Nicola Cetorelli

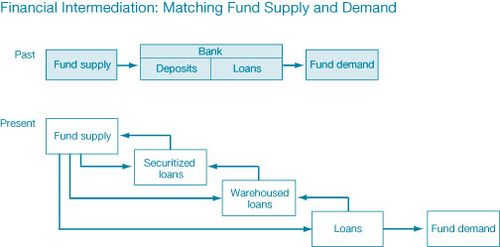

It used to be simple: Asked how to describe financial intermediation, you would just mention the word “bank.” Then things got complicated. As a result of innovation and legal and regulatory changes, financial intermediation has evolved in a way that invites us to question whether it revolves around banks anymore. The centerpiece of modern intermediation is the advent and growth of asset securitization: loans do not need to reside on the originator’s balance sheet until maturity any longer, but they can instead be packaged into securities and sold to investors. With securitization, banks’ balance sheets get replaced by a longer and more complex credit intermediation chain (Pozsar, Adrian, Ashcraft, and Boesky 2010). This evolution literally changes the picture of intermediation, as the figure below suggests. From a bank-centered system, we go to one where multiple entities interact with one another along the sequential steps of the chain, and concomitantly we hear increasingly of shadow banking, defined recently by the Financial Stability Board as a system of “credit intermediation involving entities and activities outside the regular banking system.”

In light of this evolution, what role remains for banks? How do they fit into this new way of matching fund supply and fund demand? Motivated by these questions, the Research and Statistics Group of the New York Fed is publishing a series of studies as a special volume of our Economic Policy Review. The thread common to all of the contributions is the attempt to document the extent to which, if any, banking institutions have adapted as the world of intermediation has changed around them. The next five posts on our blog will highlight findings from the individual articles. This post discusses the first article in the series, which develops a framework for thinking about all the analysis and anticipates the forthcoming posts on the other articles.

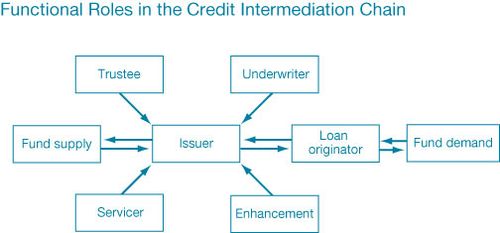

In the introductory article to the volume, Benjamin H. Mandel, Lindsay Mollineaux, and I lay out our thesis: Banks have exhibited a great capacity to adapt to the evolving system of intermediation. We develop this thesis following two separate but related approaches. To start, we posit that if funds are intermediated on a longer credit intermediation chain, then we ought to really see how it is done—that is, who does what and when at every step—in order to establish whether banks are still active players or whether other entities have eclipsed them. More specifically, we propose a different map (see the figure below), morphologically equivalent to the one above but highlighting, instead of the steps in the chain, the roles needed at every step in order for a dollar of funding to go through from beginning to end. We know, for instance, that loan origination is just the first step in this alternative mapping. The assembly of the loans into securities and the related sale to investors require the services of several parties: an issuer, that is, the company that acquires the assets ready to be transformed into securities; an underwriter, the entity in charge of the packaging and sale of the securities; a trustee, an agent that acts on behalf of the securities buyers; and a servicer, a party that manages the income streams from the underlying assets and the related payments to the investors. Finally, along the whole chain, the process may require some form of liquidity and credit enhancement to boost the quality of the issuances. All these roles are essential to the modern process of securitization, and understanding who plays these roles should tell us how far intermediation has moved away from the realm of banks.

But if these are the main roles essential to modern intermediation, we also conjecture that if financial intermediation entails increasing participation by nonbank entities, then banks can adapt by integrating those nonbank entities in the same bank holding company structure. This complementary focus, on entity type alongside functional roles, has clear normative implications, since the Federal Reserve is already the regulator of bank and financial holding companies (henceforth BHCs). Thus, understanding the degree to which the entities active along the credit intermediation chain have in fact been incorporated in BHCs would allow us to redefine what parts of modern financial intermediation have really entered the “shadow” and what parts remain open to regulatory scrutiny.

This dual focus, based on roles and entity type, is the backbone of our approach in the banking volume, and each of the articles and its corresponding blog post are directly linked to it. Our first three posts focus on roles. Tomorrow, João Santos blogs on his paper (with Vitaly Bord) on loan origination: Origination is done increasingly to feed the securitization machine, so how important do banks remain in this process? On Wednesday, Don Morgan, Benjamin H. Mandel, and Jason Wei look at the role of banks as credit enhancers along the credit intermediation chain. On Thursday, Stavros Peristiani and I consider the importance of banks in all the remaining roles (besides enhancement) depicted above—issuers, underwriters, servicers, and trustees—thus completing the mapping by roles of modern financial intermediation.

Starting Friday, the emphasis switches from roles to entity types when we present two posts analyzing the evolution of BHCs. Dafna Avraham, Patricia Selvaggi, and James Vickery describe important organizational changes—size, scope, and complexity—in the structure of U.S. BHCs over the past thirty years. The following Monday, Adam Copeland focuses on BHCs’ activities, gathering data on sources of income and tracking how those sources have changed over time. The Copeland post assesses the importance of interest income (which mainly reflects traditional intermediation activities) relative to fee-based income, and identifies the contributions of both banks and nonbank subsidiaries to the BHCs’ bottom line.

On the same day, I will close the series with a wrap-up post, taking stock of our findings and venturing onto normative grounds. In particular, I will attempt to draw some implications inspired by the following questions: If intermediation has grown complex and evolved away from banks, how do we think of monitoring and regulation going forward? In particular, how do we structure oversight so that we can respond to future innovations and new sources of systemic risk before it is too late? Banks, it turns out, may still hold the key to these questions.

Disclaimer

The views expressed in this post are those of the author and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author.

Nicola Cetorelli is an officer in the Financial Intermediation Function of the New York Fed’s Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics