Jonathan McCarthy, Simon M. Potter, and Ging Cee Ng*

Economic forecasters frequently use a simple rule of thumb called Okun’s law to link their real GDP growth forecasts to their unemployment rate forecasts. While they recognize that temporary deviations from Okun’s law may occur, forecasters often assume that sustained reductions in the unemployment rate require robust GDP growth. However, our analysis suggests that Okun’s law has not been a consistently reliable tool for predicting the size of declines in the unemployment rate during the last three expansions—a finding that reflects the impact of changes in the labor market since the early 1960s. We also find that the percentage declines in the unemployment rate over the third through fifth years of the last three expansions have been strikingly similar—a pattern that suggests an important role for flows into and out of unemployment in explaining movements in the unemployment rate, the subject of tomorrow’s blog post.

Okun’s Law

Okun’s law is often illustrated by showing the correlation between changes in the unemployment rate and GDP growth. The underlying idea is that there is a predictable relationship between the changes in hours and changes in the unemployment rate that then leads to a predictable relationship between GDP growth and unemployment. In Arthur Okun’s original 1962 study, he reported the following estimate using data from 1947:Q2 to 1960:Q4 (we have converted it into an annual form for the benefit of the reader):

The coefficient multiplying the difference between output growth and the constant—the latter can be interpreted as the potential growth rate—is known as Okun’s coefficient. This version of Okun’s law states that if growth is about 7.3 percent over a year, then unemployment will decline by 1 percentage point.

Although Okun’s law is simple, a number of subtle assumptions about the labor market underlie it. To illustrate, we go back to basics and derive some simple relationships. Recall that GDP growth can be decomposed into the sum of growth in output per hour (labor productivity) and the growth in hours (labor input).

Using the convention of log changes to approximate growth rates, we can then split hours growth as follows:

Further, recall from yesterday’s post that we can express the log change in the employment-to-population ratio as

Using these expressions for the growth in hours and the log change in the employment-to-population ratio in the decomposition of GDP growth into labor productivity growth and hours growth, splitting each of the series into a trend (long-run) component and a cyclical component, and noting that potential growth is the sum of trend growth in productivity and hours, we derive the following relationship between the change in the unemployment rate and output growth relative to potential growth:

Assuming that the cyclical changes in productivity growth, hours per employee, and labor force participation have stable relationships to output growth and potential growth, we then obtain the Okun’s law relationship:

At the time

of the original Okun study, these assumptions about the cyclical behavior of productivity growth, hours, and labor force participation seemed reasonable given the composition of the U.S. labor market: More than two-thirds of the labor force was male, most of these men worked full-time, and the highest level of educational attainment was high school for more than half of the labor force.

Today, the composition of the U.S. labor force is much different: Only a little more than half of the labor force is male, a considerably larger share of the labor force works part-time, and workers with a college degree or higher are the largest group within the workforce. Furthermore, a larger share of potential workers with differing productivity now move more fluidly in and out of the labor force depending upon individual circumstances and/or economic conditions. Consequently, many of the assumptions underlying Okun’s law are much less valid now than they were a half-century ago.

Given these changes in the labor market, we are not surprised that the relationship found by Okun has subsequently proved to be unstable, especially in recent years. Still, considering that Okun’s law underlies many unemployment rate forecasts and that the evolution of unemployment from this point in the expansion onward is an important policy issue, we next examine this relationship in previous long expansions.

Unemployment Declines in Long Expansions

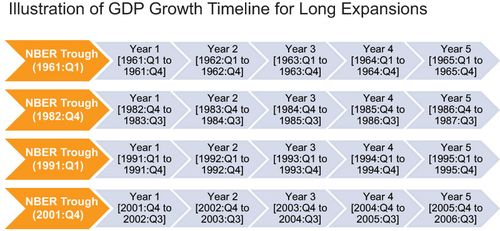

Here, instead of showing time variation of Okun’s coefficient using regression techniques (as in a recent blog post by Duy and an earlier paper by Knotek), we compare the decline in the unemployment rate between the start of the third year of a long expansion and the end of the fifth year to the decline predicted by Okun’s law, with the latter based on the cumulative difference between GDP growth and potential growth over this period. (The figure below illustrates this timing for each of the long expansions.) We look at developments starting after the first two years of an expansion both to match where we are in the current expansion and to motivate some of our analysis of labor market flows in the next blog post. To construct potential growth rates, we use the historical potential output series produced by the Congressional Budget Office (CBO), which enables us to abstract from changes in potential growth. We can then examine the size of deviations from Okun’s law in terms of actual unemployment outcomes.

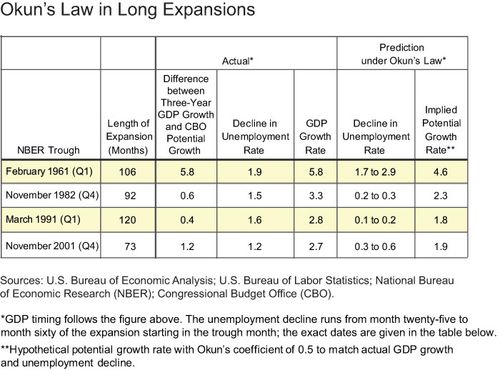

The results of this exercise for the four long postwar expansions—those that have lasted more than six years—are shown in the table below, where we present the range of unemployment rate predictions assuming that Okun’s coefficient varies from 0.3 (Okun’s initial estimate) to 0.5 (a value currently used by many forecasters). (Note that we also obtained similar results using different timing conventions.)

For the 1960s expansion, the actual decline in the unemployment rate is within the range of predictions using Okun’s law. As noted above, the structure of the labor market in the 1960s more closely fits the underlying stability and homogeneity of the labor force required for Okun’s law to hold. However, for the three most recent expansions, the decline in the unemployment rate is substantially greater than that predicted by Okun’s law. Further, this difference is particularly striking in the expansions of the 1990s and 2000s that started with “jobless recoveries.” It seems that Okun’s law has not been a reliable indicator of unemployment declines over long periods of recent expansions.

Of course, one way to reconcile the discrepancy would be for potential growth to have been lower than that estimated by the CBO, which would widen the gap between actual and potential growth. In the last column

of the table above, we show the hypothetical potential growth rate using Okun’s law (assuming an Okun’s coefficient of 0.5) needed to match the actual GDP growth and unemployment rate decline in each of the recent long expansions. Especially in the case of the 1990s, when information technology was pushing up trend productivity (for example, see Jorgenson, Ho, and Stiroh), these implied potential growth rates seem implausible.

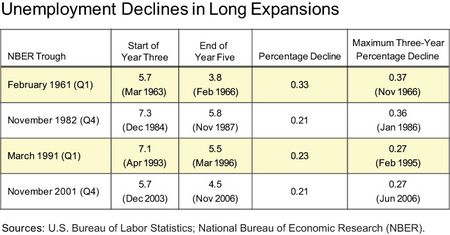

The table below shows for each of the four long expansions the starting level of the unemployment rate in year three, the ending value in year five, the maximum three-year percentage decline in the unemployment rate, and the percentage change between year three and year five. Here, we look at the percentage decline rather than the more usual percentage point decline to account for the different starting levels of the unemployment rate in these expansions: a decline in the unemployment rate from 8 percent to 7 percent (0.125 percentage fall) seems more easily attainable than a decline from 4 percent to 3 percent (0.25 percentage fall).

Looking at the last column of the table, we see that the unemployment rate fell more slowly in the last two jobless recoveries than in the previous long expansions (as well as in most of the shorter expansions not shown). However, the percentage declines in the unemployment rate between the start of year three and the end of year five in the last three expansions have been strikingly similar. If this similarity holds in the current expansion, the unemployment rate would be around 7 percent in June 2014. Note that by looking at long expansions to make this calculation, we are assuming the absence of shocks that would lead to a surge in flows from employment into unemployment.

Lastly, suppose that actual GDP growth is 2 percentage points above potential GDP growth and that the Okun’s coefficient is 0.5. Okun’s law would predict a fall in the unemployment rate of 1 percentage point independent of its level (that is, it would predict a fall from 10 percent to 9 percent as well as from 4 percent to 3 percent). Such an implication seems inconsistent with labor market flows: Given the typical pattern of flows into and out of unemployment, a decline from 10 percent to 9 percent is much easier to achieve than a decline from 4 percent to 3 percent. But similar percentage declines at parallel points of business cycles, as shown in the second table, are more consistent with labor market flows.

This post has shown that Okun’s law has been regularly “violated” in recent long expansions. As an alternative to a mechanical GDP-unemployment relationship, the next post in this series will examine the flows into and out of unemployment as a tool for understanding movements in the unemployment rate.

*Ging Cee Ng is an associate economist in the Research and Statistics Group.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

How does one reconcile 14 MM unemployed and number of people receiving unemployment benefits – 7 MM. If you are receiving unemployment benefits that means you have been laid off. So who are these remaining 7MM, they left on their own due to sickness or some kind of emergency. Don’t know whether any policy will work for these guys.