One key motivation for imposing tariffs on imported goods is to protect U.S. firms from foreign competition. By taxing imports, domestic prices become relatively cheaper, and Americans switch expenditure from foreign goods to domestic goods, thereby expanding the domestic industry. In a recent Liberty Street Economics post, we highlighted that our recent study found large aggregate losses to the U.S. from the U.S.-China trade war. Here, we delve into the cross-sectional patterns in search of segments of the economy that may have benefited from import protection. What we find, instead, is that most firms suffered large valuation losses on tariff-announcement days. We also document that these financial losses translated into future reductions in profits, employment, sales, and labor productivity.

Why Tariffs Might Hurt U.S. Firms

During the 2018-19 U.S.-China trade war, the U.S. levied 10 to 50 percent import tariffs on more than $300 billion of imports from China (and some other countries). To understand why tariffs can cause the domestic industry to shrink, we need to distinguish between tariffs on inputs and outputs. The focus is usually on industry output tariffs; for example, higher tariffs on cars can protect the domestic car industry because the higher tariff-inclusive price of imported vehicles makes consumers switch to domestic cars. But, U.S. import tariffs were largely levied on industry inputs, for example, steel. Input tariffs raise the cost of producing final goods like cars in the U.S., making domestic production less competitive. However, foreign firms do not need to pay for these tariffs when producing in their markets. As a result, higher input tariffs make it difficult for U.S. producers to compete with foreign firms exporting to the U.S. market or in U.S. export markets.

Whether U.S. firms benefit from import protection depends on the net effect, that is, the “effective rate of protection.” The fact that U.S. tariffs affected industry inputs more broadly than outputs foreshadows our finding that most U.S. firms suffered on net. In addition, the U.S. import tariffs imposed during the trade war resulted in retaliation from China with high tariffs on U.S. exports, making U.S. exports less competitive in China, leading to losses in their export sales revenue.

Which Firms Had Worse Stock-Market Returns on Tariff-Announcement Days?

Our approach is to examine the stock-market returns of all publicly listed firms in the U.S. on the days of any major tariff announcements during 2018-19. This is meaningful as we show in our paper that the stock-price movements from these announcement dates are tightly linked with future movements in cash flow.

