This week, four Ph.D. students in economics and finance are wrapping up their summer internships at the New York Fed’s Research Department. The ten-week internships—which are compensated—offer interns the opportunity to further their dissertation research, interact with the Bank’s research economists, and give informal, “brown bag” lunch seminars to hear feedback on their work.

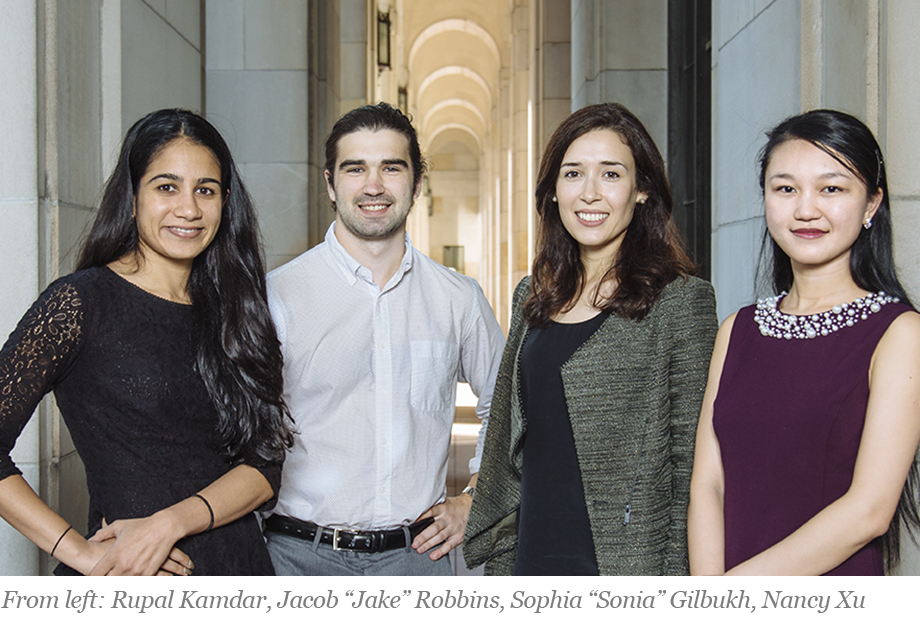

This year, two interns were hired through the Bank’s internship program: Jacob “Jake” Robbins from Brown University and Nancy Xu from Columbia Business School. Two others, Sophia “Sonia” Gilbukh of New York University and Rupal Kamdar of the University of California, Berkeley, were CSWEP fellows. CSWEP (Committee on the Status of Women in the Economics Profession) is a standing committee of the American Economic Association charged with promoting and monitoring the careers of female economists in academia, government, and the private sector.

We checked in with this year’s cohort of interns for a little debrief:

Q: Was there a key experience or project that stands out from your internship?

Gilbukh: The summer internship offers an invaluable opportunity to work alongside leading researchers and policymakers. The economists are very generous with their time and the obligatory brown bag presentations at the beginning and at the end of the stay are a great way to get feedback for your work.

Kamdar: During my time at the Bank, I presented my research to the staff economists twice. The discussion during, and feedback after, the presentations was thoughtful, constructive, and wide-ranging. The experience was invaluable in helping me advance my research.

Robbins: The best experience of the internship has been giving a seminar on my research to the macroeconomics group here. The seminar was incredibly useful—I received several comments which have helped the direction of my research.

Xu: The internship could easily have turned into a continuation of a Ph.D. life. However, my adviser here, Gara Afonso (among many others), continues to encourage me to break my “Ph.D.” momentum and start practicing “being a real economist.”

Q: What surprised you about your experience here?

Gilbukh: While I worked at the Bank as a research analyst before starting graduate school, I had forgotten just how much gold we are quite literally sitting on top of. The gold vault tour was one of the more memorable experiences I have had this summer.

Kamdar: A gold brick is surprisingly heavy! Don’t worry I am not running off with them. But on a more serious note—in academia, economists with like-minded approaches and interests often congregate in certain departments. The Bank pleasantly surprised me in terms of the heterogeneity of methods used and questions asked.

Robbins: I was surprised about the sheer size of the research group here—around sixty-five Ph.D. researchers on one floor! Compared to the average academic department, there are many more macroeconomists here to talk to about research.

Xu: The academic atmosphere and the social part of it impressed me a lot. I have two excellent designated, economist mentors, but I ended up connecting and collaborating with many others not in my function.

Q: Tell us a little bit about your research.

Sophia “Sonia” Gilbukh, New York University

My dissertation studies how the free entry of real estate agents can affect housing market outcomes and amplify the housing cycle. The real estate market is highly intermediated, with 90 percent of both buyers and sellers hiring an agent to facilitate transactions. Due to easy entry and fixed commission rates, roughly a third of agents are brand new to the profession, with an equal proportion exiting each year. Using a dynamic structural model of agents’ entry and exit decisions, I estimate how much these intermediaries may have contributed to the recent housing crisis. My colleagues and I then evaluate policies that raise the cost of entry and by improving the equilibrium distribution of intermediaries’ experience, might have dampened the housing collapse.

Rupal Kamdar, University of California, Berkeley

My research identifies a new transmission mechanism linking monetary policy to the housing market that I call the “securitization channel” of monetary policy. The hypothesis is that after mortgage originators sell loans to securitizers, they no longer bear the loan’s prepayment risk. Thus, when mortgage rates fall, these lenders are more likely to signal to their borrowers to refinance, resulting in more borrower refinancing. The findings have implications for the efficacy of policy to increase refinancing, lower mortgage payments, stimulate demand, and improve economic outcomes.

Jacob “Jake” Robbins, Brown University

Over the past forty years, the U.S. economy has changed in important and surprising ways. Interest rates have declined precipitously and inequality has risen, with the “labor share” of income (the fraction of national income going to workers) declining from around 66 percent in 1980, to around 62 percent. Thomas Piketty has documented that most of the wealth accumulated over that period has been concentrated in the hands of the very few. These facts challenge standard macroeconomic theory, which has long been based around the idea that all of these factors should be constant in the long run. My research tries to understand what’s driving these long-running changes, using both theory and evidence.

Nancy Xu, Columbia Business School

Unprecedented globalization has amplified the traditional channels through which risk is transmitted around the world, resulting in a stronger commonality in the “quantity of risk” (that is, uncertainties) across countries. Another crucial determinant of asset prices is the “price of risk”—the extra return demanded by risk-averse investors as compensation for bearing additional risk. My research investigates the role of quantity-of-risk factors and price-of-risk factors (that is, risk aversion) in explaining stylized facts on comovements in global stock and bond returns. I uncover a potentially dominant role of U.S. risk aversion in explaining differences between the two global comovements.

—Trevor Delaney

Disclaimer

The views expressed in this post are those of the author and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author.

How to cite this blog post:

““Hey, Economist!” How Was Your Ph.D. Internship?,” Federal Reserve Bank of New York Liberty Street Economics (blog), August 18, 2017, http://libertystreeteconomics.newyorkfed.org/2017/08/hey-economist-how-was-your-phd-internship.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics