Security dealers sometimes enter into tri-party repo contracts to fund one class of securities with the expectation they will wind up settling the contract with higher quality securities. This strategy is costly to dealers because they could have borrowed funds at lower rates had they agreed to use the higher-quality securities at the outset. So why do dealers do this? Why obtain or arrange excess funding for the initial asset class? In this post, we discuss possible rationales for an excess funding strategy and measure the extent of excess funding capacity in the tri-party repo market. In a second post, we examine the maturities of repos used to generate excess funding capacity and estimate the costs of this strategy.

Background on Repo

A repo is effectively a collateralized loan, structured as a paired sale and future repurchase of securities at specified terms. The difference between the future and current price of the securities determines an implied interest rate, which is typically used to price the repo. The interest or repo rates are typically lower the higher the quality (in terms of risk and liquidity) of the securities posted as collateral (for example, see the tri-party repo rates posted by the Bank of New York Mellon). This feature makes generating excess funding capacity costly, because dealers negotiate a repo rate based on lower-quality collateral, but end up allocating higher-quality securities.

Another important feature of repos is the haircut, which represents the additional collateral available to the lender to cover losses in the event of a counterparty default. Unlike with rates, the haircut for a given trade will depend on the quality of the eligible securities allocated at settlement; if a dealer posts better-than-necessary collateral to a repo, the required haircut declines accordingly but the negotiated interest rate on the cash does not change.

Why Maintain Excess Funding Capacity?

A dealer might maintain excess funding capacity for two reasons. First, it may be difficult to find investors willing to provide funding against certain asset classes. When such an investor is found, the dealer might negotiate more funding than necessary to ensure funding in the future.

Second, a dealer may want excess capacity as a buffer in times of crisis when investors may reduce the amount of funding they are willing to provide against particular asset classes. Having excess capacity gives a dealer time to find other investors or to de-lever. In fact, some dealers consider excess funding capacity in their internal stress tests.

How Prevalent Is Excess Funding?

Using confidential, daily data covering March 2017, we compute dealers’ excess funding capacity in tri-party repo, where U.S. dealers obtain a large part of their secured funding (for background, see this blog post). Our data cover a variety of transactions types but we focus on those labeled as repos that are not between affiliated parties. This subsample accounts for around 65 percent of the total value of tri-party repo in aggregate and by asset class (see total value statistics here).

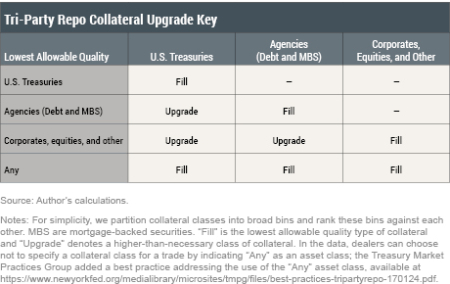

Our data reveal both the lowest-quality asset class from which securities can be used to fulfill the obligations of a repo and the asset class of the securities actually allocated at settlement. We define excess funding capacity to be the amount of a repo backed by higher-than-necessary quality collateral, with the table below outlining what is considered higher quality than necessary. As an example, suppose that a dealer enters into a $95 repo where equities are the lowest-quality securities permissible. If the dealers allocates $90 of equities and $5 of U.S. Treasuries to the trade, the dealer has generated excess funding of $5 ($95-$90) with this repo (ignoring the securities allocated to satisfy the haircut requirements.)

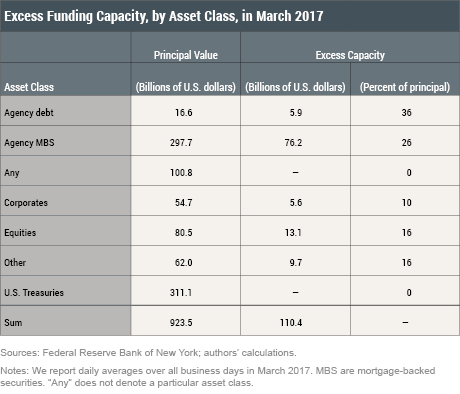

The table below reports excess funding capacity by asset class. For example, of roughly $17 billion in agency debt repos in our sample (principal amount), nearly $6 billion, or 36 percent, represents excess capacity. The two asset classes with the highest amount of excess capacity are agency mortgage-backed securities (MBS) and equities repos, with $76 billion and $13.1 billion, respectively.

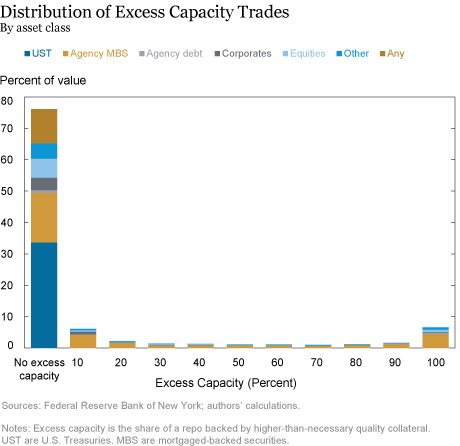

The chart below shows the distribution of repos, weighted by principal amount, by the excess funding capacity they generate. Not surprisingly (since excess capacity is costly), 76 percent of repos do not generate excess funding capacity, (including all “Any” and U.S. Treasuries repos, which by definition cannot create excess funding). Twelve percent of repos by value, however, generate excess capacity of 50 percent or more, indicating that dealers are entering into these contracts with deliberate intent to acquire excess funding capacity. Focusing on repos which acquire 50 percent or more excess funding capacity, we find that agency MBS and equities trades dominate and are a significant part of the entire market, accounting for 8.1 percent and 1.4 percent, respectively, of total value traded.

Takeaways

In the tri-party repo market, we find that dealers seek excess funding capacity, especially for agency MBS and equities securities. This fact suggests that dealers value the option of having funding available for such asset classes in the future. In our next post, we examine the repos generating excess funding capacity in more detail and estimate how much this strategy costs dealers.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Adam Copeland is an officer in the Federal Reserve Bank of New York’s Research and Statistics Group.

Ira Selig is a manager in the Bank’s Supervision Group.

Ira Selig is a manager in the Bank’s Supervision Group.

Noah Zinsmeister is a senior research analyst in the Bank’s Research and Statistics Group.

How to cite this blog post:

Adam Copeland, Ira Selig, and Noah Zinsmeister, “Excess Funding Capacity in Tri-Party Repo, Federal Reserve Bank of New York Liberty Street Economics (blog), [Insert Publish Date], 2017, Permalink: http://libertystreeteconomics.newyorkfed.org/2017/09/excess-funding-capacity-in-tri-party-repo.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics