The largest U.S. financial institutions conduct business around the world, maintaining a strong presence through branches and subsidiaries in foreign countries. This blog post highlights trends in their foreign ownership over the past twenty-five years, complementing recent research from the New York Fed on large and complex banks. We document a constant decline in the importance of foreign branches for U.S. financial institutions, an increase in the complexity of foreign subsidiary networks, and a shift of activity from Latin America and the Caribbean to Europe and other regions.

The main data source for this blog post is the National Information Center (NIC), a depository of financial data and institutional characteristics of entities regulated by the Federal Reserve. With information from NIC, we can trace the organizational structure of all U.S. banking organizations over time, including the location of their foreign branches and subsidiaries. The database covers a broad range of institutions, including foreign banks, securities broker-dealers, and insurance companies. As of the end of 2014, we were able to link a total of 8,379 foreign entities, including 628 branches and 1,683 banking subsidiaries, to U.S. firms.

Foreign ownership is highly concentrated in a few firms

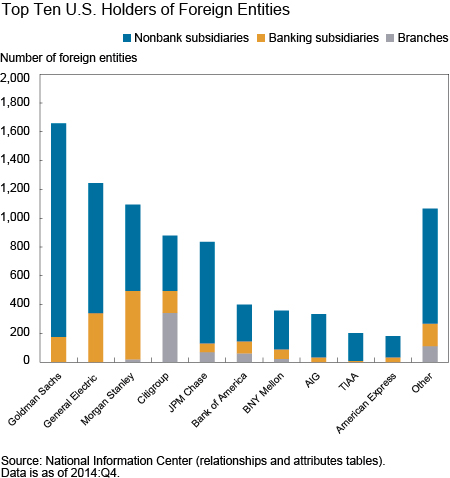

Of the roughly 4,800 topholders in our data set (U.S. entities that are not owned by another entity) only 2.8 percent operate one or more foreign affiliates. The high degree of concentration is illustrated in the chart below, which shows the number of foreign branches, bank subsidiaries, and nonbank subsidiaries owned by the most significant ten topholders in our data set. Citigroup, JPMorgan Chase, and Bank of America possess 75 percent of all foreign branches; Morgan Stanley, General Electric, and Goldman Sachs own 63 percent of all foreign bank subsidiaries.

Internationally active institutions have become more global over time

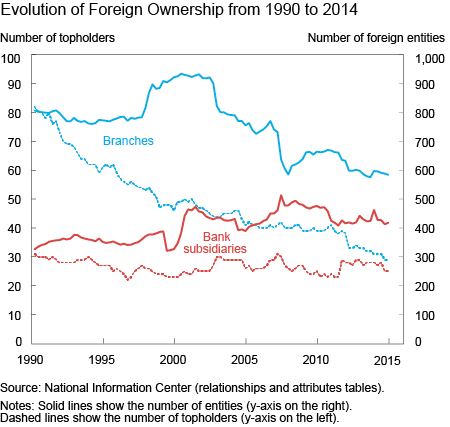

The next chart summarizes the evolution of U.S. banks’ foreign ownership of branches and bank subsidiaries from 1990 to 2014. To make the numbers comparable over time, we did not include entities that were only recently put under the Fed’s supervision as a result of regulatory changes. These are firms that converted to bank holding companies (BHCs) during the financial crisis as well as savings and loan holding companies (SLHCs), which the Dodd-Frank Act put under Fed supervisory authority in 2011. (The BHCs excluded from the chart are General Electric, American Express, General Motors Acceptance Corporation/Ally, Goldman Sachs, Morgan Stanley, Discover, CIT, and Metlife.) Similarly, entities that J.P. Morgan and Bank of America acquired from Bear Stearns and Merrill Lynch, respectively, are left out, since data for these entities are only available since 2008.

Focus first on the solid lines in the chart, which trace the number of foreign branches in blue and foreign bank subsidiaries in red. The scale associated with these lines is on the right. As indicated by the solid blue line, the importance of foreign branches has been decreasing over time. Today, only around 6 percent of NIC foreign entities are branches, down from 32 percent in 1995. By contrast, the U.S. banks have expanded their bank subsidiary networks. Bank subsidiaries as a share of foreign entities have increased from 15 percent to 20 percent over the same period.

The dashed lines depict the number of U.S. topholders with foreign branches in blue and bank subsidiaries in red. The corresponding scale is on the left. The increase in the solid lines relative to the dashed lines indicates that internationally active firms have become more global in the past twenty-five years. In fact, the concentration of foreign ownership has increased since 1990, especially during the precrisis period as smaller banks closed their foreign branches while the biggest institutions acquired additional foreign branches and bank subsidiaries. Since the financial crisis, foreign office closures have been shared more equally by larger and smaller banks, and the concentration of foreign branches and banking subsidiaries have leveled off and fallen slightly, respectively.

The structure of foreign ownership has become increasingly complex

So far we have focused on foreign branches and bank subsidiaries, but U.S. financial institutions have also stepped up their ownership of foreign nonbank subsidiaries. In 1990, there were 1,300 foreign nonbank subsidiaries in our database; at the end of 2014, there were over 6,000 such entities. Much of this increase is due to the inclusion of new institutions since the financial crisis. (For example, Goldman Sachs and Morgan Stanley together own a total of over 2,000 foreign nonbank subsidiaries.) However, even if we set aside entities owned by newly regulated BHCs and SLHCs, there are still over 2,000 foreign nonbank subsidiaries owned by U.S. topholders today, an increase of more than 50 percent from the 1990 level. This surge is overwhelmingly due to the addition of foreign nonbank institutions that are not securities broker-dealers or insurance companies.

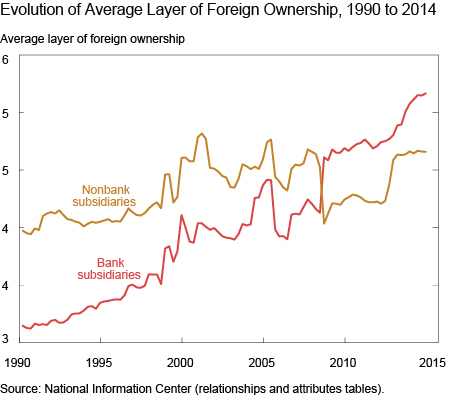

Another way to examine the increasing complexity of U.S. banks’ foreign operations is to look at the ownership structure. The chart below shows the average number of layers of control between topholders and their foreign subsidiaries from 1990 to the present. (Two layers of control, for example, would mean that the foreign entity is a subsidiary of another subsidiary of the topholder.) Today, the average bank subsidiary has over five layers of control between itself and its topholder, up from an average of just over three in 1990. The maximum number of layers of control for any entity in the NIC data set today is sixteen for bank subsidiaries and nineteen for nonbank subsidiaries, up from six and nine in 1990, respectively.

Some Substantial Changes in the Geographic Distribution

The interactive charts below show the number of branches, bank subsidiaries, and nonbank subsidiaries across countries and over time. The darker-shaded a country is, the larger the number of entities that U.S. financial institutions operate there. The bar at the top of each chart can be used to explore the geographic distribution of entities over time.

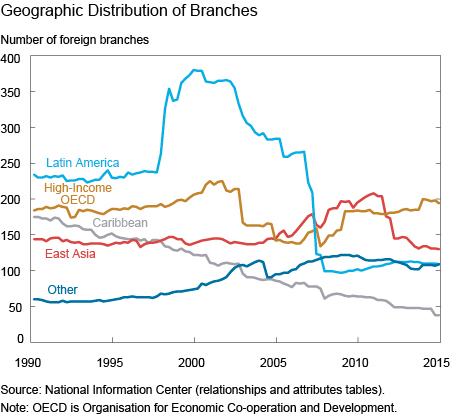

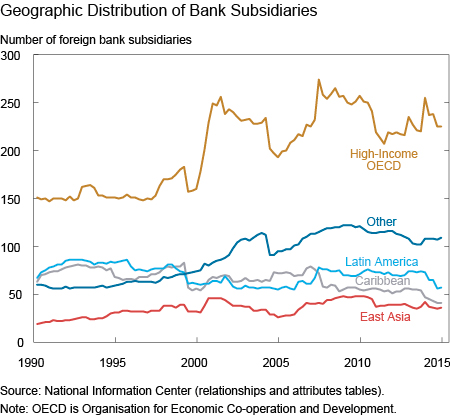

The next pair of charts summarizes information from above, depicting the number of foreign branches and bank subsidiaries by region over time (ignoring entities that entered our sample only recently). The first chart reveals that the decline in total foreign branches since the early 1990s has been driven largely by a retrenchment from the Caribbean and Latin America. The steady fall in the number of entities in the Caribbean is almost entirely due to branch closures on the Cayman Islands. The large drop in the number of Latin American branches in 2006-07 can be explained by Bank of America closing nearly all of its branches in Chile and Argentina. The expansion in ownership of foreign bank subsidiaries, seen in the second chart, has been driven by an increase in activity in Europe, particularly by Citigroup and BankBoston (since acquired by Bank of America) in the United Kingdom and Luxembourg.

What key factors can explain the patterns of foreign ownership?

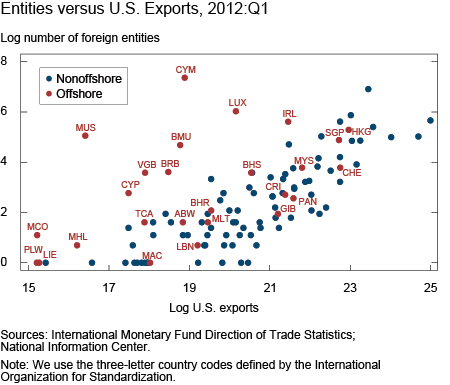

One important driver of foreign ownership is a country’s status as a tax-haven financial center. More than 30 percent of foreign entities are located in the Cayman Islands, Cyprus, Hong Kong, Ireland, Luxembourg, and the Netherlands alone. In the chart below, we plot the number of foreign entities in a country against the log of quarterly U.S. exports to that country, and show a strong correlation. Tax-haven financial centers, which are indicated in red, have a much higher number of foreign entities than suggested by their trade links with the United States.

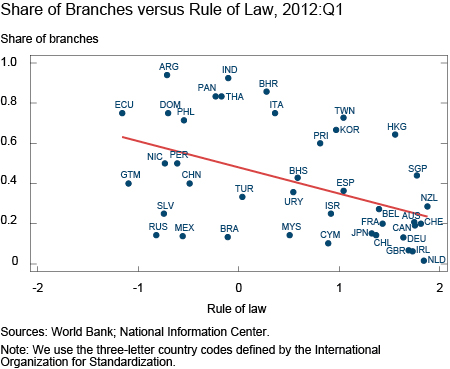

Whether banks operate through branches (offices) or through bank subsidiaries (separate legal entities) in a foreign market depends largely on country risk. In the next chart, we plot the ratio of foreign branches to the sum of branches and bank subsidiaries against a measure of a country’s rule of law from the World Governance Indicators for the year 2012. One reason for the negative relationship between the share of branches and a country’s rule of law might be that parent banks find it optimal to grant the affiliate more independence as a subsidiary when the institutional and regulatory environment in the foreign country is good.

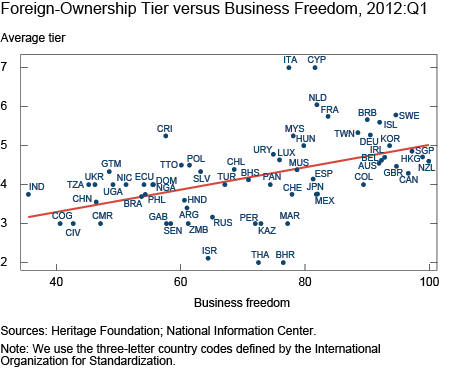

Perhaps unsurprisingly, the average layer of ownership of entities within a country is highly correlated with the country’s business freedom as the chart below indicates based on observations in the first quarter of 2012. The average foreign-ownership tier increases with the ease at which a business can be opened, licensed, and closed, as U.S. firms find it easier to construct complex ownership structures. Although not charted here, the average tier is biggest for entities in places like Jersey and Cyprus, as of the fourth quarter of 2014.

Conclusion

U.S. financial institutions are active around the globe, owning branches and subsidiaries in a growing number of countries. Data from NIC allow us to trace the foreign ownership structure of all U.S. banking organizations over time. Interestingly, the global financial crisis appears to have had relatively little impact so far on banks’ foreign ownership. While foreign branch networks are shrinking, subsidiary networks are expanding and are increasingly complex. Still, it remains to be seen whether financial reforms will have an impact on the scope and the form of U.S. banks’ global activities over time.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Friederike Niepmann is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Friederike Niepmann is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Preston Mui is a former senior research analyst in the Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Have you considered the impact of foreign entities created for: securitization purposes, ease of entering into derivatives positions, achieving tax advantaged income, etc.? Having worked for the multi-national banks, broker/dealers and insurance companies, I advised on setting up such entities and wonder how much this setting up of paper entities impacts your calculations and their significance to the conclusions drawn above.