The global financial crisis, and the ensuing Dodd-Frank Act, identified size and complexity as determinants of banks’ systemic importance, increasing the potential risks to financial stability. While it’s known that big banks haven’t shrunk, the question that remains is: have they simplified? In this post, we show that while the largest U.S. bank holding companies (BHCs) have somewhat simplified their organizational structures, they remain very complex. The industries spanned by entities within the BHCs have shifted more than they have declined, and the countries in which some large BHCs have entities still include numerous “secrecy” or tax-haven locations.

Measures of Bank Complexity

While BHC size is essentially unidimensional (measured in terms of assets), complexity is a multidimensional concept, which in the system established to address global systemically important banks is considered as a combination of balance sheet and derivatives exposures and the number of distinct entities in the organization. Following Avraham, Selvaggi, and Vickery (2012) and Cetorelli and Goldberg (2014), we focus here on organizational complexity, as measured by the number of subsidiaries owned by a BHC and the span of a BHC across industries (including nonbank industries) and countries. These factors are important. Diversification in business lines and countries can add value and contribute to financial stability. However, greater complexity along these dimensions, all else equal, can make a failing bank harder to resolve—an issue contributing to systemic risk and the “too complex to fail” problem. Our data, from bank regulatory filings on the Federal Reserve’s form FR-Y6, are discussed in detail in a previous Liberty Street Economics post.

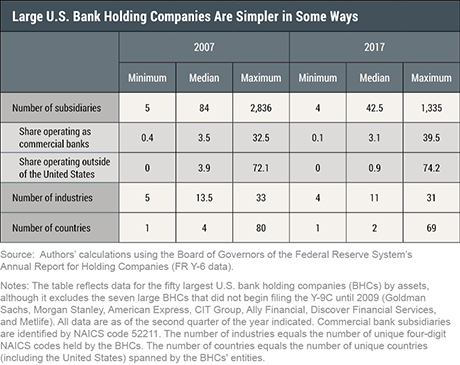

The table below compares some high-level measures of organizational complexity for the largest fifty BHCs in 2007, just before the crisis, and in 2017, a full decade later. The number of subsidiaries at these BHCs has declined substantially—the median number of subsidiaries fell from 84 to 42.5 between 2007 and 2017, and the maximum from over 2,800 to 1,335 in the same period. While over 1,000 subsidiaries certainly is still a complicated organization, the decline suggests large BHCs are simplifying along this dimension. The fraction of these subsidiaries that are commercial banks (second row) fell for some banks and increased for others, implying that, on net, many BHCs are shrinking the numbers of both commercial bank and nonbank subsidiaries. BHCs also reduced their span across industries, though more modestly than the overall number of subsidiaries, suggesting that BHCs may be simplifying their organizational charts more than their industrial footprints. The geographic footprint of the median bank fell from four countries to two, while the maximum span fell from eighty countries to sixty-nine.

Changing Operational Scope

Within BHCs, there have been large changes over time in the number of nonfinancial affiliates. For example, many have moved, via subsidiaries, into providing community housing services, in response to changes in bank regulation and in the low-income housing tax credit, as explored in Cetorelli and Wang (2016). We focus instead on the pattern of changes over time in BHCs’ financial subsidiaries.

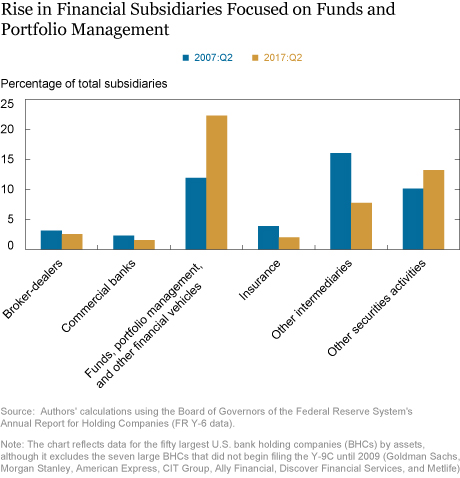

In the past decade, large U.S. BHCs have shifted their composition of financial subsidiaries away from the more traditional bank and nonbank intermediaries, such as nondepository credit intermediaries, mortgage brokers, and insurance companies. Meanwhile, there has been a large increase in subsidiaries related to “funds, portfolio management, and other financial vehicles,” which accounted for over 22 percent of all nonbank subsidiaries in 2017 versus just 12 percent in 2007. Also more prevalent are subsidiaries involved in “other securities activities,” defined as the catch-all for other financial investment activities (and which excludes activity categorized as relating to securities and commodity exchanges, portfolio management, and trust and custody activities).

Locating in Fewer Countries, but Still in Secretive Ones?

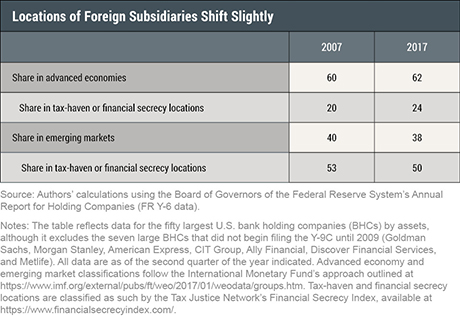

U.S. BHCs are operating in fewer countries than in 2007, reducing one dimension of complexity. However, the countries in which these subsidiaries are located also need investigating. The table below reports the fraction of the foreign subsidiaries located in advanced or emerging market nations, and in countries classified as tax havens or financial secrecy jurisdictions in the Financial Secrecy Index compiled by the Tax Justice Network. Over the past decade, large U.S. BHCs on balance have shifted their foreign subsidiaries slightly toward advanced economies over emerging markets. Among the advanced economies, the share of subsidiaries in tax-haven locations has increased, for example, with Ireland’s role increasing from 3 percent to 5 percent of all foreign subsidiaries between 2007 and 2017. While almost all emerging-market tax havens are experiencing slight declines in total foreign subsidiary shares, the percentage located in the Cayman Islands increased from 10 percent to 11 percent, maintaining the territory as the most popular secretive location. The overall share in tax and secrecy locations has not declined.

Simplifying Somewhat, but Still Complex

Although the organizational, business, and geographic complexity of the largest U.S. BHCs has declined somewhat since before the crisis, these institutions remain highly complex in terms of industries spanned and still operate a large share of subsidiaries in secretive locations. Some degree of diversification in business lines and geography may add value and enhance financial stability, yet it can complicate resolution and transparency, so the policy discussion about optimal levels and types of complexity is itself complex. Our findings thus underscore the importance of regulatory frameworks that continue to focus first on limiting the risk of failure and improving resolution mechanisms for dealing with these BHCs in the event of failure.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Linda S. Goldberg is a senior vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

April Meehl is a senior research analyst in the Bank’s Research and Statistics Group.

How to cite this blog post:

Linda S. Goldberg and April Meehl, “Have the Biggest U.S. Banks Become Less Complex?,” Federal Reserve Bank of New York Liberty Street Economics (blog), May 7, 2018, http://libertystreeteconomics.newyorkfed.org/2018/05/have-the-biggest-us-banks-become-less

-complex.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

A relevant research paper co-authored with Mark Flood, Robin Lumsdaine and Jon Simon, can be found at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3031726