Mary Amiti, Oleg Itskhoki, and Jozef Konings

There are around 180 currencies in the world, but only a very small number of them play an outsized role in international trade, finance, and central bank foreign exchange reserves. In the modern era, the U.S. dollar has a dominant international presence, followed to a lesser extent by the euro and a handful of other currencies. Although the use of specific currencies is remarkably stable over time, with the status of dominant currencies remaining unchanged over decades, there have been decisive shifts in the international monetary system over long horizons. For example, the British pound only lost its dominant currency status in the 1930s, well after Britain stopped being the leading world economy. In a new study, we show that the currency that is used in international trade transactions is an active firm-level decision rather than something that is just fixed. This finding raises the question of what factors could augment or reduce the U.S. dollar’s dominance in world trade.

Dominant Currencies

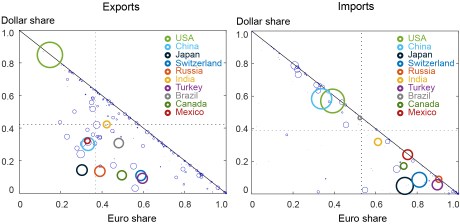

We use a unique data set covering Belgian trade with all countries—unique in that it comprises information on the currency of invoicing as well as firm characteristics. The data show that while the U.S. dollar accounts for a disproportionate share of international trade, a small subset of other currencies is also actively used in international trade alongside the U.S. dollar—most notably the euro but also to a lesser extent the Japanese yen, the British pound, the Swiss franc, and the Chinese yuan. These patterns are shown in the chart below, which plots the dollar and the euro share of trade for Belgian exports in the left panel and Belgian imports in the right panel. Each circle corresponds to a separate country outside the EU, and the size of the circle depicts the country’s share of total Belgian trade. The fact that most circles lie on the negative diagonal reflects the dominance of the combined use of the dollar and the euro in trade invoicing with virtually every trade partner.

The Euro and the U.S. Dollar Are the Dominant Currencies in Belgian Bilateral Trade

Notes: Each dot represents the share of trade invoiced in dollars (vertical axis) and the share in euros (horizontal axis). The left panel shows exports; the right panel shows imports.

A distinctive feature of dominant currencies is that the same currency is equally prevalent in both imports and exports; this feature is common to both the dollar and the euro. These patterns are at odds with standard international macro models that assume countries adopt either the destination currency or the source currency, with the role of many currencies roughly proportional to their country’s role in world trade. In light of this, new economic models incorporate the role of dominant currencies.

It is important to note a clear distinction between different dominant currencies: the dollar is in many cases also a “vehicle” currency—meaning it is not used domestically by either the importing or exporting country—while this is less common for the euro. One can thus think of the dollar as the global dominant currency and of the euro as the regional dominant currency. Indeed, the dollar plays an outsized role relative to the U.S. trade share. However, when comparing the value share of dollar invoicing with the trade share of U.S. and dollar-pegged countries, the use of the U.S. dollar does not appear to be an outlier relative to the use of the euro.

Currency Invoicing Is an Active Firm Choice

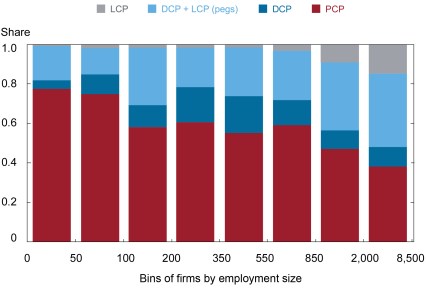

Our research shows that the currency choice in exporting depends on firm size, the share of inputs imported from outside the euro zone, and what the exporters’ competitors choose in each destination, referred to as strategic complementarities. Larger and more import-intensive firms are more likely to deviate from pricing in euros and choose foreign-currency pricing of exports. The chart below illustrates this pattern, showing a steep gradient in the use of currencies across firms of different size. Smaller Belgian exporters use euros almost entirely in their ex-EU exports. In contrast, larger exporters use the dollar, and the largest firms occasionally price in the destination currency.

Larger Firms Are More Likely to Choose the Destination Currency

Note: Red bars represent the share of exports invoiced in euros (in other words, producer currency pricing, PCP); dark and light blue bars reflect the share invoiced in dollars (DCP), with light blue identifying dollar invoicing in exports to dollar-pegged destinations; gray bars refer to local (destination) currency pricing (LCP).

In addition, our results show that firms that rely more on imported inputs, in particular those invoiced in dollars, are more likely to adopt the dollar in export pricing, while larger firms are more likely to adopt the destination currency. Firms with cross-border ownership, arguably proxying for their participation in global value chains, are more likely to invoice in dollars. We also provide direct evidence of strategic complementarities in currency choice, whereby the currency used by the firm’s competitors has a strong impact on the firm’s own currency choice.

Why Currency Choice Matters

At the country level, optimal exchange rate policy involves stabilizing the producer price index, taking into account foreign inputs that affect producer prices. This results in a fixed point, whereby pegging to the dollar at the country level compels more exports, at home and abroad, to adopt dollar pricing, and in turn dollar pricing in a country’s exports and imports compels the country to adopt dollar pegging. This results in a strategic complementarity at the macroeconomic level for the use of the dollar in global trade and monetary anchoring.

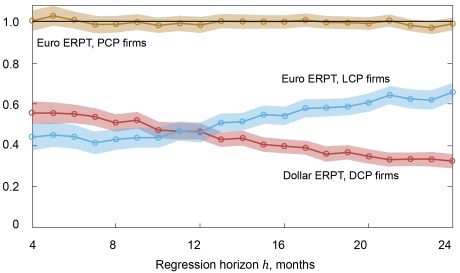

The firm’s currency choice is, in turn, a key determinant of the exchange rate pass-through into prices and quantities. A large literature has shown that exchange rate pass-through into destination prices is incomplete when exports are invoiced in a foreign currency. Our identification strategy relies on comparing firms with similar characteristics that choose to price in different currencies for idiosyncratic reasons, thus isolating the effect of the firm’s currency choice on pass-through. Furthermore, our inference is based on the differential response of firms to the same exchange rate shocks in the same equilibrium environment, thus excluding confounding macroeconomic variation.

In the chart below, we plot the exchange rate pass-through into Belgian firms’ export prices at horizons from four months to twenty-four months. The euro exchange rate pass-through for firms that invoice in euros (PCP firms) is shown in gold, indicating 100 percent pass-through (equal to 1 on the vertical axis), while the pass-through of non-euro pricing firms is incomplete and gradually increases over time (blue line). In turn, the dollar exchange rate pass-through for dollar pricing firms is high and gradually decreasing (red line). Our dynamic estimates indicate an expected price duration of nearly ten months, which implies that about a third of export prices have not yet been adjusted a year after the shock.

Exchange Rate Pass-Through into Prices Is Higher for Pricing in Euros

Note: The chart plots regression coefficients reflecting exchange rate pass-through (ERPT) at different horizons by currency of pricing for euro-destination and dollar-destination exchange rates.

Finally, the cross-currency differential pass-through into prices translates into consistent differences in the response of quantities, with an estimated negative export quantity elasticity of around 1.5 for all goods and over 2 for differentiated goods, in line with other macroeconomic estimates of this elasticity. This establishes the allocative effects of sticky prices in the endogenously chosen currency of invoicing. The quantities, however, take time to adjust, with the effects becoming significant only about a year after the shock, suggesting a role for quantity adjustment frictions in addition to price stickiness.

Macroeconomic Implications of Currency Choice

These results have broad macroeconomic implications. In particular, they emphasize the forces that could augment or reduce the dollar’s dominant role in world trade. One possibility that would augment its role is that the U.S. dollar strengthens its position as the dominant global currency. This could happen with greater globalization of production and more intensive reliance on global value chains, as our results show that cross-border foreign direct investment—a proxy for global value chains—is associated with more U.S. dollar currency invoicing. This would render exchange rates less relevant as determinants of relative prices and expenditure-switching in the global supply chain.

A possibility that could reduce the dollar’s dominance is the fragmentation and localization of production chains, for example in response to a global pandemic shock or to geopolitical competition (“friend-shoring”), with more intensive regional trade and greater barriers to cross-regional trade. This, in turn, may increase the expenditure-switching role of bilateral exchange rate movements, at least if an equilibrium with multiple trade currencies emerges as a result of such fragmentation.

Alternatively, a shift in the exchange rate anchoring policies of the major trade partners, such as China, could trigger a long-run shift in the equilibrium environment. If China were to freely float its exchange rate, encouraging Chinese exporters to price more intensively in renminbi, the equilibrium environment would change for exporting firms around the world. In particular, this would alter both the dynamics of prices in the input markets as well as the competitive environment in the output markets across many industries. As our results show, the currency in which a firm’s imports are invoiced and the currency in which its competitors price are key determinants of an exporting firm’s currency choice, and hence this shift could dramatically change the optimal invoicing patterns for exporting firms. This, in turn, may lead monetary authorities across the world to further adjust their nominal anchoring and realign their exchange rate management policies, changing further the equilibrium in the international monetary system away from the dominance of the dollar.

Mary Amiti is the head of Labor and Product Market Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Oleg Itskhoki is a professor of economics at the University of California, Los Angeles

Jozef Konings is a professor in economics and director of research at the Nazabayev University Graduate School of Business, and a professor of economics at KU Leuven.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Thanks for presenting nice data on usd dollar.Right now its preminent currency of global trade and safe for comparetively other currencyies.

Seemingly missing from this analysis is the role (demand) of reserve currency as a tool to control exporting countries’ exchange rate with the US, and the role of trust in a currency’s integrity and issuer. China is the 2nd largest economy yet the Renmimbi accounts for 1% of all trade. This is only because the lack of trust in an opaque banking system of a communist country – ie lack of clearly defined rules, or, trust.