The Treasury Market Practices Group (TMPG) recently released a consultative white paper on clearing and settlement processes for secondary market trades of U.S. Treasury securities. The paper describes in detail the many ways Treasury trades are cleared and settled— information that may not be readily available to all market participants—and identifies potential risk and resiliency issues. The work is designed to facilitate discussion as to whether current practices have room for improvement. In this post, we summarize the current state of clearing and settlement for secondary market Treasury trades and highlight some of the risks described in the white paper.

The Secondary Market for Treasury Securities

The secondary market for the outright purchase and sale of Treasury securities is composed of the dealer-to-customer and dealer-to-dealer segments. The structure of the dealer-to-dealer segment has undergone significant changes since 2000 with the increased use of technology, innovations in trading platforms, and greater use of automated execution strategies. In particular, there has been a marked increase in the speed of trade execution, driven in part by a new type of market participant— principal trading firms, which typically trade only for their own interests rather than on behalf of clients.

How Do Trades Clear and Settle in the Secondary Market?

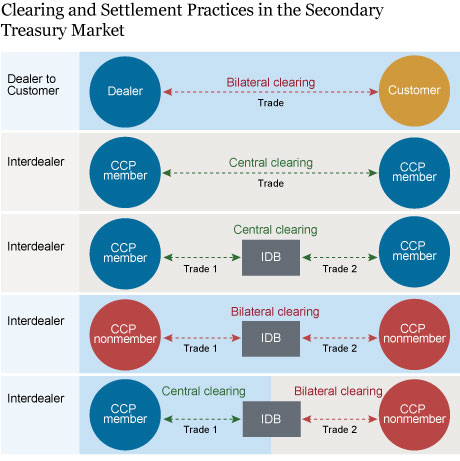

In the dealer-to-customer segment, dealers are market makers, buying and selling from their customers. These trades are bilaterally cleared, meaning that the dealer and customer bilaterally manage the associated counterparty risks. For example, after agreeing to buy securities from a customer, the dealer can take steps to mitigate the risk that the customer may fail to deliver the promised securities, such as quickly performing the back-office processes of trade matching and comparison, which confirm trade details and reconcile any disagreements.

In the dealer-to-dealer segment, dealers trade with one another and certain other market participants, primarily through interdealer brokers (IDBs). For a trade executed through an IDB, the IDB stands as principal to each party of the trade so as to maintain each party’s anonymity. Execution through the IDB thereby results in two trades: one in which the IDB buys securities from the ultimate seller and another in which the IDB sells securities to the ultimate buyer.

Historically, IDB trades were centrally cleared because all the firms trading through IDBs, as well as the IDBs themselves, were members of the Fixed Income Clearing Corporation, a financial utility that acts as a central counterparty (CCP). When all parties to a trade are CCP members, they submit their trade details to the CCP, which then guarantees and novates the trade. These steps, which typically occur within minutes of trade execution, result in the transfer of clearing and settlement risk to the CCP. Whether two CCP members execute a trade directly with one another or trade anonymously on an IDB platform, the associated risks of clearance and settlement are quickly transferred to the CCP.

With the evolution of the market after 2000, two new clearing and settlement cases emerged. In particular, principal trading firms, which are typically not CCP members, began trading on IDB platforms. Not being members of the CCP, however, meant that their trades could not be centrally cleared. When two CCP nonmembers execute a trade on an IDB platform, both of the resulting trades are bilaterally cleared. When a CCP member and a CCP nonmember execute a trade, a hybrid case arises in which one of the resulting trades is bilaterally cleared and the other is centrally cleared.

The exhibit below provides a summary of these clearing and settlement practices.

What Are the Risks and Resiliency Issues?

Do market participants fully understand the risks associated with the various clearing and settlement methods? The white paper discusses several concerns on which the TMPG hopes to receive feedback. Here we highlight one, which is that the Treasury market’s evolution has resulted in an increased share of trades being bilaterally cleared and settled.

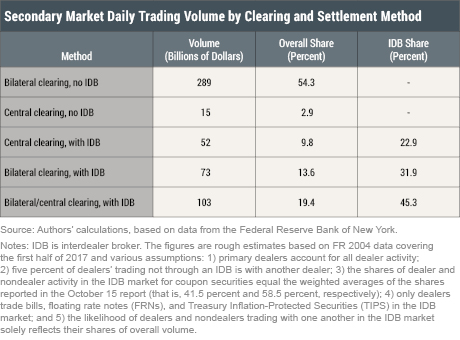

Historically, only the dealer-to-customer segment of the market was bilaterally cleared. Currently, a significant share of the interdealer segment is bilaterally cleared because of the material activity of CCP nonmembers on IDB platforms. Across the five clearing and settlement processes, the pure central clearing model (the second and third methods listed in the table below) accounts for less than 15 percent of overall activity. Furthermore, of the activity occurring on IDB platforms (the last three methods in the table), roughly three-quarters of activity involves bilateral clearing.

The shift away from central clearing is meaningful because of central clearing’s risk mitigation features. First, central clearing allows trades to be netted across all CCP members, lowering net settlement exposures and thereby reducing counterparty credit risks. Second, CCPs employ loss-sharing mechanisms that spread the cost of a member default across all members, thereby lowering the burden of default on any one participant. Third, the clearing process at a CCP is transparent and uniform for all CCP members, which reduces the uncertainty over potential losses owing to counterparty default.

Next Steps

The TMPG asked for public feedback on the white paper by September 28. Based on that feedback, the TMPG expects to finalize the white paper and may provide further voluntary guidance on clearing and settlement best practices.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Adam Copeland is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Michael J. Fleming is a vice president in the Bank’s Research and Statistics Group.

Frank M. Keane is a vice president in the Bank’s Markets Group.

Radhika Mithal is an officer in the Bank’s Markets Group.

How to cite this blog post:

Adam Copeland, Michael J. Fleming, Frank M. Keane, and Radhika Mithal, “Do You Know How Your Treasury Trades Are Cleared and Settled?,” Federal Reserve Bank of New York Liberty Street Economics (blog), September 12, 2018, http://libertystreeteconomics.newyorkfed.org/2018/09/do-you-know-how-your-treasury-trades-are-cleared-and

-settled.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics