a year-over-year percentage change.

The Rationale Behind Asset Purchases

Central bank asset purchases aim to stimulate spending by influencing longer-term interest rates. Lower interest rates boost durables consumption and investment spending, working to meet the inflation target as demand and prices increase.

The mechanism of transmission can be split into a number of interdependent channels describing how QE is meant to promote spending. Specifically, central bank purchases of financial assets:

- Lower both short- and longer-term rates, reduce term premia, and prompt agents to rebalance their portfolios, thus supporting an easing in broad financial conditions.

- Provide a signal about the evolution of the policy stance.

- Create capital gains for households that hold these assets, thus boosting wealth.

- May make banks more willing to lend because the reserves created by asset purchases increase the availability of bank credit (Joyce et al. 2012).

While all these channels point to a moderately effective role of asset purchases in stimulating the economy, the international experience under consideration does not support the view that such purchases create a rise in inflation rates. Particularly compelling is the lack of evidence supporting the conventional interpretation of QE as related to the “money multiplier approach.” Let’s briefly summarize the underlying economic logic.

From an accounting point of view, the central bank creates additional (excess) reserves for the banking system when it buys government bonds, thus increasing the monetary base (which consists of banknotes and banks’ reserves with the central bank). Banks get a new asset (central bank funds) that replaces the asset they sell.

Now, according to the textbook narrative there is a fairly stable money supply process driven by the actions of the central bank. The key assumption is that both banks and the money-holding sector respond in a predictable way to an increase in the monetary base. The volume of broad money supplied to the economy is then determined as a multiple of the monetary base. According to this framework, therefore, the increase in reserves prompts banks to make more loans and create additional deposits equal to a multiple of this increase. The creation of additional deposits stimulates spending and drives up prices. The more massive the scale of asset purchases programs, the argument goes, the more upward pressure on prices.

The Fall of Money Multipliers

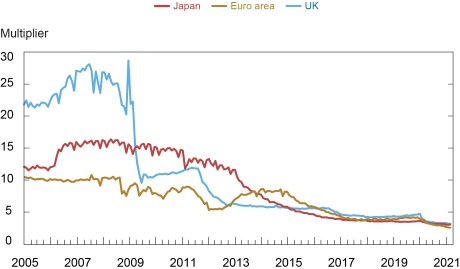

But the international experience is that the large volume of reserves did not lead to a corresponding increase in broad money. Indeed, the evidence points to large declines in the money multipliers (see the following chart).

Money Multiplier for Japan, the Euro Area, and the UK

Sources: Bank of Japan; European Central Bank; Bank of England.

Notes: The money multiplier for Japan is defined as new money stock (broad money) as a percentage of the money base, both defined by the Bank of Japan. For the euro area, the multiplier is defined as the money supply (M3) as a percentage of total ECB liabilities in the form of deposit facilities, currency accounts (minimum reserve system), and banknotes in circulation, defined by the ECB. For the United Kingdom, the multiplier is defined as the money supply (M4) as a percentage of total BoE liabilities in the form of reserve balances and notes in circulation, defined by the BoE.

How can we then interpret these recent experiences? One perspective builds upon what is referred to as the “endogenous money” approach (Moore 1988). According to this logic, banks’ lending is not dictated by reserves but by the extent to which commercial banks are willing to extend loans to their customers based on the profitability of those loans, regulatory considerations, and the creditworthiness of the customers. From an economic logic perspective, the reason that the commercial banks might be reluctant to lend depends on the extent to which they assess that there are creditworthy customers, so that the return on their loans is larger in risk-adjusted terms that the return on reserves. Other formal constraints on bank lending stem from the capital requirements that relate to quantity and quality of the assets that the banks must hold to fulfill regulatory obligations.

On the demand side, in an environment of low interest rates, agents may be unwilling to take advantage of the greater availability of liquidity to finance consumption or investment spending. Simply, if money in the form of cash or deposits is just as remunerative as other assets, agents have an incentive to hoard it without increasing their consumption. Similarly, firms might not invest if they expect sales to be depressed, resulting in a low demand of loans by the private sector. In this case, money velocity falls and the money multipliers shrink. Central bank liabilities increase considerably, but nominal spending does not.

According to this approach, the international experience does not suggest that quantitative easing is necessarily inflationary. Instead, it will be challenging to observe inflationary pressure associated with central bank reserves growth in a world of low natural interest rates related to demographic and other structural drivers. Whether these lessons shed light on the post-COVID environment will depend, among other factors, on how the gap between aggregate supply and demand will be closed, and to what extent fiscal policy over the medium term may boost aggregate demand and natural real interest rates, possibly offsetting the high propensity to save by the private sector.

Gianluca Benigno is an assistant vice president and head of international research in the Federal Reserve Bank of New York’s Research and Statistics Group.

Paolo Pesenti is a senior vice president and policy lead on monetary policy in the Bank’s Research and Statistics Group.

How to cite this post:

Gianluca Benigno and Paolo Pesenti, “The International Experience of Central Bank Asset Purchases and Inflation,” Federal Reserve Bank of New York Liberty Street Economics, October 20, 2021, https://libertystreeteconomics.newyorkfed.org/2021/10/the-international-experience-of-central-bank-asset-purchases-and-inflation.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics