Mary Amiti and Amit Khandelwal

Firms must produce high-quality goods to be competitive in international markets, but how do they transition from producing low- to high-quality goods? In a new study (“Import Competition and Quality Upgrading,” forthcoming in the Review of Economics and Statistics), we focus on how tougher import competition affects firms’ decisions to upgrade the quality of their goods. Our results, which we summarize in this post, show that stiffer import competition affects quality-upgrading decisions. For firms already producing very high-quality goods, lower tariffs induce them to produce goods of even higher quality. However, for firms producing very low-quality goods, lower tariffs actually discourage quality upgrading. Ours is the first study to show a significant relationship between import competition and quality.

How to Measure Quality

A major challenge in these types of studies is how to measure quality. The typical approach is to use unit values—the ratio of the value to the quantity sold—as a proxy for quality. However, the problem with this type of measure is that higher prices don’t always necessarily reflect higher quality. For example, one country may set higher prices than another country because it might have higher wage costs, even if the quality is lower. To allow for this possibility, we use an approach developed in Khandelwal (2010) to measure quality. This methodology assigns a higher quality to products with higher market shares, conditional on prices.

To measure quality, we draw on data from fifty-six countries that export to the United States within the manufacturing sector. These data, which are for the 1990-2005 period, are obtained from the U.S. Census Bureau, which reports values and quantities of trade in highly disaggregated product codes (covering more than 10,000 distinct products). Many studies have found that exporting firms have the highest-quality products, and it’s likely that firms export their highest-quality goods to the United States. We define the world quality frontier for each product, for each year, as the maximum quality level among countries that export the product. A product’s proximity to the world frontier is its quality relative to this world maximum. Thus, if a product is of very low quality, its proximity to the frontier will be close to zero; if it’s at the frontier, it will be close to one.

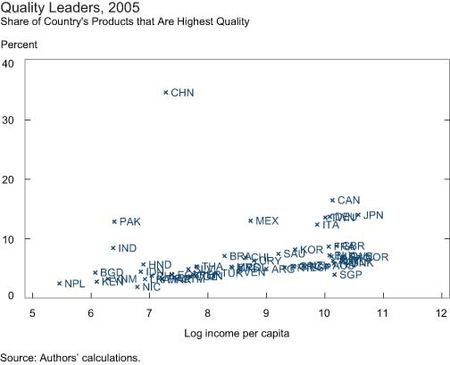

Consistent with our expectations, we find that high-per-capita-income countries export more high-quality products. The chart below, which plots the proportion of each country’s products at the quality frontier, shows a positive relationship, with high-income countries like Canada exporting a large share of high-quality products to the United States. The one outlier we notice in the chart is China: a low-income-per-capita country that exports a large fraction of high-quality goods. This is because China exports many high-quality products that have very little domestic value added. For example, Koopman, Wang, and Wei (2008) show that China’s domestic value added in computers is only 5 percent value. We show that the results hold with and without China.

Import Competition

We measure import competition using import tariffs, from the World Bank World Integrated Trade Solution database, for each of the fifty-six countries in our sample at the HS six-digit level—the most disaggregated data available that are comparable across the world. Tariffs are a good proxy for import competition, as many studies have shown that lowering tariffs leads to procompetitive pressures in the liberalizing country by reducing mark-ups and inducing a reallocation of resources to more productive firms. These tariff levels vary considerably across industries, countries, and time. For example, average tariffs in Singapore and Norway were only 5 percent, whereas they were as high as 63 percent in Morocco and Pakistan; average tariffs were declining during our sample period.

Main Findings

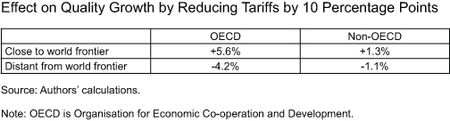

Import tariffs have a significant impact on quality upgrading, but whether they have a positive or negative effect depends on how far away the firm is from the world quality frontier within its industry. The main results are summarized in the table below. For OECD (Organisation for Economic Co-operation and Development) countries, a 10 percentage point fall in tariffs increases quality growth by 5.6 percent for those products close to the world quality frontier but reduces quality growth for those distant from the frontier. Although smaller in magnitude, a similar pattern appears for non-OECD countries, with a 1.3 percent increase in quality growth for products close to the frontier and a 1.1 percent decline for those distant from it. These results support distance-to-frontier models developed by Aghion et al. (2009), who provide a clear intuition for these findings. That is, if a firm is close to the world frontier it is in its interest to invest in innovation in order to stay in that top position. However, if a firm is a long way from the frontier, it realizes that even if it invests in costly innovation it still won’t be able to catch up to the firms already at the frontier.

In addition, we show that these effects hold for countries across a large range of income levels, provided that the country has a minimum level of institutional quality. If a country has many other market distortions in place, just reducing import tariffs alone might not achieve the competitive effects. For example, for the effects of tougher import competition to be present, there must be the potential for entry and exit of firms; however, if regulations prevent this from happening smoothly, the procompetitive effects of import competition won’t be realized. We confirm this by showing that the results in the table are only present for countries with high-quality institutions, which we measure using the World Bank’s “Doing Business Survey,” based on a country’s regulatory environment. We find that our results hold for both OECD and non-OECD countries with high institutional quality measures, but not for those with poor business environments.

Conclusion

Exposing domestic firms to foreign competition affects the quality of exports. Importantly, the effect of import competition on quality upgrading depends on the product’s quality relative to that of its competitors: Lower tariffs promote quality upgrading of products close to the world quality frontier but discourage quality upgrading for those far away from it. For these results to hold, a country must have a good business environment.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Mary Amiti is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Amit Khandelwal is the Gary Winnick and Martin Granoff Associate Professor of Business at Columbia University’s Graduate School of Business.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics