In recent years, policymakers in advanced and emerging economies have employed a variety of macroprudential policy tools—targeted rules or requirements that enhance the stability of the financial system as a whole by addressing the interconnectedness of individual financial institutions and their common exposure to economic risk factors. To examine the foreign experience with these tools, we constructed a novel macroprudential policy (MAPP) index. This index allows us to quantify the effects of these policies on bank credit and house prices, two variables that are often the target of policymakers because of their links to boom-bust leverage cycles. We then used the index in the empirical analysis to measure the effectiveness of these policies in emerging market countries and advanced economies. Our estimates suggest that macroprudential tightening can significantly reduce credit growth and house price appreciation.

Defining a Macroprudential Policy Index

Macroprudential policy tools include caps on loan-to-value (LTV) ratios for housing loans, caps on debt service-to-income (DSTI) ratios, and quantitative limits on mortgages. Other tools include time-varying capital requirements (CR), loan loss provisioning (LP), consumer loan limits, and credit growth ceilings. Note that CRs are often implemented by adjusting the risk weights of specific bank asset classes, such as housing or consumer loans. Similarly, LPs involve adjusting provisions either on a general basis or for specific assets such as housing or consumer loans.

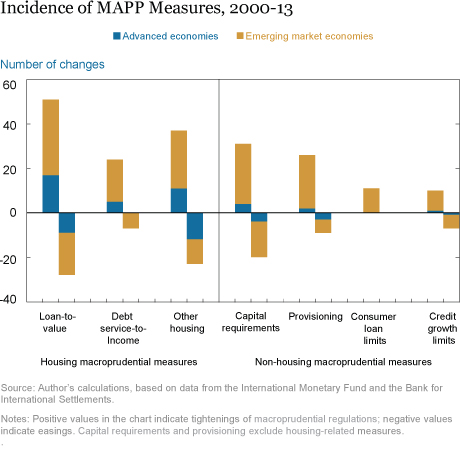

We have constructed a novel quarterly macroprudential policy index using data from fifty-seven advanced and emerging economies from 2000 to 2013 (see this recent working paper). The index is built by categorizing a policy action in a given month as a tightening (+1) or an easing (-1) for each of the seven tools listed above. The chart below shows the total number of tightening and easing policy actions for each macroprudential tool over the sample period. The most frequently used tools have been caps on LTV ratios and CRs. Adjustments of other measures such as caps on DSTI ratios, lending restrictions on mortgages, and LPs have also been popular but less frequent. Tightenings have been much more common than easings across all groups, with actions more frequent in emerging economies.

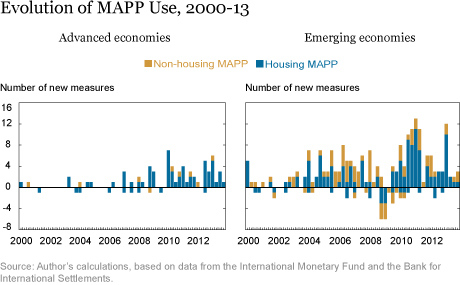

The MAPP index for each country is created by summing the indicator values across all seven macroprudential tools. We also created subindexes grouping housing-related measures (LTV, DSTI, and “other” housing measures) and non-housing-related measures (CRs and LPs that target general credit conditions, consumer loan limits, and credit growth ceilings). The following chart summarizes the results over time for advanced and emerging economies. Both sets of countries increased their use of macroprudential policy tools after the financial crisis as policymakers became more attentive to systemic risks. Nearly all of the measures used in the advanced economies targeted the housing sector while emerging economies implemented both housing and non-housing measures.

Other Policies

Macroprudential policies are not the only tools used to control credit growth and house prices. The monetary policy rate, reserve requirements on domestic currency deposits, and capital controls also affect financial conditions. The table below shows the correlations in the use of macroprudential policies and these other policy tools. Policymakers in foreign economies generally use macroprudential measures, the monetary policy rate, and reserve requirements as complements. The correlations are weakly positive with the exception of housing-related macroprudential measures and policy rate changes, which are negatively correlated. This negative relationship might be reflecting the difficulty faced by policymakers who use monetary policy to deal with housing booms. Emerging economies, prone to volatile capital flows, also rely on capital controls to affect domestic financial conditions.

Effects of Macroprudential Policies

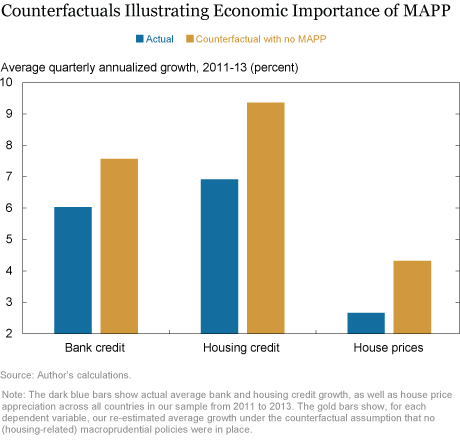

The MAPP index allows us to estimate a dynamic panel data model that quantifies the effects of these policies on bank credit and house prices, after taking into account the impact of GDP growth, changes in the monetary policy rate, and global financial conditions. Our estimations suggest that macroprudential tightening has significantly reduced credit growth and house price appreciation. As shown in the chart below, the growth rate in bank credit and house prices would have been significantly higher over the 2011-13 period in the absence of these measures.

These results provide new evidence in support of adopting macroprudential policies to attenuate credit and house price cycles. The evidence, it should be noted, does not demonstrate that these tools can fully eliminate booms.

Disclaimer

The views expressed in this post are those of the author and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author.

Ozge Akinci is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this blog post:

Ozge Akinci, “International Evidence on the Use and Effectiveness of Macroprudential Policies,” Federal Reserve Bank of New York Liberty Street Economics (blog), May 18, 2016, http://libertystreeteconomics.newyorkfed.org/2016/05/international-evidence-on-the-use-and-effectiveness-of-macroprudential-policies.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics