The adoption of new technologies is transforming the mortgage industry. For instance, borrowers can now obtain a mortgage entirely online, and lenders use increasingly sophisticated methods to verify borrower income and assets. In a recent staff report, we present evidence suggesting that technology is reducing frictions in mortgage lending, such as reducing the time it takes to originate a mortgage, and increasing the elasticity of mortgage supply. These benefits do not seem to come at the cost of less careful screening of borrowers.

The “FinTech” Business Model

Although many mortgage originators are adopting new technologies to varying degrees, it is clear that some lenders have placed particular emphasis on using technology to streamline and automate the mortgage origination process. We view the defining features of this “FinTech” business model to be an end-to-end online mortgage application platform and centralized mortgage underwriting augmented by automation.

Online applications enable a borrower to be approved for a loan without talking to a loan officer or visiting a physical location. Supporting documents can be uploaded and processed electronically while other information can be verified by accessing records and accounts directly; these options automate what has historically been a document- and labor‑intensive underwriting process. All of this is complemented by centralized underwriting operations that allow for labor specialization and greater scalability. These processes contrast sharply with traditional mortgage lenders that collect physical documents and operate in a hub‑and-spoke model where branches house loan officers and underwriters in the markets in which they operate.

To identify FinTech mortgage lenders, we evaluate the sophistication of their online application process by determining whether an applicant can obtain a pre-approval online without being prompted to interact with a loan officer. We then use Wayback Machine, which archives webpages, to assess when the lender began offering this option. Although online applications are only one dimension of the FinTech model, they serve as an easily observed indicator for the other, complementary technology enhancements.

Our classification process identifies six FinTech mortgage lenders during our sample period, 2010-16. Our list of FinTech originators conforms closely with reports by industry observers and other researchers. The market share of FinTech lenders, based on our classification, has grown from 2 percent in 2010 to 8 percent by 2016. The number of lenders offering a fully online application platform has continued to grow rapidly since the end of our sample period.

The FinTech lenders we classify are all nondepository institutions (that is, mortgage banks) and their loans are usually securitized through the agency mortgage backed securities (MBS) market, rather than held in portfolio. Also, a FinTech lender origination is typically a refinancing of an existing mortgage rather than a mortgage for the purchase of a new home.

FinTech = Faster

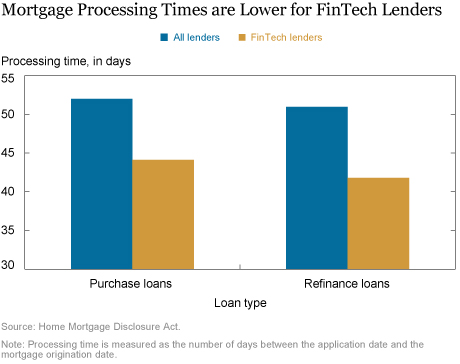

The first dimension we examine is the speed of mortgage originations. Our analysis is based on loan-level data collected under the Home Mortgage Disclosure Act, which contains information on individual loan applications and originations. We calculate the processing time of a mortgage as the number of days between the application and origination. The chart below summarizes processing times by lender type for home purchase loans and refinance loans.

We find that mortgages from FinTech lenders close about 20 percent faster than those from other lenders. This difference is larger for refinances than for purchase mortgages. In our staff report we show that these differences remain, or are even stronger, after controlling for loan and borrower characteristics as well as a fine set of geographic controls at the census tract level. These results provide a first source of evidence that technology-based mortgage lending is helping to streamline the processing and underwriting of mortgage applications.

Are FinTech Loans More Risky?

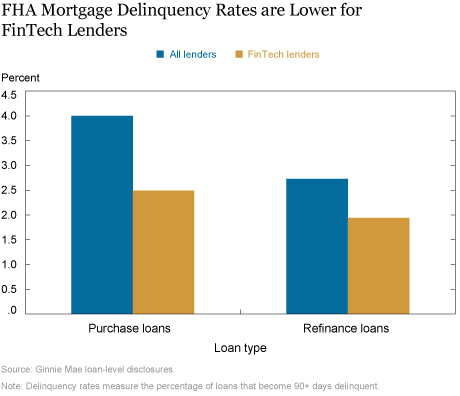

One concern may be that faster approval and quicker processing comes at the cost of diligent screening of the borrower. We examine this question by looking at two sources of information on borrower default for mortgages from FinTech lenders compared with other originators. The chart below summarizes results from one of these sources—loan-level data on Federal Housing Administration (FHA) mortgages securitized into Ginnie Mae MBS. We focus on the FHA market because it is the riskiest segment of the mortgage market—borrowers generally contribute a down‑payment of less than 5 percent, and often have low credit scores—and is a segment of the market that has grown rapidly in recent years.