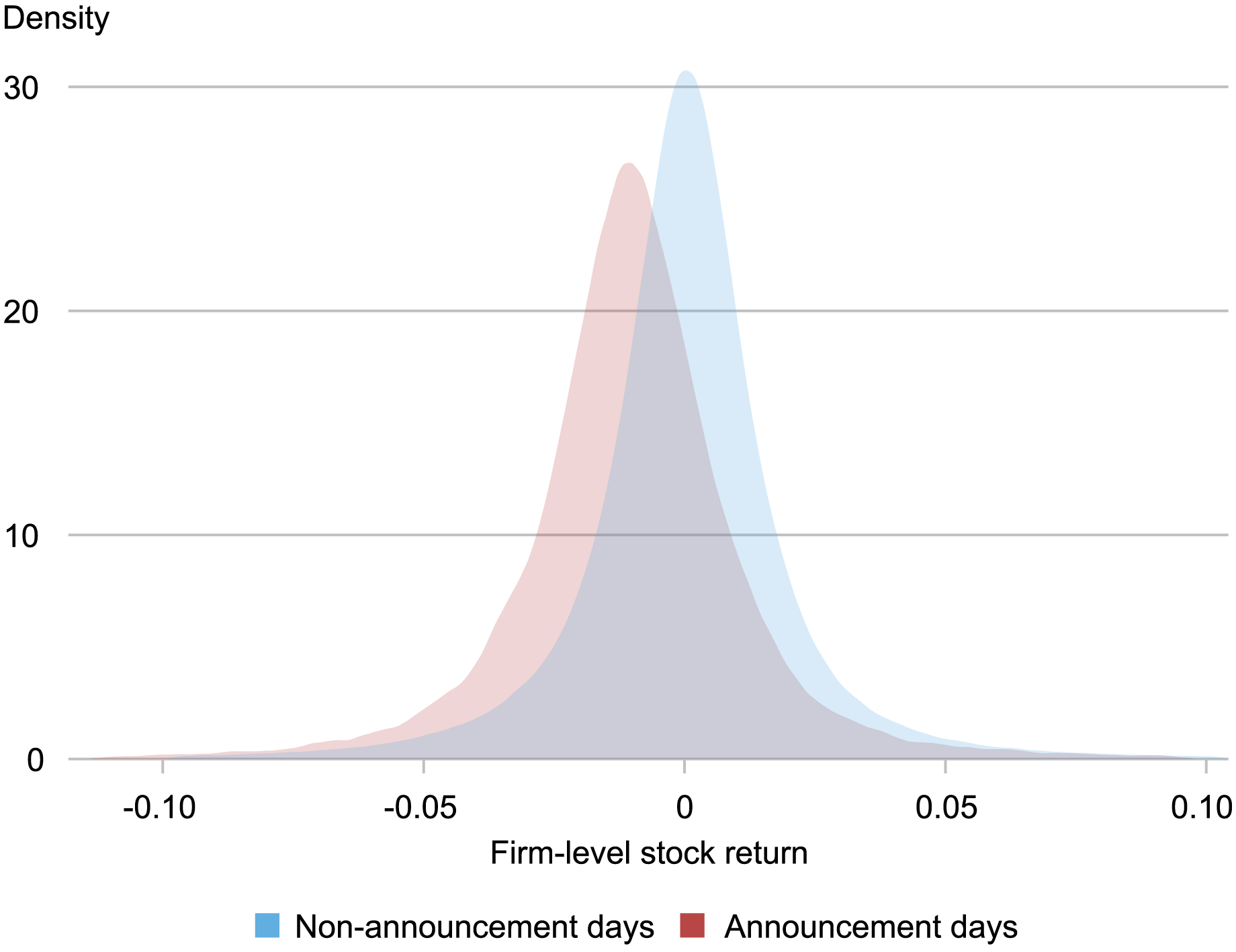

In the chart below, we plot the entire distribution of publicly listed U.S. firms’ stock returns on days when no tariff announcements were made (in blue) and on days when tariffs were announced (in red). The chart shows that the entire distribution of firm stock returns is shifted to the left, meaning that the tariffs’ announcement tended to lower U.S. equity prices.

The Negative Impact of the Tariff Announcements on Stock Returns Was Broad

Note: The sample comprises daily stock returns for all publicly listed firms from 2018 to 2019.

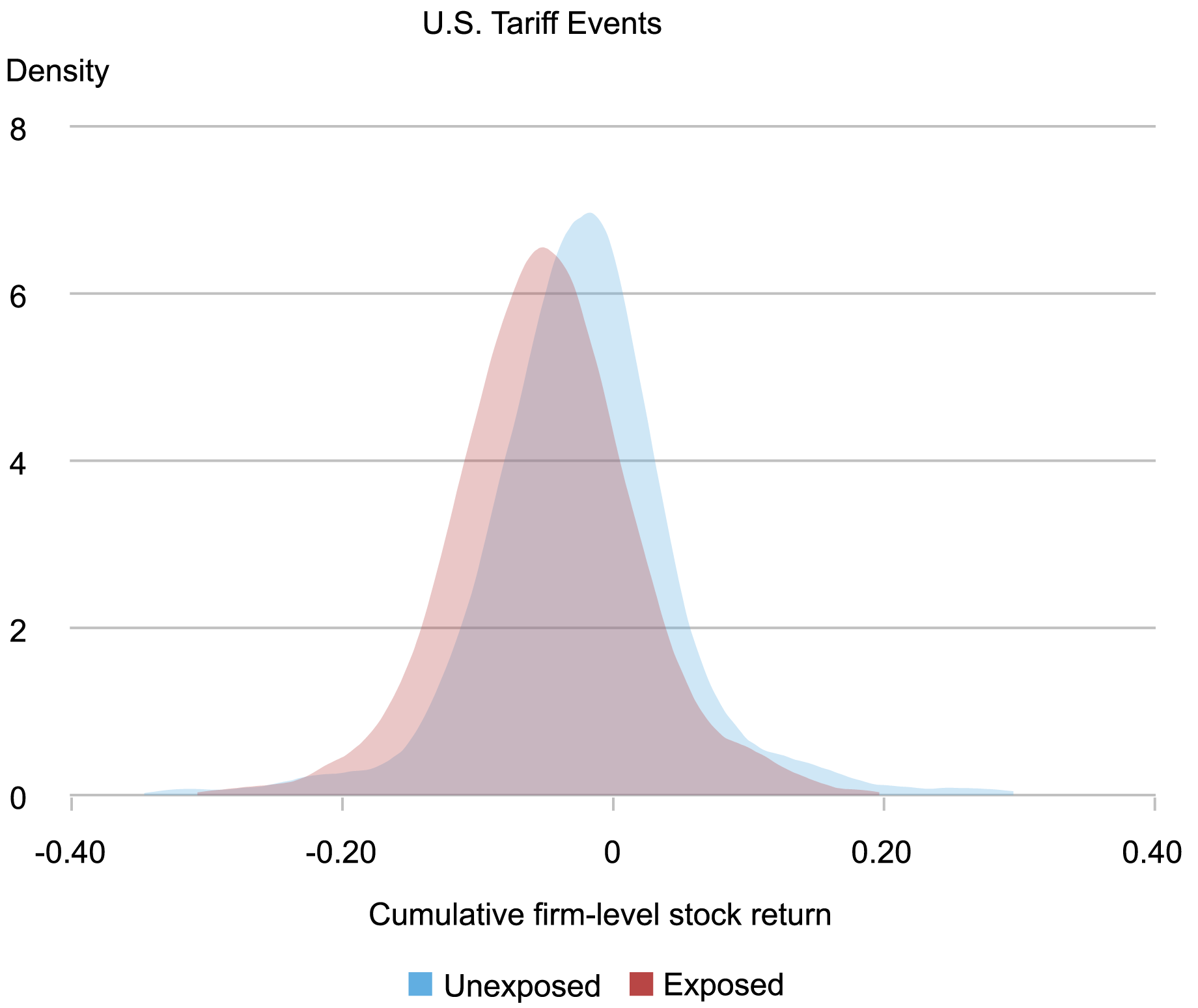

Most of the tariffs that were announced were targeted at imports from China. Therefore, we expect firms that are exposed to China to experience the largest losses. A firm that was directly exposed to China through importing from China or selling in China (either by exporting or by selling through a subsidiary) had worse stock-market performance than those that were not directly exposed. Since the data reveal that half of U.S. listed firms are exposed to China through one of these mechanisms, the trade war directly affected many of America’s largest firms.

The chart below plots the distribution of one-day stock-market returns for unexposed firms in blue and for exposed firms in red. As expected, exposed firms experienced relatively larger losses than unexposed firms on the days of tariff announcements, as shown in the chart with the distribution of returns for exposed firms to the left of the unexposed. Interestingly, and perhaps surprisingly, the distribution of the unexposed firms also shifted to the left.

Distribution of Stock-Market Returns of Exposed Firms Is to the Left of Unexposed Firms

We were also interested in understanding whether these movements in firm stock returns accurately reflected predictions of firms’ future performance. Using annual data for 2013 to 2021, we looked at the correlation between stock-price movements on tariff-announcement days during 2018-19 and real future outcomes for 2019 to 2021. We found that firms with lower stock returns around announcement dates experienced lower profits, employment, sales, and labor productivity.

Firms with Worse Stock-Market Returns Had Worse Future Real Outcomes

| Effect of a one-standard-deviation fall (=0.56%) in stock-market returns on: | Percent |

|---|---|

| Profits | -12.9 |

| Employment | -3.9 |

| Sales | -6.7 |

| Labor productivity | -2.2 |

We find that a fall in a firm’s stock prices on tariff-announcement days is associated with a significant decline in firm performance between 2019 and 2021. In particular, a one-standard-deviation fall in a firm’s stock prices (a 0.56 percent fall in market value) is associated with a fall of 12.9 percent in profits, 3.9 percent in employment, 6.7 percent in sales, and 2.2 percent in productivity.

In sum, extracting gains from imposing tariffs is difficult because global supply chains are complex and foreign countries retaliate. Using stock-market returns on trade war announcement days, our results show that firms experienced large losses in expected cash flows and real outcomes. These losses were broad-based, with firms exposed to China experiencing the largest losses.

Mary Amiti is the head of Labor and Product Market Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Matthieu Gomez is an associate professor of economics at Columbia University.

Sang Hoon Kong is an economics PhD student at Columbia University.

David E. Weinstein is the Carl S. Shoup Professor of the Japanese Economy at Columbia University.

How to cite this post:

Mary Amiti, Matthieu Gomez, Sang Hoon Kong, and David E. Weinstein, “Do Import Tariffs Protect U.S. Firms?,” Federal Reserve Bank of New York Liberty Street Economics, December 5, 2024, https://libertystreeteconomics.newyorkfed.org/2024/12/do-import-tariffs-protect-u-s-firms/

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Thank you for the informative article. It would be helpful to understand what steps the new U.S. administration could take to improve the situation or make their tariff policy more beneficial for the U.S. economy.