This post presents our quarterly update of the economic forecasts generated by the Federal Reserve Bank of New York’s dynamic stochastic general equilibrium (DSGE) model. We describe very briefly our forecast and its change since May 2017.

As usual, we wish to remind our readers that the DSGE model forecast is not an official New York Fed forecast, but only an input to the Research staff’s overall forecasting process. For more information about the model and variables discussed here, see our DSGE Model Q & A.

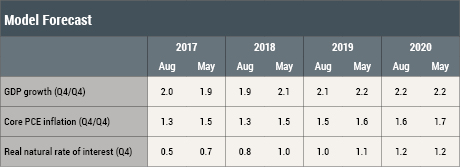

The August model forecast for 2017–20 is summarized in the table below, alongside the May forecast, and presented in the charts that follow. The model uses quarterly macroeconomic data released through the second quarter of 2017 and available financial data through August 3, 2017.

How do the latest forecasts compare with the May forecasts?

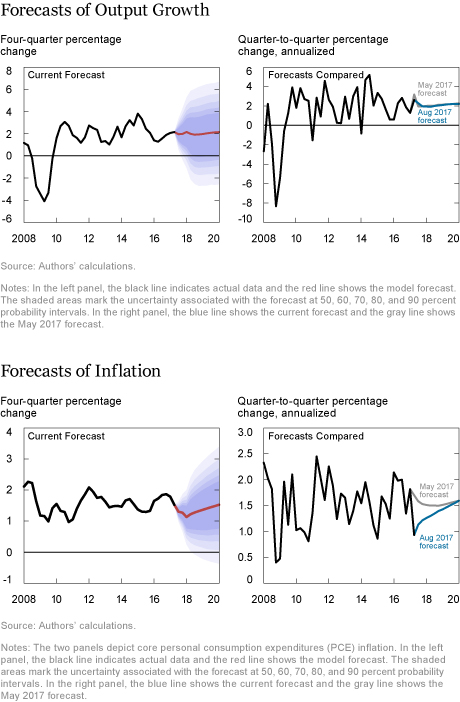

- The current GDP growth forecast is essentially in line with May’s projection. GDP growth is projected to be about 2.0 percent in 2017 and 2018 (in Q4/Q4 terms) and to pick up modestly in the following years.

- As in the past several quarters, narrow credit spreads provide stimulus to growth by maintaining accommodative financial conditions, but their effect is partially offset by slower productivity growth. As a result, the model continues to forecast relatively modest growth.

- The medium-term core PCE inflation forecast is lower than in May, and has returned to a level similar to those projected in November 2016 and February 2017. The forecast increase in May reflected PCE data in 2017:Q1 that was surprisingly strong from the model’s perspective. In contrast, the steep decline of core PCE in the second quarter of 2017 has pushed down the core inflation outlook to 1.3 percent (Q4/Q4) for 2017 and 2018. After that, inflation is projected to increase gradually to 1.6 percent (Q4/Q4) in 2020.

- As shown in the charts, projections for both output and core PCE are surrounded by notable uncertainty.

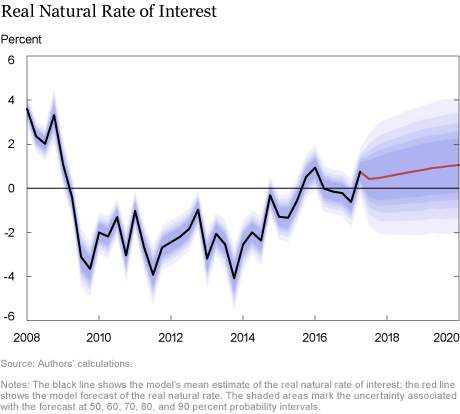

- The estimate of the real natural rate of interest—the real rate of interest that would prevail in the economy absent nominal rigidities and markup shocks—is slightly lower for 2017 through 2019 relative to the May estimate. The model continues to project a gradual increase in the natural rate from 0.5 percent in 2017 to 1.2 percent in 2020.

- The shallow projected path of the real natural interest rate reflects the low path of core PCE inflation.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Michael Cai is a research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Marc Giannoni was an assistant vice president in the Group at the time this post was written.

Abhi Gupta is a senior research analyst in the Group.

Pearl Li is a senior research analyst in the Group.

Argia Sbordone is a vice president in the Group.

How to cite this blog post:

Michael Cai, Marc Giannoni, Abhi Gupta, Pearl Li, and Argia Sbordone, “The New York Fed DSGE Model Forecast—August 2017,” Federal Reserve Bank of New York Liberty Street Economics (blog), September 8, 2017, http://libertystreeteconomics.newyorkfed.org/2017/09/the-new-york-fed-dsge-model-forecast-august-2017.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics