The close relationship between market volatility and trading activity is a long-established fact in financial markets. In recent years, much of the trading in U.S. Treasury and equity markets has been associated with nearly simultaneous trading between the leading cash and futures platforms. The striking cross-activity patterns that arise in both high-frequency cross-market trading and related cross-market order book changes in U.S. Treasury markets are also witnessed in other asset classes and naturally lead to the question that we investigate in this post of how the cross-market component of overall trading activity is related to volatility.

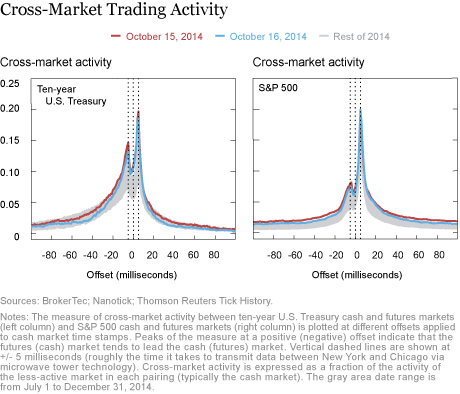

The chart below displays a measure of cross-market activity for the ten-year Treasury note cash and futures markets (left column) and the S&P 500 cash and futures markets (right column) across different millisecond offsets. Of note is the pronounced asymmetry of the spike in the measure at +5 milliseconds for the S&P 500 compared with the ten-year U.S. Treasury. The much higher spike for the positive 5 millisecond offset is consistent with the often-cited dominant role played by the S&P futures market in price discovery. Leaving this asymmetry aside, the spikes in cross-market activity on October 15 and 16, 2014, stand out as being well-aligned with the heightened volatility and trading observed on those days. Cross-market trading and quoting activity thus appears to be related to variations in market volatility, which can create (short-lived) dislocations in relative valuations as market participants respond to news about fundamentals or market activity itself.

We further demonstrate empirically that the peak number of cross-active milliseconds (the largest cross-activity measure across all offsets expressed as a count rather than a fraction of total activity) comoves more strongly with market volatility than generic market-activity proxies such as trading volume and the number of transactions. This pattern is consistent with a positive feedback effect by which an increase in volatility can spur additional trading activity by creating cross-market trading opportunities. This observation stands in contrast to the more conventional view in the finance and economics literature which holds that trading activity predominantly influences volatility but not vice versa.

Intraday Patterns in Volatility and Cross-Market Trading Activity

We analyze the link between cross-market activity and volatility in both U.S. Treasuries (ten-year Treasury note cash and futures) and equities (S&P 500 E-mini and SPY ETF) over the six-month period from July 1 to December 31, 2014. We measure cross-market activity on each trading day as the peak number of cross-active milliseconds across all offsets and restrict attention to the most active electronic U.S. trading hours for each pair: from 7:00 to 16:00 ET for the ten-year Treasury note and from 9:30 to 16:00 ET for the S&P 500. While we carry out the analysis at millisecond frequency, it trivially generalizes to any other frequency with adequate time resolution for meaningful cross-activity measurements at different offsets.

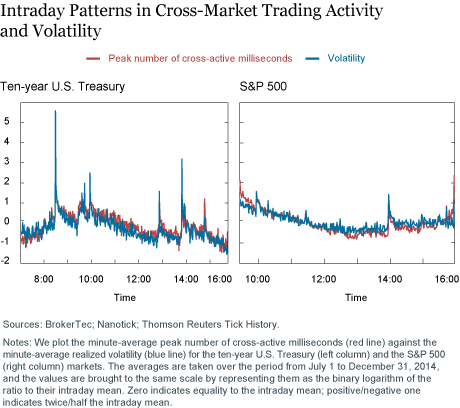

The panel of charts below shows that for both the ten-year Treasury note and S&P 500 the prevailing intraday volatility pattern is matched very closely by the diurnal pattern in cross-market activity as measured by the peak number of cross-active milliseconds between the cash and futures markets. The biggest volatility spikes for U.S. Treasuries occur at 8:30, 10:00, 13:00, and 14:00 ET around known times of news announcements, Treasury auctions, and the release of Federal Open Market Committee announcements and meeting minutes. For the S&P 500, only the spikes at 10:00 and 14:00 ET stand out (to a lesser degree). For U.S. Treasuries, there is also a notable peak around 15:00 ET (corresponding to the CME market close for all pit-traded interest rate options).

Furthermore, in terms of correlation, the peak number of cross-active milliseconds is tracking the intraday volatility pattern somewhat more closely than either trading volume or the number of trades. However, the tight range of most observed values within negative and positive one (excluding the extremes) suggests that interday as opposed to intraday variation may provide a better measure of the degree to which the different activity series relate to volatility.

Day-to-Day Variations in Volatility and Cross-Market Trading Activity

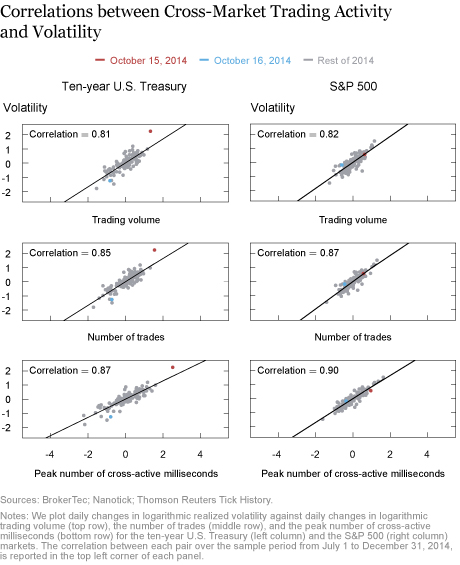

The panel of charts below shows changes in daily logarithmic realized volatility plotted against changes in each daily logarithmic activity measure over the July 1 to December 31, 2014, sample period. For both the ten-year Treasury (left column) and the S&P 500 (right column) markets, the day-to-day changes in volatility appear to be more closely correlated with the day-to-day changes in the peak number of cross-active milliseconds (bottom row) than with the changes in the number of trades (middle row) or trading volume (top row).

Moreover, the peak number of cross-active milliseconds often appears to crowd out both trading volume and the number of trades if included jointly as regressors for volatility. This result is quite remarkable since it establishes that the peak number of cross-active milliseconds subsumes both trading volume and the number of trades in terms of information content about volatility. It is also worth highlighting that while October 15 (in red) and October 16 (in blue) are known to have exhibited extreme volatility, they are not large outliers in terms of the strong linear relationship observed between changes in volatility and changes in the peak number of cross-active milliseconds (bottom row).

Evolution of the Relationship between Volatility and Cross-Market Trading Activity

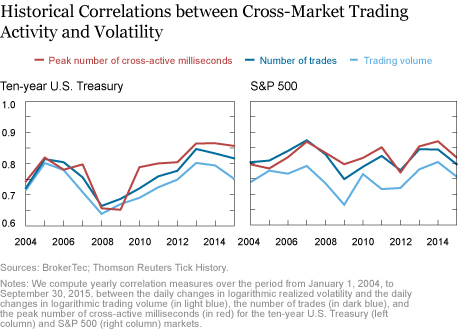

To better assess the extent to which market volatility has become more closely associated with high-frequency cross-market trading activity, the next panel of charts juxtaposes the above historical correlations between trading activity and volatility for the ten-year U.S. Treasury (left column) and the S&P 500 (right column) markets each year from January 1, 2004, to September 30, 2015. In particular, measuring the peak number of cross-active milliseconds day by day and correlating logarithmic differences of the daily measures during each twelve-month period limits the impact of secular trends in latency and trading practices over the past decade resulting from technological improvements and the related evolution in high-frequency trading. The charts below thus strongly indicate that with the rise in high-frequency trading in recent years, cross-market activity as measured by the peak number of cross-active milliseconds between the cash and futures markets has typically been more tightly linked to volatility than standard activity measures such as overall trading volume or the number of trades.

Summary

We document that a measure of cross-market activity expressed as the peak number of cross-active milliseconds (across all offsets) is more strongly linked to volatility than trading volume and the number of trades in both U.S. Treasury and equity markets. This observation may reflect the fact that volatility can create brief dislocations in relative values spurring bursts of cross-market activity by high-frequency traders seeking to exploit these trading opportunities. When liquidity is ample, measures of cross-market activity can therefore capture incremental information about market volatility beyond traditional measures of overall market activity such as trading volume and the number of transactions. Our findings strongly suggest the need to study activity in arbitrage-linked markets jointly rather than in isolation in order to account for the significant volatility-related surges in cross-market trading observed in the data.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Dobrislav Dobrev is a senior economist at the Board of Governors of the Federal Reserve System.

Ernst Schaumburg is the head of analytical development and an assistant vice president in the Federal Reserve Bank of New York’s Integrated Policy Analysis Group.

Ernst Schaumburg is the head of analytical development and an assistant vice president in the Federal Reserve Bank of New York’s Integrated Policy Analysis Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics