In late August, as part of the Federal Reserve’s review of Monetary Policy Strategy, Tools, and Communications, the Federal Open Market Committee (FOMC) published a revised Statement on Longer-Run Goals and Monetary Policy Strategy. As observers have noted, the revised statement incorporated important changes to the Federal Reserve’s approach to monetary policy. This includes emphasizing maximum employment as a broad-based and inclusive goal and focusing on “shortfalls” rather than “deviations” of employment from its maximum level. The statement also noted that, in order to anchor longer-term inflation expectations at the FOMC’s longer-run goal, the Committee would seek to achieve inflation that averages 2 percent over time. In this post, we investigate the possible impact of these changes on financial market participants’ expectations for policy rate outcomes, based on responses to the Survey of Primary Dealers (SPD) and Survey of Market Participants (SMP) conducted by the New York Fed’s Open Market Trading Desk both shortly before and after the conclusion of the framework review. We find that the conclusion of the framework review coincided with a notable shift in market participants’ perceptions of the FOMC’s policy rate “reaction function,” in the direction of higher expected inflation and lower expected unemployment at the time of the next increase in the federal funds target range (or “liftoff”).

Recent Desk survey data show shifts in expectations for inflation and unemployment rate at liftoff

One can think of the reaction function as a description of how monetary policy settings are adjusted in response to evolving conditions and expectations. Gauging market perceptions of the reaction function can help in interpreting signals from financial markets and assist policymakers in understanding the extent to which market perceptions align with their policy intentions. However, survey questions that only elicit expectations for the path of the federal funds target range reflect both perceptions of the policy rate reaction function as well as expectations for future economic conditions. For example, two respondents may have different views on the likely path of the target range because of differing economic outlooks but nevertheless have similar views on how the FOMC would set the target range in response to given levels of inflation, unemployment, or other variables.

When the target range is at the effective lower bound (ELB), a useful way to try to isolate respondents’ views on the reaction function is to directly ask for their estimates of the values of various economic indicators that will prevail at the time of liftoff. Recent iterations of the SPD and SMP have included just this type of question; respondents have been asked for the most likely level of the unemployment rate, headline twelve-month personal consumption expenditures (PCE) inflation, the labor force participation rate, and the level of real GDP at the time of the next increase in the target range.

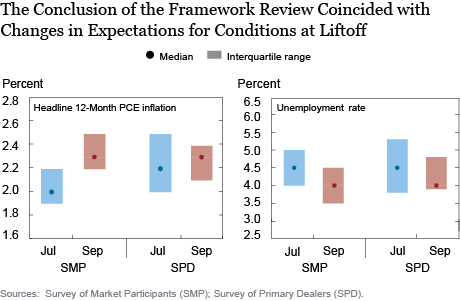

Examining changes in responses to these questions before and after the conclusion of the framework review provides compelling evidence of a shift in perceptions of the Committee’s reaction function. As the chart below shows, among market participants, the median expectation for headline twelve-month PCE inflation at liftoff increased from 2.0 percent in the July survey to 2.3 percent in the September survey, while the median expectation for the unemployment rate at liftoff fell from 4.5 percent to 4.0 percent in the respective surveys. Similarly, among primary dealers, the median expectation for headline twelve-month PCE inflation at liftoff increased from 2.2 percent in the July survey to 2.3 percent in the September survey, while the median expectation for the unemployment rate at liftoff fell from 4.5 percent to 4.0 percent. Across both surveys, the interquartile ranges of respondents’ expectations moved in similar directions as the medians.

While various other developments could have influenced perceptions of the FOMC’s reaction function, market commentary and qualitative responses to other questions in the surveys suggest that these shifts were primarily in response to the outcome of the framework review.

Recent responses imply higher inflation, lower unemployment rate at liftoff compared to pre-2015

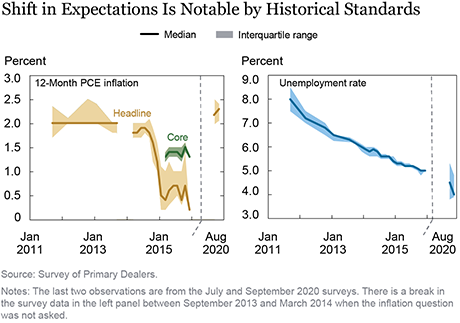

To put the levels and changes shown above into historical context, we compare recent SPD data with responses to similar questions asked in the SPD from 2011 to 2015, during the prior period in which the target range was set at the ELB. (We focus on SPD data because the SMP was launched in 2014, limiting historical comparisons.)

As shown in the chart below, we find that responses from recent surveys indicate higher expected inflation and a lower expected unemployment rate at liftoff than in the previous ELB episode, and that the recent changes in these expectations are notable by historical standards. Specifically, during the earlier period, the median estimate for headline twelve-month PCE inflation at liftoff averaged about 2 percent until mid-2014 and then declined sharply as expectations persisted for the Committee to raise the target range at a time when energy prices had depressed headline inflation. In light of the impact of energy prices on headline inflation at that time, it is helpful to also compare recent results to estimates for core twelve-month PCE inflation at liftoff during the previous ELB episode, given it should be less impacted than headline inflation by transitory shocks to energy prices. Although only a subset of questions near the end of that period asked for estimates of core PCE inflation at liftoff, median responses for that indicator were less volatile and averaged around 1.4 percent—considerably below the median of 2.3 percent in the September 2020 SPD following the outcome of the framework review. Meanwhile, the median estimate for the unemployment rate at liftoff gradually declined from 8 percent in 2011 to 5 percent just before the 2015 liftoff—higher than the median estimate of 4 percent in the September 2020 survey.

Expectations may continue to evolve following changes to forward guidance

In sum, responses to the SPD and SMP suggest that the Fed’s announcement of the outcome of the monetary policy framework review induced a notable shift in market participants’ perceptions of the FOMC’s reaction function. On the whole, this shift appears large when compared to prior historical experience at the ELB, when a similar survey question was also asked of SPD respondents.

It is important to note that soon after the conclusion of the framework review and after the September surveys, the FOMC introduced changes to the guidance in its post-meeting statement on the overall stance of monetary policy and path of the target range, including the conditions the Committee expects to prevail at the time of liftoff. These changes, which (as the Chair explained in his September press conference) were guided by the outcome of the framework review, may have further shaped market perceptions of the policy reaction function. Indeed, though changes in views were dispersed, the median across combined responses from the November SPD and SMP indicated a slight further increase in the median expectation for the level of inflation at the time of liftoff, while the median expected unemployment rate was unchanged. Going forward, data on perceptions and expectations such as those contained in the Desk’s surveys are likely to prove useful in judging how views about the reaction function evolve.

Ryan Bush is a manager for policy and market analysis in the Federal Reserve Bank of New York’s Markets Group.

Ryan Bush is a manager for policy and market analysis in the Federal Reserve Bank of New York’s Markets Group.

Haitham Jendoubi is a senior associate for policy and market analysis in the Bank’s Markets Group.

Haitham Jendoubi is a senior associate for policy and market analysis in the Bank’s Markets Group.

Matthew Raskin is a vice president for policy and market analysis in the Bank’s Markets Group.

Matthew Raskin is a vice president for policy and market analysis in the Bank’s Markets Group.

Giorgio Topa is a vice president in the Bank’s Research and Statistics Group.

Giorgio Topa is a vice president in the Bank’s Research and Statistics Group.

How to cite this post:

Ryan Bush, Haitham Jendoubi, Matthew Raskin, and Giorgio Topa, “How Did Market Perceptions of the FOMC’s Reaction Function Change after the Fed’s Framework Review?,” Federal Reserve Bank of New York Liberty Street Economics, December 18, 2020, https://libertystreeteconomics.newyorkfed.org/2020/12/how-did-market-perceptions-of-the-fomcs-reaction-function-change-after-the-feds-framework-review.html.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics