The Tax Cuts and Jobs Act of 2017 changed the tax brackets, tax rates, credits and deductions for individuals and similarly altered corporate tax rates, deductions and exclusions. In this post, we examine whether the reform has shifted individuals’ expectations about their financial situation and the macroeconomic outlook. We also ask whether households have already started to adjust their behavior in line with their expectations. In order to answer these questions, we use novel data from a special module of the New York Fed’s Survey of Consumer Expectations (SCE) fielded in February 2018 to a nationally representative sample of heads of households.

The Impact of the Tax Cut

In our survey we first asked respondents about their understanding of the main features of the 2017 tax reform. Responses reflect that respondents believe they have a broad basic understanding of the tax reform with over 55 percent of the respondents reporting a good to excellent understanding of the tax reform and 30 percent a fair understanding. Moreover, higher-income respondents (defined here as those with household income of more than $75,000) report having a better understanding of the tax reform compared to lower-income respondents.

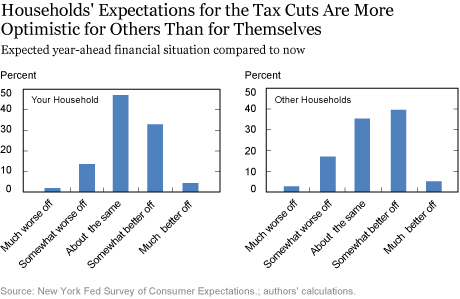

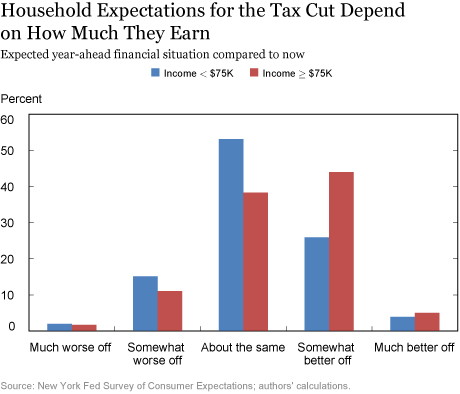

When we analyze how household heads think their financial situation will change in the next twelve months as a result of the tax reform, we see that around 37 percent of household heads expect to be better off, 16 percent worse off, and 47 percent expect no change in their financial situation. The chart below presents the distribution of responses by income level. The results show that respondents with higher income are more optimistic about improvements in their financial situation in the next twelve months as a result of the tax reform.

In addition, the expectations of households about their own financial situation differ somewhat from what they expect for the financial situation of U.S. households more broadly. The right panel of the chart above shows that the expectations about others’ financial situation is more spread out. A somewhat larger proportion of respondents expect a deterioration in the financial situation of other households than they do for themselves, and a much larger proportion expect an improvement in the financial situation of the general U.S. population in next twelve months as a result of the tax reform.

A detailed look into households’ expectations demonstrate that around 43 percent of households expect an increase in their after-tax income in the next twelve months as a result of the federal tax reform, while 15 percent expect a decrease in their after-tax income. Few household heads report expecting to change their hours of work over the next twelve months, while 32 percent expect to increase, and 10 percent expect to decrease their savings over the same period. Only 12 percent of respondents anticipate an increase in their spending and 15 percent expect to reduce spending because of the tax reform.

In addition, in February some SCE respondents already reported seeing some changes in their household income and in their spending and savings behavior as a result of the federal tax reform. Their experiences were found to be closely linked to their expectations. To give an example, 70 percent of the respondents who in February reported having increased their savings, as a result of the tax reform, expect an increase in their household income over the next twelve months. While 60 percent of those who reported a decline in their spending expect that the tax reform will decrease their household income over the next twelve months.

Revisions in Expectations

In order to quantify the impact of the federal tax reform on household expectations, the survey elicits information about households’ responses to counterfactual questions. Specifically, individuals are asked:

Earlier in the survey you reported that you expect [X] to increase/decrease by __% over the next 12 months. Now imagine that the federal tax code had not changed in December. If that were the case, what do you think would happen to [X] over the next 12 months?

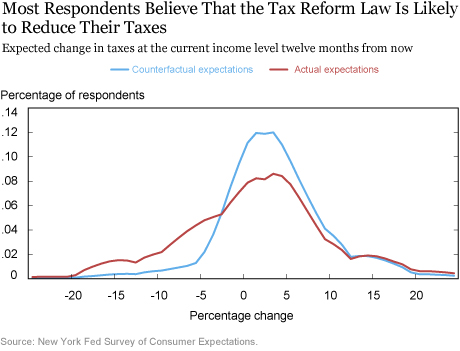

The SCE elicits households’ expectations about themselves (for example, X includes “your total household spending”) and about macroeconomic aggregates (for example, X includes “the average home price nationwide”) every month. The difference between the actual expectations and the counterfactual expectations of individuals, which we call the revision in expectations, gives us the net perceived effect of the tax reform.

The chart below illustrates the distributions of both the actual and the counterfactual expected percent change in total taxes at the current income level twelve months from now. Based on the chart, it is evident that the majority (to be exact, 77.6 percent) of the household heads have revised down or kept constant their expectations about the percent change in total taxes twelve months from now, as a result of the tax reform, with a nontrivial minority (22.4 percent) revising upward.

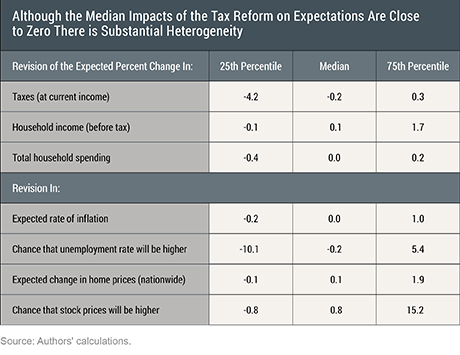

The table below presents the interpolated quartiles (see Section 5 of “An Overview of the Survey of Consumer Expectations”) of the distribution of the revisions in expectations due to the federal tax reform. For all these different expectations, the median impact of the federal tax reform is close to zero. Yet, there is substantial heterogeneity in how households revise their expectations and we see sizable revisions at the 25th and 75th percentiles. For example, a quarter of the household heads expect at least a 1.7 percentage point increase in their before-tax household income due to the federal tax reform. For inflation expectations, we see that a quarter of the respondents expect a minimum 1.0 percentage point increase in the inflation rate due to the tax reform and this result is robust across all demographic groups.

However, for unemployment, home price, and stock price expectations, we observe substantial heterogeneity across demographic groups especially in the upper tail. Overall, household heads have revised their expectations upward for the chance that stock prices will be higher in the next twelve months. College-graduate respondents and those who reside in the counties that voted for Donald Trump have even more optimistic revisions in their stock market expectations.

Interestingly, we observe that household income expectations are more responsive to the tax reform compared with the expectations about the total household spending. In order to understand this phenomenon, we generate a measure of marginal propensity to consume based on expectations. This measure is constructed by estimating the impact of the revisions in the household income expectations on the revisions in household spending expectations due to the tax reform. In other words, we analyze the regression of the revisions in the expected change in total spending as a result of the tax reform on the revisions in the expected change in household income. In this regression, the variable for the revisions in the household income expectations is interacted with a dummy that shows whether the revision is positive or negative. We find that there is an asymmetry in the marginal propensity to consume based on the direction of the revision. Specifically, while a 1 percentage point increase in the expected change in household income is associated with a 0.2 percentage point increase in the expected change in total spending; a 1 percentage point decline in the expected change in household income is associated with a 0.5 percentage point decline in the expected change in total spending. This is consistent with evidence we previously presented on the asymmetry in the marginal propensity to consume in response to positive and negative income shocks. Since a higher proportion of the respondents expect an increase in their household income as a result of the federal tax reform, the effects coming from these two groups only partially cancel each other out and we observe a modest increase of 1.4 percentage points in spending growth expectations, on average.

Conclusion

Overall, we find remarkable heterogeneity in the tax reform’s perceived impact: Although a small majority expects no change in their financial situation, 37 percent of respondents expect to be financially better off and 16 percent expect to be worse off. Similarly, even though the median change in expected taxes is a small decline, substantial proportions of respondents expect large increases or large decreases in taxes. We also see considerable variation in changes in respondents’ macroeconomic outlook due to the reform. In terms of aggregate household behavior the impact of the reform will reflect these countervailing responses in expectations. Of note, even though more respondents expect a reduction in taxes, we observe a relatively modest increase in average expected spending due to the tax reform. That stems from a higher marginal propensity to consume among those who expect an increase in their taxes relative to those who expect a decline in their taxes.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Gizem Kosar is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Gizem Kosar is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Wilbert van der Klaauw is a senior vice president in the Bank’s Research and Statistics Group.

Wilbert van der Klaauw is a senior vice president in the Bank’s Research and Statistics Group.

Olivier Armantier is an assistant vice president in the Bank’s Research and Statistics Group.

Olivier Armantier is an assistant vice president in the Bank’s Research and Statistics Group.

John J. Conlon is a senior research analyst in the Bank’s Research and Statistics Group.

John J. Conlon is a senior research analyst in the Bank’s Research and Statistics Group.

How to cite this blog post:

Gizem Kosar, Wilbert van der Klaauw, Olivier Armantier, and John Conlon, “Mixed Impacts of the Federal Tax Reform on Consumer Expectations,” Federal Reserve Bank of New York Liberty Street Economics (blog), May 23, 2018, http://libertystreeteconomics.newyorkfed.org/2018/05/mixed-impacts-of-the-federal-tax-reform-on-consumer

-expectations.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics