Today, the New York Fed’s Center for Microeconomic Data released its Quarterly Report on Household Debt and Credit for the third quarter of 2021. Overall debt balances increased, bolstered primarily by a sizeable increase in mortgage balances, and for the second consecutive quarter, an increase in credit card balances. The changes in credit card balances in the second and third quarters of 2021 are remarkable since they appear to be a return to the normal seasonal patterns in balances. In a Liberty Street Economics post earlier this year we wrote about some demographic variation in these balance changes and the likely role of stimulus checks and forbearance programs in helping borrowers pay down expensive revolving debt balances. Here, we’ll take a fresh look at credit card balances and at the dynamics behind new and closing credit card accounts and limit changes, to examine how credit access and usage continue to evolve. The Quarterly Report and this analysis are based on our Consumer Credit Panel, which is itself based on Equifax credit data.

A Closer Look at Credit Cards

Credit card balances typically follow a pronounced seasonal pattern—modest increases in the second and third quarter, a larger increase in the fourth quarter coincident with holiday spending, and then a large reduction in the first quarter, as borrowers pay off their holiday spending. These patterns changed a lot over the first four quarters of the pandemic (2020:Q2–2021:Q1). The changes that we saw over the past two quarters were notable in their relative normalcy with regard to the increasing levels and the typical seasonal pattern of credit card balances, after a particularly challenging year.

Credit Card Balances’ Seasonal Pattern Broken by Pandemic

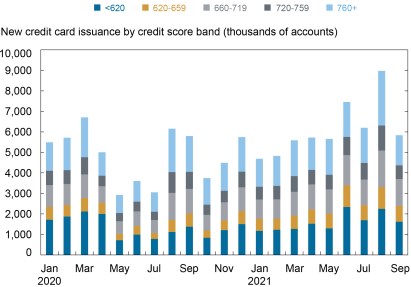

In the next chart, we examine monthly credit card issuance—these are newly issued credit card accounts that are broken out by the borrowers’ credit score buckets. Card issuance sharply declined during the first months of the pandemic, particularly for subprime borrowers (here, those with credit scores below 620). Evidence from the Survey of Consumer Expectations (SCE) shows that this decline reflected simultaneous declines in demand and access. But this appears to have reversed during the fall of 2020, when issuance to borrowers of all scores returned to, or even surpassed, pre-pandemic levels. These issuances have real consequences for borrowers and borrowing, too. Because the opening of new cards reflects additional credit demand, borrowers with newly opened credit card accounts have typically seen an average balance increase of $645 in that month (on all open cards).

New Credit Card Issuance Recovers to Pre-Pandemic Levels

Source: New York Fed Consumer Credit Panel / Equifax

Note: Credit score is Equifax Risk Score 3.0

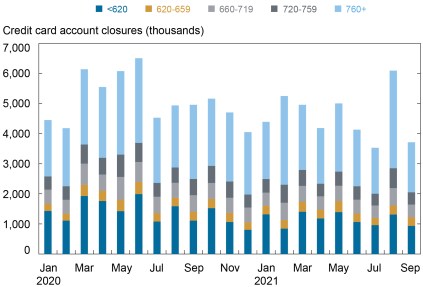

As for card closures, shown in the following chart, we observe a temporary increase in closed credit card accounts in the early part of the pandemic. The combination of a reduced number of issuances with an increased number of closures led to a notable decline in the number of accounts overall—visible on page 10 of our Quarterly Report on Household Debt and Credit.

Account Closures Slow Down

Source: New York Fed Consumer Credit Panel / Equifax

Note: Credit score is Equifax Risk Score 3.0

Credit card balances and accounts have been influenced by several factors in these unusual times. Consumption saw sharp swings, as it was alternately tamped down by pandemic-related lockdowns and then bolstered by cash transferred from relief efforts. These swings were reflected in credit card balances. And when banks reduced risks in the early part of the pandemic, they reduced exposures by pausing the issuance of new cards and closing some existing accounts. But our monthly credit report data reveal that the irregularities in credit card accounts and use were fleeting outcomes reflecting the intense early months of the pandemic recession and the most recent data suggest a return to normal trends, albeit from lower levels.

Andrew Haughwout is a senior vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Donghoon Lee is an officer in the Bank’s Research and Statistics Group.

Daniel Mangrum is an economist in the Bank’s Research and Statistics Group.

Wilbert van der Klaauw is a senior vice president in the Bank’s Research and Statistics Group.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors. goes here

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics