In a recent series of blog posts, the former Chairman of the Federal Reserve System, Ben Bernanke, has asked the question: “Why are interest rates so low?” (See part 1, part 2, and part 3.) He refers, of course, to the fact that the U.S. government is able to borrow at an annualized rate of around 2 percent for ten years, or around 3 percent for thirty years. If you expect that inflation is going to be on average 2 percent over the next ten or thirty years, this implies that the U.S. government can borrow at real rates of interest between 0 and 1 percent at the ten- and thirty-year maturities. This phenomenon is by no means limited to the United States. Governments in Japan and Germany are able to borrow for ten years at nominal rates below 1 percent, and the ten-year yield on Swiss government debt is slightly negative. Why is that?

To answer this question, it is useful to consider the concept of the “natural rate of interest,” introduced by Knut Wicksell in 1898 and fully integrated in modern macroeconomic models by Michael Woodford. This natural rate refers to the real interest rate consistent with full employment of labor and capital resources. More specifically, it can be viewed as the rate of interest that would obtain if all prices and wages had adjusted so as to bring the level of economic activity to its full-employment level. The natural rate of interest can vary substantially over time, as it is driven by numerous factors such as the long-run potential growth rate of the economy, demographic composition of the population, desirability of saving on the part of households, perceived profitability of investment opportunities, government spending, and taxes. Importantly, by construction, the natural rate of interest does not depend on the stance of monetary policy: when prices and wages are assumed to adjust instantaneously, economic activity fully employs all available resources, and there is little monetary policy can do to affect economic activity.

According to Wicksell, the natural rate of interest is the right benchmark for determining the extent to which monetary policy is accommodative. He argues that, “it is not a high or low rate of interest in the absolute sense which must be regarded as influencing the demand for raw materials, labour, and land or other productive resources, and so indirectly as determining the movement of prices. The causality factor is the current rate of interest on loans as compared to [the natural rate].” An implication is that monetary policy is not by itself expansionary if interest rates are low and restrictive if interest rates are high. Instead, monetary policy turns out to be expansionary if rates are below the natural rate and restrictive if rates are above the natural rate.

One key difficulty, however, is that the natural rate is not directly observable, as it is a counterfactual rate that would obtain only if all the economy’s resources were fully employed. To get a sense of where the natural rate is, economists have employed various techniques. In a recent paper, Jim Hamilton, Ethan Harris, Jan Hatzius, and Kenneth West use moving averages of the actual real rate of interest over a relatively long period of time as a proxy for the natural rate of interest. The idea is that we can estimate the natural rate of interest by averaging the actual interest rate in periods when the actual rate is below the natural rate and periods when the actual rate is above the natural rate. They assess that recent estimates of the real rate are low as a result of temporary headwinds on investment, deleveraging, and so on, but that the long-run equilibrium U.S. real interest rate remains significantly positive. While the measure provided by these authors is very useful to understand low frequency changes in the actual real rate of interest, it arguably does not correspond to the Wicksellian notion of the natural rate. As Paul Krugman points out in a recent blog post, when monetary policy is constrained (by, for example, the zero lower bound) the actual and natural rates may not coincide, and if the constraint binds for a long time, the difference between the two can be quite persistent. The practical implication is that this long-run measure of the effective real rate cannot be used to assess the stance of monetary policy in those instances.

Another approach, proposed by Thomas Laubach and John C. Williams, involves estimating a statistical model linking real GDP, inflation, and a short-term interest rate, and assuming that the gap between real GDP and its long-run trend depends on the past gaps between the actual interest rate and the natural rate. This model allows one to disentangle movements in the natural rate driven by long-run growth considerations from those driven by cyclical considerations. However, the estimated measure is best suited for a longer-run measure of the natural rate of interest, as discussed more recently in an article by San Francisco Fed President Williams.

DSGE models, such as the New York Fed’s DSGE model, provide an alternative approach for estimating the natural rate of interest by imposing on the relationships among economic variables a structure informed by modern economic theory. This model, which builds on the model with financial frictions used in Del Negro, Giannoni, and Schorfheide (2015), is estimated using data on real GDP, consumption, investment, hours worked, real wages, two distinct measures of inflation (the GDP deflator and core PCE inflation), the federal funds rate, and the ten-year Treasury yield. We also use survey-based long-run inflation expectations to capture information about the public’s perception of the Fed’s inflation objective, and market data on expectations of future federal funds rates to incorporate the effects of forward guidance on the policy rate. Finally, the model allows for persistent shocks to both the level and the growth rate of productivity, in an attempt to allow for the possibility of secular stagnation, and uses data on the growth rate of productivity. We discuss the model’s forecasts in the first post of the series.

Having a model makes it possible to define, and compute, the Wicksellian notions of “full employment” output and interest rates, precisely because we can construct a counterfactual economy. Specifically, we construct the natural rate as the equilibrium interest rate that would obtain if prices and wages were perfectly flexible (so that output and employment would be at their “potential”), if there were no shocks to the markup on goods and labor markets, and no financial frictions. Robert Barsky, Alejandro Justiniano, and Leonardo Melosi have used a similar model to estimate the natural rate of interest.

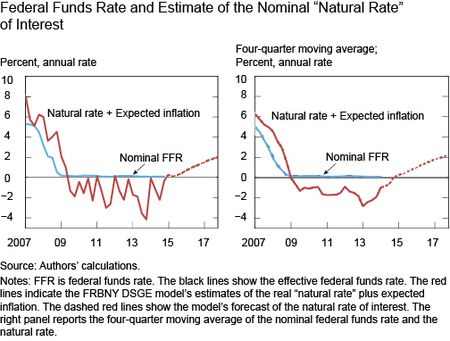

The red line in the chart below shows the model’s estimate of the nominal natural rate of interest (that is, the sum of the real natural rate of interest and expected inflation) along with its forecast. For comparison, the chart also shows the recent evolution of the nominal federal funds rate (solid blue line).

The chart shows that the estimated quarterly natural rate of interest is quite volatile in the short run, mostly because of fluctuations in quarterly consumption. As these short-term fluctuations are averaged out (right-hand panel), the estimated natural rate paints a fairly consistent picture: The natural rate fell sharply during the crisis, from above 6 percent in early 2007 to about -2 percent in mid-2009. The natural rate was slightly above the actual rate for the period preceding the Great Recession, and well below it for the entire post-Recession period, indicating that the zero lower bound imposed a constraint on interest rate policy. The natural rate is currently close to, but still below, the actual rate, suggesting that policy is not particularly accommodative. Finally, the natural rate is projected to increase in the near future, since the factors that brought down the natural rate during the crisis are dissipating, as discussed in our first post.

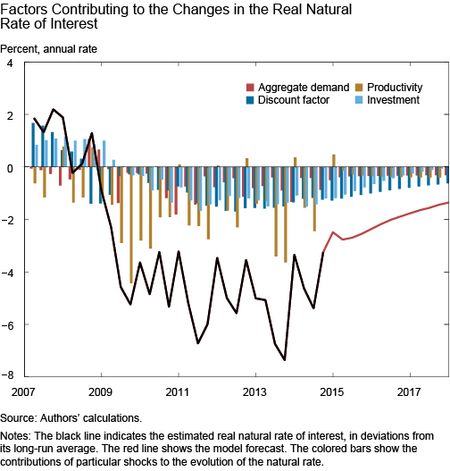

What are the factors that have led to such a precipitous drop in the natural rate and that have kept the rate at such a low level? The DSGE model allows us to trace the evolution of the natural rate back to the original shocks perturbing the economy. The next chart shows the real natural rate of interest, in deviations from its long-run mean. The colored bars show the contribution of various shocks to the evolution of the natural rate.

The dark blue bars refer to household “discount factor” shocks, that is, to disturbances to the household’s willingness to consume or save. The chart shows that while in 2007, households appeared more willing than normal to consume, they have since reversed this tendency by saving more than usual. This factor boosted the real natural rate above its long-run average by 2 percentage points in early 2007 and depressed the rate by about 1 ½ percentage points in 2012-13. The light blue bars refer to shocks in firms’ willingness to invest in physical capital. The chart reveals that in 2007 and 2008, firms were very willing to invest. However, since 2009, they have been much more prudent, which contributed to lowering the natural rate by more than one percentage point. These effects are projected to abate slowly as consumers are able and willing to consume more again and firms are projected to invest more. Changes in total factor productivity are also responsible for large drops in the natural rate, from 2008 to late 2014, as the orange bars show. Finally, other aggregate demand factors, such as government expenditures, have pushed up the natural rate in late 2008 but have exerted a downward pressure on rates since then.

Several factors are missing from the analysis. For instance, a potentially important omission relates to the assumption of a closed economy. Properly accounting for international factors would likely result in a different estimate of the natural rate. Explanations pertaining to the “global saving glut” advanced by Ben Bernanke suggest that foreign saving might push the natural rate of interest to even lower levels than estimated here.

In conclusion, the low level of interest rates experienced since 2008 is largely attributable to a reduction in the natural rate of interest, which reflects cautious behavior on the part of households and firms. Monetary policy has largely accommodated the decline in the natural rate of interest, in order to mitigate the adverse effects of the crisis, but the zero lower bound on interest rates has imposed a constraint on the ability of interest rate policy to stabilize the economy. Looking ahead, we expect these headwinds to continue to abate, and the natural rate of interest to return closer to historical levels.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Marco Del Negro is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Marco Del Negro is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Marc Giannoni is an assistant vice president in the Bank’s Research and Statistics Group.

Marc Giannoni is an assistant vice president in the Bank’s Research and Statistics Group.

Matt Cocci is a senior research analyst in the Bank’s Research and Statistics Group.

Sara Shahanaghi is a senior research analyst in the Bank’s Research and Statistics Group.

Micah Smith is a senior research analyst in the Bank’s Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Thank you for your response. You mention that your model forecasts future productivity growth. I’d be interested in seeing more detail on this given the considerable variability of underlying productivity growth through time. You mention that lower expected inflation pushes up the actual real rate of interest so the central bank may mitigate the decline in inflation by lowering the nominal rate. However, the lower inflation rate also pushes up the real return on capital maintaining equidistance between the money and natural rates. You state that the natural rate of interest that you report corresponds to a riskless rate. The rates I calculate are estimations of BBB aggregates. The current spread between the risk free rate and the 5 y BBB rate is around 3.5%, so this alone would not explain the large difference. Finally, you mention that it is somewhat puzzling that governments have been borrowing at much lower rates, (as have corporates too). My point here is that many macro models make the assumption that the Fisher / Keynes view holds and that there is a natural tendency for projects to come on to the market which will depress the return on capital down to the corresponding money rate. But much of the evidence is contrary to this hypothesis. Market imperfections, asymmetric information, regulation, forms of protectionism are all potential explanations. Hence it is quite possible to have large differences between the two rates without seeing inflation increase.

In reply to Franke: Thank you for your interest. On question A), we are indeed using data on long-run inflation expectations to estimate the model. These data come from the Blue Chip Economic Indicators survey and the Survey of Professional Forecasters. More detail on the model, its estimation, and the data used are available in Del Negro, Giannoni, and Schorfheide’s “Inflation in the Great Recession and New Keynesian Models” available at https://www.aeaweb.org/articles.php?doi=10.1257/mac.20140097. On B), the interpretation is that if all prices and wages had adjusted very rapidly in 2013 and if there were no financial frictions, so that the economy would be at full employment, then short-term interest rates would be in line with the natural rate. Of course, in reality, prices and wages don’t adjust instantaneously and there are financial frictions. So bringing the federal funds rate down to the natural rate does not guarantee that the economy would be at full employment all the time, but the natural rate indicates how non-monetary factors in the economy affect interest rates. Finally on C), while it is important to understand movements in the long-run natural rate of interest, our blog post suggests that there are also considerable fluctuations in the short- to medium-term, for instance as households change their propensity to consume, and firms are more or less inclined to invest. In past decades, the real federal funds rate has overall tracked our estimated natural rate of interest reasonably well, although the latter has been more volatile. The natural rate was substantially lower than actual rates in early 1980s indicating that policy was particularly restrictive then.

In reply to Peters: Thank you for your comments. Some of the criticisms in Montier’s piece have been dealt with by Krugman (in “I’m With Stupid” available at http://krugman.blogs.nytimes.com/2015/05/20/im-with-stupid); we won’t address those. However, Montier’s claim that is most relevant here is that the natural rate of interest comes out of a market that doesn’t exist in the real world. He is surely right on this one: in the real world, economic activity is not at full employment at all times! However, this doesn’t make the natural rate of interest less relevant and interesting. What monetary policy does is to move around short-term interest rates (and other tools) in order to maintain inflation close to its target and activity (or employment) close to its potential. At what level should the interest rate be set? The natural rate provides an answer. By construction, this rate abstracts from the effect of monetary policy; this is not a weakness, it is a strength, as it allows policymakers to see where the non-monetary forces are pushing interest rates. You state that “most of the drivers of the natural rate are merely hypothesized or the result of unverified assumptions.” Of course, since the natural rate is by definition a counterfactual object, the answer is model-specific, and we should always maintain a healthy dose of skepticism about any model-based construct. Regarding the claim that “inflation is assumed to be demand-led,” if you mean that supply is not a determinant of inflation, this is not true in the model we use. In reply to Aubrey: Thank you for your comments. As for your first comment, the “flaw” in the natural rate concept that you report and that was mentioned by Davidson, Mydral, and Hayek is subtle. In our model, the natural rate depends on many things, including expected future productivity growth rather than contemporaneous productivity growth. An increase in expected future productivity growth raises the natural real rate of interest and lowers expected future inflation, as you point out. However, the lower expected inflation pushes up the actual real rate of interest, for a given nominal rate. The central bank may mitigate the decline in inflation lowering the nominal rate. In general, it is not always possible to fully stabilize inflation and activity at full employment by setting the policy rate in line with the natural rate. The latter still provides a valuable reference point for the setting of monetary policy. As you point out in your second comment, alternative methods could be used to estimate a natural rate of interest. You propose to look at the return on capital in individual companies and obtain a return to capital around 12 percent. If that is the case, it is somewhat puzzling that governments have been borrowing at much lower rates. However, investment by individual companies is likely to be more risky. The natural rate of interest that we report corresponds instead to a riskless rate. It is therefore not surprising that our estimate is lower than yours.

I’d be interested in some details on your work. A) You say you are using survey-based inflation expectations. Given that all the available series have quite serious deficiencies in some way or another, which one are you using here? B) I am not sure I understand the interpretation of the natural rate in this context. Does this imply that, say, in 2013 a nominal FF rate of around -2% would have returned the model economy to full employment instantaneously? C) Not sure whether it really makes sense to use a concept of the natural rate in which it is so heavily influenced by cyclical factors. As a medium- to long-term concept, I think it should be mostly affected by structural shifts. Any cyclicality should not so much affect the estimate of the natural rate but rather the appropriate level of the actual rate in relation to that. In this regard, it would have been interesting to see, whether your estimate of “natural rate + expected inflation” was actually below the actual nominal FF rate before the crisis in 2005/2006, i.e. if policy was at any point “restrictive” by that measure.

I was wondering what your reaction/response is to Montier’s GMO piece “The Idolatry of Interest Rates” that was published on the same day as this blog post: https://www.gmo.com/docs/default-source/research-and-commentary/strategies/asset-allocation/the-idolatry-of-interest-rates-part-1-chasing-will-'o-the-wisp.pdf?sfvrsn=6 I think he argues that your concept of a Wicksellian natural rate is just a concept of the mental model you are using, that most of the drivers of the natural rate are merely hypothesized or the result of unverified assumptions (the largest being that your models tell nothing about the nature of money, and that inflation is assumed to be demand-led) I’d appreciate seeing you address this an other critiques of the approach in a future blog segment.

So the next question is therefore how come the economy isn’t growing at levels to take advantage of such potentially high profits? The main issue here is whether you agree that marginal rates of the efficiency of capital fall to the equivalent money rates as both Fisher and Keynes assumed would happen. Given many markets at the micro level are not perfectly efficient there is little reason to assume this will happen. Barriers to entry in many sectors are high, with some sectors only able to survive profitably with a handful of firms. Markets that display the characteristics expected by Fisher and Keynes would require minimal barriers to entry and lots of suppliers, which by definition are likely to be lower value added goods such as clothing. The US economy benefits from higher value added goods and services which by definition are difficult to replicate. The reality in most sectors in advanced economies is that conditions approaching perfect competition do not exist. Hence there is little reason to assume that these two rates should equilibrate at the macro level.

I think one outstanding challenge here in trying to deal with the natural rate of interest concept is that Wicksell’s notion of equilibrium was focussed on price stability, an idea that Davidson, Myrdal and Hayek showed was flawed. An increase in productivity will lead to a rise in the natural rate, which can lead to a fall in prices. To stabilise prices the money rate needs to fall, which in turn moves the natural and money rates further apart. With regards to the challenge of attempting to observe the natural rate, Wicksell’s notion of the natural rate is based on Bohm-Bawerk’s idea of originary interest which is determined by the marginal productivity of capital. Wicksell did explain that to calculate this, one would need to collect this data from company annual reports. Myrdal later argued that by creating a weighted index of company returns on capital such an estimation would be possible. My calculations of the natural rate based on average returns on capital, which provides useful proxies for the marginal productivity given the time series, generate rates that are quite different to your calculations. http://www.creditcapitaladvisory.com/2014/09/04/swedish-perspective-equilibrium-level-interest/ The levels for 2013 are in the region of 12%. So the next question is therefore how come the economy isn’t growing at levels to take advantage of such potentially high profits?