As interest in understanding the economic impacts of climate change grows, the climate economics and finance literature has developed a number of indices to quantify climate risks. Various approaches have been employed, utilizing firm-level emissions data, financial market data (from equity and derivatives markets), or textual data. Focusing on the latter approach, we conduct descriptive analyses of six text-based climate risk indices from published or well-cited papers. In this blog post, we highlight the differences and commonalities across these indices.

Text-Based Approaches to Measuring Climate Risk

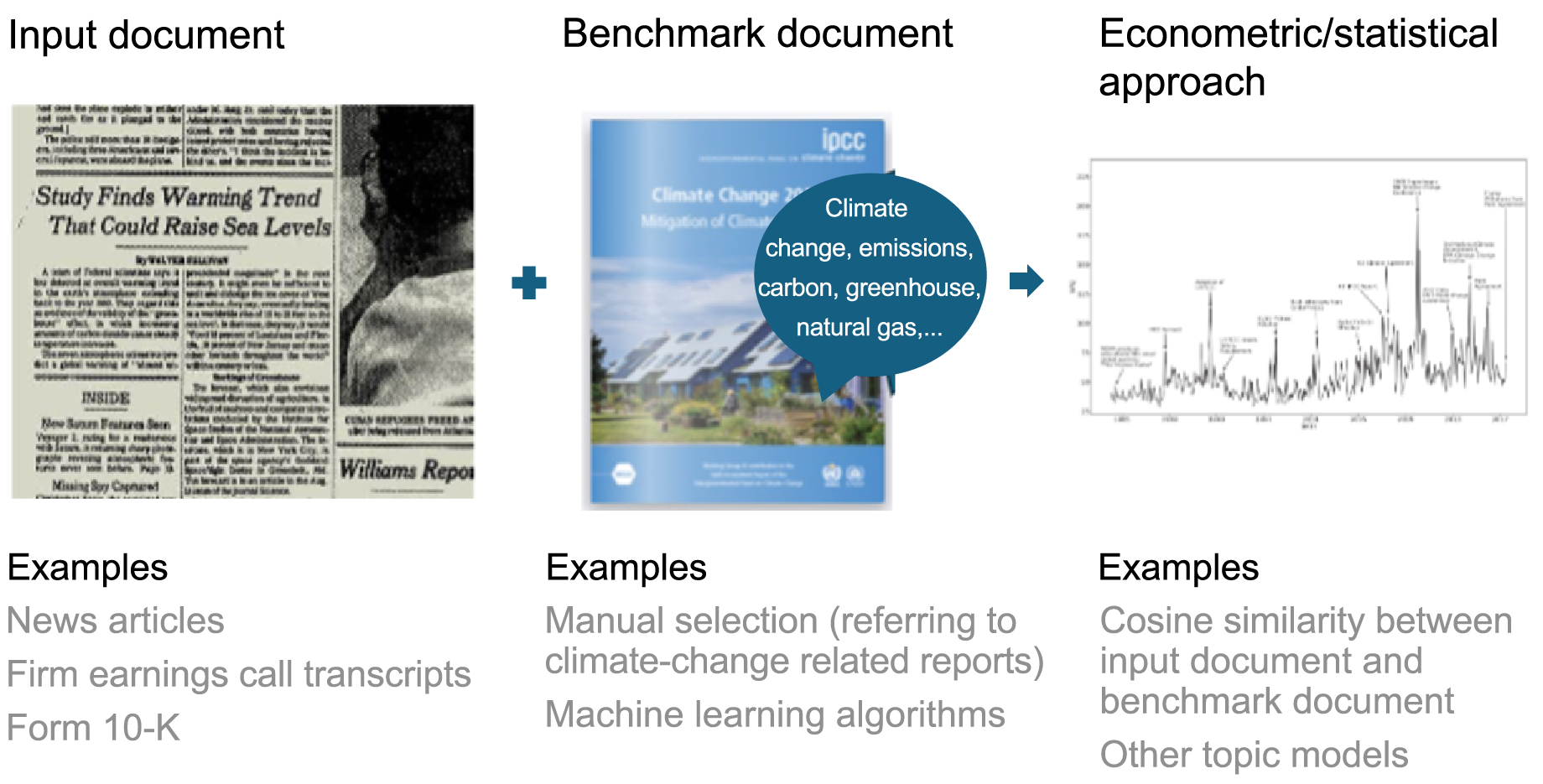

Text-based approaches to gauging climate risk share a common implementation framework. They begin by using newspaper articles or firm disclosures, like annual reports and earnings call transcripts, which can reflect economic agents’ perceptions of climate risk. These texts are then compared to a benchmark document as a collection of keywords, phrases, or text sections representing climate change. A number of econometric and statistical techniques are subsequently applied to quantify the similarity between the input text and the benchmark document, with the results aggregated to produce a climate risk index. The figure below visualizes this framework.

Framework for Building Climate Risk Indices

Source: Authors; Engle et al. (2020).

What Do Text-Based Climate Indices Have in Common?

Our analysis of six text-based climate indices—from Engle et al. (2020); De Nard et al. (2024); Gavriilidis (2021); Faccini et al. (2023); Bua et al. (2023)—reveals several stylized facts. First, the average pairwise correlation between indices is notably low, at 0.24, suggesting that they capture different types of information. These low correlations likely stem from differences across indices with respect to data sources, benchmark document creation, and econometric techniques.

Second, only a few events are consistently identified as significant drivers across indices, highlighting a lack of consensus in pinpointing major climate risk events. We compiled a list of events identified by the authors of the papers in our study as significant drivers of their respective indices, resulting in thirty-eight unique events. Of these, only four are commonly identified across two or more indices: the ratification of the Kyoto Protocol, the United Nations Climate Change Conferences in Copenhagen and Doha, and the United States’ withdrawal from the Paris accords. This low level of agreement suggests that identifying major climate transition events remains challenging.

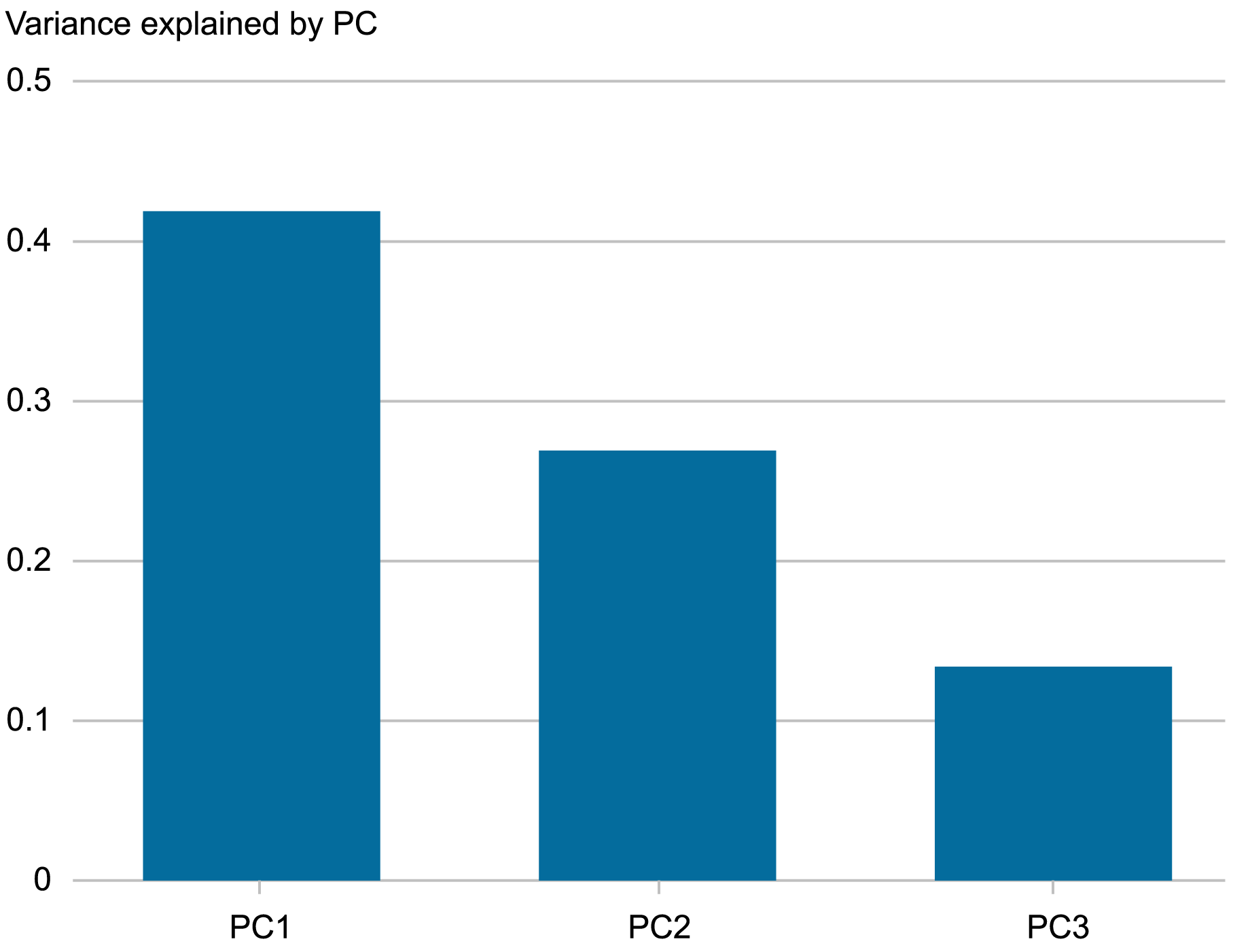

Our third finding comes from principal component analysis (PCA), which helps us to identify common patterns of variability across the indices. The results of our PCA, presented in the chart below, show that the first three principal components (PCs) together explain 82 percent of the variation, with the first PC (PC1) alone accounting for 42 percent.

First Three Principal Components (PCs) Explain 82 Percent of Variation Across Climate Indices

Source: Authors’ calculations.

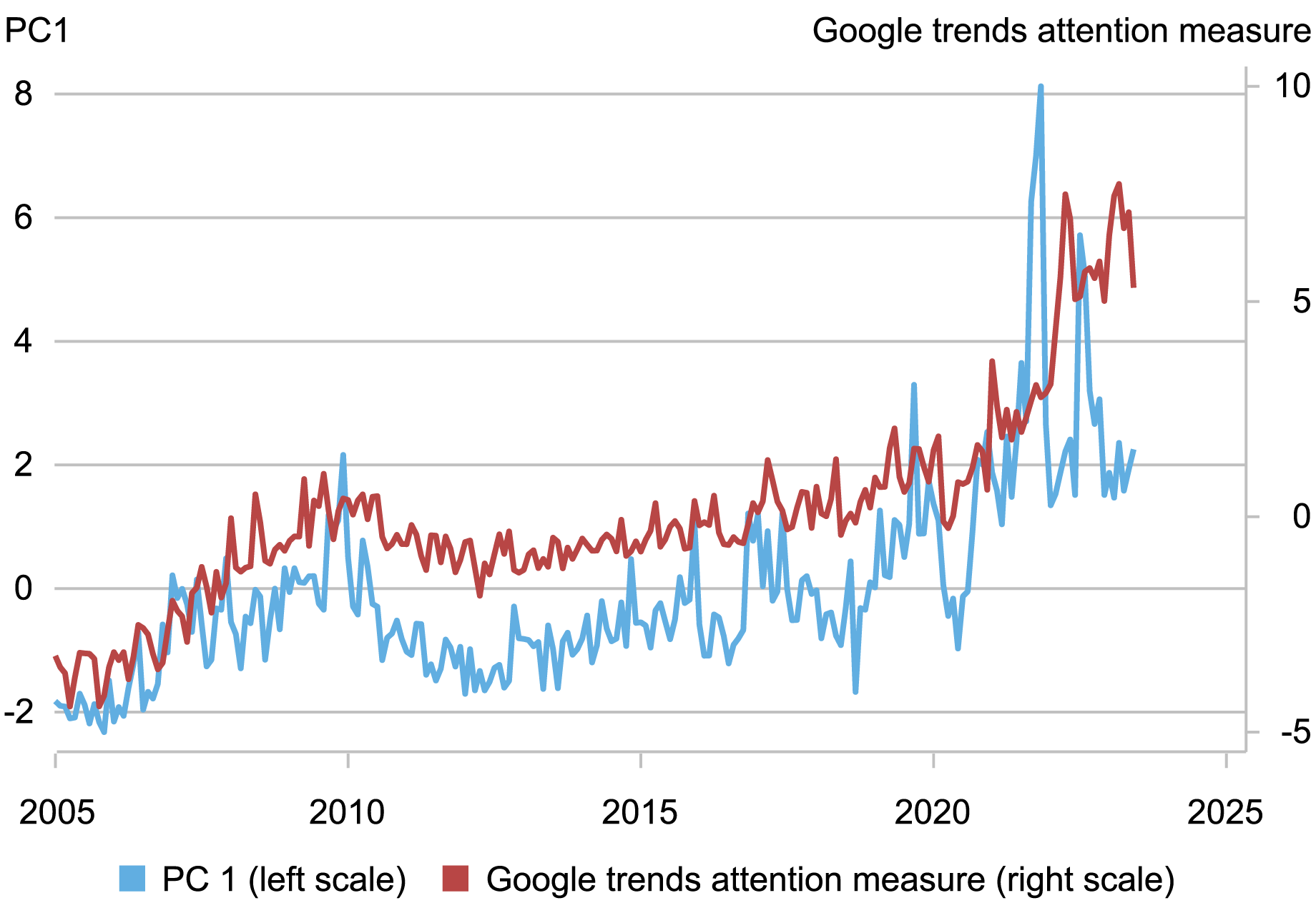

What macroeconomic factors are associated with the three principal components? To answer this, we correlate the first three PCs with various macroeconomic variables. As shown in the table below, we find that PC1 is strongly associated with increased public attention to climate change, measured by Google Trends search volume for climate keywords as identified by the New York Times.

Correlations between First Three Principal Components (PCs) and Macroeconomic Factors

| Measure | PC1 | PC2 | PC3 |

| PC1 | 1 | 0.11 | 0.17 |

| PC2 | 0.11 | 1 | -0.90 |

| PC3 | 0.17 | -0.09 | 1 |

| Google Trends | 0.75 | -0.80 | 0.28 |

| Stranded asset | -0.36 | 0.63 | -0.01 |

| U.S. Economic Policy Uncertainty | 0.09 | -0.04 | 0.57 |

| Oil Volatility Index | 0.10 | -0.09 | 0.31 |

| Climate laws | 0.45 | -0.11 | 0.03 |

| Geopolitical Risk | 0.05 | -0.12 | -0.13 |

The following chart shows that PC1 indeed closely follows the Google Trends attention measure, both of which increased sharply during the 2021-22 period. In addition, we find a high correlation between PC1 and the number of climate laws implemented, which should also be expected to correlate with attention to climate change.

Time Series of First Principal Component (PC1) and

Google Trends Attention Measure

Source: Authors’ calculations.

We find that PC2 is correlated with the performance of the fossil fuel sector (measured by returns on energy and coal ETFs, normalized by market returns—a method used in Jung et al. [2021]), while PC3 is correlated with U.S. economic policy uncertainty (using an index constructed by Baker et al. [2016]). We find that oil volatility is somewhat correlated with PC3, and that, interestingly, geopolitical risk (index constructed by Caldara and Iacoviello [2022]) is not strongly correlated with any of the three PCs.

Overall, these findings suggest that, though it is challenging to identify a common set of “climate shock events” that drive significant changes across all indices, most indices tend to rise together over time, especially after 2020, and this trend seems to be strongly correlated with the attention to climate change factor.

Avenues for Future Research

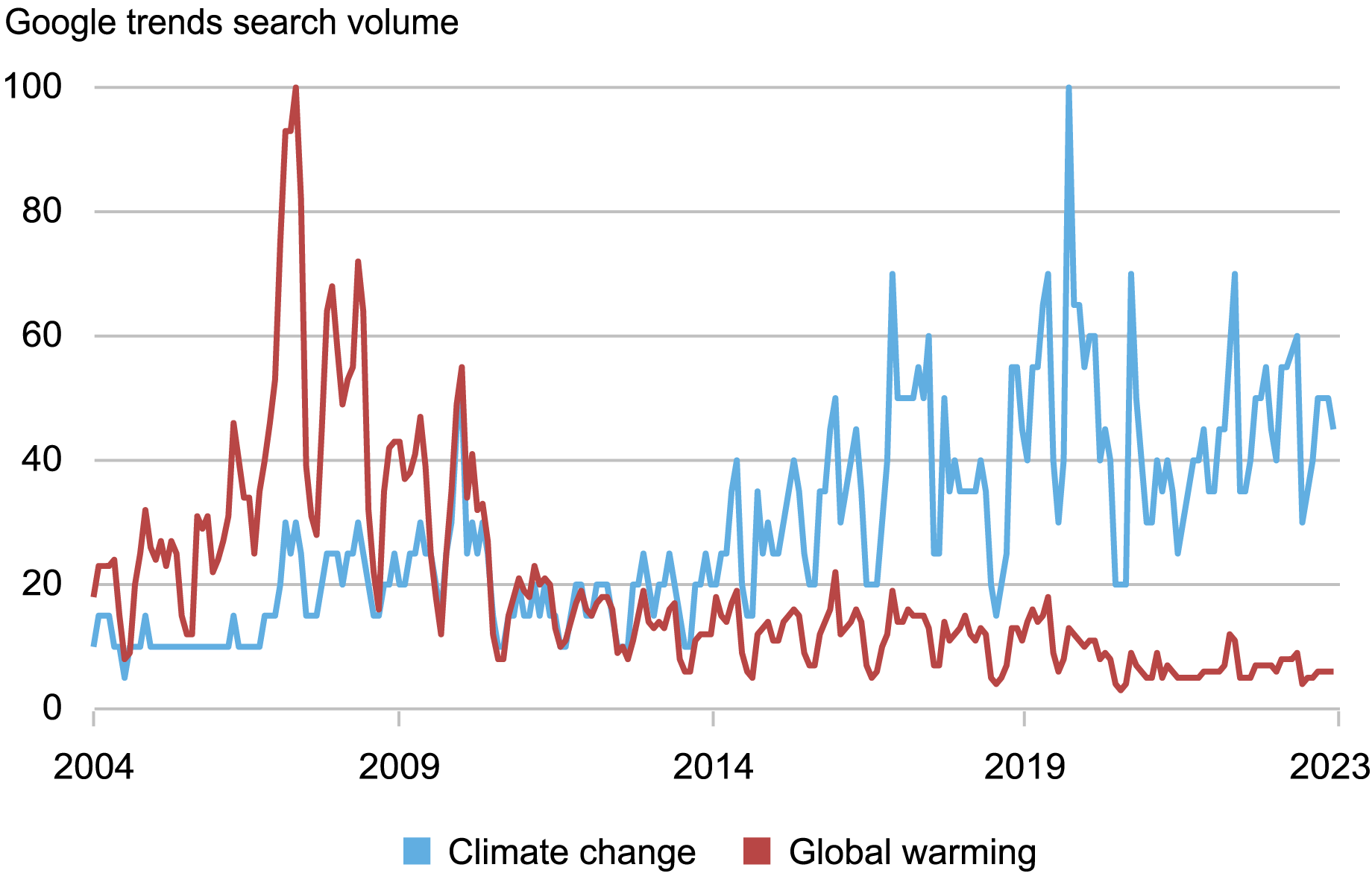

How can climate indices improve? Making the benchmark document time-varying is important, especially if we want to extend the analysis over a longer horizon. The chart below illustrates the dynamic nature of climate change phraseology by comparing Google search volumes for “climate change” and “global warming,” indicating that using “global warming” without “climate change” as the keyword can lead to a misleading index.

Developing local indices would be useful for understanding international spillovers or regulatory arbitrage, particularly as climate policies diverge across regions. For instance, two indices—one by Engle et al. (2020) based on U.S. news sources and one by Bua et al. (2024) based on European sources—employ very similar empirical approaches in their construction, but show a correlation of just 0.01. This low correlation is likely driven, at least in part, by differences in climate polices between the U.S. and Europe.

Google Trends Search Volume for “Climate Change” and

“Global Warming”

Source: Authors’ calculations.

Our findings suggest a promising direction for future research. Since PC1 seems to increase with rising attention to climate change, it would be valuable for examining how the rapid repricing of climate risk impacts financial stability.

Hyeyoon Jung is a financial research economist in Climate Risk Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Oliver Hannaoui is a graduate student at the Polytechnic Institute of Paris.

How to cite this post:

Hyeyoon Jung and Oliver Hannaoui , “What Do Climate Risk Indices Measure?,” Federal Reserve Bank of New York Liberty Street Economics, October 7, 2024, https://libertystreeteconomics.newyorkfed.org/2024/10/what-do-climate-risk-indices-measure/

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics