Classic arbitrage involves the same asset selling at different prices; the leverage rule arbitrage we study here involves assets of different risk levels requiring the same amount of capital. The supplementary leverage ratio (SLR) rule, finalized by U.S. regulators in September 2014, requires a minimum ratio of capital to assets at the largest U.S. banks. The floor is higher for more systemically important banks, but not for banks with riskier assets. That non-risk-based aspect of SLR was intentional, since the leverage limit was meant to backstop (“supplement”) risk-based capital rules in case banks underestimate their asset risk and overstate their capital strength. As policymakers have noted and bankers have warned, if the leverage rule is the binding capital requirement, banks can “arbitrage” the rule by selling safer assets and replacing them with riskier, higher-yielding ones. The findings of our recent staff report are consistent with those concerns.

The Supplementary Leverage Rule

The SLR rule covers only the fifteen largest banks in the United States—those using the “advanced approach” (internal models) for estimating asset risk for setting risk-based capital requirements. When finalized, the rule required a minimum ratio of tier 1 capital to total leverage exposure of 5 percent for globally systemically important banks (G-SIBs, subject to an “enhanced SLR,” or eSLR) and 3 percent for other covered banks.

While U.S. banks already faced a leverage limit, the SLR limit is potentially much more binding than the existing limit because the SLR denominator includes off-balance sheet assets and derivative exposures. For some banks, the SLR limit was also more binding than their risk-based capital requirement; the typical (median) bank in 2013 had less than 1 percentage point of slack relative to the leverage limit, versus 6 percentage points relative to its risk-based capital requirement.

Banks bound by the SLR limit have two options for maintaining compliance: raise capital or shed assets. If a bank chooses to raise capital, it can offset any increase in funding costs by shifting from safer, lower-yielding assets to riskier, higher-yielding ones. If it chooses to reduce assets, the least costly option is to shed low-yielding assets, such as reserves. In either case, that “reach for yield” arbitrage should register as higher security yields or riskier holdings.

Identifying the SLR Effect

We use difference-in-difference (diff-in-diff) analysis to identify potential causal effects of the leverage rule. Essentially, we compare the change in various risk measures at the fifteen banks covered by the rule (SLR banks) before and after September 2014 to the change at the next largest eighteen banks (non-SLR banks), institutions with assets of at least $50 billion. The two sets of banks faced similar (though not identical) post-crisis reforms apart from the SLR rule, so any differential risk change can, given sufficient controls, be attributed to the SLR rule. We studied multiple risk measures, including security yields, riskier (risk-weighted) asset holdings, and overall bank risk measures including leverage.

Reach for Yield?

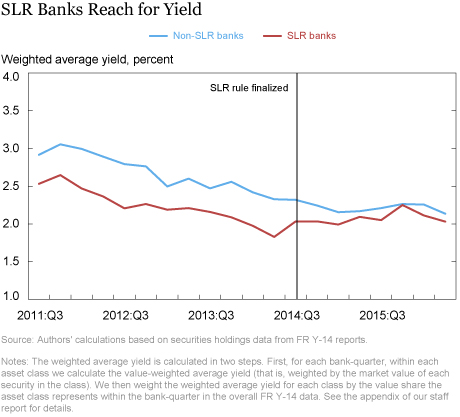

The chart below suggests a shift toward higher-yielding securities by SLR banks in response to the new leverage rule. Average yields on securities held by SLR and non-SLR banks trended downward roughly in parallel until 2014, with SLR yields being consistently lower. Their paths started to diverge in the third quarter of 2014, with security yields at SLR banks rising, narrowing the gap with those at non-SLR banks.

Our formal diff-in-diff estimates confirm that impression. Given bank size, risk-based capital, and other controls, we estimate that mean security yields at SLR banks were 34 basis points (bp) higher relative to those at non-SLR banks after the third quarter of 2014. Reinforcing the causal connection, the effects are larger for SLR banks with less leverage slack (42 bp) than for those with more leverage slack (26 bp).

We find some evidence that this reach reflects active risk-shifting—banks actually adding riskier securities to their portfolio, not merely shedding safer ones. The distinction matters since active risk-shifting, as an act of commission, reveals something about bank behavior or culture and informs the design of incentive-compatible regulation.

Riskier Asset Holdings

Using alternative data, we find consistent evidence that SLR banks increased their holdings of riskier (risk-weighted) security and trading assets relative to non-SLR banks after the leverage rule was finalized. We find some evidence that total assets at SLR banks become riskier, implying that the rule might, perversely, have increased overall bank risk.

Riskier Assets Offset by Deleveraging?

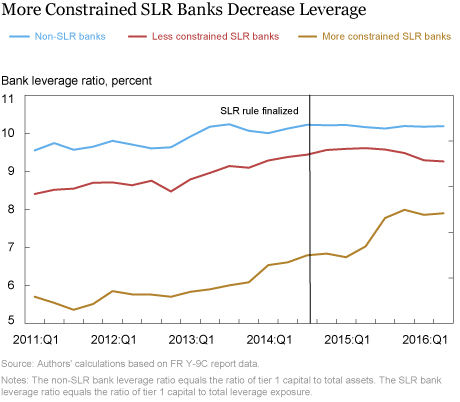

Despite the evident asset shift, we find virtually no change in overall bank risk, not even at the more constrained SLR banks. These overall measures reflect asset risk and leverage, however, and we find that the more constrained SLR banks deleveraged post-SLR (as reflected in the chart below). That reduced leverage may have offset riskier assets, leaving overall risk unchanged.

No Arbitrage Opportunities

Our evidence suggests that banks were arbitraging the SLR (and eSLR) rule by shifting from safer assets toward riskier, higher-yielding ones. Evidence from other studies we discuss point to the same behavior by banks or dealers with portfolios heavily weighted toward safe, low-yield assets as part of their business models. Policymakers are aware of this regulatory arbitrage and are addressing it.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Dong Beom Choi is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Dong Beom Choi is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Michael R. Holcomb is a senior research analyst in the Bank’s Research and Statistics Group.

Michael R. Holcomb is a senior research analyst in the Bank’s Research and Statistics Group.

Donald P. Morgan is an assistant vice president in the Bank’s Research and Statistics Group.

Donald P. Morgan is an assistant vice president in the Bank’s Research and Statistics Group.

How to cite this blog post:

Dong Beom Choi, Michael R. Holcomb, and Donald P. Morgan, “Leverage Rule Arbitrage,” Federal Reserve Bank of New York Liberty Street Economics (blog), October 12, 2018, http://libertystreeteconomics.newyorkfed.org/2018/10/leverage-rule-arbitrage.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics