Recent commentary suggests concern among market participants about corporate bond market liquidity. However, we showed in our previous post that liquidity in the corporate bond market remains ample. One interpretation is that liquidity risk might have increased, even as the average level of liquidity remains sanguine. In this post, we propose a measure of liquidity risk in the corporate bond market and analyze its evolution over time.

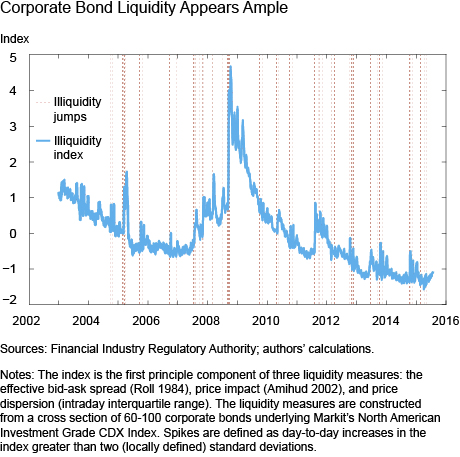

Corporate Bond Market Liquidity Measures Indicate Ample Liquidity

In our previous post, we examined several liquidity measures for the corporate bond market and found that they indicate ample liquidity. In this post, we create an index of illiquidity by combining three liquidity measures using principal components, a statistical technique for extracting key (principal) information from multidimensioned data sets. The low level of the index, shown in the chart below, suggests that corporate bonds are quite liquid by historical standards, although the market was extremely illiquid during the financial crisis. Furthermore, days on which market liquidity deteriorated markedly from the previous day, indicated by red vertical lines, are distributed fairly evenly across the sample.

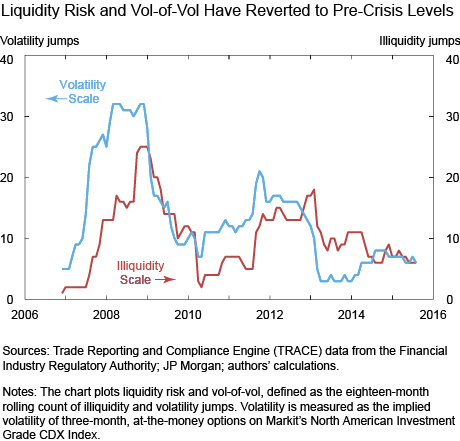

Corporate Bond Market Liquidity Risk is Stable

We measure market liquidity risk by counting the frequency of large day-to-day increases in illiquidity and price volatility, where “large” is defined relative to measures of recent liquidity and volatility changes (details are described here). We refer to the illiquidity jumps as “liquidity risk” and to the volatility jumps as “vol-of-vol.” Counting the number of such jumps in an eighteen-month trailing window shows that liquidity risk and vol-of-vol have declined substantially from crisis levels (see the chart below).

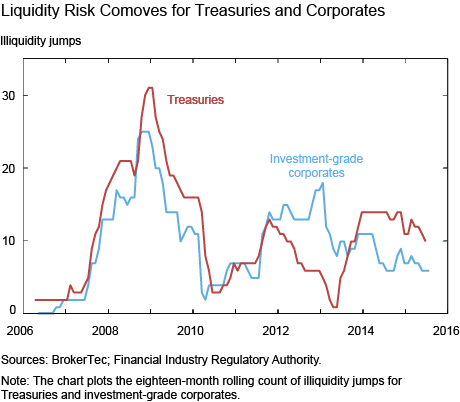

Treasury and Corporate Bond Market Liquidity Risk Comoved during Crisis

Liquidity risk in the corporate bond market and the Treasury market moved together during the crisis and its immediate aftermath but have diverged since 2011 (see chart below). While liquidity risk for Treasuries has increased and appears elevated, liquidity risk for corporate bonds has declined in recent years. (We explore the recent rise in Treasury liquidity risk in a related post).

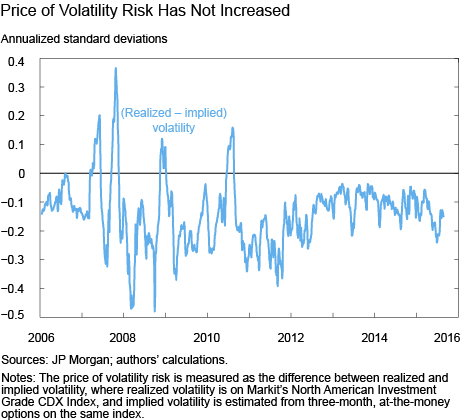

The Price of Corporate Bond Volatility Risk is Stable

While there are no readily available market price indicators for liquidity risk, the link between liquidity risk and vol-of-vol suggests that the price of volatility risk may indicate whether the price of liquidity risk has increased. We measure the price of volatility risk (that is, the volatility risk premium) in the corporate bond market by the difference between realized (five-year, investment-grade) CDX index volatility and (three-month, at-the-money) option-implied CDX index volatility. This difference reflects buyers’ willingness to purchase insurance in the options market against sharp price declines. Because providing insurance is costly, the volatility risk premium is negative, on average. The chart below shows that the volatility risk premium has not trended downward, implying that the price of volatility risk has not increased.

Caveats

Our analysis of historical data does not, by definition, capture the impact of future events. Liquidity risk will increase when credit markets are subject to significant turbulence in the future. However, the evolution of the implied volatility risk premium in credit markets, which should be forward-looking, does not suggest that future turbulence is currently priced by the market.

A related caveat is that tail risk measures prior to financial crises commonly appear benign. For example, tail risk measures in stocks, bonds, and options markets in 2005 and 2006 did not foreshadow the 2007-08 crisis. Adrian and Boyarchenko and Brunnermeier and Sannikov call this the “volatility paradox” and present theories where it emerges endogenously.

In Sum

While some market commentators are concerned about a decrease in liquidity, or perhaps an increase in liquidity risk in credit markets, we are not able to detect such changes. Current metrics indicate ample levels of liquidity in the corporate bond market, and liquidity risk in the corporate bond market seems to have actually declined in recent years. This is in contrast to liquidity risk in equity and Treasury markets, which we discuss in our companion post, and which appears to have increased.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Tobias Adrian is the associate director and a senior vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Michael J. Fleming is a vice president in the Bank’s Research and Statistics Group.

Or Shachar is an economist in the Bank’s Research and Statistics Group.

Daniel Stackman is a senior research analyst in the Bank’s Research and Statistics Group.

Daniel Stackman is a senior research analyst in the Bank’s Research and Statistics Group.

Erik Vogt is an economist in the Bank’s Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics