Credit default swaps (CDS) are frequently credited with being the cause of AIG’s collapse during the financial crisis. A Reuters article from September 2008, for example, notes “[w]hen you hear that the collapse of AIG […] might lead to a systemic collapse of the global financial system, the feared culprit is, largely, that once-obscure […] instrument known as a credit default swap.” Yet, despite the prominent role that CDS played during the financial crisis, little is known about how individual financial institutions utilize CDS contracts on individual companies. In a recent New York Fed staff report, we assess the choice banks face when trading the idiosyncratic credit risk of a firm, and argue that banks’ participation decisions have been affected in the post-regulation period, either by direct changes in market structure or by changes in the relative cost of pursuing different strategies.

Trading Corporate Credit Risk

Financial institutions face a choice of which market to use to assume corporate credit risk. Corporate bonds and loans provide direct exposures to corporate credit, while CDS, options written on CDS, and equity options provide derivative exposures. In our work, we focus on strategies that involve the most prevalent types of credit-linked assets: single-name CDS contracts, index CDS contracts, and corporate bonds, as these represent the most direct form of tradeable exposures.

Financial institutions may have different motives in choosing their optimal allocation between corporate bonds and CDS. First, credit derivatives may be used to redistribute credit risk within the financial system: an institution that has exposure to a corporation through either bonds or loans may choose to insure itself against the credit risk of that position by buying protection in the CDS market. Unexpected changes in the value of bond positions that the institution seeks to insure should thus precipitate changes in CDS positions being held for hedging purposes.

Second, institutions may use credit derivatives to express their beliefs about the credit worthiness of a corporation, regardless of whether they have direct credit exposure through the cash market. Selling CDS protection provides a levered exposure to the credit risk of a corporation; to the extent that an institution uses CDS to speculate on credit risk, predictable changes in demand for credit risk should be associated with greater speculative activity.

Finally, institutions may use both credit derivatives and cash products to achieve their desired exposure to credit risk. When there are more frictions in the market for the underlying cash products, the derivatives market should be more attractive, and vice versa. Hence, the relative transaction costs across the cash and derivative markets determine the optimal allocation.

Studying Portfolio Allocation Decisions

To study institutions’ portfolio allocation decisions, we combine corporate bond and CDS data sets at the participant-reference entity level. Specifically, we use confidential positions-level data from Depository Trust & Clearing Corporation (DTCC), and transactions-level data from the regulatory version of the Financial Industry Regulatory Authority’s Trade Reporting and Compliance Engine (TRACE). We then construct net flows of credit bought or sold by each participant in an individual reference entity taken through the CDS market and through the bond market, respectively.

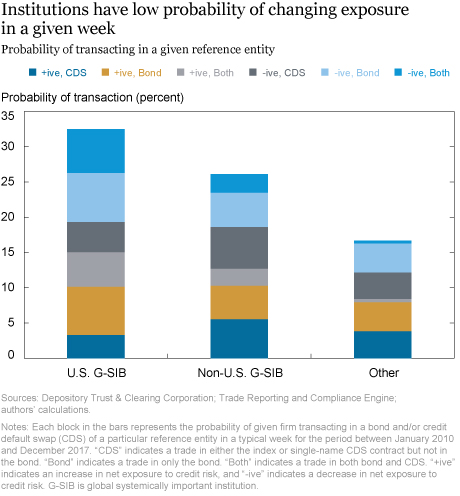

Based on the institutions that participate both in the U.S. corporate bond market and the CDS market, we document four fundamental facts. First, as shown in the chart below, even large financial institutions have a low probability of changing their exposure to any particular reference entity in an average week. Global systemically important banks (G-SIBs) domiciled in the United States have a 33 percent probability of changing their exposure; G-SIBs based in other countries have a 26 percent probability of changing their exposure; and other institutions that trade in both CDS and corporate bond markets have a 17 percent probability of changing their exposure.

More striking, institutions rarely transact in both markets in the same week; U.S. G-SIBs are the most likely to do so and have an 11 percent probability of changing their credit risk exposure through paired CDS and bond transactions. The rarity of paired transactions suggests that aggregated transactions data, even at the reference entity level, may be misleading about the extent to which market participants use the CDS market for either hedging or speculative purposes, as the set of institutions accounting for the majority of the transactions in the corporate bond market in a given week might be different from the set of institutions that account for the majority of transactions in the CDS market.

Second, both G-SIBs and other institutions have a high probability of using index CDS contracts to change their exposure to credit risk, either through transactions in the index contract alone or through transactions in both index and single-name contracts. When institutions use index CDS contracts to change their exposure to a single reference entity, they also create “orphaned” exposures to the remaining constituents of the index. Given the lower liquidity of single-name CDS contracts relative to index contracts, these exposures may create a liquidity imbalance in the overall institution’s credit risk portfolio as index positions cannot be easily hedged with transactions in the single-name market.

Third, we show that institutions change their participation decisions in response to changes in the regulatory environment. In particular, we find that G-SIBs are less likely to use CDS contracts but hedge a greater fraction of their corporate bond transaction flow in the CDS market after January 2014. Similarly, G-SIBs increase the volume and frequency of their transactions in single-name CDS after the single-name contract becomes eligible for clearing, consistent with lower capital requirements on cleared single-name positions. These results suggest that regulatory capital constraints play an important role in determining which markets institutions use to change their exposure to corporate credit risk.

Finally, the strategies that institutions follow at the reference-entity level have translated to real outcomes for the institutions themselves. Institutions that are more reliant on either naked CDS strategies or on strategies where the CDS transactions hedge bond transactions have lower trading revenue, whereas institutions that have paired bond-CDS transactions with the CDS amplifying the bond exposure have greater trading revenue.

Aggregate Credit Exposure

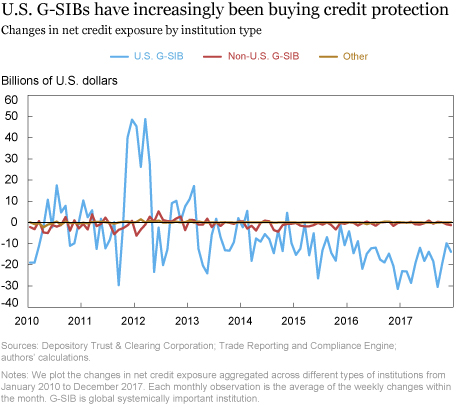

Do strategy differences across institution types translate into overall credit risk exposure differences? The chart below shows that, in the aggregate, U.S. G-SIBs have historically had a different profile of overall exposure to corporate credit risk than other institutions. While non-U.S. G-SIBs and non-G-SIBs have net exposure close to zero for most of our sample, U.S. G-SIBs were, on average, net buyers of exposure prior to January 2014 but have increasingly been net sellers of credit risk exposure after January 2014.

This decrease in net exposure taken by U.S. G-SIBs is due exclusively to their reduced use of CDS markets, with U.S. G-SIBs taking $32 million less exposure in the index CDS market, $2.67 million less exposure in the single-name CDS market, and $1.51 million more exposure in the corporate bond market for an average reference entity in the post-2014 period. Thus, while prior to 2014, U.S. G-SIBs were net sellers of protection in the single-name CDS market and net flat in the index CDS market, they become net flat in the single-name CDS market and net buyers of protection in the index CDS market in the later period.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Nina Boyarchenko is a senior economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Anna M. Costello is an assistant professor at University of Michigan’s Ross School of Business.

Or Shachar is an economist in the Bank’s Research and Statistics Group.

How to cite this blog post:

Nina Boyarchenko, Anna M. Costello, and Or Shachar, “Credit Market Choice,” Federal Reserve Bank of New York Liberty Street Economics (blog), ), October 17, 2018 , http://libertystreeteconomics.newyorkfed.org/2018/10/credit-market-choice.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

There is no question that CDS on multi-sector collateralized debt obligations and CDS on bonds differ significantly. In referencing to the CDS sold by AIG and their role in the financial crisis in our introduction, we were attempting to convey the tension surrounding the usage of CDS in general, particularly in times of financial stress.

The introduction is misleading. AIG sold CDS on MBS. The article is about corporate CDS. This is like comparing European equity options to exotic options. Yes, they are both options but they have vastly different risk profiles. The rest of the article is interesting though. As the Reuters article states later: “Many CDSs were sold as insurance to cover those exotic financial instruments that created and spread the subprime housing crisis, details of which are covered here 1. As those mortgage-backed securities and collateralized debt obligations became nearly worthless, suddenly that seemingly low-risk event-an actual bond default-was happening daily. The banks and hedge funds selling CDSs were no longer taking in free cash; they were having to pay out big money.”