Efforts in the spring of 2020 to contain the spread of COVID-19 resulted in a sharp contraction in U.S. economic growth and an unprecedented, rapid rise in unemployment. While the first wave of the pandemic slowed the spring housing market, home sales rebounded sharply over the rest of the year, with strong gains in house prices. Given the rising house prices and continuing high unemployment, concerns arose that COVID-19 may have negatively affected first-time homebuyers. Using a new and more accurate measure of first-time homebuyers, we find that these buyers have not been adversely affected by the pandemic. At the same time, gains from lower mortgage rates have gone to existing homeowners and not to households purchasing their first home.

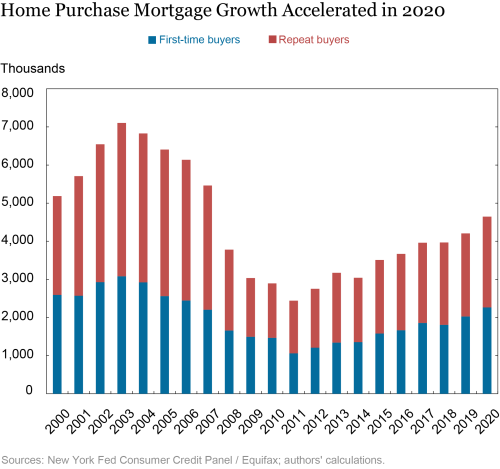

The strong performance of the housing market during 2020 is reflected both in terms of the volume of home purchases as well as the growth in house prices. The chart below shows total purchase mortgages by year, broken down into first-time homebuyers (FTBs) and repeat buyers. The data are based on new mortgage liens on household credit files, and so will not reflect any “all cash” home purchases.

The annual pace of new purchase mortgages has been trending higher since 2011. This growth accelerated in 2020, with purchase mortgage volume increasing 10.5 percent, compared to 6.0 percent in 2019. Similarly, house prices rose 9.2 percent in 2020 compared to 3.6 percent in 2019, according to CoreLogic, reflecting strong demand and relatively low inventories.

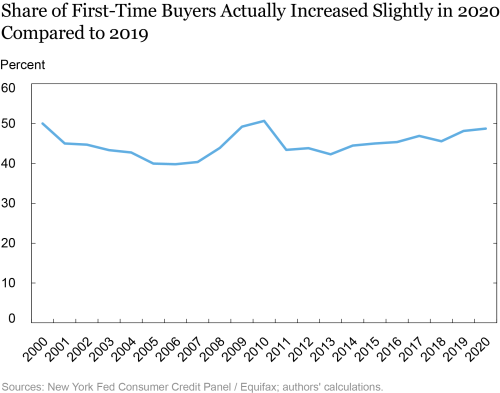

Using a large representative sample of U.S. household credit files, we can identify a FTB as the first instance of a mortgage lien on a household’s credit file. The share of new purchase mortgages taken out by FTBs each year is shown in the chart below.

We find that in 2019, prior to the COVID-19 outbreak, the share of FTBs among all purchase mortgages (excluding all-cash purchases) was 48.2 percent. In 2020, the FTB share increased to 48.8 percent, as opposed to the decline based on NAR survey data. This slight increase is also in sharp contrast to the 8.5 percentage point decline in the FTB share following the financial crisis. The FTB share has been trending up since 2013 and is now essentially back to its level in 2000.

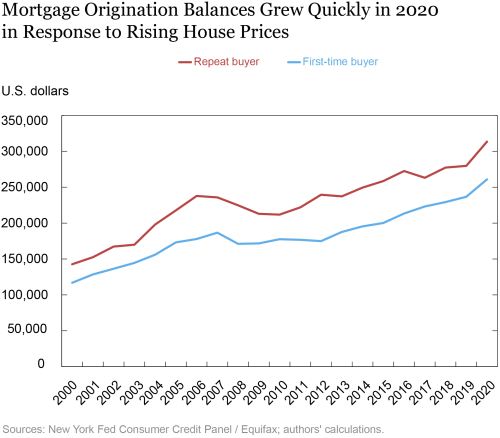

Meanwhile, rising house prices pushed up mortgage balances for both FTBs and repeat buyers. The chart below shows the average mortgage balance over time for the two types of buyers.

The average mortgage origination balance for FTBs increased by 10.2 percent in 2020, more than triple the pace of 3.2 percent in 2019. Similarly, mortgage balances for repeat buyers increased by 12.1 percent in 2020 after remaining relatively flat in 2019 (an increase of only 0.8 percent).

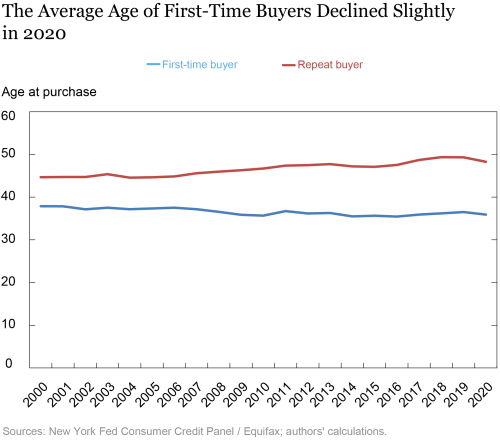

Rising house prices and a weak labor market might be expected to create affordability problems for FTBs, leading to a lower FTB share in 2020. Why did this not occur? Were FTBs in 2020 relatively older and thus had higher incomes and more time to save for a down payment? The next chart provides data on the average age of FTBs and repeat buyers.

Instead of rising, the average age of FTBs actually declined slightly, to 36.1 years in 2020 from 36.5 years in 2019.

The monthly payments on a house depend on both the mortgage balance and the mortgage rate. S&P Global reports that the average rate on a thirty-year fixed-rate mortgage fell from 4.75 percent in 2019 to 3.77 percent in 2020. For FTBs, this decline in mortgage rates completely offset the rise in house prices (and consequently mortgage balances). Based on our credit panel data, the average scheduled monthly payment for a FTB declined slightly from $1,625 in 2019 to $1,598 in 2020.

In addition to being able to afford the monthly principal and interest payments on a home, a FTB must also accumulate sufficient savings to make a down payment. Higher house prices can make saving enough for a down payment even more challenging for FTBs. However, if households invested their down-payment savings in broad equity market indices, their after-tax return in 2020 would have exceeded the rise in house prices. Generous pandemic stimulus checks and automatic forbearance on federal student loans could possibly have helped FTBs save for a down payment as well.

If FTBs were facing difficulties in making a down payment as house prices increased, they could either have tried to make a smaller-percentage down payment or have sought down-payment assistance. CoreLogic provided us with average down-payment percentages for FTBs (using the official definition for FTB of not owning a home in the last three years). In 2019, the down payment for FTBs was 8.9 percent, on average. In response to rising house prices, this percentage declined slightly in 2020, to 8.6 percent.1

Borrowers using Federal Housing Administration (FHA)-backed mortgages can use down-payment assistance (DPA) to reduce the burden of saving for a home. However, the FHA does not break out DPA use by FTBs and non-FTBs, although FTBs represent 70 percent of FHA purchase mortgages in 2020, based on our data. The use of FHA DPA increased slightly from 39.3 percent in 2019 to 39.8 percent in 2020.2 Both the lower down-payment percentages and higher use of DPA indicate that some FTBs faced challenges in purchasing a home in 2020 but that credit markets were able to accommodate them.

Summing Up

The COVID-19 health crisis sent the economy into a sharp recession, resulting in an unprecedented increase in unemployment. At the same time, low inventories and strong demand led to faster gains in house prices. Despite these challenges, the share of FTBs actually increased slightly in 2020. The decline in mortgage rates offset rising house prices to keep monthly payments roughly unchanged. This result illustrates that in a market with low inventory and strong demand, the benefit from lower mortgage rates goes to sellers and not first-time buyers.

(1) We thank Frank Nothaft of CoreLogic for providing these tabulations.

(2) Table B-10, page 98. https://www.hud.gov/sites/dfiles/Housing

/documents/2020FHAAnnualReportMMIFund.pdf

Donghoon Lee is an officer in the Federal Reserve Bank of New York’s Research and Statistics Group.

Donghoon Lee is an officer in the Federal Reserve Bank of New York’s Research and Statistics Group.

Joseph Tracy is an executive vice president and senior advisor to the president of the Federal Reserve Bank of Dallas.

Joseph Tracy is an executive vice president and senior advisor to the president of the Federal Reserve Bank of Dallas.

How to cite this post:

Donghoon Lee and Joseph Tracy, “How COVID-19 Affected First-Time Homebuyers,” Federal Reserve Bank of New York Liberty Street Economics, April 12, 2021, https://libertystreeteconomics.newyorkfed.org/2021/04/how-covid-19-affected-first-time-homebuyers.html.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

This research is interesting, but…it doesn’t capture potential buyers priced out of the feeding frenzy that I hear about in housing markets in various places across the country. The “story” is that homes are being snapped off the market within days of listing at premiums to the listing price, and often with waivers of inspections or mortgage contingencies. A realtor friend in Louisville, a daughter in Springfield, a brother in Sacramento, all describe buyers with excellent credit and down payments repeatedly disappointed and heartbroken as homes are taken in quick all cash deals, or with extra cash thrown in to lock in the purchase. By definition, potential first time buyers who are pushed out of the market are not captured in this study: they aren’t getting mortgages, since they aren’t completing home purchases. The real impact of the pandemic on first time buyers can be better measured by looking at markets where home prices are rising inordinately fast and where many buyers are missing out on generational lows in mortgage rates because they can’t compete in the frenzy.