Leyla Alkan, Vic Chakrian, Adam Copeland, Isaac Davis, and Antoine Martin

The fragility inherent in the tri-party repo market came to light during the 2008-09 financial crisis. One of the main vulnerabilities is the risk of fire sales, which can be enhanced by the response of some investors to stress events. Money market mutual funds (MMFs) and the agents investing cash collateral obtained from securities lending (SLs) are thought to behave, in times of stress, in ways that exacerbate fire-sale risks in the tri-party repo market. Based on detailed investor data, we find that MMFs and SLs constitute almost half of the investor market, making it crucial for tri-party repo participants and regulators to account for MMF and SL investment behavior when considering how to mitigate the risk of fire sales.

How Investors Can Compound Fire-Sale Risks

A recent New York Fed staff report details the risks of fire sales in the tri-party repo market. The first risk, termed pre-default fire-sale risk, occurs when a dealer is under stress, but has not defaulted. A stressed dealer may be forced to sell its securities quickly, an action that likely depresses market prices and creates fire-sale conditions. Tri-party repo investors can aggravate this risk by quickly withdrawing funding from a troubled dealer, and so forcing that dealer to sell even more securities quickly.

The second risk, termed post-default fire-sale risk, occurs after a dealer default, when that dealer’s investors receive the repo securities in lieu of repayment. Fire sales can then occur if investors attempt to liquidate these securities in an uncoordinated and rapid pace. In this scenario, investors as a group will be trying to sell off a substantial amount of collateral at the same time.

Two categories of tri-party repo investors, MMFs and SLs, have business models that increase the likelihood of both types of fire-sale risks in the tri-party repo market. This is because both investor types are particularly susceptible to their own liquidity pressures.

MMFs are a class of mutual funds that invests in relatively safe financial assets, with a short maturity. Nevertheless, MMFs can be subject to runs when perceived by shareholders to have worrisome risk exposures, such as when lending cash to a stressed dealer (see this post on the vulnerabilities of MMFs).

Securities lending refers to a collateralized loan of a security between two entities. In the United States, these loans are typically collateralized with cash. For that reason, securities lenders often hold large pools of cash collateral, which they reinvest in money markets, including the tri-party repo market, to enhance their return. Most securities loans in the United States are done on an open maturity basis, which means that the lender of a security has to return the cash collateral whenever the borrower of the security returns it. This arrangement can create liquidity pressures on the cash reinvestment funds of securities lenders that may have placed their cash in longer-term trades and/or less liquid assets (see this article in our Current Issues series on the risks associated with the reinvestment of cash collateral).

Other types of investors in tri-party repo, such as trusts, investment managers, and pensions, do not face these liquidity pressures (or at least not to the same extent). So, when faced with a dealer under stress, MMFs and SLs face stronger incentives to stop lending immediately, in order to avoid ending up with collateral in lieu of cash. This withdrawal of funding, however, raises the probability of pre-default fire-sale risk and further pushes the dealer towards default. The same liquidity pressures also push MMFs and SLs to sell the repo securities they receive from a defaulting dealer as quickly as possible, increasing the probability of a post-default fire sale.

Proportion of Investor Types

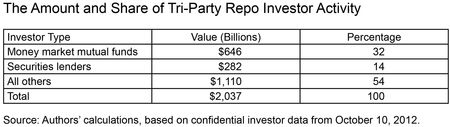

Because the liquidity pressures faced by MMFs and SLs propel them to take actions that increase the probability of fire sale, it is important for market participants and regulators to know the prevalence of these investor types in the tri-party repo market. Past estimates, based on conversations with market participants, had MMFs accounting for a quarter to a third of all tri-party repo activity, and SLs with another quarter.

Using detailed supervisory data, we estimated that MMFs account for about 32 percent of all funds invested in tri-party repo and SLs account for about 14

percent of the total. These calculations are based on a snapshot of investor activity on October 10, 2012, but we found similar results using data from September and November of 2012. Included in “all others” are mutual funds, banks, investment managers, trusts, pensions, municipalities, and other institutions. None of these other investor types represents more than 10 percent of the market individually.

We categorized investors into various types based upon their name. For MMFs and SLs, this categorization was fairly straightforward. Because there is significant concentration in the MMF and SL industries, the above results are mainly driven by categorizing the top fifty MMFs and SLs. Hence, the errors associated with miscategorizing smaller MMFs or SLs with obscure or ambivalent names are small and do not impact the results presented in the table. There were a few larger investors that looked to be SLs but, because we could not be sure, we classified elsewhere. Because of this decision, we believe our approach may underestimate the extent of SL participation in the tri-party repo market.

By our calculations, MMFs and SLs are the two largest classes of investors, together representing just about half of the market. Their dominant presence heightens the risk of both pre- and post-default fire sales, so it is important for market participants and regulators to take this fact into account when evaluating tools to address the fire-sale vulnerability in the tri-party repo market.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Leyla Alkan is a bank examiner in the Federal Reserve Bank of New York’s Financial Institution Supervision Group.

Vic Chakrian is an assistant vice president in the Financial Institution Supervision Group.

Adam Copeland is a senior economist in the Research and Statistics Group.

Isaac Davis is a research analyst in the Research and Statistics Group.

Antoine Martin is a vice president in the Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Post-default fire-sale risk may be ameliorated somewhat by the 21-day stay on the disposition of securities collateral (including securities sold under a repurchase agreement) typically imposed under section 78eee(b)(2)(C)(ii) of the Securities Investor Protection Act, which would apply to the insolvency of any major U.S. dealer. In other words, in a bankruptcy default situation, repo buyers would not be permitted to dispose of the purchased securities without obtaining the consent of the Securities Investor Protection Corporation, until the expiration of the 21-day stay typically ordered in a SIPA case. Of course in a non-bankruptcy default, the SIPA stay wouldn’t apply, but it is not so easy to imagine a default that would occur simultaneously across many different repurchase agreements, apart from a bankruptcy. Interestingly, the 21-day stay would not apply in a SIPA case commenced under Title II of Dodd-Frank, because Dodd-Frank’s safe harbors override the 21-day SIPA stay (instead, there is a shorter stay that expires at 5:00 p.m. eastern time on the business day following commencement of the case). See section 210(c)(8)(A) of Title II of Dodd-Frank. So the post-default fire-sale risk is perhaps greater in a Dodd-Frank “orderly liquidation authority” case than it is in a plain-vanilla SIPA case – a somewhat strange outcome.