We find that default rates are 38 percent lower for purchase loans and 29 percent lower for refinance loans. Importantly, these differences are conditional on the risk score of the borrower, the loan-to-value ratio of the loan, as well as controls for the month the loan is issued and the location of the borrower.

In other words, the faster processing of FinTech mortgages does not seem to come at the cost of lax screening of borrowers. In fact, as a group FinTech lenders issue less risky loans, at least in the FHA market. One potential explanation for their superior loan performance is that automated underwriting procedures reduce the incidence of fraud resulting in lower instances of default.

Mortgage Industry Capacity Constraints

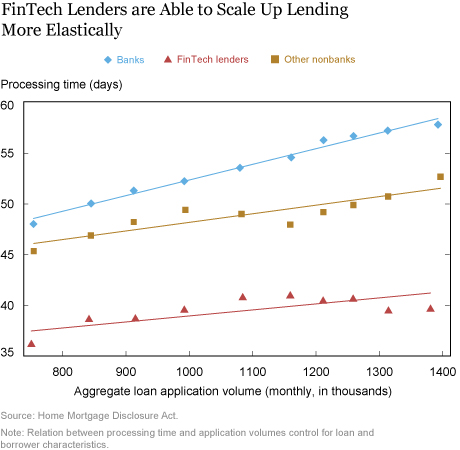

There is evidence that during periods of high demand the mortgage industry takes longer to process and originate mortgages. However the FinTech model may help alleviate these constraints. To test this possibility we examine the sensitivity of processing times to overall application volumes for different types of lenders. We summarize our results in a binscatter plot that summarizes average processing time at different levels of application volume.

The plot demonstrates that as overall application volume increases, FinTech lender processing times increase less than processing times for other nonbank lenders and significantly less than the times for bank lenders. Further analysis in our staff report suggests that this is true even when we control for the location of the borrower. Hence, it appears that the FinTech model has the potential to reduce capacity constraints in the supply of mortgages when mortgage demand is high.

Effects on Refinancing Behavior

We also consider the impact on household borrowing behavior. Prior academic research has shown that many borrowers do not refinance their fixed rate mortgages optimally. For instance, if interest rates fall sufficiently, households can typically benefit from refinancing their mortgage to take advantage of lower rates but many do not. A benefit of FinTech lenders is that the mortgage origination process is easier and less time-consuming. Therefore, it may well be that these benefits have increased households’ propensity to refinance loans.

To examine this we use Equifax’s Credit Risk Insight Servicing McDash (CRISM) data set. CRISM provides information on loan and borrower characteristics as well as identifiers that allow us to track borrowers across loans in order to identify refinance activity. Indeed we find that as the FinTech share of mortgages in a county increases, the propensity for borrowers to refinance also increases. A roughly 8 percent increase in FinTech lender market share corresponds to a 10 percent increase in refinance activity.

Final Thoughts

In this post we examine how technology is changing mortgage originations. We find that FinTech mortgage lenders originate loans more quickly than other lenders and that these loans are less risky. We also observe that FinTech lenders appear to alleviate capacity constraints during periods of high mortgage demand. Lastly, we find that households in areas where FinTech has grown have increased their propensity to refinance.

While only a handful of firms were considered FinTech lenders during the time period we examine, 2010-16, going forward we anticipate more firms to replicate the FinTech model. However, it is unclear whether traditional lenders or small firms will be able to adopt these practices and achieve similar effects.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Andreas Fuster was an officer in the Federal Reserve Bank of New York’s Research and Statistics Group at the time this post was written.

Matthew Plosser is a senior economist in the Bank’s Research and Statistics Group.

James Vickery is an assistant vice president in the Bank’s Research and Statistics Group.

How to cite this blog post:

Andreas Fuster, Matthew Plosser, and James Vickery, “How Is Technology Changing the Mortgage Market?,” Federal Reserve Bank of New York Liberty Street Economics (blog), June 25, 2018, http://libertystreeteconomics.newyorkfed.org/2018/06/how-is-technology-changing-the-mortgage-market.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics