Editor’s note: Since this post was first published, the first paragraph under the “Looking Forward” subhead has been updated to clarify the expected increase in the speed of FX transaction settlements. (Jan. 25, 2:30 p.m.)

The foreign exchange market has evolved extensively over time, undergoing important shifts in the types of market participants and the mix of instruments traded, within a trading ecosystem that has become increasingly complex. In this post, we discuss fundamental changes in this market over the past twenty-five years and highlight some of the implications for its future evolution. Our analysis suggests that maintaining a healthy price discovery process and fostering a level playing field among participants are areas to watch for challenges. The consequences of the evolution of the FX market—well beyond those anticipated twenty-five years ago—remain active areas of research and policy consideration.

Evolving Size, Instruments, and Currency Composition

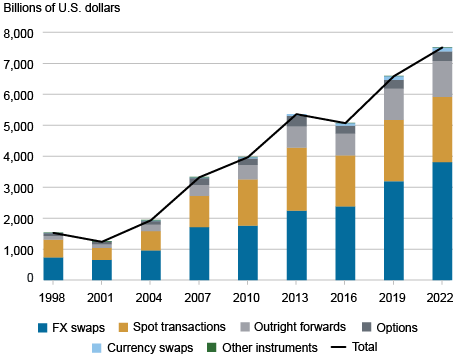

In 1998, when flexible exchange rates had been in place for twenty-five years, the definitive guide to how the FX market operated—“All About The Foreign Exchange Market in the United States”—was written by Sam Cross, at that time the Executive Vice President of the Foreign Department at the Federal Reserve Bank of New York. The FX market has grown substantially in the last twenty-five years since that publication, and it continues to be the largest financial market in the world by trading volume. Average daily turnover increased from $1.5 to $7.5 trillion between 1998 and 2022 (BIS 2022), with the increase occurring across both FX spot and FX derivatives. Over the past ten years, however, FX spot trading volume has stagnated, while much of the growth has come from activity in FX swaps, instruments used primarily for funding and hedging. The growth in FX swap turnover owes in part to the shortening in maturity of these instruments, as they now have to be rolled over more frequently.

The FX Market Continues to Grow Substantially

Notes: The data do not include transaction in exchange-traded FX instruments, such as FX futures and related options. The exchange-traded FX sector is small compared to the overall FX market.

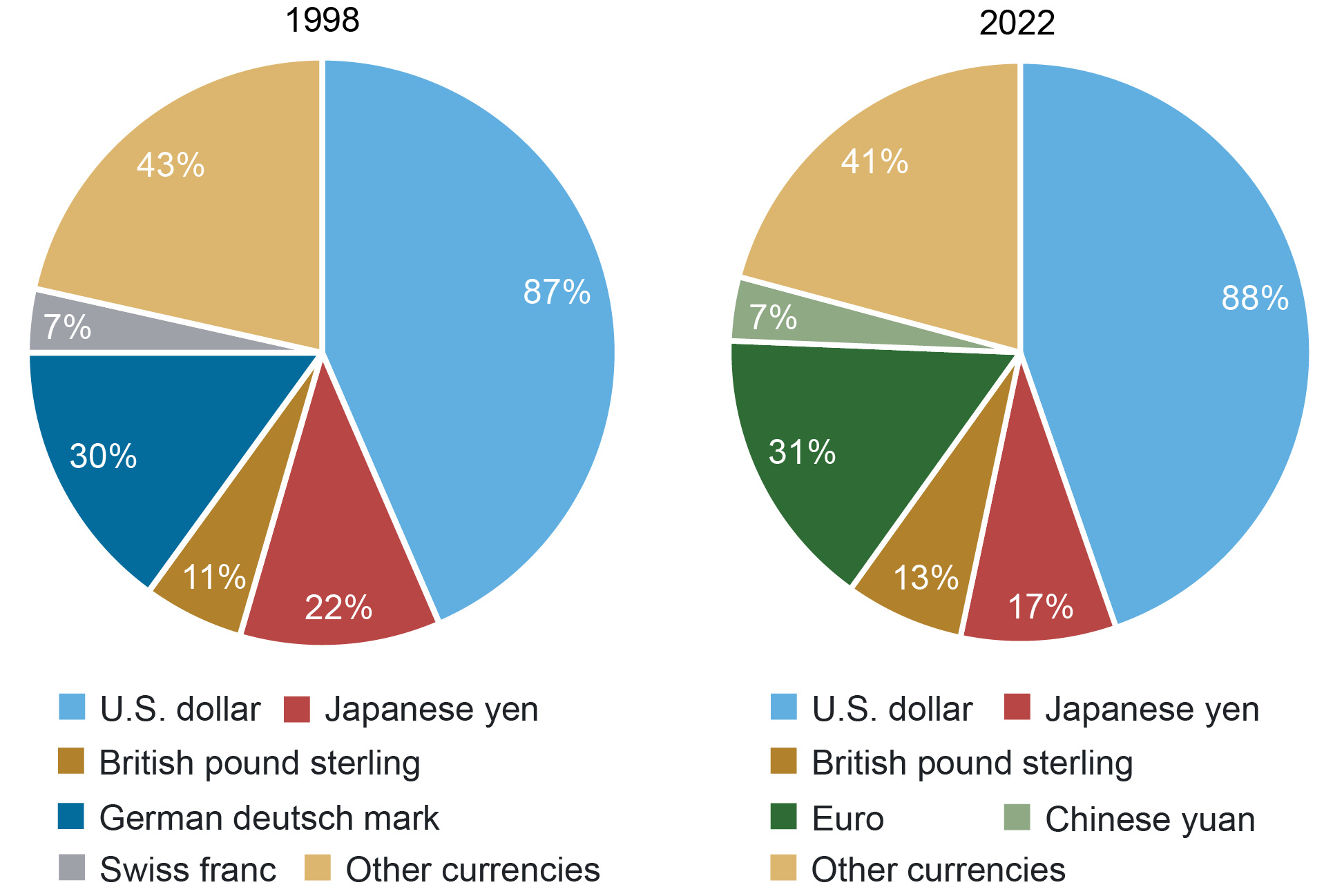

The U.S. dollar continues to play a dominant role in the FX market, as it did twenty-five years ago. The dollar was on one side of 87 percent of all FX transactions around the world in 1998, and 88 percent in 2022. The euro, introduced in 1999, has replaced the German mark as the second most-traded currency and remains involved in about 30 percent of all transactions. The Chinese yuan has replaced the Swiss franc as the fifth most-traded currency; it is now part of 7 percent of all FX transactions.

U.S. Dollars Remain the Dominant Currency in FX Transactions

Source: BIS Triennial Central Bank Survey, 1998 and 2022.

The location of trading desks is broadly similar today compared with twenty-five years ago, with the United Kingdom (almost exclusively London) and the United States (mostly New York) accounting for a large share of the global trading volume (57 percent). FX trading activity has grown in Asia, with Singapore, Hong Kong, and Japan now accounting together for about 20 percent of global FX volume.

The U.S. and U.K. Continue to Dominate FX Trading

| 1998 | 2022 | ||||

| United Kingdom | 32.6 | United Kingdom | 38.1 | ||

| United States | 18.2 | United States | 19.4 | ||

| Japan | 7.0 | Singapore | 9.4 | ||

| Singapore | 6.9 | Hong Kong | 7.0 | ||

| Germany | 4.7 | Japan | 4.4 |

Note: Percent of total trading volume.

Broader Variety of Market Participants

The mix of FX market participants has changed substantially, especially in the spot market. Twenty-five years ago, dealers at large banks received orders about equally from non-financial customers, mainly corporations, and from “other financial” counterparties, such as small banks, pension funds, and hedge funds. That activity accounted for a bit more than a third of global transactions. But almost two-thirds of the turnover was “interdealer,” where large dealers traded among themselves to hedge and unwind their positions.

Trading between dealers at large banks has declined over time to less than half of overall turnover. One important factor has been the rise of “internalization” whereby dealers match opposing customer flows in-house instead of unwinding positions by trading in the interdealer market. Dealers in major trading centers currently internalize about 80 percent of spot orders. Meanwhile, trading between dealers and other financial counterparties generates almost half of FX market activity. Principal trading firms (PTFs, also known as high-frequency traders or HFTs), which are counted among other financials, have become important participants in the spot FX market. In contrast, trading involving non-financial counterparties has declined substantially, highlighting the fact that international trade now only plays a relatively modest role in driving FX trading.

FX Market Transactions Shift to More Trading between Other Financial Counterparties

| Counterparty Type | 1998 | 2022 |

| Dealer/Dealer | 63.0 | 46.1 |

| Dealer/Other Financial | 19.6 | 48.2 |

| Dealer/Non-Financial | 17.4 | 5.7 |

Note: Percent of total turnover.

Increasingly Complex Ecosystem for Spot FX Market Trading

The trading environment has become considerably more complex as the number of execution methods and trading platforms has grown and the market has become increasingly electronic (Chaboud, Rime, Sushko, 2023). In the late 1990s, two electronic brokers, Reuters (now Refinitiv) and Electronic Broking Services (EBS), established themselves in the interdealer market as the clear sources of price discovery, becoming known jointly as the “primary market.” By the early 2000s, electronic multi-dealer platforms began to emerge in the dealer-to-customer market, enabling clients to concurrently submit a request for quote (RFQ) to multiple counterparties, and banks also began to offer proprietary platforms allowing for direct electronic trade with clients. The number of trading platforms has continued to grow since then. Nearly 60 percent of trading now takes place electronically, more than double what was observed in 1998 when many trades were still conducted by telephone.

Concerns about FX Market Risks, Resiliency, and Integrity

We view these developments as increasing competition and providing new options to market participants. However, they may also have made price discovery more difficult in the FX market. Because of the multiplicity of trading platforms and the growth in internalization, the primary market has experienced a substantial decline in trading volume in the past decade and is no longer the sole locus of price discovery. Large market participants now consider a broader set of trading platforms when assessing the current level of each exchange rate, and the futures market has also become increasingly important to price discovery in the spot FX market (Chaboud, Dao, Vega, Zikes 2023). The rising complexity of the market may then have contributed to an increase in the information advantage of larger, more sophisticated market participants, who can dedicate more resources to assess the evolution of each exchange rate at high frequency.

In addition, while electronification increases the availability of data and analytics and helps in reducing transaction costs, it also increases the risk that less-sophisticated market participants are disadvantaged relative to more technologically advanced, faster market participants, especially PTFs. To address this issue, several FX trading platforms have introduced some constraints on transactions (such as “speed bumps”), while others offer options to exclude transacting with the fastest traders.

These developments are relevant for the broader international roles of the U.S. dollar, including on invoicing international trade activities and all types of international financial transactions (Goldberg, Lerman, Reichgott 2022). Academic research shows that currency transaction environments and trading costs influence the selection of currencies for different roles, and these roles are synergistic. From the vantage point of the United States, and as the dollar roles are strategic assets, our view is that the integrity, efficiency, and resilience of the FX market support the global economy, financial stability, and the public’s trust in the financial system.

To this end, over the past twenty-five years, one focus of policy efforts has been on FX settlement risk, while another important focus has been around industry best practices. FX settlement risk, or Herstatt risk, is the risk that one party delivers the currency it has sold but does not receive the currency it purchased. To reduce FX settlement risk in the global financial system, the Continuous Linked Settlement (CLS) institution was formed in 2002 by market participants with the support of the official sector to settle FX transactions on a payment-versus-payment (PVP) basis. This development helped ensure that payment in one currency can only occur when the payment in the other currency takes place. While not all FX transactions settle through CLS, its establishment was a major milestone that resulted in a substantial reduction in settlement risk.

Another focus began over a decade ago when concerns arose about the behavior of some market participants, and official investigations revealed serious misconduct. In response, following several years of work by the official and private sectors, including the Foreign Exchange Committee (FXC), a Federal Reserve Bank of New York-sponsored industry group, the FX Global Code was published in 2017. The FX Global Code provides principles and expectations for responsible market conduct and conventions. Adoption of the Code by large FX dealers has been widespread, and it is increasing amongst the buyside community; central banks also adhere to the Code, and the New York Fed has signed a statement of commitment to demonstrate its support. The FX Global Code is an example of a voluntary code of conduct that has had a notable impact on market behavior, informing the academic discussion about the relative effectiveness of strictly enforced rules versus voluntary adherence to good practice in the industry.

Looking Forward

In this 50th year of flexible exchange rates, and 25 years since Sam Cross’s book, the global FX market continues to evolve. Traditional bank-dealers are now challenged by non-bank participants including PTFs, contributing to the broader debate about the impact of high-frequency trading on volatility and liquidity in financial markets. Moreover, the speed with which FX transactions are settled is set to increase soon. Although the vast majority of spot FX transactions are currently settled the second business day after a trade (T+2), efforts are under way to prepare for a greater volume of trades requesting settlement of next business day (T+1), matching the upcoming move to T+1 for U.S. securities planned for mid-2024. This transition will create new challenges, especially when an FX trade involves two countries with wide time zone differences.

Further down the road, some central banks are developing their own central bank digital currencies (CBDCs). This opens the possibility for the quasi-immediate settlement of FX trades, a concept recently tested by the BIS. If many countries adopt their own CBDCs, there will likely be far-reaching consequences for the fundamental structure and functioning of the global FX and payment ecosystem, including the role of the current intermediaries.

Our views are that research will have to focus on and identify the challenges that are likely to arise from these transitions and the broader evolution of the FX market. Global currencies play an essential role in both international trade and finance. For the U.S. in particular, the dollar’s key international roles means that developments in this space bear further analysis and monitoring. As a well-functioning and resilient FX market is critical to the international economy, official institutions will then have to act decisively to foster beneficial outcomes in this immensely important global financial market.

Alain Chaboud is a senior economic project manager at the Federal Reserve Board of Governors.

Lisa Chung is the director of Capital Markets Trading in the Federal Reserve Bank of New York’s Markets Group.

Linda S. Goldberg is a financial research advisor for Financial Intermediation Policy Research in the Federal Reserve Bank of New York’s Research and Statistics Group.

Anna Nordstrom is the head of Capital Markets Trading in the Federal Reserve Bank of New York’s Markets Group.

How to cite this post:

Alain Chaboud, Lisa Chung, Linda S. Goldberg, and Anna Nordstrom, “Towards Increasing Complexity: The Evolution of the FX Market,” Federal Reserve Bank of New York Liberty Street Economics, January 11, 2024, https://libertystreeteconomics.newyorkfed.org/2024/01/towards-increasing-complexity-the-evolution-of-the-fx-market/

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics