Every quarter, senior loan officers at selected large banks around the United States are asked by Fed economists how their standards for approving business loans changed compared with the quarter before. Of all the questions in the Senior Loan Officer Opinion Survey (SLOOS), responses to that question about standards usually attract the most attention from the financial press and researchers. Relatively ignored by comparison are loan officers’ reports on how they changed interest spreads, collateral requirements, and other terms on loans they are willing to approve. Lenders can clearly expand or contract credit by altering those terms even without changing their standards for approving loans, so we investigate whether the reports on loan terms collected in the SLOOS are also informative.

The Standards Question

The first question in the SLOOS asks about standards for approving commercial and industrial (C&I) loans to large and medium-sized firms:

Over the past three months, how have your bank’s credit standards for approving loan

applications for C&I loans or credit lines—excluding those to finance mergers and

acquisitions—changed?1) tightened considerably

2) tightened somewhat

3) remained basically unchanged

4) eased somewhat

5) eased considerably

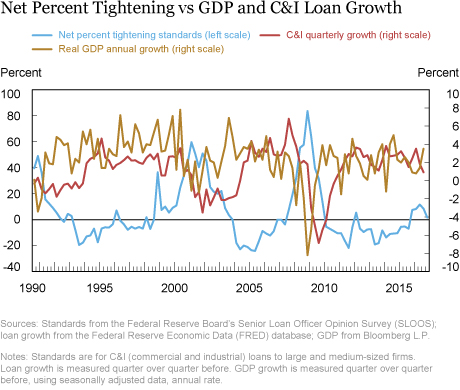

The net percent tightening—the percentage of respondents answering 1 or 2 minus the percentage answering 4 or 5—is plotted below along with the growth rates of C&I loans at banks and real GDP.

Although it may not be obvious at first glance, lending standards and growth in loans and output are negatively correlated. That negative relationship is starkest during the financial crisis and Great Recession, and also over the 2001 recession. More generally, Lown and Morgan show that loan officers’ reports are strong predictors of C&I loan growth and economic activity, even after controlling for various other leading indicators. Bassett et al. confirm and extend those findings using bank-level responses, and de Bondt et al. document that the lending standards collected by the European Central Bank are also highly informative.

So Lending Standards Are Predictive, But What about Loan Terms?

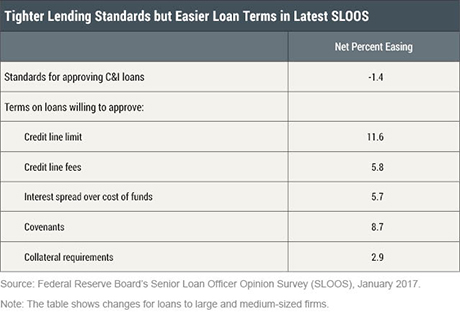

At least since 1990, SLOOS respondents have also reported changes in five other loan terms: interest spreads (over costs of funds), credit line fees, credit line loan limits, collateral requirements, and covenants (restrictions imposed by lenders on borrowers). Even without changing their standards for approving loans—the extensive margin—lenders can expand or contract credit supply by changing terms on the loans they do approve—the intensive margin. In fact, lending standards and loan terms sometimes do move independently, and occasionally even in opposite directions, as we observe in the latest SLOOS:

While a small net fraction (1.4 percent) of loan officers report tightening C&I lending standards, lenders report easing all five loan terms on net, ranging from 11.6 percent (of all respondents) net easing of credit line limits, to 2.9 percent net easing on collateral requirements. We’re not aware of any theory to explain why lenders would restrict credit on the extensive margin (by tightening standards) but expand along the intensive margin (by easing terms), but empirically, if loan terms move independently from lending standards to a sufficient extent, they could provide a useful signal beyond that provided by standards. That said, changes in all five loan terms are highly correlated with changes in standards (0.91 or higher), so it’s not obvious that they provide much new information.

Off to the Races

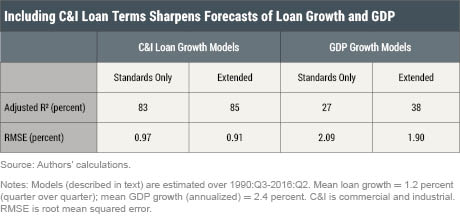

To investigate, we run a simple forecasting “horse race” where we first regress C&I loan growth and GDP growth on their own lagged values plus the current and lagged values of standards (net percent tightening). We then compare the forecasting errors from those standards only models to those of extended models that include the same variables plus the current and lagged values of the first and second principal components of the five loan terms. Principal component analysis is a common statistical method for reducing the number of correlated variables in a data set into a smaller number of uncorrelated variables while still conserving the essential information. In our case, the first two principal components explain 98 percent of the variation of the other series.

The winner, although not by a lot, is the extended model with standards and loan terms, as shown in the table below. The extended model fits the data better, as indicated by the higher adjusted R2, particularly for GDP growth. Adding loan terms to the model reduces the average forecast error (root mean squared error) for loan growth by 6 percent (from 0.97 to 0.91) and reduces the root mean squared error for GDP growth by about 9 percent (from 2.09 to 1.90). We are a bit puzzled that including loan terms improves the GDP forecast more than it does the loan forecast since loan terms are more directly, possibly causally, connected to lending than to output.

Takeaway

It’s well established that the changes in commercial lending standards reported in the SLOOS provide reliable signals about future loan growth and economic activity. Our analysis, although cursory, suggests that changes in loan terms in the SLOOS also bear watching.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Donald P. Morgan is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

John Sporn was an associate in the Bank’s Markets Group at the time this post was written.

How to cite this blog post:

Donald P. Morgan and John Sporn, “Getting More from the Senior Loan Officer Opinion Survey?,” Federal Reserve Bank of New York Liberty Street Economics (blog), February 22, 2017, http://libertystreeteconomics.newyorkfed.org/2017/02/getting-more-from-the-senior-loan-officer-opinion-survey-.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics