Should open-end mutual funds experience redemption pressures, they may be forced to sell assets, thus contributing to asset price dislocations that in turn could be felt by other entities holding similar assets. This fire-sale externality is a key rationale behind proposed and implemented regulatory actions. In this post, I quantify the spillover risks from fire sales, and present some preliminary results on the potential exposure of U.S. banking institutions to asset fire sales from open-end funds.

Outflows from Open-End Funds during the Covid Crisis

We typically think of banks as the natural providers of liquidity, mainly through their deposit accounts, but nonbank financial institutions have also become major suppliers of liquidity in the economy over the years. Among the latter are open-end mutual funds (OEFs) that give investors the option to redeem their shares on demand. Because redemptions by an investor can affect the share value of remaining investors, OEF investors have a first-mover advantage to redeem ahead of everyone else in stressed circumstances, generating the conditions for run-like dynamics (Chen, Goldstein, and Jiang [2010]; Goldstein, Jiang, and Ng [2017]).

When OEFs experience significant outflows, as during March 2020, they may accommodate the redemptions through the partial liquidation of their asset holdings. This sale of assets, if conducted broadly across funds, affects prices to a greater extent than during normal market conditions when sales by some entities are offset through purchases by others. Such diffused asset (fire) sales could have macroeconomic consequences, a possibility that was explicitly mentioned in the holistic review of pandemic-related market turmoil that regulatory agencies undertook in Fall 2020.

Quantifying Fire-Sale Risk from Open-End Funds

In previous Liberty Street Economics analysis (see here and here), my coauthors and I had concluded that spillover potential from OEFs has increased, due in part to OEFs in aggregate attracting more investors, but also to a growth in the commonality of their asset holdings. In that analysis, we had hypothesized a redemption shock affecting some funds, and then assessed the potential spillovers to other funds. The latter may not have been affected by the original shock but the value of their portfolios could be adversely affected as they held assets in common with funds that were hit by the original shock. However, such hypothetical shocks could propagate beyond the OEFs to other entities holding similar assets. In particular, banks may become exposed to a crisis indirectly through their exposures to assets held by the OEFs.

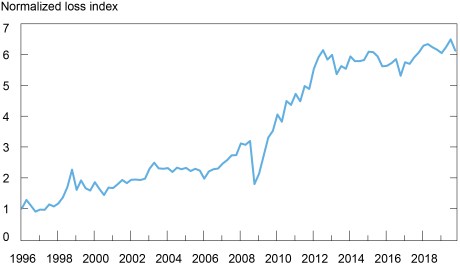

In order to quantify such exposures, I hypothesize shock scenarios that could affect the population of U.S.-registered fixed-income OEFs at a given point in time, and estimate the extent of the spillover impact on the cross section of U.S. bank holding companies (BHCs). The chart below shows the time series of the aggregate spillover vulnerabilities of the top 100 BHCs calculated for every quarter between 1996:Q1 and 2019:Q4. The line is normalized to one in 1996:Q1, so that the changes can be easily interpreted as changes from that baseline. The estimates suggest that the potential systemic spillovers from OEFs to BHCs from forced asset sales have increased substantially over time, approximately by a six-fold since the mid-1996. It is interesting to note that after a period when the aggregate vulnerability seemed to have reduced, spillovers reached their historical high point right at the onset of the COVID-19 crisis.

BHC Losses as a Ratio of Total Equity

Source: Author’s calculations.

Notes: BHC is bank holding company. Losses are normalized to 1996:Q1.

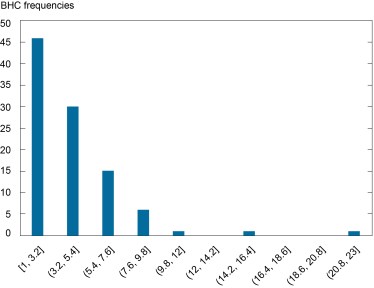

By studying the cross section of vulnerabilities, we can assess whether a given BHC, based on its own characteristics, appears to be more or less exposed to a possible OEF fire sale. The histogram in the chart below shows the distribution of spillover losses for each BHC in the cross section, calculated as of 2019:Q4. The numbers are normalized to the value calculated for the BHC with the lowest spillover number, so that the histogram conveniently describes the “distance” in multiples of spillovers across the BHCs. The estimates indicate substantial heterogeneity in the exposure of BHCs to a potential OEF-driven fire sale.

Normalized Losses for BHC Cross Section, 2019:Q4

Source: Author’s calculations.

Notes: The numbers are normalized to the value calculated for the bank holding company (BHC) with the lowest spillover number, so that the histogram conveniently describes the “distance” in multiples of spillovers across the BHCs. So, for example, the first bar depicts BHCs with spillovers up to 3.2 times as large as the smallest observed in the cross section.

The fact that BHCs are differentially exposed to fire-sale vulnerabilities suggests a possible role for supervisory oversight. Accordingly, I correlate the cross-sectional vulnerability to BHC-specific characteristics that are likely to contribute to increased vulnerability: total assets on their balance sheets, the equity to asset ratio, and the share of relatively illiquid assets held on their balance sheets. Total assets of BHCs are positively correlated with spillover vulnerability (since larger dollar exposures likely translate to larger declines in asset values) but the correlation is modest. More relevant is the (negative) correlation with a BHC’s own equity to asset ratio. And finally, as one would expect, the correlation is large and positive with the relative holdings of more illiquid assets.

Fire-Sale Vulnerability of BHCs during March 2020

Using the cross section of BHC vulnerabilities as of 2019:Q4, I construct an index of latent vulnerability to the shock that then materialized in the subsequent quarter. Did BHCs that were from an ex ante perspective more exposed to OEFs’ asset sales experience a stronger impact ex post? Since the exposure measure in 2019:Q4 is purely driven by the pre-crisis degree of asset commonality, it may reasonably be considered as unrelated to factors that drove the redemption pressure and the subsequent asset sales during the first half of March.

To detect an immediate balance sheet impact from a BHC’s latent vulnerability, I focus on its available-for-sale holdings of securities as a share of total assets. If asset sales impacted prices, then BHCs with greater exposures to sales from OEFs should have experienced larger losses in the mark-to-market values of their securities holdings. I find that, indeed, the BHCs with above-median latent vulnerability exhibited a larger reduction (estimated at about 56 basis points) in the value of their shares of securities holdings. This change is statistically significant. It is also economically meaningful as the magnitude is about 10 percent of the standard deviation of the distribution of the change in value of BHCs’ securities portfolio shares.

To trace the potential impact of the immediate change in balance sheet values to possible effects on banks’ activities and reported performance, I compare the return on equity (ROE) of BHCs as of 2019:Q4 with their performance in 2020:Q4. The preliminary results indicate that the ROE of those BHCs with a high latent vulnerability deteriorates disproportionately relative to banks with low vulnerability, by about half of a percentage point more. The difference in impact between the two groups is about 10 percent when considering the ROE four quarters out. It is economically significant since the mean ROE across the two groups is about 10 percent.

Summing Up

BHCs are vulnerable to potential forced sales of assets from OEFs. These vulnerabilities have grown over time, simply as a result of the steady increase in the dollar amount of assets held in common. Are there specific aspects of a BHC’s business model that make it more vulnerable to this kind of risk? Are there specific asset classes that might be especially important when shocks are transmitted from OEFs to BHCs? Exploring these and other related questions is key to developing monitoring guidelines and observable metrics that could assist examiners in supervising banks.

Nicola Cetorelli is a vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Disclaimer

The views expressed in this post are those of the author and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics