Update: A technical appendix has been added to the post.

According to conventional wisdom, an open-ended investment fund that has a floating net asset value (NAV) and no leverage will never experience a run and hence never have to fire-sell assets. In that view, a decline in the value of the fund’s assets will just lead to a commensurate and automatic decline in the fund’s equity—end of story. In this post, we argue that the conventional wisdom is incomplete and then explore some of the systemic risk consequences of investment funds’ vulnerabilities to fire-sale spillovers.

Early Bird Gets the Worm

The main reason a fund is vulnerable to runs is the existence of a first mover advantage when investors want to redeem their shares. The first mover advantage stems from the way in which funds pay out redemptions. When investors redeem, their shares are valued at end-of-day floating NAV and paid later in cash. Investors who withdraw earlier impose various costs on investors who withdraw later. The most important is perhaps the cost of selling illiquid assets. When facing small redemptions, a fund can use its liquidity buffer to make payouts and avoid liquidation losses, but when redemptions exceed the liquidity buffer, the fund will have to sell assets to pay the investors. For illiquid assets, this is costly, because the fund can only sell at discounted prices. Depending on the size and speed of the redemptions, a forced liquidation of assets can significantly reduce the price at which those assets are sold. Investors who arrive after the first round of sales will redeem their shares at a lower NAV than the early birds. It therefore pays to be first, even in the absence of leverage or a fixed NAV.

Goldstein, Jiang, and Ng (2015) provide strong evidence that these run-like dynamics stemming from holding illiquid assets are indeed at play. They show that mutual funds holding corporate bonds are more vulnerable to sudden investor withdrawals than are equity-only funds after episodes of underperformance: Because corporate bonds tend to be more illiquid than stocks, the first mover advantage is amplified. Conversely, the authors also show that investors in funds that hold Treasury securities (which are highly liquid bonds) have little redemption sensitivity to performance even though they have the same payout structure as corporate bond funds.

The price dislocations that follow after large redemptions and liquidations are quite significant and have market-wide implications. For example, in a study of forced sales by equity mutual funds, Coval and Stafford (2007) find that the 10 percent of funds that face the highest “selling pressure” in a given quarter depress the prices of the stocks they fire-sell by an average of 15 percent. In addition, the price effect cumulates over more than nine months. These numbers were estimated during “normal” times. It is conceivable that the price impact could be even higher or more persistent during financial stress or adverse macroeconomic conditions.

The market-wide price impact of liquidations, in turn, can produce spillovers. Any investors holding the assets that were forcibly sold will suffer mark-to-market losses even if they had nothing to do with the funds that sold the assets in the first place, or with the initial redemptions. These harmed third parties may need to rebalance their portfolios, triggering a second round of liquidations, which in turn triggers a third round, and so on. (Of course we expect each round to be smaller than the previous one, otherwise prices would converge to zero!)

We have just identified one particular, yet important, dimension of systemic risk. Redemption runs at the fund level trigger fire sales that depress market prices and spread losses to the broader financial system. In this way, the first-mover advantage embedded in the payout rules for open-ended mutual funds can affect a wide range of investors, even beyond the mutual fund universe.

Concerns about fund vulnerabilities have hardly ever been more relevant. The last half of August 2015 witnessed large withdrawals from both equity and bond mutual funds after turmoil from emerging markets hit the U.S. stock market. The SEC has been actively monitoring asset managers and recently proposed new liquidity management rules for mutual funds and exchange-traded funds. In the background, some larger questions loom: Are asset management funds systemically important? And should the activity or the institutions involved be designated as such? The debate is still raging, with many differing views and players: the Financial Stability Oversight Council, the Securities and Exchange Commission, the Financial Stability Board, the Office of Financial Research, the Systemic Risk Council, the fund managers, Blackrock, the Bank of England, The Economist, and so on.

A Macroprudential Stress Test

One way to assess whether mutual funds are in fact systemically important (at least when it comes to fire sales) is to put some numbers on the vulnerability to spillovers resulting from the redemptions and subsequent liquidations discussed above. To do so, we perform a macroprudential stress test. Just as in a normal stress test, we postulate a hypothetical scenario that places substantial strain on the financial system and then trace its consequences. In contrast to a regular microprudential stress test, in which the health of each firm is individually examined, our test analyzes the second-round spillovers for the system as a whole. In other words, we analyze the systemic risk created by fire sales.

The scenario we consider is a permanent, unexpected parallel shift of the yield curve of 100 basis points, holding stock returns constant. We are agnostic about the likelihood of that scenario actually materializing; as in any stress test, we want to analyze the vulnerability of the system to a severe event independently of its probability. As a consequence of the unexpected yield curve movement, bond mutual funds’ returns decline, producing initial losses. Investors respond by redeeming fund shares, a behavioral response widely documented after poor fund performance and most recently observed in August. We allow the size of redemptions to differ across funds and across time, capturing the idiosyncratic flow sensitivity to performance of each fund, which we empirically estimate using regression analysis and recent historical data. Given withdrawals from funds, we compute the liquidations required to meet the withdrawals and the resulting impact of the fire sales on prices. As is customary, we assume that the sale of assets has a linear impact on prices. This means that if the sale of, say, $10 billion of a given security reduces its price by 10 basis points, the sale of $100 billion of the same security would reduce the price by 100 basis points. Besides assuming linearity, we assume that different asset classes exhibit a different degree of liquidity. Reliable point estimates for the price impact of liquidation are not available in the literature for most of the assets we consider. To get around this problem, we use the weights assigned to different assets in the calculation of the Basel III Liquidity Coverage Ratio and the Net Stable Ratio to compute the relative liquidities of the different assets and then calibrate the absolute level by using estimates from the literature on the liquidity of Treasuries and equities.

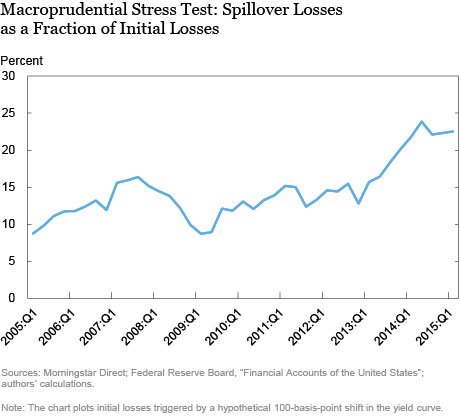

To make our stress test macroprudential, we calculate the losses caused by the decrease in market prices for all mutual funds holding any of the fire-sold assets and then sum these losses across the system. We call these losses aggregate vulnerability. The chart below shows, for each quarter since 2005, aggregate vulnerability as a fraction of the initial losses that would have occurred if the yield curve had shifted by 100 basis points. In the first quarter of 2005, the yield curve movement would have produced 9 cents of second-round spillover losses for each dollar of initial first-round loss. By the first quarter of 2015, in contrast, spillover losses would be 22 cents per dollar of initial loss.

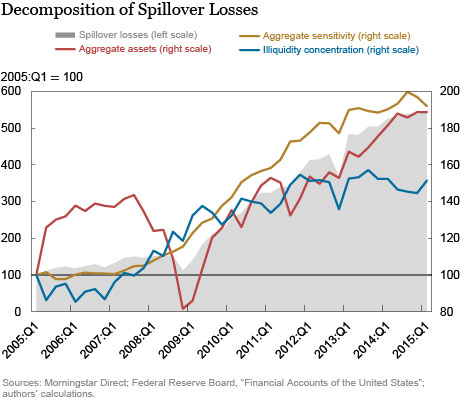

One reason for the increase in spillover vulnerability is that mutual funds—bond funds in particular—have grown substantially since 2009. However, a decomposition of spillover losses themselves—as opposed to their ratio to initial losses—shows that asset growth is not the only relevant factor. In the next chart, the line labeled “aggregate sensitivity” shows that the increase in the flow sensitivity to performance of the system has contributed as much to the increased vulnerability as the increase in aggregate assets. In other words, investors seem to have become more skittish since the crisis and are quicker to redeem shares, and in larger amounts, for a given degree of underperformance. The third factor, “illiquidity concentration,” captures how concentrated illiquid assets are in large funds with high flow sensitivity. The higher this concentration, the higher the “contagion” from funds selling illiquid assets to other funds. This third factor is also significantly higher today than before the financial crisis.

In sum, our macroprudential stress test reveals that mutual funds can, in fact, be subject to a “run”—despite the fact that they have no significant leverage and a floating NAV. In addition, the test shows that such a run can produce significant negative spillovers in asset markets through forced liquidations.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

![]() Nicola Cetorelli is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Nicola Cetorelli is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Fernando M. Duarte is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Thomas M. Eisenbach is an economist in the Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

This post generated a considerable amount of discussion and we have received several requests for details on the analysis. We have put together a background note giving the details of the methodology and the empirical implementation. (https://www.newyorkfed.org/medialibrary/media/research/blog/2016/LSE_2016_asset-managers_duarte-eisenbach_background.pdf) In addition, we want to respond to two themes raised in the comments – first, the complexity of the mutual fund universe and, second, the comparison to historical experience. On the first theme, we certainly agree that there is significant variation in characteristics across funds and investors. As described in more detail in our background note, we are taking into account as much heterogeneity as feasible with the data we use. Our sample period runs from 2005:Q1 to 2015:Q1 and contains 10,511 unique funds and 254,526 fund-quarter observations. Based on this data, we estimate the investor flow sensitivity for every fund individually, resulting in a sensitivity that corresponds to the average sensitivity observed for investors in a particular fund. On the second theme of judging systemicness by relying on historical experience, an important clarification is in order: Our exercise is to design a hypothetical scenario of intentionally severe stress and then observe the potential for spillovers. Of course, one can then entertain an evaluation of the likelihood of certain scenarios to actually materialize in reality, but this is a separate exercise. Our analysis specifically does not assess the likelihood of such a severe scenario occurring.

Would it make sense to impose standardized, extended minimum redemption periods according to estimated liquidity of underlying securities in a fund? The less liquid the underlying securities in a fund, the longer the minimum redemption period (1 day, 7 days, 14 days, 21 days, etc.) ?

The linked Strategic Insight report, previously shared with the FSOC, IOSCO and others, offers an empirical perspective on this topic. We analyzed mutual fund redemptions patterns over the past three decades, including multiple periods of financial market stress. I also offered a forward-looking analysis based on a deep understanding of the mutual fund marketplaces as a leading researcher of this industry over 30 years. http://www.regulations.gov/#!documentDetail;D=FSOC-2014-0001-0016 Looking ahead: It is my view that the heterogeneous nature of mutual fund investors, and the rising and dominant share of mutual funds invested through buy-and-hold asset allocation programs, suggest that mutual funds and their management companies will never pose systemic risks. Each large mutual fund and large mutual fund management company serve hundreds of thousands, at times millions of individual investors, within hundreds of distribution platforms, with each account held by individual investors averaging between $20,000-$50,000. Most of these investments are targeted for very long-term savings for retirement, with a 30-50 years of accumulation and distribution horizons. These millions of investors, hundreds of distribution platforms, and hundreds of thousands of financial advisers, have never acted in a herd-like redemption pattern implied by the FSOC. It is my view that large mutual funds and fund management companies, through their extraordinary diversification of investors and marketplace presence, are actually more stable that are smaller investment pool with more concentrated investors’ base. I believe that the U.S. lessons and observations, as suggested in our report, equally apply to funds offered globally in other sizable and maturing mutual fund markets. Looking Back: 1. During every crisis over the past three decades, and longer, capital preservation driven withdrawals by mutual fund investors were always limited in magnitude (in aggregate, generally adding up to under 2% of assets even during the most alarming monthly periods) and very short in duration (a few days, a few weeks). 2. Stock fund portfolio managers, using their cash and liquidity facilities, buffer investor redemptions in times of crisis. For example, during October 2008, stock funds’ PMs net sold an amount equal only 0.4% of all assets held in such funds. Such stock net liquidations equaled just a third of stock fund investors’ net redemptions during the month (investors net redemptions were under 2% of all stock fund assets under management during October 2008). 3. The magnitude of bond fund redemptions during times of financial stress were a bit different, but the pattern of such redemptions are largely similar. In separate chapters of this report we discuss these historical patterns of stock and bond fund redemptions; the industry’s developments that make high redemption risks smaller, not larger, today; and why we have concluded that the FSOC concerns of systemic risk poses by large mutual funds and large mutual fund managers are unwarranted. Thank you.

This blog argues that when interest rates rise, bond mutual fund outflows create significant feedback effects, raising interest rates even more. The result, however, is based on a theoretical “calibrated” model. A better approach is to look at actual experience. Consider the “Taper Tantrum” of May-June 2013. Long-term interest rates rose by about 100 basis points, similar to the rate shock the theoretical model assumes. Rises in interest rates were tied closely to statements by Fed officials; outflows from bond mutual funds were quite modest; and evidence is lacking that even those modest outflows created further increases in interest rates. For more information, see Collins and Plantier (2014) at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2510666. Consider also what the logic of this model implies. The model would appear to apply to all market participants who buy and sell bonds, including the Federal Reserve itself. The Fed holds more than $4 trillion in bonds. According to this theoretical model, when the Fed begins to sell those bonds, long-term interest rates will spike. In reality, we doubt that gradual sales of bonds by the Fed will have much effect on bond prices, provided market participants expect and understand those sales. The same would be true of the modest outflows expected from bond mutual funds following a rise in interest rates. Sean Collins and Chris Plantier, Investment Company Institute

It’s hard to know how much credence to give these estimated spillover losses without knowing more about the underlying regression models. Is that information available anywhere? Thanks.