On July 6, 2011, the Task Force on Tri-Party Repo Infrastructure—an industry group sponsored by the New York Fed—released a Progress Report in which it reaffirmed the goal of eliminating the wholesale “unwind” of repos (and the requisite extension of more than a trillion dollars of intraday credit by repo clearing banks), but acknowledged unspecified delays in achieving that goal. The “unwind” is the settlement of repos that currently takes place each morning and replaces credit from investors with credit from the clearing banks. As I explain in this post, by postponing settlement until the afternoon and thereby linking the settlement of new and maturing repos, the proposed new settlement approach could help stabilize the tri-party repo market by eliminating the incentive for investors to withdraw funds from a dealer simply because they believe other investors will do the same. In effect, eliminating the unwind can reduce the risk of the equivalent of bank runs in the repo market, or “repo runs.”

A repurchase agreement is a sale of securities coupled with an agreement to repurchase the securities at a specified price at a later date. In the United States, a tri-party repo is a form of repurchase agreement in which a third party, the clearing bank, intermediates between the cash investor and the collateral provider. A detailed description of the tri-party repo market can be found in the working paper “The Tri-Party Repo Market before the 2010 Reforms.”

Under current practices, the tri-party repo clearing banks “unwind” all repos each morning—that is, investors receive their cash back and dealers receive their collateral back. Later in the day, investors choose whether to reinvest their cash with the dealers by renewing their repos. Under the proposed new rules, the clearing bank would not unwind repos every morning. Instead, new and maturing repos would be settled simultaneously, in the afternoon. “Term” (multiple-day) repos and “rolling” repos (those renewed every day unless canceled by one of the parties) would no longer be unwound.

A Simple Model of Dealer Funding Illustrating the Perils of Unwinding

Consider a hypothetical dealer that currently has three identical investors. Each investor has provided financing for one period (say, last night) and must decide whether to reinvest with the dealer (tonight). Assume that the dealer avoids default if at least two of the three investors reinvest. Otherwise the dealer defaults.

The payoff for the investor will vary with the circumstances:

- S, for “success,” if she invests and the dealer avoids default;

- O, for “out,” if she does not invest and is able to get her cash back;

- F, for “fail,” if she invests but the dealer is forced to default or if she forgoes investing but is unable to get her cash out.

Whether an investor who does not want to reinvest is able to get her cash back depends on the rules of settlement, which are considered in detail below.

Assume S > O > F. The first inequality reflects the fact that investors prefer investing in a surviving dealer to keeping their cash uninvested. The second inequality reflects the fact that investors would rather hold cash uninvested than invest in a defaulting dealer, because in this way they avoid the cost of liquidating their collateral.

Each investor chooses whether or not to invest, taking as given what other investors do. I focus on situations where an investor cannot be better off by changing her decision unilaterally. Formally, I focus on Nash equilibria in strategies that are not weakly dominated. A Nash equilibrium is a set of strategies, one for each investor, such that no investor has an incentive to unilaterally change her action. A strategy is weakly dominated if another strategy offers a payoff that is as good or better, regardless of the actions of the other investors.

Current Practice: How Unwinding Tri-Party Repos Can Make the Market Unstable

Under current rules, the clearing bank unwinds all repos each morning. As a result, the investors hold cash before they make their reinvestment decision.

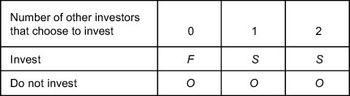

The table below reports the payoffs to the representative investor, I, in the tri-party repo market with unwind. The top row indicates how many other investors reinvest, and each cell shows the payoff that investor I will receive given her decision to invest or not to invest.

With unwind, investor I always earns O if she chooses not to invest because the clearing bank returns the cash to investors before they must make their reinvestment decision. This is a key feature of the unwind of repos. The major consequence is that an investor is better off not investing if she believes that other investors may not invest, since O > F. Of course, investor I is better off investing if she believes that other investors will invest, since S > O. Hence, there are two equilibria: either all investors invest, or all investors forgo investing. With unwind, pure coordination failures are possible and instability results.

Proposed New Practice: The Tri-Party Repo Market without Unwinding

Under the proposed new rules, the clearing bank will not return the cash to investors every morning, before they need to make their reinvestment decision. Instead, new and maturing repos are settled simultaneously in the afternoon.

Consider the following settlement rules: First, the clearing bank checks whether the dealer has enough funding to repay the previous day’s repos. If there is enough funding, then all the previous day’s repos are repaid simultaneously. If there is not enough funding, then the dealer must default and investors cannot get their cash. When there is no unwind, these rules eliminate coordination failures.

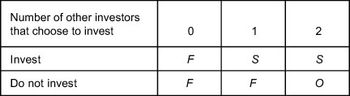

The payoffs of investor I in the case of the tri-party repo market without unwind are shown in the table below:

If no other investors reinvest, then the dealer must default. Because there is no unwind, investor I cannot get her cash back if she chooses not to reinvest. If one other investor reinvests, then the dealer succeeds if investor I reinvests and defaults otherwise. Again, because there is no unwind, the investors hold the collateral in case of default. If both other investors reinvest, then the dealer survives no matter what investor I does. In particular, if investor I chooses not to reinvest, she gets her cash back.

This second table shows that “do not invest” is a weakly dominated strategy since investor I’s payoff is at least as high, and sometimes higher, if she invests than if she does not invest, regardless of what other investors do. Without unwind, the only equilibrium is for all investors to choose to invest, so pure coordination failures do not happen and the market is more stable.

This framework illustrates why unwinding tri-party repos every morning can contribute to the fragility of the market. Without unwind, rolling over the dealer’s liabilities is not inherently fragile. With the unwind, and the extension of credit by the clearing bank, coordination failures can occur and lead to fragility. While the model used to illustrate the point is simple, it captures essential features of the tri-party repo market. For a fuller and more formal treatment of this issue, see the working paper “Repo Runs.”

The good news is that the proposed reforms, once implemented, will contribute to the stability of the tri-party repo market. Important prerequisites for achieving these reforms will be implemented this year—including the three-way matching of trades and the deferred settlement of maturing repos. The bad news is that the reform task force acknowledged unspecified delays in eliminating the unwind. As a result, the goal of linking the settlement of maturing repos to new repos and greatly reducing the need for credit provided by the clearing banks will not be realized as early as expected. Until that key step is taken, the market will be more fragile than necessary.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics