Tobias Adrian and Ernst Schaumburg

During the height of the 2007-09 financial crisis, intermediation activities across the financial sector collapsed. In response, the Federal Reserve invoked section 13(3) of the Federal Reserve Act, citing “unusual and exigent circumstances,” to authorize the creation of a series of emergency lending facilities. These liquidity facilities provided last-resort-lending options to qualified borrowers in several strained markets in order to prevent the distress on Wall Street from spilling over onto Main Street. In an earlier post, we discussed the commercial paper funding facility. In this post, we review the Primary Dealer Credit Facility (PDCF), a program that represents the Fed’s first lending facility to nondepository financial institutions since the Great Depression.

To understand the economic rationale for the PDCF, we need to recall the unfolding of the financial crisis. By 2007, the downturn in the housing market and the realization that many subprime borrowers would not be able to repay their mortgages had rendered the value of mortgage-backed credit instruments highly uncertain. Faced with these market conditions, Bear Stearns, on July 31, 2007, liquidated two hedge funds that had invested in various types of mortgage-related securities. Broad strains in money markets were observed shortly thereafter, on August 9, 2007, when BNP Paribas announced that it would halt redemptions in certain investment funds with exposure to U.S. residential mortgages. The following day, the Federal Reserve announced that it “will provide reserves as necessary…to promote trading in the federal funds market.” However, by providing reserves to the fed funds market, the Fed was only able to support the funding of commercial banks.

In the following months, funding conditions for nonbank financial institutions became increasingly strained, particularly for securities brokers and dealers. During the week of March 10, 2008, Bear Stearns, one of the largest dealers, experienced severe funding problems, and was subsequently taken over by JPMorgan Chase. In order to prevent contagion from spreading from Bear Stearns to other dealers, the Fed established the PDCF on March 16, 2008. The PDCF was a borrowing facility open to any of the Fed’s registered primary dealers. Primary dealers are a subset of securities brokers and dealers that have an ongoing trading relationship with the Fed in their capacity as market makers for Treasury securities. While some of the primary dealers are associated with banks, others are nonbank financial intermediaries. Bear Stearns was the PDCF’s primary initial user, on March 28, 2008, with a peak borrowing amount of $28.5 billion. (Detailed data on PDCF usage were recently published by the Federal Reserve Board.)

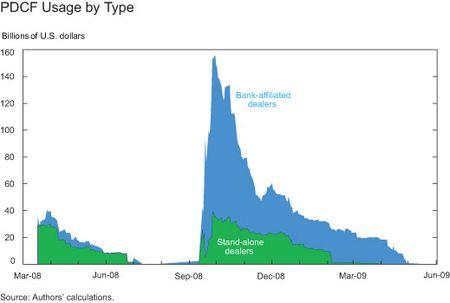

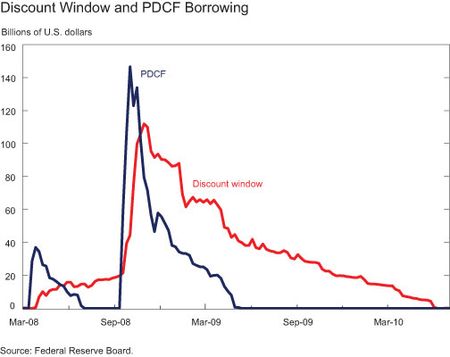

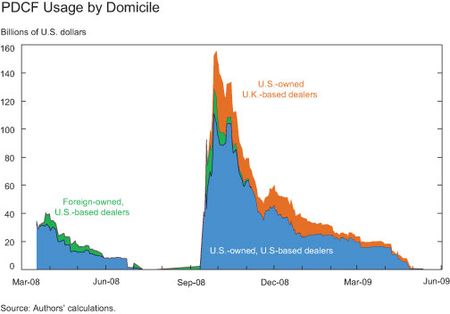

The creation of the PDCF was one of many extraordinary actions undertaken during the crisis that was aimed at nonbank intermediaries. Although Bear Stearns’ use of the PDCF had dropped off by the completion of its takeover by JPMorgan Chase in June 2008, the facility would be used more heavily than ever by other primary dealers following the failure of Lehman Brothers later that year. At its peak of $155.8 billion on September 29, 2008, PDCF borrowing was larger than the combined discount window borrowing of all commercial banks. In fact, the PDCF can be viewed as an extension of the Fed’s main lender-of-last-resort facility, the discount window, to the dealer sector.

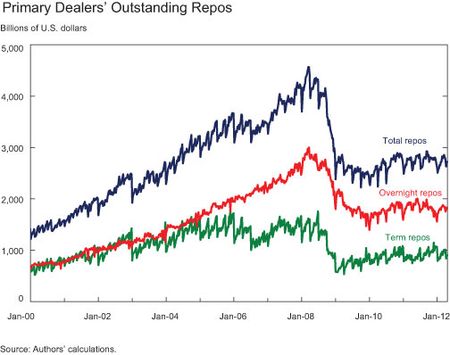

Unlike traditional discount window loans, the PDCF loans were executed as collateralized loans through the tri-party repo system, where dealers settle repurchase agreements, or repos. These contracts require the sale of an asset paired with an agreement to repurchase the asset at a fixed price. The counterparty initially selling the asset plays the part of the borrower, and the counterparty buying the asset plays the part of the lender, with the price differential during the two exchanges representing interest income. Generally, the amount borrowed will be less than the market value of the collateral: if $95 is borrowed on collateral worth $100, we say the borrower takes a 5 percent haircut. The haircut serves to protect the lender against deterioration in the market value of the collateral. Over several decades, repo contracts had become increasingly important instruments for the short-term financing of securities, in part because of their collateralized nature and preferential treatment under the U.S. bankruptcy code, which assures lenders that repo collateral is bankruptcy remote. Financing in the repo market peaked at $4.5 trillion, in March 2008, and continues to be a large source of financing for primary dealers.

On September 12, 2008, in the wake of the bankruptcy of Lehman Brothers, the Fed began to accept a greater variety of collateral for loans issued by the PDCF, including non-investment-grade securities and equities. The broader acceptance of collateral at the PDCF was intended to prevent funding problems from spreading to other dealers. The Fed was concerned that a collapse of lending activity in the repo market, caused by an inability to borrow against these risky assets, might trigger massive sell-offs of collateral at fire-sale prices. After Lehman filed for Chapter 11 bankruptcy protection on September 15, 2008, other dealers that were experiencing funding difficulties accessed the PDCF, causing its usage to shoot up quickly. The financial distress was by no means limited to U.S.-owned primary dealers; foreign-owned, U.S.-based primary dealers and U.K. subsidiaries of U.S.-owned primary dealers borrowed from the facility as well. Of the twenty firms that were primary dealers in March 2008, eighteen ultimately accessed the PDCF.

The sharp drop-off in PDCF usage following the peak can be taken—somewhat paradoxically—as evidence of the facility’s effectiveness. The terms of the PDCF were designed to make the facility’s usage unattractive in normally functioning markets, so that it would be used only as last-resort funding. One way

the Fed accomplished this was through the pricing of the PDCF. In particular, the Fed extended loans at the discount rate, which was set above the fed funds rate (at the same level as the primary discount rate). Because rates in the repo market generally fall below the fed funds rate, borrowing through the PDCF would ordinarily be more expensive than borrowing in the private market. Moreover, the Fed implemented an escalating usage fee, which was imposed on borrowers that used the facility for more than forty-five days. In addition, the haircuts imposed on pledged collateral were monitored and updated to achieve a balance between preventing losses, which required higher haircuts, and helping restore greater liquidity, which required lower haircuts.

The steps taken by the Fed to stabilize the financial system have been criticized because of their focus on “Wall Street” rather than “Main Street.” However, the PDCF, like other lender-of-last-resort facilities, prevented a more severe collapse of the capital markets services provided by Wall Street, which would have further exacerbated the impact of the financial crisis on American households and businesses. It is worth noting that the PDCF did not suffer losses, but rather earned a positive return for U.S. taxpayers. That is, the usage fees and surcharge in excess of the discount rate produced income estimated at $292 million to the Federal Reserve, which was ultimately passed on to the Treasury Department.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Tobias Adrian is a vice president in the Capital Markets Function of the New York Fed’s Research and Statistics Group.

Ernst Schaumburg is a research officer in the Capital Markets Function of the New York Fed’s Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics