COVID-19 and associated social distancing measures have had major labor market ramifications, with massive job losses and furloughs. Millions of people have filed jobless claims since mid-March—6.9 million in the week of March 28 alone. These developments will surely lead to financial hardship for millions of Americans, especially those who hold outstanding debts while facing diminishing or disappearing wages. The CARES Act, passed by Congress on April 2, 2020, provided $2.2 trillion in disaster relief to combat the economic impacts of COVID-19. Among other measures, it included mortgage and student debt relief measures to alleviate the cash flow problems of borrowers. In this post, we examine who could benefit most (and by how much) from various debt relief provisions under the CARES Act.

Data and Definitions

In addition to direct stimulus to individuals and corporations, the CARES Act provides for debt forbearance (that is, a temporary break from debt service payments) for various types of loans. FHA- and GSE-backed mortgages are eligible for a 180-day forbearance period, which can be extended to 360 days, but the borrower needs to contact the mortgage servicer to request forbearance. There was also a moratorium on foreclosure for 60 days after March 18. Federal student debt borrowers can defer payments until September 30, with interest waived. This forbearance is administrative and does not have to be negotiated. The Act also suspends involuntary collections, which includes wage garnishment and the reduction of tax refunds or other federal benefits, for qualifying federal student debt borrowers who are in default. While private student debt makes up a small share (approximately 8 percent) of total outstanding student debt, our data do not enable us to differentiate between federal and private student debt. The small subset of the student debt borrowers who have only private student loans will not be eligible for CARES Act forbearance relief. For simplicity, we will consider all student debt borrowers as being eligible for student debt forbearance in this post.

To understand who may benefit (and by how much) from the mortgage and student debt relief proposed, we draw on the New York Fed’s Consumer Credit Panel—an anonymized, nationally representative sample of Equifax credit report data. Our data set for this post covers a representative 1 percent sample of the nation’s adults with credit records, showing payments, balances, and delinquencies for various types of debt, including student loans, mortgages, auto loans, and credit cards. We focus on mortgage and student debt in this post because the relief under the CARES Act pertained to these two kinds of consumer debt.

To understand who the potential beneficiaries of debt relief are, we examine differences in forbearance relief across income, age and racial lines. Specifically, we split zip codes into equal-population quartiles of median household income (pre-tax); we refer to the bottom quartile as “low income,” (with median income below $46,310) the two middle quartiles as “middle income,” and the top quartile as “high income” (with median income above $78,303). We also look at zip codes that are “majority Black,” “majority Hispanic,” “majority white,” and “mixed.” We define majority Black zip codes (neighborhoods) as those in which Black residents make up at least 50 percent of the population, and define majority Hispanic and majority white zip codes (neighborhoods) similarly. We group all other neighborhoods together into a fourth category, “mixed” neighborhoods. For all income and race data, we use the 2014-18 Five-Year American Community Survey. We investigate the extent of mortgage and student debt relief faced by each of these neighborhoods: low income, middle income, high income, majority Black, majority Hispanic, majority white, and mixed.

At the end of December 2019, the majority of borrowers (63 percent) in our sample have neither mortgage nor student debt, but 21 percent have a mortgage but no student debt and 12 percent have student debt but no mortgage. Only 4 percent of adults have both mortgage and student debt. The median student debt borrower is 34 years old while the median age of mortgagors is 51. Thus, while the student debt relief will potentially benefit younger borrowers, the mortgage relief will potentially benefit relatively older borrowers.

Who Can Benefit from CARES Act Debt Relief?

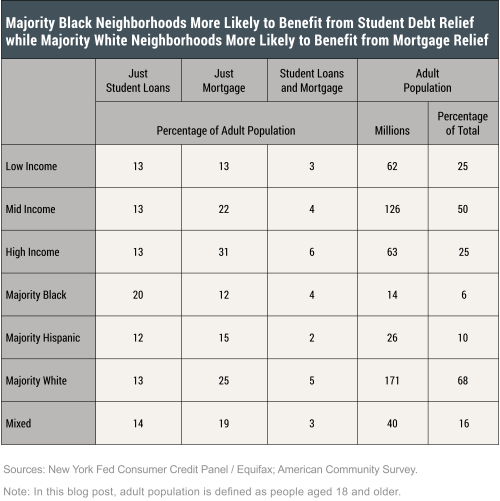

Borrowers who have student debt or mortgage debt (and hence may qualify for CARES Act debt moratoria) fall into three groups: those with student debt but no mortgage, those with mortgage but no student debt, and those with both types of debt. In the table below, we investigate what share of the adult (above 18) population in each type of neighborhood has student debt but no mortgage (column 1), mortgage but no student debt (column 2), and both mortgage and student debt (column 3), and hence will potentially be eligible for corresponding student debt and/or mortgage debt relief. Differentiating across neighborhoods by income, we find in column 1 that similar shares of the adult population will potentially be eligible for assistance from only the student debt relief provisions of the CARES Act across the three neighborhoods (18 percent), but a markedly higher share (more than double) can be eligible for mortgage relief in the high income neighborhoods relative to low income neighborhoods (column 2). The share of the adult population that may benefit from only mortgage relief is also considerably larger in middle income neighborhoods (1.6 times) than in low income neighborhoods. Column 3 reveals that the share of adult population respectively in high and middle income neighborhoods that can benefit from both the CARES Act mortgage and student debt relief is double the corresponding share in low income neighborhoods.

Differentiating by race, column 1 shows that a significantly larger share (20 percent) of the adult population in majority Black neighborhoods can be eligible for assistance from only the student debt relief provisions of the CARES Act compared to such shares in the majority Hispanic, majority white, and mixed neighborhoods. In contrast, columns 2 and 3 find that a substantially larger share in majority white neighborhoods will be potentially eligible for only mortgage relief or both mortgage and student debt relief compared to the shares in majority Black, majority Hispanic, and mixed neighborhoods.

Is There Heterogeneity in the Expected Benefit from the CARES Act Student Debt Forbearance?

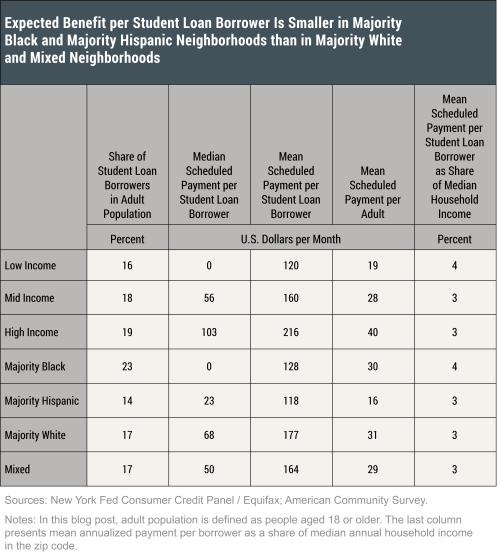

To further understand who may benefit and the extent of the potential cash flow assistance (driven by funds released by deferral of payments), we look at a neighborhood type in the table below and examine what share of the adult population in that neighborhood will be eligible for any student debt assistance and how much assistance they may receive based on their debt profile at the end of 2019. Differentiating by income, we find in the first column that a slightly higher share of the adult population in high and middle income neighborhoods can benefit from student debt relief than in the low income neighborhood. Unlike column 1 of the first table in this post, this column accounts for any student debt relief, regardless of whether the borrower holds both mortgage and student debt or holds student debt but no mortgage debt. The higher shares in this table (in contrast to the earlier table) are driven by increased incidence of borrowers who hold both student and mortgage debt in the high and middle income neighborhoods.

Turning to the amount of potential forbearance, we find that the median scheduled monthly payments per borrower (those eligible for forbearance) in low income neighborhoods are markedly smaller than those in high income neighborhoods; at least half of the student loan borrowers in low income neighborhoods had a scheduled payment of zero before the onset of the pandemic. These may be due to a number of factors: smaller loan sizes in these neighborhoods, larger incidence of in-school deferment, or higher participation in income-driven repayment programs in these neighborhoods. In column 4, we find that the mean scheduled payment per adult (and hence the potential assistance per adult) in high income neighborhoods is more than double that in low income neighborhoods. Annualizing the payments and comparing mean scheduled payment to the median household income of the zip code the person lives in, we find that the relief is actually a higher share of median income in these low income neighborhoods, despite the smaller forbearance amount (column 5).

By race, we continue to find that majority Black zip codes have markedly higher concentrations of student debt borrowers relative to the other neighborhoods. 23 percent of the adult population of majority Black neighborhoods is eligible for student debt relief versus 14 percent in majority Hispanic and 17 percent in majority white and mixed neighborhoods. However, as in the case of low income neighborhoods, more than 50 percent of borrowers in majority Black zip codes have no regular monthly scheduled payment, and thus would not benefit from forbearance. We find in column 3 that the mean scheduled payment per borrower is higher in majority white neighborhoods and significantly lower in majority Black and majority Hispanic neighborhoods. In column 4, we find that the mean scheduled payment per adult is broadly similar across majority white, majority Black and mixed neighborhoods, while it is perceptibly lower in Hispanic neighborhoods. The difference in patterns between columns 3 and 4 is driven by the fact that majority white neighborhoods are considerably more populous than majority Black neighborhoods (column 4 of the first table in this post). Interestingly, we once again find in the last column that the potential forbearance amount will constitute a higher share of median household income in majority Black neighborhoods than in other neighborhoods. In summary, we find that larger shares of borrowers from majority Black neighborhoods can benefit from the student debt relief provision, although the expected per-borrower relief to these communities is smaller. Regardless, this relief will address a higher debt burden (as share of income) in these neighborhoods.

Understanding Heterogeneity in the CARES Act Mortgage Debt Forbearance Relief

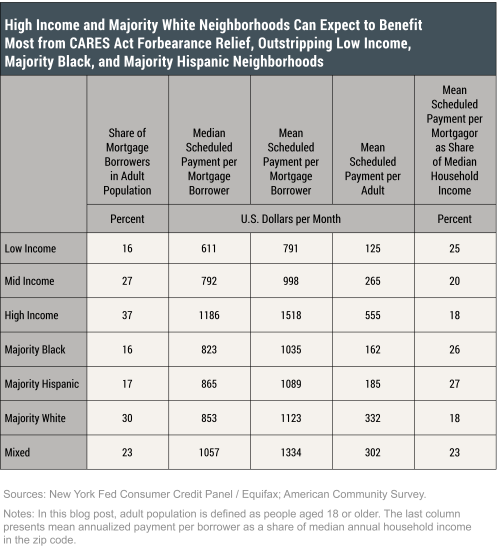

We can repeat this analysis for mortgage debt. Remember, not all mortgages are FHA or GSE-backed and hence eligible for forbearance. The table below shows that the highest concentrations are in majority white and higher-income zip codes, as qualifying for a mortgage requires a relatively high credit score and steady stream of income. Mortgagors in high income zip codes also pay much more per month than those in other areas, indicating higher home value and mortgage balance on average. We find from column 3 that the monthly scheduled payment of mortgagors (and hence the potential forbearance amount per mortgagor) is higher for those from high income, mixed, and majority white neighborhoods, and smallest for those from low income and majority Black neighborhoods. Looking at mean scheduled payment per adult in the various neighborhoods, the indicator of average per-capita forbearance dollars to a neighborhood, once again we find that high income, majority white, and mixed neighborhoods can expect higher mortgage forbearance relief, while this relief is lowest for low income, majority Black, and majority Hispanic neighborhoods (column 4). Nevertheless, turning to the mean payment as a share of median income in the neighborhood, we find that this relief amount again constitutes higher relative debt burdens in low income, majority Black, and majority Hispanic neighborhoods, largely because of lower median income in these neighborhoods.

To summarize, we have investigated who may benefit (and the expected forbearance amounts) from the various debt relief provisions in the CARES Act. We find that while student debt relief may be expected to reach a larger share of borrowers in majority Black neighborhoods, the dollar value of expected student debt relief per borrower will be perceptibly less in low income, majority Black, and majority Hispanic neighborhoods. Unlike student debt relief, mortgage relief may be concentrated in high income and majority white neighborhoods, both in terms of dollar amounts and share of borrowers that will be potentially assisted. It is worth emphasizing that in this post we have outlined who may benefit from the mortgage and student debt relief provisions of the CARES Act. In other words, we have focused on the supply of this relief to different neighborhoods. Who will actually benefit and the amount of relief obtained will be determined by a combination of supply and demand factors. Since, low income and majority minority neighborhoods have been affected more negatively by this pandemic, residents in these neighborhoods may have the highest take-up rate. Moreover, mortgage benefits are not automatic; mortgagors must actively seek out these benefits by contacting servicers and proving financial hardship. Thus, ultimately, who actually benefits and by how much will be determined by a combination of factors, a topic we will continue to study. This post starts the conversation by investigating the potential beneficiaries and the potential reach (in dollar terms) of the forbearance programs.

Rajashri Chakrabarti is a senior economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Andrew F. Haughwout is a senior vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Donghoon Lee is an officer in the Bank’s Research and Statistics Group.

Joelle Scally is a senior data strategist in the Bank’s Research and Statistics Group.

Wilbert van der Klaauw is a senior vice president in the Bank’s Research and Statistics Group.

How to cite this post:

Rajashri Chakrabarti, Andrew Haughwout, Donghoon Lee, William Nober, Joelle Scally, and Wilbert van der Klaauw. “Debt Relief and the CARES Act: Which Borrowers Benefit the Most?” August 18, 2020, https://libertystreeteconomics.newyorkfed.org/2020/08/debt-relief-and-the-cares-act-which-borrowers-benefit-the-most.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Robert: Thanks for your comment. The objective of our post is to simply understand who may be eligible for the mortgage and student debt relief measures offered under the CARES Act. Our August 6 post* provides some color on the changes in balance reduction seen during this time, and indeed the forbearance and waiving of interest had a direct impact on the repayment rates. * https://libertystreeteconomics.newyorkfed.org/2020/08/a-monthly-peek-into-americans-credit-during-the-covid-19-pandemic.html

If this is a temporary problem for a subset of borrowers, hardship suspension of payments or income driven repayment plans already in existence already provide exactly the prescribed protection in the case of student loans (earn little or nothing, pay little or nothing). In theory, the suspension of interest accrual should encourage faster repayment of principal as well. If however, borrowers are still unable to repay principal, either during or post pandemic, then suspension of repayment and interest only delays the day of reckoning. If this is not a temporary problem, and applies to the majority of borrowers, or more importantly, the majority of dollars in the federal portfolio, i.e. these borrowers will be unable to repay going forward for the foreseeable future, then we need to reexamine how we issue student loans in the first place (how much, for what costs [what is truly an education related expense when classes are 100 percent online?], to which schools and which programs). The Federal loan program does not work if the majority of loan dollars issued end up in a perpetual game of kick-the-can or paying pennies on the dollar towards eventual cancellation, with a very small minority being fully repaid, while we keep issuing new ones under the same wide open conditions. Outright cancellation of student loans poses a moral hazard that encourages more borrowing, rewards irresponsible lending and race-to-the-bottom admission and academic standards, and does not stimulate the economy when the loans are not being fully repaid in the first place. Those who could not afford to fully repay their student loans pre-pandemic were not doing so due to income driven plans or forbearance, so reducing their principal simply moves up the timing of the taxpayer cost recognition. Reduction of mortgage principal on the other hand reduces monthly loan payments in real dollars, which could directly stimulate the economy.