This post is the second in a three-part series exploring racial, gender, and educational differences in household debt outcomes. In the first post, we examined how the propensity to take out household debt and loan amounts varied among students by race, gender, and education level, finding notable differences across all of these dimensions. Were these disparities in debt behavior by gender, race, and education level associated with differences in financial stress, as captured by delinquencies? This post focuses on this question.

As in our previous post, we draw on a novel merger of individual-level demographic and education data from CUNY and consumer debt data from the New York Fed/Equifax Consumer Credit Panel, resulting in an anonymous data set covering more than 84,000 students who entered CUNY as first-time freshmen between 1999 and 2014. (See the previous post for more detail on this topic.)

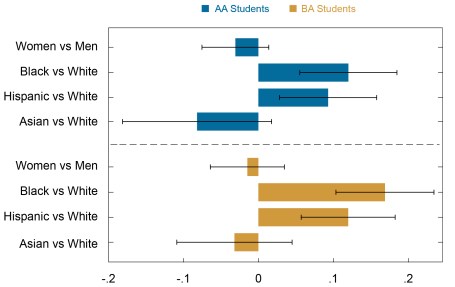

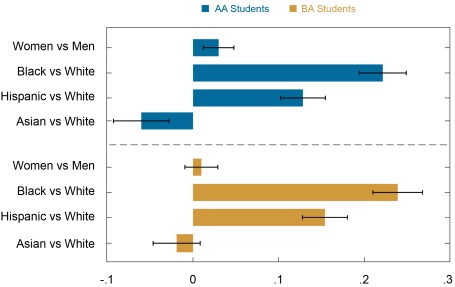

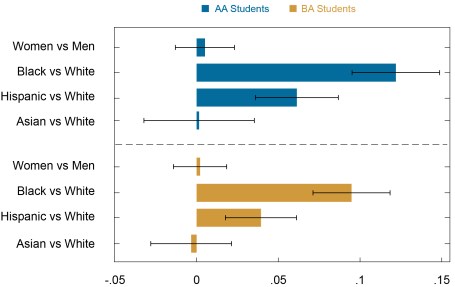

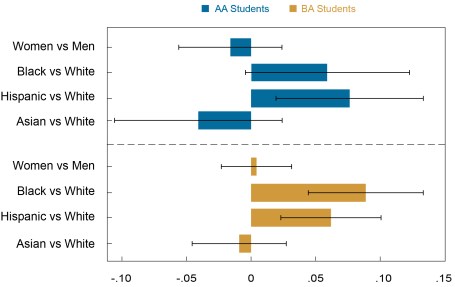

Once again, we utilize multivariate regression analysis and present bar charts for the regression coefficients of interest; these show the correlations between demographics, educational outcomes, and debt delinquencies, controlling for factors such as immigration and visa status, type of high school attended, year of entry to CUNY, and whether a student has a disability, is economically disadvantaged, or is an English language learner. The charts shown below are split into two panels: the upper panel represents results for students who enter CUNY for an associate (AA) degree, while the lower panel depicts results for students who enter CUNY for a bachelors (BA) degree. We will refer to the former group of students as AA students and to the latter group of students as BA students.

Student Loan Delinquency

We find that 37 percent of AA students, and 21 percent of BA students were ever delinquent on their student loan by age 30. The corresponding rates in the nationally representative data from our CCP-NSC sample (described in our first post) are respectively 22 percent and 21 percent for the two-year and four-year public school students.

Recall from our previous post that women and Black students were more likely to take out student debt and in larger amounts than men and white students, respectively, while the pattern was opposite for Asian and Hispanic students (with the exception of Hispanic BA students, who were more likely to take out student debt). Exploring gender differences in student loan delinquencies (chart below), we find that female AA and BA students were less likely to be ever delinquent on student loan debt by age 30 in comparison to their male counterparts (with differences of 3.1 percentage points and 1.5 percentage points respectively, which amount to 9 percent and 7 percent respectively of the AA and BA sample averages).

Differentiating by race, we find that Black and Hispanic AA and BA students were more likely to be ever delinquent than white students by age 30, with differences of 12.0 percentage points and 9.3 percentage points respectively for Black and Hispanic AA students and 16.9 percentage points and 12.0 percentage points respectively for Black and Hispanic BA students. These are large differences—the AA Black-white and Hispanic-white differences correspond to 33 percent and 25 percent of the AA sample average while the BA Black-white and Hispanic-white differences constitute 80 percent and 57 percent of the BA sample average. In contrast, Asian AA and BA students were less likely to be delinquent than the corresponding white students.

To sum up, higher origination balances and higher propensities to borrow were associated with larger delinquency probabilities by age 30, as seen for Black AA and BA students. Conversely, lower origination amounts and lower propensities to borrow were associated with lower delinquency probabilities, as seen for Asian AA and BA students. Hispanic students had higher probabilities of delinquency relative to white students, even though they originated smaller dollar amounts of student loan debt, while female students had a higher rate of taking out student loans but were less likely to be delinquent. This apparent puzzle may be contributed by potential differences in labor market outcomes of these two groups.

Black and Hispanic Students More Likely to Be Delinquent on Their Student Loan Debt, while Asian Students Less Likely to Be So

Difference in Probability of Student Loan Delinquency by Age 30

Sources: CUNY; New York Fed Consumer Credit Panel / Equifax.

Note: Bands for the 95 percent confidence interval are shown.

Credit Card Debt

The average credit card delinquency rates in our sample were 38 percent for AA students and 22 percent for BA students by age 30 (which, in turn were similar to those in the representative NSC-CCP sample of 40 percent for two-year students and 28 percent for four-year students).

Turning to credit card delinquency rates and distinguishing by gender, we found that female AA and BA students were 3 percentage points and 1 percentage point more likely to be delinquent on their credit card debt by age 30 respectively as compared to their male counterparts (although the difference for BA students is not statistically distinguishable from zero), with the AA female-male gap equaling 8 percent of the average delinquency rate for AA students.

Distinguishing by race, we found that Black and Hispanic AA and BA students were more likely to be delinquent than white students (the differences were 22.2 percentage points and 12.8 percentage points, respectively, for Black and Hispanic AA students and 23.9 percentage points and 15.4 percentage points for Black and Hispanic BA students). These differences were very large in comparison to the sample average. For AA students, the Black-white and Hispanic-white gaps respectively constituted 58 percent and 34 percent of the sample average; for BA students, these gaps were respectively 109 percent and 70 percent of the sample average. Breaking from this pattern, Asian AA and BA students were less likely to be delinquent than corresponding white students, although the difference for BA students was not statistically significant (or different from zero).

The higher delinquency rates for women and minority students (except Asians) relative to men and white students respectively despite their lower credit card origination amounts is intriguing. These seemingly opposite patterns can potentially be attributed to differences in labor market outcomes of these groups, a potential mechanism we will discuss more in the third post in this series.

Black and Hispanic Students More Likely to Be Delinquent on Credit Card Debt despite Lower Average Balances

Difference in Probability of Credit Card Delinquency by Age 30

Sources: CUNY; New York Fed Consumer Credit Panel /Equifax.

Note: Bands for the 95 percent confidence interval are shown.

Auto Loan Delinquency

11 percent of AA students and 5 percent of BA students ever held delinquent auto loans in our sample by the age of 30. The numbers in the nationally representative CCP-NSC sample were similar: 13 percent for two-year public students and 7 percent for four-year public students by age 30. In the first post, we saw that women and racial minorities had lower average origination amounts (except Black and Hispanic BA students) and were less likely to take out an auto loan by age 30 compared to male and white students respectively.

Turning to auto loan delinquency rates and differentiating by race, we find sizable differences–Black and Hispanic AA students were 12.2 percentage points and 6.1 percentage points more likely to be delinquent by age 30 (110 percent and 56 percent of the sample average), while Black and Hispanic BA students were 9.5 percentage points and 3.9 percentage points more likely to be delinquent (190 percent and 79 percent of the sample average). The delinquency rates of women and Asians, on the other hand, were not statistically different from those of men and white students, respectively. The markedly higher delinquency rates of Black and Hispanic AA students despite lower origination amounts once again may have stemmed from differences in labor market outcomes between white students and these racial groups.

Black and Hispanic Students Markedly More Likely to Be Delinquent on Auto Loan Debt by Age 30

Difference in Probability of Auto Loan Delinquency by Age 30

Sources: CUNY; New York Fed Consumer Credit Panel /Equifax.

Note: Bands for the 95 percent confidence interval are shown.

Mortgage Delinquency

In the nationally representative NSC-CCP sample, 4 percent and 2 percent respectively of two-year and four-year public school students were ever delinquent on their mortgage debt by age 30. In contrast, we find that in our sample 14 percent of AA students and 6 percent of BA students were delinquent on their mortgage debt by age 30, thus exhibiting substantially higher delinquencies than in the national public-school students’ sample.

Even though Black and Hispanic AA and BA students were less likely to hold mortgage debt and had lower origination amounts, we find in the chart below that Black and Hispanic students were considerably more likely to be delinquent on their mortgage debt than corresponding white students (with Black-white and Hispanic-white differences being 6 percentage points and 8 percentage points, respectively, for AA students and 9 percentage points and 6 percentage points for BA students), though the differences for Black AA students were not statistically different from zero. Once again, these differences are substantial, with the AA Hispanic-white gap constituting 54 percent of the sample average and the BA Black-white and Hispanic-white gaps constituting 148 percent and 103 percent of the corresponding sample average. Asian students had lower delinquency probabilities than their white peers, even though the gaps were not statistically different from zero. This is despite the fact that they had higher propensities of originating mortgage debt and had larger origination amounts.

The higher delinquency probabilities of Black and Hispanic BA students (relative to white students) may relate to their higher probabilities of taking out student loan debt seen in our first post and higher student loan delinquencies seen in the first chart above. They may also relate to differences in labor market outcomes between Black and Hispanic BA students and their white peers. Notably, the delinquency likelihood of Black BA students relative to white students were larger than the corresponding likelihood for AA students.

This pattern, along with the fact that the Black-white gaps in homeownership rates and origination amounts were more prominent for BA rather than AA students by age 30, may indicate higher financial stress for the BA students, potentially due to higher tuition and a higher incidence of student debt for this group, as shown in the earlier post.

Black and Hispanic Bachelors Students More Likely to Be Delinquent despite Lower Mortgage Debt Origination Amounts

Difference in Probability of Mortgage Delinquency by Age 30

Sources: CUNY; New York Fed Consumer Credit Panel /Equifax.

Note: Bands for the 95 percent confidence interval are shown.

Summing Up

In every single category of debt, Black and Hispanic students in our sample were more likely than white students to be delinquent by the age of 30. This is true even though Black and Hispanic students were less likely to have held three of the four types of debt in the first place (credit card, auto, and mortgage) and in many cases their origination amounts/credit card balances were lower.

This leads us to ask the question: why are delinquency rates so much higher for Black and Hispanic students? Asian students, on the other hand, were less likely to have held a delinquent debt. Yet, very few of the delinquency results for women and Asian students were statistically different from zero, especially among BA students.

In the next and final post of this three-part series, we will explore possible mechanisms for our results so far. We will seek to understand why Black and Hispanic students had a higher propensity for delinquency despite their lower rates of debt origination, and why Asian students experience the reverse phenomenon.

Chart data ![]()

Ruchi Avtar is a senior research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Rajashri Chakrabarti is a senior economist in the Bank’s Research and Statistics Group.

Kasey Chatterji-Len was a summer analyst in the Bank’s Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics