In the literature on monetary policy spillovers considered in the two previous posts, countries that would otherwise operate independently are connected to one another through bilateral trade relationships, and it is assumed that there are no frictions in currency, financial, and asset markets. But what if we introduce a number of real-world complexities, such as a dominant global currency and tight linkages across international capital markets? Given these additional factors, is it still possible to draw generalized conclusions about international policy spillovers—and can we still think of them as a fundamentally bilateral phenomenon? In our third and final post, we explore these questions by focusing on two key elements in the determination of international policy spillovers: the U.S. dollar and the Global Financial Cycle.

The Primacy of the U.S. Dollar

The empirical evidence on the centrality of the U.S. dollar is overwhelming. Other than being the local currency of the largest national economy, the U.S. dollar is chosen by many other countries as a reserve currency and is the dominant denomination currency when it comes to international investments and global banking. It is also the dominant currency in international trade.

This does not just reflect the large footprint of the United States in global commerce. In fact, countries price their external goods and services trade in U.S. dollars even when the United States is not involved in the bilateral exchange. Similar dynamics operate in the context of international financial transactions. The centrality of the U.S. dollar means that countries will be exposed to shocks that alter the dollar’s value, even if those countries do not engage in direct bilateral relationships with the U.S. In turn, this opens up the potential for shocks that originate in the U.S. to be especially pervasive in the determination of global spillovers.

Understanding the Global Financial Cycle

An additional crucial piece of the puzzle is what has become known as the Global Financial Cycle. In a nutshell, this term refers to the large comovement that characterizes global financial aggregates. A convenient way of summarizing the correlation among variables is to look at how much of this common variation can be explained by single factors. Intuitively, if one needs nearly as many factors as variables, then the degree of comovement is fairly low. If, on the other hand, a few or even a single factor can explain a large chunk of the common variation among different variables, then the notion that they comove to a large extent cannot be easily discarded.

Evidence of these comovements has been documented across a variety of financial aggregates, including asset prices, capital flows, and credit. In particular, a few striking patterns have emerged. First, looking at international risk asset prices—including equity prices traded worldwide, commodity prices, and corporate bonds–it is possible to account for up to 25 percent of the variation in global asset prices using just one factor. Similarly, up to a fifth of the variation in gross capital flows worldwide is captured by just one factor. Second, these two factors that summarize the comovements in asset prices and capital flows are remarkably similar. Third, these two factors correlate strongly with measures of global risk (e.g., VIX). Taken together, these empirical facts suggest not only that financial prices and quantities tend to dance largely to the same tune, but also that variations in risk perceptions can lead to large swings in global asset prices and capital flows.

Global Policy Shocks

In the context of global policy spillovers, the existence of a Global Financial Cycle matters because it creates an additional channel for the international transmission of shocks that again does not depend on the existence of bilateral relations. If a monetary policy shift in one country can affect the global cycle, all countries that are exposed to it will be affected as well, in a manner that is proportional to their exposure, and regardless of their bilateral relations. The centrality of the U.S. dollar and more broadly of the U.S. economy within the international monetary and financial system thus confer a special role to U.S. policy shocks when it comes to studying international policy spillovers.

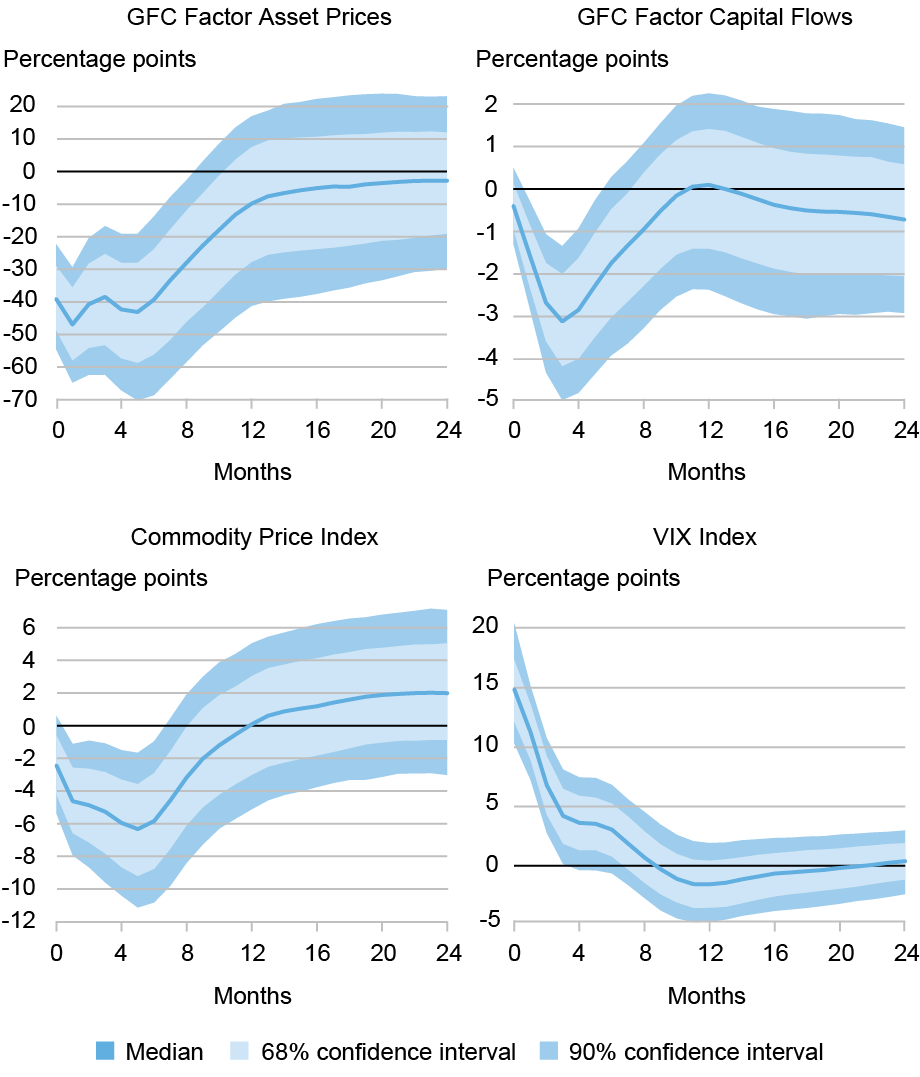

The chart below summarizes the main features of the international transmission of U.S. policy shocks. The responses are scaled to a shock that raises the policy rate by 100 basis points. In this scenario, together with cooling domestic conditions, a contractionary shift in U.S. monetary policy generates important global spillovers. Global financial conditions tighten materially. Global asset prices and global capital flows—as summarized by their respective common factors—decline, and the VIX spikes. Commodity prices also go down. These effects have been confirmed in numerous related studies, across different samples and using a range of data and estimation techniques. In short, there is strong empirical evidence confirming U.S. monetary policy as a driver of the Global Financial Cycle.

Response of Some Global Variables to a U.S. Monetary Policy Tightening

Note: The chart reports the response of a selection of global financial variables to a U.S. monetary policy tightening normalized to increase the one-year rate by 100 basis points.

Varied Effects across Countries

The movements in the U.S. dollar and global financial conditions induced by shifts in U.S. monetary policy do not mean that all countries will react in the same way or to the same extent. For example, flexible exchange rate regimes help to mitigate the effects of adverse spillovers, owing to the mechanisms discussed in the previous posts, even if they cannot completely offset them. At the same time, emerging markets (EMs) tend to be especially exposed to these large swings in financial conditions and global risk aversion. In particular, they tend to be hit by both a contraction in capital inflows and a surge of capital outflows, as well as a rise in credit spreads. A large literature that uses more granular data is able to further explore the effects of U.S. policy shocks on foreign credit origination, on banking activity and liquidity provision, and on borrowing and financing costs.

Modeling Feedback Effects in Emerging Markets

In our recent research, we developed a model with cross-border financial linkages that provides theoretical foundations for these empirical findings. Our model departs from the models discussed in the previous posts of this series in two main ways: First, the presence of financial constraints for EM foreign currency borrowers in the international financial markets drives three-way feedback effects, which we call the financial channel of spillovers. This channel works to greatly enhance the effect of U.S. policy hikes on domestic spending in EMs, via amplified fluctuations in investment spending. Second, the presence of a dominant currency (the U.S. dollar) in trade invoicing dampens the expenditure-switching effects analyzed in the first post and modifies the heterogeneity channels considered in the second post. Overall, financial channels and dominant-currency effects together imply a sizable hit to EM activity from a tightening of U.S. monetary policy, consistent with the empirical evidence presented above.

How does this three-way feedback mechanism work in our framework? A tightening of U.S. monetary policy triggers losses in EM borrowers’ balance sheets. Given the presence of some balance sheet mismatch on the part of EM banks (as their assets are denominated in local currency, while some of their debt is in dollars), the local currency depreciation triggered by the tightening raises the real burden of the dollar-denominated debt, reducing banks’ net worth. Weaker local balance sheets then initiate powerful feedback effects. The local lending spread increases as a result, making credit more expensive for local borrowers, triggering declines in investment spending and in the price of capital (or Tobin’s Q), and ultimately slowing activity. These developments then feed back into borrowers’ financial positions, weakening them further. These feedback effects operating through domestic conditions are well known in the literature and are usually referred to as the “financial accelerator” following the influential work of Bernanke-Gertler-Gilchrist.

External Feedback Effects and the Financial Accelerator

Our model adds a second set of feedback effects, based on the interaction between balance sheets and external conditions, that amplifies the domestic-based financial accelerator. A weakening of local balance sheets widens the uncovered interest parity premium on the local currency, which is accommodated via a depreciation of the latter against the dollar. Because local balance sheets are partly mismatched, a weaker local currency then feeds into balance sheet health, further weakening it, and once again initiating both rounds of feedback. The end result is a sharply amplified decline in local investment spending, asset prices, exchange rates, and ultimately GDP (through a large contraction in investment demand).

In conclusion, given the strength of the feedback mechanisms considered above, the amount of amplification of U.S. monetary shocks is considerable even with a relatively modest degree of balance sheet mismatch. Notably, this is the case even though the majority of debt for the typical borrower (both in the model and according to available data for the universe of EMs) is denominated in local currency.

Revisit the first and second posts in the series.

Sushant Acharya is an associate professor of economics at the University of Melbourne

Ozge Akinci is head of International Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Silvia Miranda-Agrippino is a research economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Paolo Pesenti is director of monetary policy in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Sushant Acharya, Ozge Akinci, Silvia Miranda-Agrippino, and Paolo A. Pesenti, “Monetary Policy Spillovers and the Role of the Dollar,” Federal Reserve Bank of New York Liberty Street Economics, April 7, 2025, https://libertystreeteconomics.newyorkfed.org/2025/04/monetary-policy-spillovers-and-the-role-of-the-dollar/

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics