In this post we summarize the main results of our contribution to a recent e-book, “The Making of the European Monetary Union: 30 years since the ERM crisis,” on the economic and financial crises in Europe since 1992-93, and focus on the spillovers of those crises onto the United States and the global economy. We find that the answer to the question in the title of this post is a (moderate) yes.

About thirty years ago, many European countries witnessed a series of speculative attacks in their currency and bond markets, in parallel with high unemployment, plummeting growth, and disruption in the financial and banking sectors. The implications of the 1992-93 Exchange Rate Mechanism (ERM) crisis have been highlighted in past Liberty Street Economics posts and extensively covered by a vast literature, including a 1998 book, “Financial Markets and European Monetary Cooperation.” More recently, on the occasion of its thirtieth anniversary, the ERM crisis has been revisited in “The Making of the European Monetary Union: 30 years since the ERM crisis,” published by the CEPR. The e-book covers not only the events preceding the introduction of the euro and the establishment of the Economic and Monetary Union, but also the more recent sovereign risk crises that shook European markets and threatened the process of economic and financial integration in the euro area. It pays particular attention to the period from the Global Financial Crisis (GFC) to the COVID-19 pandemic.

In our contribution to the e-book, we focused on the implications of the European crises for the U.S. and the rest of the global economy. Our note was titled “When Europe catches a cold the rest of the world sneezes,” a twist on a motto reportedly coined by Klemens von Metternich, the XIX century Austrian statesman and diplomat—who said, “When France sneezes the rest of Europe catches a cold”—to emphasize how events in one country or region affect and influence events elsewhere. In our note we flipped Metternich’s proposition and focused on spillovers from Europe to the U.S. and the rest of the world based on events occurring ten years ago, at a time when Europe had caught a major cold, if not a full-fledged flu. The scenario was a pretext to address a recurrent question over the past three decades, and a still relevant one nowadays: Does European turmoil transmit negatively to the rest of the world, affecting the macroeconomic outlook and financial conditions in the global economy? And if the answer is “yes,” to what extent?

Euro Area 2012: From Stagnation to Contraction

Travelling back in time to the fall of 2012, a generalized fiscal retrenchment appears as a key driver of the recession, especially in the European periphery. Concerns about fiscal positions in Europe had translated into higher spreads and a credit crunch. At the time, the adjustment program was particularly offtrack in Greece, and preservation of Greece’s euro area (EA) membership was an openly debated question. Markets discussed the likelihood and impact of scenarios involving a sudden stop in disbursements, accelerating capital and deposit flights, redenomination of currency, sovereign default, as well as corporate and banking insolvencies.

The U.S. Federal Reserve was especially concerned with developments in Europe. As a paradigmatic example, the minutes of the September 2012 FOMC meeting included sentences such as: “Many participants…noted that a high level of uncertainty regarding the European fiscal and banking crisis and the outlook for U.S. fiscal and regulatory policies was weighing on confidence, thereby restraining household and business spending. …Prominent among these risks were a possible intensification of strains in the euro zone, with potential spillovers to U.S. financial markets and institutions and thus to the broader U.S. economy….” European developments were expected to affect the U.S. via (i) trade linkages as U.S. residents use goods and services imported from abroad, and produce goods and services exported abroad; (ii) cross-border financial flows, as U.S. residents lend to and borrow from foreigners, as well as strains on European banks with repercussion for U.S. financial institutions; (iii) macroeconomic factors whereas exchange rates and foreign prices affect U.S. inflation and real incomes, and (iv) broader confidence shocks leading to tighter financial conditions.

A Quantitative Analysis

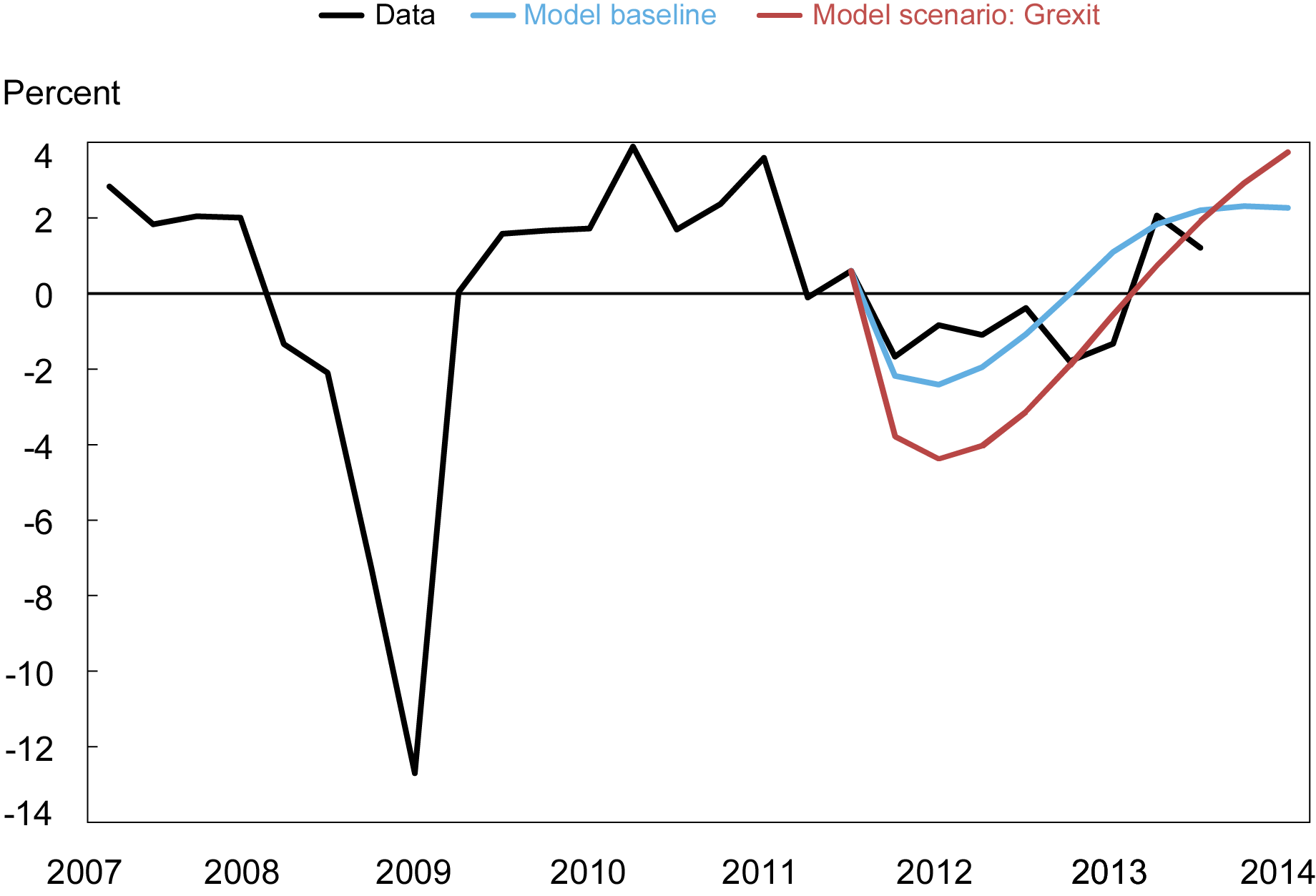

To assess the macroeconomic effects of the EA crisis we used an extension of the open-economy DSGE model presented in a staff report, Akinci and Queralto (2022), to include input-output production linkages between countries, in additional to financial linkages. We also built a “baseline” scenario replicating the 2012 events to match the rise in credit spreads seen at that time and the parallel depreciation of the euro vis-à-vis the U.S. dollar. As shown in the chart below, the model predicted output losses around 2.5 percent (Q/Q at an annual rate) at the trough (blue line), consistent with the data (black line).

Euro Area GDP Fell Considerably during the Euro-Area Debt Crises but Could Have Been Worse if Greece Had Left the EA.

Next, we considered a counterfactual scenario to analyze what could have happened if Greece had left the EA (“Grexit”) and quantified the global macroeconomic effects of this scenario through the lens of our model. In our model, Grexit was modeled as a larger and more persistent increase in the credit spread and a greater and more persistent depreciation of the euro vis-à-vis the U.S. dollar. Note that the reaction of both the credit spreads and the exchange rate were comparable to magnitudes seen during the GFC in 2008. As shown in the chart above, the model predicted a decline of GDP at the trough around 5 percent (annual rate), or twice as large as the decline observed in 2012 (red line). Importantly, the decline in the counterfactual Grexit scenario was quite persistent.

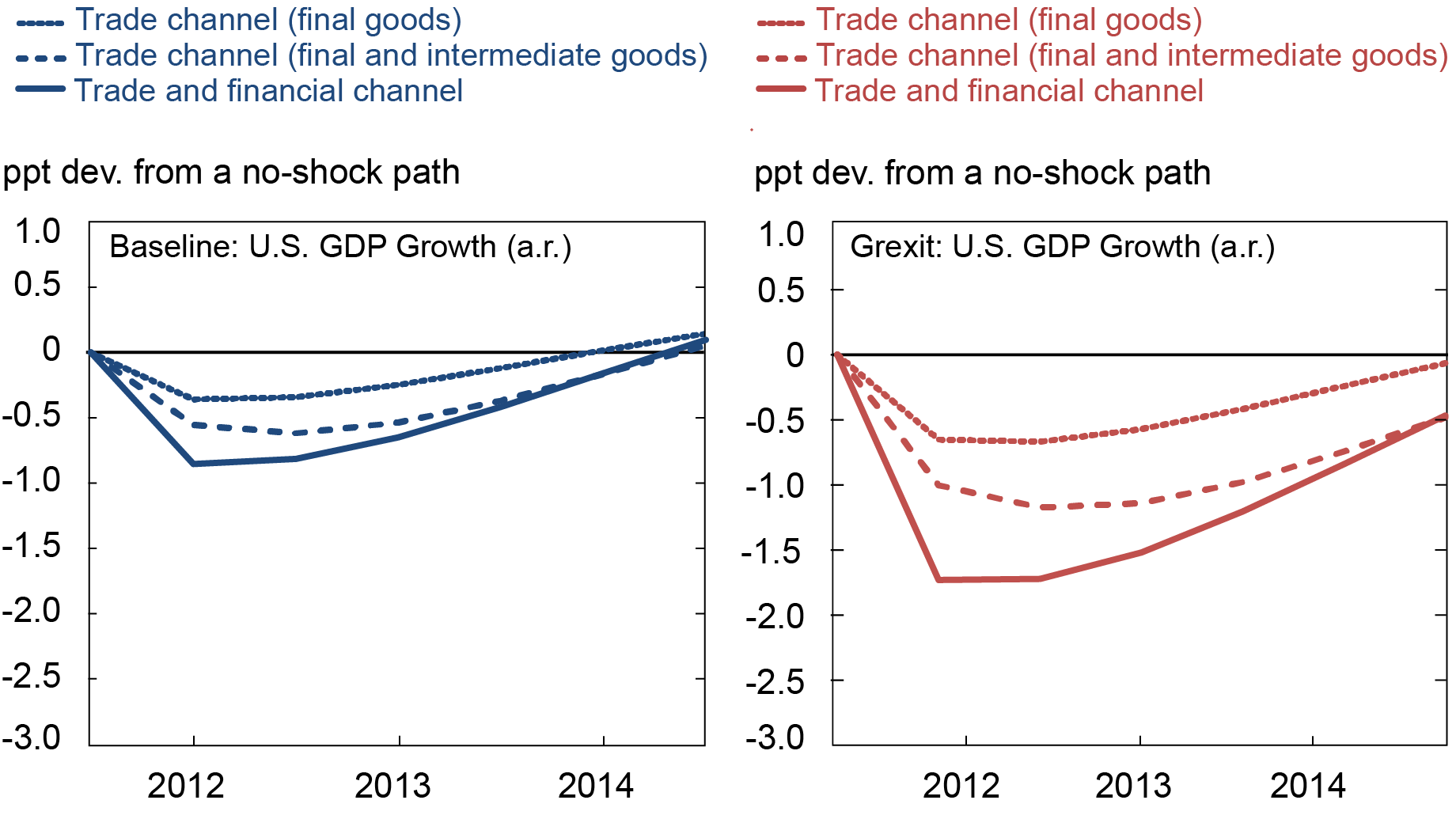

Finally, we evaluated the spillovers from the EA to the United States and the rest of the world under both the baseline and the Grexit scenarios. Our model quantified two main channels through which the EA debt crisis could impact the foreign economies.

Euro-Area Debt Crises Transmitted to U.S. via Trade and Financial Channels

The trade channel operated through a fall in U.S. goods exports due to lower foreign demand, both because EA domestic absorption plummets and because U.S. goods become more expensive as the dollar appreciates. Global demand shifted toward foreign intermediates and away from the U.S. intermediates as the dollar appreciated, which in turn hit U.S. producers further as part of those intermediates were domestically produced.

The financial channel operated through U.S. banks’ balance sheets exposure to EA risks. Lower returns on EA assets eroded the value of some of U.S. bank assets, causing the financial accelerator to kick in: the initial drop in bank asset values was amplified through a fall in economy-wide asset prices, generating a further fall in bank assets values, which eventually generated noticeably higher U.S. credit spreads and lower investment spending.

Overall, in the baseline scenario, the model predicted negative spillovers to U.S./Rest of world, reducing GDP growth by up to 85 basis points, mostly through the trade channel. In the Grexit scenario, weaker EA growth and a stronger U.S. dollar reduced growth by another 85 bps, especially through lower intermediate goods exports. Also, the financial channel had larger and more persistent effects in the Grexit scenario, as the U.S. banking sector experienced equity losses through its exposure to European banks, resulting in much tighter financial conditions. Everything considered, GDP growth in the U.S./R.O.W. could have been 170 bps below the no-shock path if Grexit had occurred.

Ultimately, what did the EA crisis mean (and what might future EA crises mean) for the U.S. and the rest of the world? Ten years ago or so it depended on the nature and modalities of the potential scenarios going forward. Spillovers ended up being negative but relatively contained, mostly related to a slowdown of trade in intermediate goods. To a large extent this relatively benign outcome was related to the fact that U.S. financial institutions had reduced their exposures and increased capital against remaining exposures. Still, the implications of more disruptive scenarios (such as Grexit) were subject to extreme uncertainty. As Metternich would have put it, in 2012 the U.S. just sneezed, luckily. It could have been pneumonia.

Ozge Akinci is an economic research advisor in International Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Paolo Pesenti is the director of Monetary Policy Research in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Ozge Akinci and Paolo Pesenti, “Do Economic Crises in Europe Affect the U.S.? Some Lessons from the Past Three Decades,” Federal Reserve Bank of New York Liberty Street Economics, May 31, 2023, https://libertystreeteconomics.newyorkfed.org/2023/05/do-economic-crises-in-europe-affect-the-u-s-some-lessons-from-the-past-three-decades/

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics