In a recent Liberty Street Economics post, I showed that one major category of consumer spending—spending on discretionary services such as recreation, transportation, and household utilities—behaved very differently in the 2007-09 recession and subsequent recovery than in previous business cycles: specifically, it fell more steeply and has recovered much more slowly. This finding prompted one of the editors of this blog to inquire whether consumer goods spending has also departed markedly from its behavior in past cycles. To answer that question, I examined the decline of expenditures on consumer durable goods and nondurable goods across recessions as well as the pace of recovery during long expansions like the current one.

The Decline in Goods Consumption

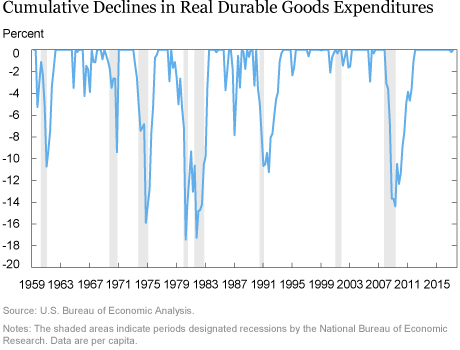

The chart below shows the extent of declines in real per capita consumer durable goods expenditures from their previous peak. Note that a zero value in this chart indicates that expenditures were at or above their previous peak. Comparing this chart to the corresponding chart for discretionary services expenditures in my earlier post, we see that durable goods expenditures fell below previous peaks much more frequently than did the services expenditures. This pattern reflects the widely noted volatility in durable goods expenditures.

If we focus more narrowly on the decline in consumer durable goods expenditures in the last recession, two points emerge. First, the depth of the decline in these expenditures was not unusually large. Spending on durable goods fell more in the recessions of the mid-1970s and early 1980s, and fell almost as much in the early 1990s recession. Second, the length of time that durable goods spending remained below its peak differed little from that observed in the recessions of the mid-1970s, early 1980s, and early 1990s. In contrast, the drop in discretionary services expenditures in this cycle was both considerably larger and more persistent than in previous business cycles.

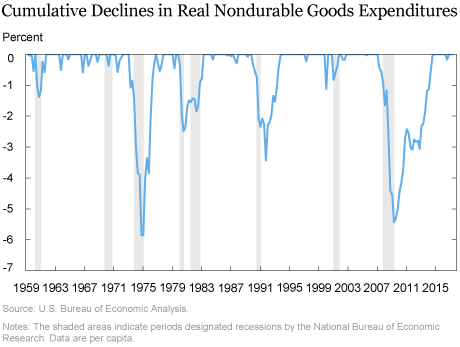

The next chart is the corresponding chart for real per capita consumer nondurable goods expenditures. Around the last recession, these expenditures remained below their peak for a prolonged period (thirty-one quarters), which is only modestly shorter than that for discretionary services expenditures (forty quarters). Even so, the extent of the decline in discretionary services spending was extraordinary, while the extent of the drop in nondurable goods expenditures was not: during the mid-1970s recession, spending on nondurable goods fell more than it did in the most recent recession. So the combination of depth and persistence that characterizes the fall in discretionary services expenditures appears to be unique among the major categories of consumer spending.

Recovery of Goods Expenditures

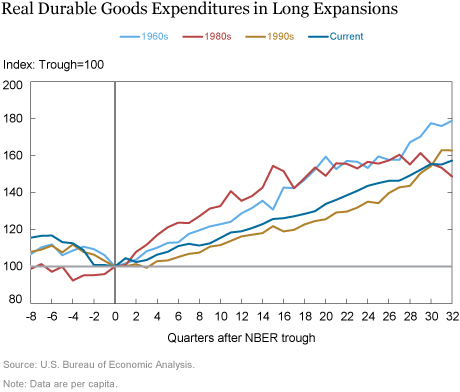

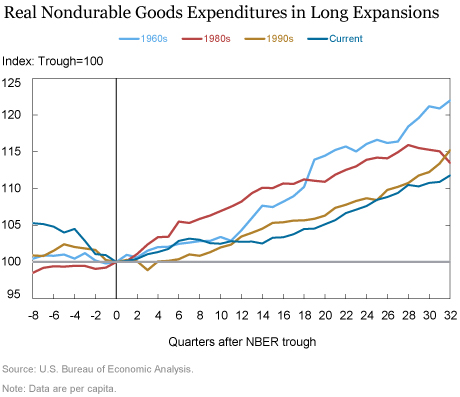

I now turn to examining the behavior of goods expenditures across expansions. Keep in mind that spending on both discretionary and nondiscretionary services has grown much more slowly in the current expansion than in other long expansions—the expansions of the 1960s and 1990s, which lasted longer than the current one, and the 1980s expansion, which lasted almost as long.

To facilitate comparisons across expansions, the next chart presents an index of real per capita consumer durable goods expenditures that equals 100 in the quarter at the end of a recession. We see that durable goods expenditures in the second quarter of 2017 were almost 60 percent above their level at the recession’s trough, suggesting a pace of recovery that is roughly similar to that observed in the 1980s and 1990s but somewhat slower than that in the 1960s.

As seen in the next chart, consumer nondurable goods expenditures have increased somewhat more slowly in the current expansion than in the other expansions pictured: In the second quarter of 2017, they were about 12 percent above their level at the recession’s trough, whereas in the expansions of the 1980s and 1990s, they were about 14 to 15 percent above the trough at the same point. Still, the differences in pace are smaller than those observed for expenditures on discretionary services: these expenditures were only about 8 percent above their trough level in the latest expansion, while they were more than 20 percent higher in previous expansions.

Overall, this analysis indicates that the behavior of consumer goods expenditures in this business cycle has not differed materially from the behavior observed in previous long expansions. The depth of declines in these expenditures was not extraordinary, and the pace of growth in the expansion has been fairly similar to that in the preceding expansions. In contrast, discretionary services expenditures suffered an unprecedentedly deep and prolonged fall in the last recession, and they have grown considerably more slowly in the current expansion.

The contrasting behavior of goods and discretionary services expenditures in the expansion is to some degree consistent with the analysis in a recent paper by Fernald, Hall, Stock, and Watson, who find that, among consumption categories, services had the largest shortfall in growth during this expansion. Their analysis attributes most of the shortfall to nondiscretionary spending on housing and financial services, whereas my previous post suggests that much of the weakness was in discretionary services. Although it is difficult to do in “real time,” ascertaining the major factors behind the slow growth of this expansion would be helpful for policymakers seeking to respond more effectively to future shocks to the household sector.

Disclaimer

The views expressed in this post are those of the author and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author.

Jonathan McCarthy is a vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this blog post:

Jonathan McCarthy, “What about Spending on Consumer Goods?,” Federal Reserve Bank of New York Liberty Street Economics (blog), January 16, 2018, http://libertystreeteconomics.newyorkfed.org/2018/01/what-about-spending-on-consumer-goods.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics