This post concludes a three-part series exploring the gender, racial, and educational disparities of debt outcomes of college students. In the previous two posts, we examined how debt holding and delinquency behaviors vary among students of different race and gender, breaking up our analyses by level of degree pursued by the student. We found that Black and Hispanic students were less likely than white students to take on credit card debt, auto loans, and mortgage debt, but experienced higher rates of delinquency in each of these debt areas by the age of 30. In contrast, Black students were more likely to take out student debt and both Black and Hispanic students experienced higher rates of student debt delinquency. We found that Asian students broadly followed reverse patterns from Black and Hispanic students by age 30. They were more likely than white students to acquire mortgages and less likely to hold student debt, but their delinquency patterns were in general similar to those of white students. Women were less likely to hold an auto loan or mortgage and more likely to hold student debt by age 30, and in most cases their delinquency outcomes were indistinguishable from males. In this post, we seek to understand mechanisms behind these racial and gender disparities and examine the role of educational attainment in explaining these patterns.

One potential mechanism may be gender and racial disparities in labor market outcomes, such as in earnings and employment. Unfortunately, we do not have data on labor market outcomes for our sample of City University of New York (CUNY) students. Rather, we consider education outcomes as a proxy for labor market outcomes drawing on the overwhelming evidence in favor of a strong linkage between education and labor market outcomes. In this post, we leverage administrative data on demographic and educational outcomes from an anonymized data set of all first-time freshman students enrolled with CUNY, the largest urban college system in the United States, between 1999 and 2014.

As in the previous two posts in this series, we focus on students who entered CUNY for an associate (AA) or a bachelor’s (BA) degree and refer to them respectively as AA and BA students. We leverage two educational outcomes here: student’s GPA at the end of the expected time to earn the degree (two years for AA students and four years for BA students), as well as their graduation rate in their intended degree (AA or BA) by age 30. We will look at differences in these outcomes by gender, race, and degree type and try to understand whether differences in educational attainment may have contributed to the racial and gender disparities in debt behavior we saw earlier on in this series.

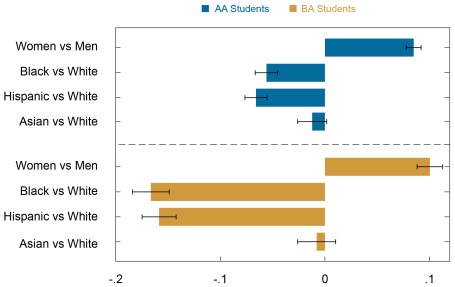

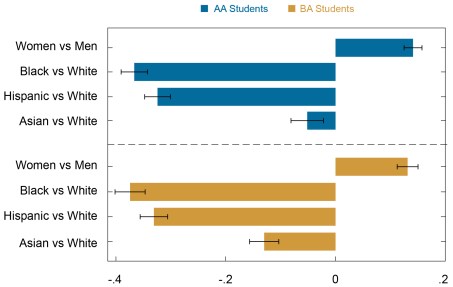

As we’ve done throughout this series, we use multivariate regression analysis, and present bar charts for the regression coefficients of interest. All regressions continue to control for a rich set of background characteristics, such as immigration and visa status, type of high school attended, year of entry to CUNY, and whether a student is disabled, economically disadvantaged, or an English-language learner. The charts shown below are split into two panels—the upper panel represents results for students who enter CUNY for an AA degree (AA students), while the lower panel depicts results for students who enter for a BA degree (BA students).

Degree Attainment

The first educational outcome we look at is intended degree attainment. In the nationally representative NSC-CCP sample (see first post for details), 19 percent of two-year public school students and 51 percent of four-year public school students graduated by the age of 30. The numbers were not too different in our CUNY sample—25 percent of AA and 52 percent of BA students attained their intended degree (AA and BA respectively) by age 30. Distinguishing by gender, we find that AA and BA female students were respectively 8.5 percentage points and 10 percentage points more likely to graduate by age 30 compared to their male peers. These differences respectively constituted 34 percent and 19 percent of the sample average.

Distinguishing by race, we find that Black and Hispanic students were markedly less likely to graduate with their intended degree by age 30 relative to white students and the gap was perceptibly larger for BA students. Specifically, Black and Hispanic AA students were respectively 5.6 percentage points and 6.6 percentage points less likely to graduate while Black and Hispanic BA students were respectively 17 percentage points and 16 percentage points less likely to graduate than the white students by age 30. These gaps were sizable—for AA students, the Black-white and Hispanic-white gaps were respectively 22 percent and 26 percent of the sample average, while for BA students, these gaps were respectively 32 percent and 31 percent of the corresponding sample average.

Since educational attainment is a critical determinant of labor market outcomes, these large disparities in graduation rates may translate into disparities in employment and earnings, which in turn may lead to racial disparities in repayment and delinquencies. On the other hand, there is no discernible difference between the graduation rates of Asian and white AA or BA students. This tallies with the overall similarity in debt and delinquency patterns for Asian and white students and the divergence from patterns for Black and Hispanic students seen in the earlier two posts in this series. Although women were more likely to graduate than men with their intended degrees, the gender pay gap in the labor market is well known and likely is an important contributor to the inferior credit card delinquency patterns of women AA students seen in the second post in this series. As discussed below, gender differences in graduation may not be the only factor affecting the gender pay gap and the gap in consumer debt and delinquencies; a detailed discussion of other social and economic factors affecting this gap is beyond the purview of this post.

Female Students More Likely, While Black and Hispanic Students Less Likely, to Graduate with Intended Degree by Age 30

Difference in Probability to Obtain Intended Degree by Age 30

College Grades

Another educational outcome that might signal labor market outcomes is a student’s GPA. The chart below shows differences in cumulative GPA at the end of the fourth semester for AA students and eighth semester for BA students—that is, after the expected time to earn the respective degrees. We refer to this as the final GPA for brevity, but this does not necessarily occur in a student’s final semester of enrollment. The average final GPA was 2.60 for AA students and 2.87 for BA students.

The chart below also shows that women had a higher GPA than men, with the gender gap being 0.14 and 0.13 points respectively for AA and BA students, equivalent to 5.4 percent of the corresponding average GPA in the sample. Differentiating by race, we find that Black, Hispanic and Asian AA and BA students had lower GPA than comparable white peers. The Black-white, Hispanic-white and Asian-white differences were respectively 0.37, 0.32 and 0.05 GPA points for AA students (14 percent, 12 percent, and 2 percent of the sample average) and 0.37, 0.33 and 0.13 points for the BA students (13 percent, 12 percent, and 4 percent of the sample average). The average disparities for female students relative to male students, and for Black and Hispanic students relative to white students were similar across both types of degrees under consideration. Additionally, results for final GPA are qualitatively very similar to results for degree attainment except for the results for Asian students. One reason behind the lower GPA of Asian students relative to white students, a result that is incongruent with national averages, is that in the CUNY data set Asian students are the racial group with the lowest average income. The contrast between the national averages, where Asian-Americans are the highest-earning racial group, and our data set may be a factor behind the unexpected low educational outcomes seen in our analysis below.

Black, Hispanic, and Asian Students Have Lower GPAs than White Students

Difference in Average GPA after 100 Percent Time in Degree

Discussion

Our analysis above shows large negative Black-white and Hispanic-white gaps in key educational outcomes. These are likely important factors in the relative adverse delinquency outcomes as well as corresponding homeownership gaps we find in this series through their effects on labor market outcomes, such as employment and earnings.

But there surely are additional factors at play that affect the racial and gender gaps in debt and delinquency outcomes we observed in this series. One reason behind our mixed debt and delinquency results for women, despite their comparatively successful educational outcomes, may be that potentially some of the household debt is taken out by another member of the household. Another possible reason is that educational attainment might not translate to professional attainment as much for women compared to men. Women and minorities face additional barriers that may contribute to some of the gender and racial differences in outcomes we find in the first two posts. Gender and racial biases may hinder hiring, promotions, and movements up the career ladder. The role of women as mothers and caretakers and often the consequent temporary withdrawal from the workforce may serve to increase the gender pay and career gaps.

The debt and delinquency results for Asians also do not follow in a straightforward manner from the educational results to the labor market outcomes those results may suggest, thus emphasizing the role of other factors that may be at play. Although Asians in this data set have lower educational attainment (which is consistent with their lower propensity to hold non-mortgage debt), interestingly, they have higher propensity to own a home. Asians, in our CUNY sample, are relatively low-income which may relate to lower educational outcomes and in turn, lower propensity to hold non-mortgage debt. Their higher probability of homeownership may be due to differences in preferences, differences in household composition and also differences in the area they live in. Thus, while the differences in educational attainment identified above surely serve as an important catalyst in the gaps in debt and delinquency, especially the Black-white and Hispanic-white gaps, they may not always paint the whole story and there clearly are other factors at play which are beyond the purview of this post.

This post concludes a three-part series investigating racial and gender disparities in debt holding and delinquency outcomes. Leveraging a unique data set merging administrative educational, demographic and debt records at the individual level, we fill an important void of information on the differential household debt outcomes among college students. We find that Black and Hispanic students are less likely than white students to hold credit card, auto, and mortgage debt, but are more likely to become delinquent in those debts. We find higher propensity for Asian students to hold mortgage debt but lower propensity to hold non-mortgage debt with not much differences in delinquencies, and mixed results for women.

Racial disparities in education outcomes in our sample suggest that Black and Hispanic debt and delinquency outcomes may be fueled by labor market disparities. However, our educational outcomes seem to fall short of explaining some of the Asian and female debt results and reveal that there are other deep-rooted social and economic factors that affect these gaps. More research is needed to identify these factors and a match of an individual-level labor market data set with the education-debt data set can further elucidate the mechanisms behind the disparities we have uncovered in this Liberty Street Economics series.

Chart data ![]()

Ruchi Avtar is a senior research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Rajashri Chakrabarti is a senior economist in the Bank’s Research and Statistics Group.

Kasey Chatterji-Len was a senior research analyst in the Bank’s Research and Statistics Group.

How to cite this post:

Ruchi Avtar, Rajashri Chakrabarti, and Kasey Chatterji-Len, “The Role of Educational Attainment in Consumer Debt and Delinquency Disparities,” Federal Reserve Bank of New York Liberty Street Economics, November 17, 2021, https://libertystreeteconomics.newyorkfed.org/2021/11/the-role-of-educational-attainment-in-household-debt-and-delinquency-disparities/.

Related Reading

Uneven Distribution of Household Debt by Gender, Race, and Education (November 2021)

Unequal Distribution of Delinquencies by Gender, Race, and Education (November 2021)

Economic Inequality: A Research Series

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics