The Federal Reserve Bank of New York today released results from its February 2015 Survey of Consumer Expectations Credit Access Survey, which provides information on consumers’ experiences with and expectations about credit demand and credit access. The survey shows little change in application rates for credit over the last twelve months, but a decline in rejection rates, in particular for credit card limit increases. The expectations component of the survey shows an increase in the average likelihood of consumers applying for credit over the next twelve months for all five credit products; the increase is most pronounced for mortgage refinances and higher credit card limits.

We introduced the survey in an earlier blog post. Here, we provide some highlights from the new release.

Consumer Experiences

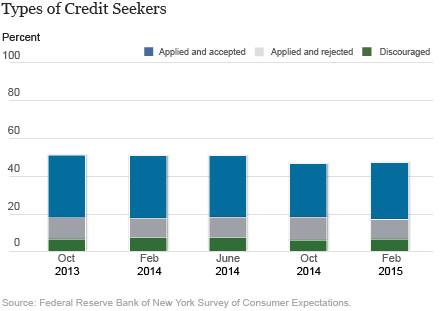

The chart below shows that the distribution of credit seekers was largely unchanged from the October 2014 survey: 30 percent of respondents applied for credit over the last twelve months and were granted credit, 10 percent applied for credit and were rejected, and 6.7 percent were too discouraged to apply, despite indicating a need for credit.

Overall, credit application rates remained steady at 40 percent, the same level that was reported four months ago. The share of applied and rejected credit seekers, as well as the rejection rates among applicants, declined for the more creditworthy groups, but rose for the least creditworthy group (consumers with a self-reported credit score of 680 or less) from 29 percent in October 2014 to 33 percent in the recent survey.

The February 2015 survey indicates that rejection rates declined from their October 2014 levels. Rejection rates per applicant decreased from 30 percent to 25 percent. Reported rejection rates for applicants aged 60 years and older decreased by 7 percentage points from October 2014 to 20 percent in the recent survey. While rejection rates declined for more creditworthy groups, they rose for the least creditworthy group to 59 percent, up from 55 percent in October 2014 and 51 percent in February 2014. Rejection rates per application decreased from 44 percent in October 2014 to 32 percent in February 2015, returning to early and mid-2014 levels. Rejection rates declined for all age groups, with larger declines for those aged 40 and below and for those aged 60 and above.

Turning to specific credit types (credit card, credit card limit increase, auto loan, mortgage, mortgage refinance), application rates were largely unchanged for each product. The most notable change in rejection rates was for credit card limit increase requests, which decreased from 38 percent in October 2014 to 24 percent in February 2015.

Finally, voluntary account closures were unchanged at 15 percent, while involuntary account closures declined slightly to 3 percent.

Consumer Expectations

Turning to the expectations component of the survey, the proportion of respondents who report that they are somewhat or very likely to apply for at least one type of credit over the next twelve months decreased from 32 percent in October 2014 to 29 percent in February 2015, back to levels seen during the first half of 2014. This decline was largely driven by middle-aged respondents (ages 41 to 59).

At the same time, however, the average likelihood of applying for credit over the next twelve months (reported on a 0-100 scale) increased for each credit type separately. This could be consistent with the lower proportion of respondents reportedly applying for any credit over the next twelve months if, for example, the increase in likelihood of applying for different credit types is more concentrated among a smaller subset of the population who are likely to apply for multiple loans, or if those likely to apply for credit are much more certain about doing so going forward (than they were in the past).

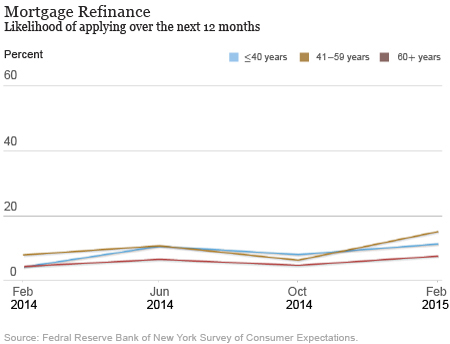

The most pronounced increase was observed for the average likelihood of applying for a mortgage refinance over the next twelve months, which doubled from 6 percent in October 2014 to 12 percent in February 2015. The chart below shows that, while increases are observed for all subgroups, they are especially large for middle-aged respondents, for whom the average likelihood of applying for a mortgage refinance jumped from 6 percent to 15 percent.

The average perceived likelihood of the credit application being rejected, conditional on applying, remained relatively stable for mortgages, credit cards, and auto loans, but declined slightly for credit card limit increase requests and mortgage refinance applications. For example, the average likelihood of a mortgage refinance application being rejected declined from 31 percent in October 2014 to 28 percent in February 2015.

Detailed findings from the survey, including interactive charts, are available on the SCE Credit Access Survey page.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Luis Armona is a senior research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Luis Armona is a senior research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Wilbert van der Klaauw is a senior vice president in the Bank’s Research and Statistics Group.

Basit Zafar is a senior economist in the Bank’s Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics