Editor’s note: The release of the March 2020 DSGE forecast was postponed as New York Fed economists shifted their focus to the COVID-19 pandemic. In conjunction with the release of the June 2020 forecast, we’ve decided to post the March 2020 forecast for the record as well.

This post presents an update of the economic forecasts generated by the Federal Reserve Bank of New York’s dynamic stochastic general equilibrium (DSGE) model. As usual, we wish to remind our readers that the DSGE model forecast is not an official New York Fed forecast, but only an input to the Research staff’s overall forecasting process. For more information about the model and variables discussed here, see our DSGE model Q & A.

In response to the pandemic, the New York Fed’s DSGE model has been modified because the economic disruptions caused by COVID-19 are likely different from patterns seen in standard business cycles. The model now includes additional shocks designed to reflect phenomena like lockdowns and social distancing (the model description on the GitHub page describes these changes in some detail).

To incorporate the substantial uncertainty surrounding future economic activity, we construct three possible scenarios, described below, that differ in the projected severity of the pandemic and its effects on economic behavior. Our final forecast combines these individual scenarios by weighting them according to our a priori views on how likely each scenario is. The weights on the three scenarios are 65, 10, and 25 percent, respectively. These probabilities are informed by the most recent (May) Survey of Professional Forecasters (SPF) probabilistic survey for year-over-year 2020 GDP growth.

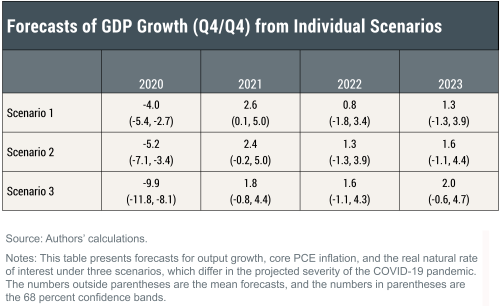

The three scenarios we consider are a “Temporary Lockdown” (Scenario 1), a “Lockdown with Business Cycle Dynamics” (Scenario 2), and a “Persistent Demand Shortfall” (Scenario 3). The table below shows the mean Q4/Q4 GDP projections for each scenario, together with the 68 percent forecast bands.

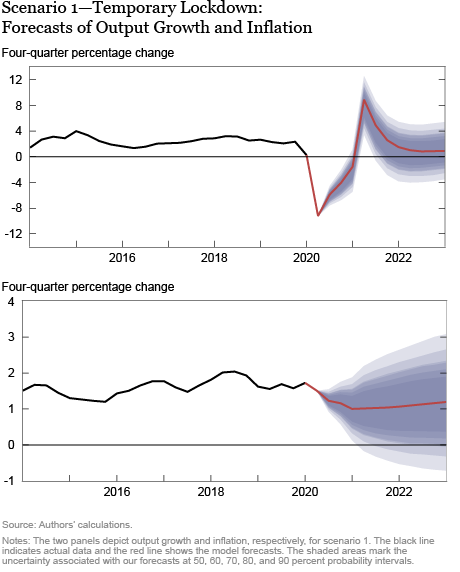

The “Temporary Lockdown” scenario explains the decline in economic activity in Q1 and Q2 of 2020 using transitory demand and supply shocks and intentionally limiting the role of the standard set of shocks that populate the model in these two quarters. This yields a relatively V-shaped recovery, with Q4/Q4 GDP growth in the neighborhood of -4.0 percent.

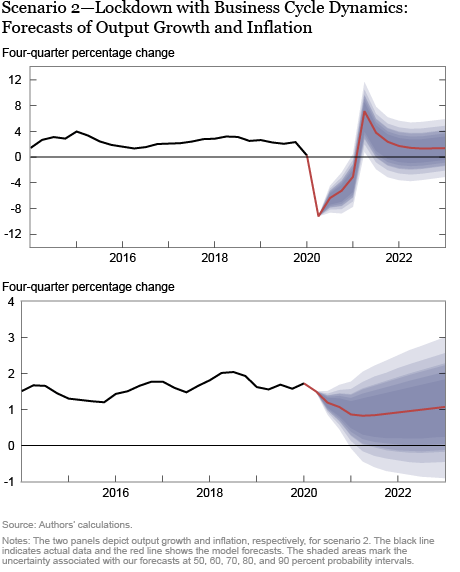

In the “Lockdown with Business Cycle Dynamics” scenario, we allow for the standard set of shocks to play a larger role, yielding more persistent effects, with Q4/Q4 GDP growth in the neighborhood of -5.2 percent.

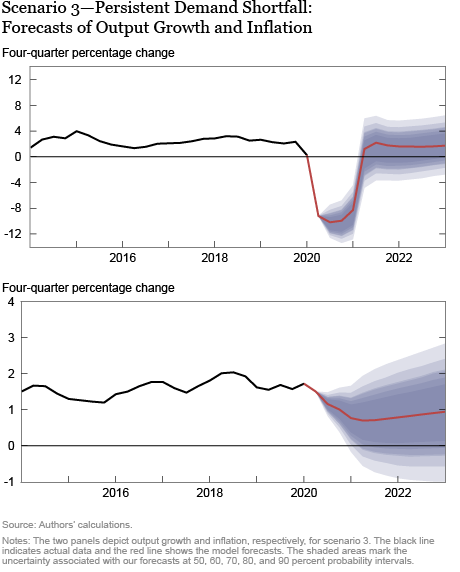

Finally, in the “Persistent Demand Shortfall” scenario, the demand shortfall is assumed to persist through Q3, reflecting prolonged weakness in demand. This scenario yields Q4/Q4 GDP growth in the neighborhood of -9.9 percent.

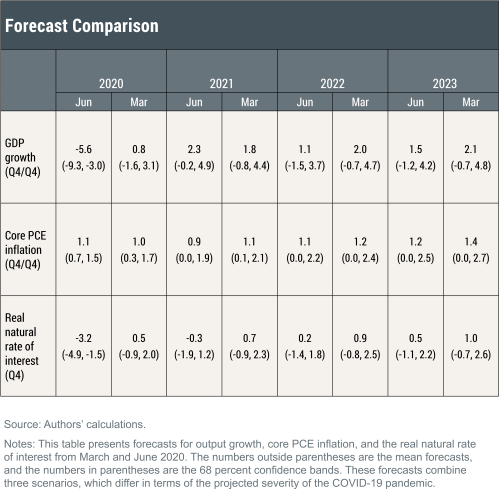

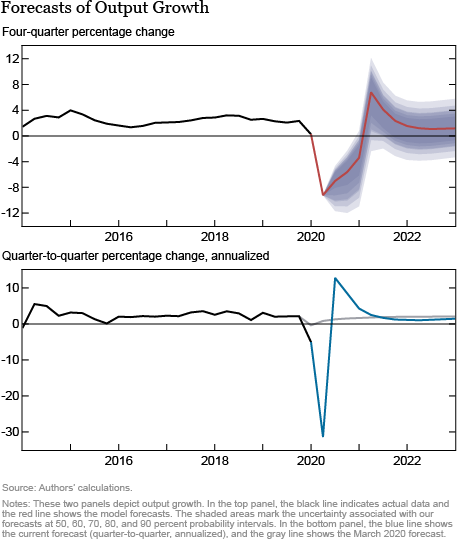

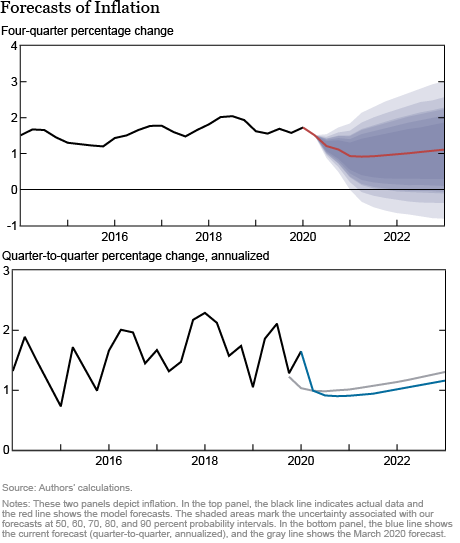

The June model forecast for 2020-23 is summarized in the table below, alongside the March forecast, and in the following charts. The forecasts from the individual scenarios are presented afterward. The model uses quarterly macroeconomic data released through 2020:Q1, financial data available through June 4, 2020, and forecasts of GDP growth and inflation for 2020:Q2 from the SPF.

How do the latest forecasts compare with the March forecasts?

- The current 2020 Q4/Q4 GDP growth forecast is dramatically weaker than the one from March (-5.6 percent versus 0.8 percent). This projection results from the substantial negative impact of COVID-19, in spite of the recent policy accommodation. The degree of uncertainty associated with these projections is also quite dramatic, with the 68 percent bands ranging from -3.0 to -9.3 percent. GDP is projected to grow at 2.3 percent in 2021, and between 1 and 2 percent for the remainder of the forecast horizon.

- Core PCE inflation is expected to initially be about the same as forecasted in March, but by the end of the forecast horizon inflation is below the March forecast (1.2 percent versus 1.4 percent). The COVID-19 pandemic acts primarily (although not exclusively) as a demand shock in the model, exerting downward pressure on both prices and economic activity.

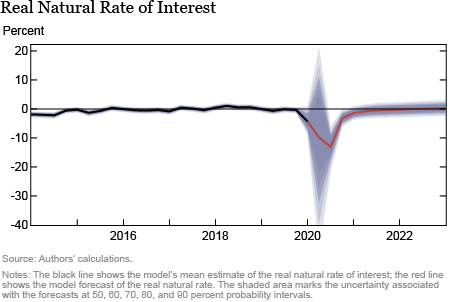

- The projections for the real natural rate of interest are much lower than in March in 2020 (-3.2 percent versus 0.5 percent), and remain lower throughout the forecast horizon. These projections are also subject to considerable uncertainty. In 2020, the 68 percent confidence bands range from -4.9 percent to -1.5 percent. In 2021-23, the 68 percent bands include both negative and very positive rates.

William Chen is a senior research analyst in the Bank’s Research and Statistics Group.

Marco Del Negro is a vice president in the Bank’s Research and Statistics Group.

Ethan Matlin is a senior research analyst in the Bank’s Research and Statistics Group.

Ethan Matlin is a senior research analyst in the Bank’s Research and Statistics Group.

Reca Sarfati is a senior research analyst in the Bank’s Research and Statistics Group.

Reca Sarfati is a senior research analyst in the Bank’s Research and Statistics Group.

How to cite this post:

William Chen, Marco Del Negro, Ethan Matlin, and Reca Sarfati, “The New York Fed DSGE Model Forecast—June 2020,” Federal Reserve Bank of New York Liberty Street Economics, June 19, 2020, https://libertystreeteconomics.newyorkfed.org/2020/06/the-new-york-fed-dsge-model-forecastjune-2020.html.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Ram: Thank you for your question. The intuition behind a negative natural real interest rate is that real interest rates ought to be negative in order to reach the “efficient” level of output and employment.*** Recall that low real rates stimulate consumption, and hence demand. The fact that the natural real rate of interest is lower than the actual real rate of interest suggest that there is a demand deficiency: consumption and demand should be higher than what they currently are in order to reach the “efficient” level of output. Depending on whether the model interprets the shocks that hit the economy over the past few quarters as, broadly speaking, demand or supply shocks, the natural real rate of interest can be positive or negative. Note that while in the mean projections the natural rate of interest is negative, there is much uncertainty around these projections, reflecting the uncertainty about the nature of the Covid-19 shock in the model. *** This post discusses the definition of the natural rate of interest in more detail: https://libertystreeteconomics.newyorkfed.org/2015/05/why-are-interest-rates-so-low.html

What is the intuition behind having a negative neutral real interest rate?