Tobias Adrian and Nina Boyarchenko

This post is the fifth in a series of six Liberty Street Economics posts on liquidity issues.

One of the most innovative and potentially far-reaching consequences of regulatory reform since the financial crisis has been the development of liquidity regulations for the banking system. While bank regulation traditionally focuses on requiring a minimum amount of capital, liquidity requirements impose a minimum amount of liquid assets. In this post, we provide a conceptual framework that allows us to evaluate the impact of liquidity requirements on economic growth, the creation of systemic risk, and household welfare. Importantly, the framework addresses both liquidity requirements and capital requirements, thus allowing the study of trade-offs and complementarities between these regulatory tools. The reader will find a more detailed discussion in our recent staff report “Liquidity Policies and Systemic Risk.”

Motivation

During the initial phase of the 2007-09 financial crisis, many banks experienced funding shortages because they did not manage their liquidity prudently, despite maintaining adequate capital levels. Funding liquidity dried up quickly, leading to stress in short-term funding markets. The rapid reversal in market conditions illustrated how quickly liquidity could evaporate, and how important liquidity management was for the functioning of the financial system. This experience motivated the Basel Committee on Banking Supervision to develop the Liquidity Coverage Ratio (LCR). In its explanation of the LCR, the Basel Committee writes that the objective of the LCR is to promote the short-term resilience of the liquidity risk profile of banks by ensuring that banks have an adequate stock of liquid assets that can be used to meet liquidity needs for a thirty-day stress scenario. The LCR thus constrains financial institutions to provision against shocks to unstable sources of funding by holding a minimum amount of liquid assets. This reverses the logic that is used for setting capital requirements, in which a minimum amount of capital is held as protection against shocks to the risky assets on banks’ balance sheets, as is illustrated in the stylized balance sheet below:

A Conceptual Framework

We study the impact of liquidity and capital regulation within the context of an economic model that features a leverage cycle of intermediaries with occasional systemic financial crises. The framework, which we explained in a previous post, features a banking system that is subject to risk-based capital constraints. Banks intermediate between households and the corporate sector, which invests capital to produce output. The economy faces two sources of adverse shocks: to the productivity of capital (impacting the asset side of banks’ balance sheets) and to funding liquidity (impacting the liability side of banks’ balance sheets). The capital regulation moderates banks’ vulnerability to these shocks by requiring that banks hold more capital against a given amount of risky assets when those assets become more risky. In this post, we enrich the regulatory framework by adding a liquidity requirement that is similar to the Basel Committee’s LCR in mandating that banks hold safe assets in proportion to their potentially unstable liabilities. As economic conditions evolve, the tightness of the capital and liquidity constraints changes, impacting the risk appetite of banks.

In good times, measured risk tends to be low, and liquid assets tend to be abundant. Regulatory constraints on banks are thus loosened, allowing banks to take on more leverage, which increases their vulnerability to fundamental shocks. When adverse shocks occur, banks are forced to deleverage by selling risky assets and accumulating safe assets. This changes the price and volatility of capital and the liquid assets, leading to adverse feedback loops. When such adverse feedback loops are severe, systemic financial distress can occur, making it necessary to restructure banks by writing down liabilities. This has an adverse impact on household wealth, leading to lower consumption and welfare.

Trading-Off Policies

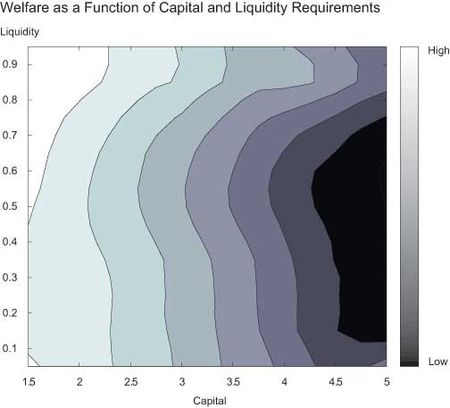

We study the impact of liquidity requirements and capital requirements on the level of systemic risk, the growth rate of aggregate consumption, and household welfare. Both the liquidity and the capital requirements increase the cost of risk taking for banks. As the capital constraint is tightened, banks have to hold more capital per unit of risk, increasing the overall funding cost for the bank. Similarly, as the liquidity constraint is tightened, banks must hold more liquid (less risky) securities, decreasing the net interest margin of their balance sheets. Hence, regulatory constraints affect both the price of risk in the economy and the level of systemic risk created by the financial sector. Prudential regulation thus trades off the pricing of risk and the quantity of systemic risk: tighter regulatory requirements lower the likelihood of systemic crisis, but may lead to an increase in the pricing of risk in normal times. The overall effect needs to be evaluated in terms of the impact these regulations have on household welfare, which is illustrated in the chart below.

The chart shows the level of welfare as a function of the tightness of capital and liquidity requirements. Lighter colors correspond to higher welfare, and higher numbers for capital and liquidity correspond to tighter requirements. The chart suggests that, within our framework, tighter liquidity regulation improves welfare while tighter capital requirements tend to lower welfare. To understand the differential impact of liquidity and capital regulations, we need to examine separately their implications for systemic risk creation and expected consumption growth rates.

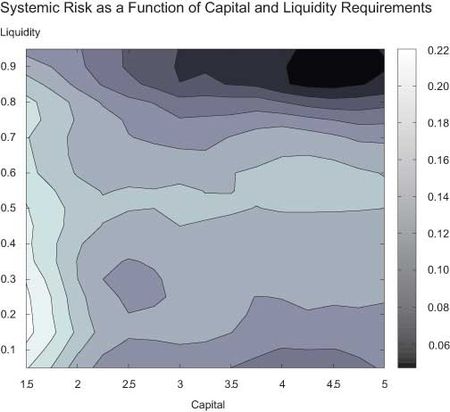

This chart shows that systemic risk—defined as the probability of the financial sector becoming distressed and needing recapitalization—is lowest when both capital and liquidity requirements are tight. Economically, both capital and liquidity requirements constrain the risk taking of financial institutions, and thus lower their vulnerability to adverse liquidity or productivity shocks. Capital and liquidity requirements are therefore substitutes with respect to the level of systemic risk. The picture for consumption growth, plotted next, looks very different.

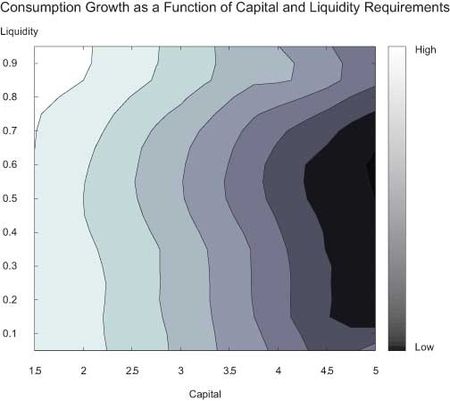

We can see from the chart that, while tighter liquidity requirements do not affect consumption growth for a fixed level of capital (or, if they impact consumption at all, they tend to increase it), tighter capital requirements lower consumption growth. By comparing this chart with the previous one, we conclude that, within our framework, the choice of the tightness of capital constraints entails a systemic risk-return trade-off (tighter capital achieves lower systemic risk at the cost of lower consumption growth), but liquidity does not face such a trade-off. Tighter liquidity requirements tend to lower the level of systemic risk, yet they do not adversely impact consumption growth. Since the impact of regulation on household welfare is determined by its effect on both consumption growth and the level of systemic risk, liquidity regulation is preferable to capital regulation within the context of our model.

Implications for Policy Implementation

Our analysis shows that the probability of systemic distress is lowered by tighter capital or liquidity requirements, which are substitutes in that respect. However, while consumption growth declines with the tightening of capital requirements, the link between consumption growth and liquidity requirements is ambiguous. There is thus a systemic risk-return trade-off with respect to capital requirements, but not necessarily with respect to liquidity requirements. As a result, household welfare tends to be highest with relatively loose capital requirements and strict liquidity requirements.

The tightness of the capital and liquidity requirements also interacts with the supply of risk-free assets, which is impacted by the amount of excess reserves (determined by the central bank) and the Treasury bill supply (determined by the Treasury Department). A larger supply of risk-free assets increases the probability of systemic distress, because it decreases the cost of holding liquid assets and, hence, increases intermediaries’ ability to take on risk. An increase of risk-free assets also tends to lower consumption growth via its impact on the risk-free rate. However, the impact of the amount of short-term debt on welfare importantly depends on interactions with the level of liquidity and capital requirements. Intermediate levels of short-term asset supply tend to be welfare maximizing.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Tobias Adrian is a senior vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Nina Boyarchenko is an economist in the Bank’s Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics