Editors’ note: When this post was first published the x-axis labels on chart 2 and 3 were incorrect, and the y-axis label was incorrect on chart 4. The charts have been corrected. 9:47 a.m. ET, July 12.

The economic disruptions associated with the COVID-19 pandemic sparked a global dash-for-cash as investors sold securities rapidly. This selling pressure occurred across advanced sovereign bond markets and caused a deterioration in market functioning, leading to a number of central bank actions. In this post, we highlight results from a recent paper in which we show that these disruptions occurred disproportionately in the U.S. Treasury market and offer explanations for why investors’ selling pressures were more pronounced and broad-based in this market than in other sovereign bond markets.

The COVID-19 Pandemic Caused Market Disruptions across Sovereign Bond Markets

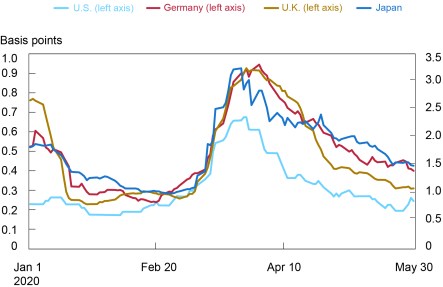

At the start of the COVID-19 pandemic in late February 2020, and in response to the economic repercussions of impending lockdown measures, investors began to demand higher-quality, safe assets. In particular, they shifted their portfolios toward sovereign bonds, and the resulting buying pressure drove sovereign yields to decline broadly. As the crisis intensified in March 2020, however, investors’ demand for cash surged, leading to selling pressure on sovereign bonds and therefore increases in their yields. This down-and-up pattern in yields is illustrated for ten-year U.S., German, U.K., and Japanese bonds in the chart below.

Cumulative Yield Changes across Sovereign Bond Markets

Notes: The chart displays the cumulative yield changes for ten-year sovereign bonds, starting on January 1, 2020. U.S., Germany, U.K., and Japan denote Treasury, bund, gilt, and Japanese government bond (JGB) securities, respectively.

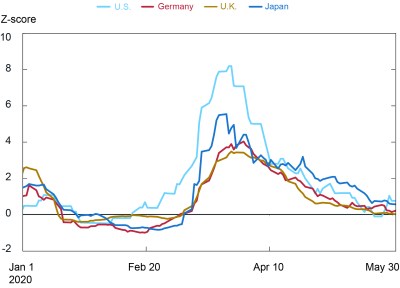

Alongside these changes in yields, sovereign bond liquidity deteriorated significantly in March 2020. For example, bid-ask spreads increased for U.S., German, U.K., and Japan ten-year sovereign bonds over late February and March 2020 (see the chart below).

The Spread between Bid and Ask Yields across Sovereign Bond Markets

Notes: The chart shows the spread between bid and ask yields for ten-year sovereign bonds on a ten-day, backward-looking moving average. U.S., Germany, U.K., and Japan denote Treasury, bund, gilt, and Japanese government bond (JGB) securities, respectively.

Although selling pressures materialized for sovereign bonds broadly in March 2020, trading conditions in the U.S. Treasury markets saw the largest impact. For example, the deterioration in the bid-ask spread, normalized by its historical average, was more pronounced for U.S. Treasuries than for German, U.K., and Japan sovereign bonds (see the chart below), whereas typically the normalized bid-ask spread of U.S. Treasuries is lower and more stable than those of German, U.K., and Japan sovereign bonds.

The Normalized Spread between Bid and Ask Yields across Sovereign Bond Markets

Notes: The chart shows the spread between the ten-day, backward-looking moving average of bid and ask yields for ten-year sovereign bonds, normalized by their respective Z-scores. Z-scores are computed from a ten-day moving average of end-of-day bid-ask spreads using data from

January 2017 to January 2019. U.S., Germany, U.K., and Japan denote Treasury, bund, gilt, and Japanese government bond (JGB) securities, respectively.

Selling Pressures Were Disproportionately Greater in the U.S. Treasury Market

The breadth and depth of selling pressures across investor types during the COVID-19 shock was more severe in U.S. Treasuries than in other major sovereign bond markets, partly because of the U.S. dollar’s dominant status as both an investment and funding currency.

While central banks sold reserves denominated in all major currencies, sales of U.S. dollar assets were disproportionately greater. Indeed, sales of U.S. dollar reserves were estimated to account for more than 80 percent of total reserves sales, well in excess of the U.S. dollar’s roughly 60 percent share of foreign exchange reserves.

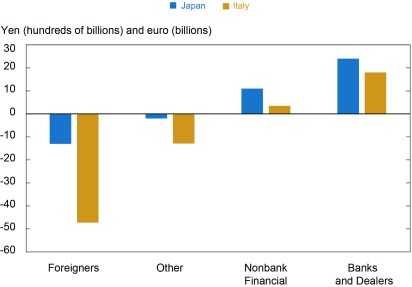

Private investor sales were also more pronounced in U.S. Treasuries than in other sovereign bonds. Data on investor transactions and holdings of sovereign bonds in Japan and Italy suggest that bond sales in March 2020 were mostly from foreign investors, as domestic nonbank investors—including asset managers, insurers, and pension funds—appeared to either add to sovereign bond positions or remain roughly neutral (see chart below). In contrast, selling pressures in the U.S. Treasury market were broad-based, as both foreign investors and U.S. domestic mutual funds—which hold a significant share of marketable Treasury holdings—were large net sellers of U.S. Treasuries in the first quarter of 2020.

Purchases of Japanese and Italian Sovereign Bonds by Investor Type in March 2020

Notes: The chart reports the net purchases of Japanese sovereign bonds (JGBs) in the secondary market, excluding bills, and the aggregate change in holdings of Italian sovereign bonds (BTPs). Nonbank Financial includes investment trusts and insurers.

Meanwhile, banks in foreign jurisdictions appeared to play a much larger role in absorbing investor sales than banks in the United States. Data from Japan and Italy show heavy net purchases from banks that helped offset foreign sales (see the chart above). In contrast, U.S. banks were modest net sellers of U.S. Treasuries in the first quarter of 2020.

Higher Leverage Underpinned Larger Selling Pressures in Treasuries

Differences in the supply of securities and the accumulation of Treasuries by levered entities such as relative value hedge funds were also factors driving heavier net sales of U.S. Treasuries in early 2020. From the start of 2017 to right before the March 2020 shock, U.S. Treasury securities (excluding those held in the Federal Reserve’s System Open Market Account) increased by more than $3 trillion, while growth in other jurisdictions was either modest (the U.K. and France) or negative (Germany and Japan). Heavy Treasury issuance, among other factors, contributed to a notable absorption of U.S. Treasuries by levered funds, rendering Treasuries considerably more vulnerable to rapid deleveraging during the March shock. Feedback from foreign market participants noted that leveraged funds’ participation in sovereign bond markets was not as large in the run-up to the crisis.

Market Microstructure Differences Were Less Consequential

In our paper, we also explore the extent to which differences in bond market structures may have amplified or mitigated strains. We find that these factors—including market-maker obligations, the share of nonbank liquidity provision, the degree of central versus bilateral clearing, and the prevalence of electronic versus voice trading—may have played a modest role but were not major sources of differentiation in the functioning of sovereign bond markets in early 2020.

Takeaways

Although investors sold a wide variety of assets during the COVID-19 pandemic, market functioning for U.S. Treasuries deteriorated disproportionately as compared to other sovereign bonds. We argue that the relatively greater decline in Treasury market functioning was due to pronounced and broad-based selling pressures, which were driven primarily by the dollar’s dominant status as an investment and funding currency as well as the large presence of levered entities in the Treasury market in early 2020.

Questions remain about how well the Treasury market will absorb future selling pressures from a broad base of investors. A significant change in the Treasury market since March 2020 is the Federal Reserve’s introduction of the Standing Repo Facility and the FIMA Repo Facility. These liquidity facilities allow eligible counterparties to exchange Treasuries for cash at an administered rate. As a stable source of funding, these new programs could attenuate the need for sales during liquidity shocks, helping to smooth market functioning.

Furthermore, the Treasury market may undergo significant changes. Suggested changes include the expansion of central clearing, the registration of active trading firms engaged in purchasing and selling of securities as dealers with the SEC, enhanced oversight of trading platforms, and improvements in the quality of data reporting.

Jordan Barone is a capital markets trading principal in the Federal Reserve Bank of New York’s Markets Group.

Alain Chaboud is a senior economic project manager in the Program Direction Section at the Federal Reserve Board.

Adam Copeland is a financial research advisor in the Federal Reserve Bank of New York’s Research and Statistics Group.

Cullen Kavoussi is a policy and market monitoring principal in the Bank’s Markets Group.

Frank Keane is a policy advisor in the Bank’s Markets Group.

Seth Searls is an associate director in the Bank’s Markets Group.

How to cite this post:

Jordan Barone, Alain Chaboud, Adam Copeland, Cullen Kavoussi, Frank Keane, and Seth Searls, “The Global Dash for Cash in March 2020,” Federal Reserve Bank of New York Liberty Street Economics, July 12, 2022, https://libertystreeteconomics.newyorkfed.org/2022/07/the-global-dash-for-cash-in-march-2020/

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Nice and interesting report on soveregin bond and US Treasuries during COVID-19 pandemic period.