In August 2007, at the onset of the recent financial crisis, the Federal Reserve encouraged banks to borrow from the discount window (DW) but few did so. This lack of DW borrowing has been widely attributed to stigma—concerns that, if discount borrowing were detected, depositors, creditors, and analysts could interpret it as a sign of financial weakness. In this post, we review the history of the DW up until 2003, when the current DW regime was established, and argue that some past policies may have inadvertently contributed to a reluctance to borrow from the DW that persists to this day.

The Discount Window’s Tradition against Borrowing

The Fed was established in 1913 to create an elastic money supply that would expand to meet high demand for liquidity during times of stress and contract once conditions improved. At that time, there were no open market operations (the buying and selling of government securities in the open market) to conduct monetary policy. Instead, the Fed adjusted the money supply by lending directly to banks through the DW. During these initial years, the DW was used extensively, and there appears to have been no mention of stigma attached to DW borrowing.

From the late 1920s, the DW gradually fell into disuse as the Fed began to take a dim view of DW borrowing and adopted a stance against the practice. The Fed observed that banks were becoming habitual borrowers from the DW, and it was concerned that an overreliance on DW borrowings would weaken banks and make them more prone to failure. Moreover, the Fed had switched to open market operations as its primary tool for conducting monetary policy. Accordingly, it viewed the DW as playing a more subordinate role by providing limited amounts of short-term credit to banks, to meet emergency needs, for example.

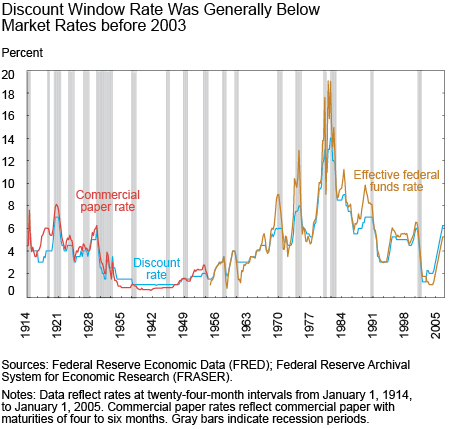

Although it discouraged DW borrowing, the Fed generally kept the DW rate below the market rate, in part because the Fed lacked independence from the Treasury and was obliged to keep the DW rate below the market rate to help the federal government finance its deficits at low rates. The Treasury–Federal Reserve Accord of 1951 freed the Fed from pressure from the Treasury, but the Fed continued to maintain the DW rate below the market rate despite recommendations to the contrary. It did so because it believed that banks that legitimately needed DW funds should not face a punitive rate. Thus, between 1914 and 2003, the DW rate was generally below the market rate on banks’ primary sources for short-term funding (in other words, the commercial paper rate before 1954 and the federal funds rate since 1954; see chart below).

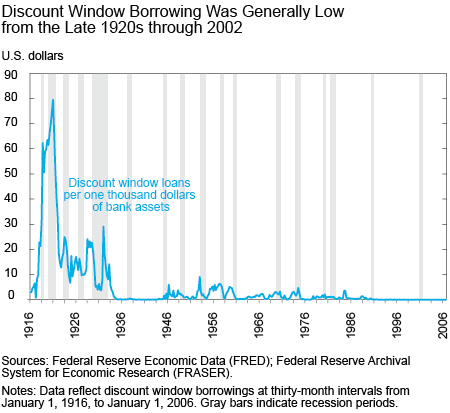

Given that DW borrowing was cheaper than borrowing on the market, the Fed aimed to limit DW borrowings in other ways, including “direct pressure” on banks not to borrow from the DW. Between the late 1920s and the 1980s, the Fed adopted and amended numerous restrictions on DW borrowing. Whenever DW borrowings increased, the Fed tightened the restrictions to suppress borrowing. For example, in the 1950s, when DW borrowings rose, the Fed issued detailed restrictions distinguishing between “appropriate” and “inappropriate” borrowings; borrowing to fund regular business activities was considered inappropriate. In 1973, the Fed added the requirement that, prior to accessing the DW, banks must demonstrate that they have exhausted private sources of funding. In the early 1980s, following another period of elevated DW borrowings, the Fed levied a surcharge on frequent borrowings by large banks to augment the administrative restrictions.

These policies appeared to have been effective, as DW borrowings (adjusted for the size of the banking sector) remained low after the 1920s, except for occasional minor spikes (see chart below). Thus, the policy of below-market lending along with specific constraints to limit borrowing characterized the Fed’s DW for most of the twentieth century.

What Policies May Have Contributed to Discount Window Stigma?

Throughout the Fed’s history, several policies may have contributed to the stigma associated with DW borrowing. The Fed’s pressure on borrowers to limit DW borrowing likely created the perception among banks that DW use should be avoided. In particular, the requirements that a borrower had to satisfy the Fed that it had a legitimate reason to borrow from the DW and that it had exhausted private sources of funding likely contributed to DW stigma. Indeed, these requirements may have led market participants to presume that if a bank was borrowing from the DW, it must be in trouble, even if, in fact, the bank was borrowing to address a temporary funding shortfall or to meet reserve requirements.

Another important factor that may have contributed to DW stigma was that, initially, the Fed lacked an official stance on DW lending to failing or insolvent institutions. Indeed, until the FDIC Improvement Act of 1991, which restricted Fed lending to undercapitalized banks, the Fed occasionally lent to banks that turned out to be insolvent. A watershed event was the experience of Continental Illinois National Bank and Trust, one of the largest banks to become insolvent and illiquid, which borrowed $3.6 billion under adjustment credit on May 11, 1984. When the DW loan became public, it further increased stigma in a way that administrative restrictions alone were not able to achieve. The incident helped reinforce a perceived link between recourse to the DW and financial problems, which made solvent banks reluctant to access the DW for fear that they might be considered insolvent.

The 2003 Discount Window Reform

To address concerns about DW stigma, the Fed fundamentally changed its DW policy in 2003, when it established the Primary Credit Facility (PCF). Only financially strong and well-capitalized banks are allowed to borrow at the PCF. The rate charged is a penalty rate above the target (range) for the fed funds rate (rather than a subsidized rate, as in the past), as seen in the DW rate chart. The PCF is a “no questions asked” facility—in other words, the Fed no longer asks banks whether they have exhausted all other sources of funding and it has no restrictions on the purpose of the loan. The Secondary Credit Facility was also created at this time, as a facility for weaker institutions that do not satisfy the criteria for Primary Credit—reinforcing the idea that borrowing from the PCF does not necessarily reflect a solvency problem.

The post-reform DW is more consistent with Walter Bagehot’s classical principles that central banks should lend freely to illiquid but solvent institutions against good collateral but at a penalty over the “normal” market rate. By lending freely, central banks create an expectation that they will be available to provide as much liquidity as is needed during a crisis and alleviate the high demand for liquidity that triggers most crises. By charging a penalty rate, they ensure that banks borrow as a last resort.

The 2003 reforms, however, do not appear to have removed the perception of DW stigma, as shown in “Discount Window Stigma during the 2007-2008 Financial Crisis,” and DW borrowing generally remained sparse (see the second chart, above). A plausible explanation for the persistence of DW stigma is that the old policies left lasting perceptions of the DW, which, among other factors, may have dissuaded banks from readily using it to this day.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Olivier Armantier is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Helene Lee is a senior associate in the Bank’s Markets Group.

Asani Sarkar is an assistant vice president in the Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

I would propose that it is time for a fundamental rethink of the Discount Window. When first conceived, the US had a much more bank-loan centric economy. Allowing loans against “good” commercial loan collateral was a way to avoid liquidity spirals at banks from impacting the broader economy. The US now, though, has a much more market-focused economy. The risk that central bankers seem most obsessed with is asset-liquidation spirals. As corporate bonds are more widely dispersed, it would seem appropriate to address the asset-liquidation concerns more directly by lending directly to bond-holders rather than through the banks (as capacity constrained intermediaries). I am of course talking my own book (working for an insurer), but if the Fed now has the ability to examine/supervise insurers and other non-bank institutions, it would see efficient to channel support directly to the end-holders of the debt.