Thomas Klitgaard and David O. Lucca

Euro area sovereign bond yields fell to record lows and the euro weakened after the European Central Bank (ECB) dramatically expanded its asset purchase program in early 2015. Some analysts predicted massive financial outflows spilling out of the euro area and affecting global markets as investors sought higher yields abroad. These arguments ignore balance of payments accounting, which requires any financial outflow from the euro area to be matched by a similar-sized inflow, absent a quick and substantial current account improvement. The focus on cross-border financial flows also is misguided since, according to asset pricing principles, the euro and global asset prices can move without any change in financial outflows.

First, Some Accounting

The balance of payments tracks a country’s international transactions. It comprises the current account, which measures cross-border flows of goods, services, investment income, and transfers; the capital account, which is usually trivial; and the financial account, which records cross-border financial flows. The three components of the balance of payments add up to zero, apart from statistical discrepancies. Putting aside the small capital account and ignoring the statistical discrepancies, this means that the current account balance is exactly matched by the financial account. The intuition is that a country running a current account surplus, with exports greater than imports, is lending to the world to make up the difference. This lending is reflected in net purchases of foreign assets measured in the financial account.

Suppose for the moment that the ECB’s asset purchase program, by driving down interest rates, causes investors to consider investing abroad. Also assume that the euro area’s current account balance remains unaffected over the near term by the monetary policy shift. Then net financial outflows must be unchanged and any increase in the pace of domestic purchases of foreign assets can only be realized if foreign investors match that increase by buying more euro area assets. In other words, the desire to invest abroad may be there, but financial outflows are constrained by the current account and financial inflows. That means that the exchange rate and other asset prices need to move in response to the ECB policy change to keep financial outflows consistent with balance of payments identities.

Now for Some Asset Pricing . . .

This insight highlights the dangers of making predictions about gross cross-border financial outflows when evaluating the impact of asset purchase policies. The workhorse model in the field of asset pricing is the Lucas tree model, named after Nobel-prize winner Robert J. Lucas. In this model, investors trade claims to future uncertain dividend streams, and asset prices fluctuate to reflect new information about future cash flows. But because agents are alike and have the same information about future cash flows, there is no motive for them to trade. In equilibrium, asset prices adjust to new information so that investors are content with their original portfolio holdings given the new information. The insight in this model is that asset prices can change without any transaction taking place. In our case, global asset prices and exchange rates can move without any shift in observed cross-border flows.

The ECB’s asset purchase program may indeed have caused investors to consider shifting into foreign assets and so asset prices had to adjust. In particular, the euro’s depreciation helped keep financial outflows in line with inflows by making foreign assets, in euro terms, more expensive, thereby lowering their expected returns.

What Financial Flow Data Show

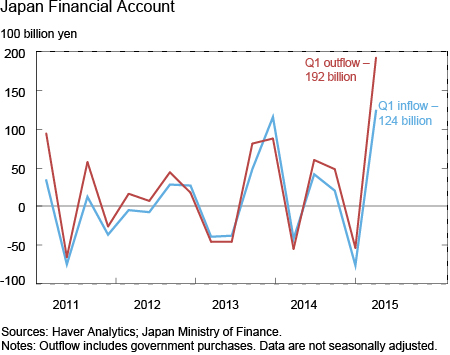

The recent experience with quantitative easing in Japan helps illustrate our point. In late 2012, the yen started to depreciate with the increased likelihood that the country would expand its asset purchase program. In April 2013, when the policy was actually implemented, commentary similar to that on the ECB program anticipated a “wall of money” flowing out of Japan in search of higher yields and affecting global asset prices. Indeed, analysts worried that emerging countries would have trouble absorbing these flows, leading to asset price bubbles. While asset prices and exchange rates adjusted in Japan and abroad, a surge in outflows never occurred. As seen in the chart below, cross-border flows reversed in the second quarter of 2013 before increasing in the third quarter. Outflows for the year were modest and the current account balance, the difference between the two lines, was largely unchanged. The wall of money never materialized.

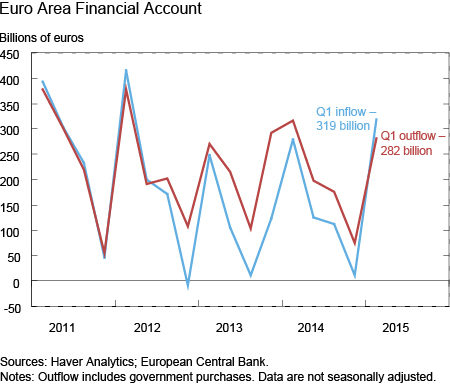

Nor does euro area data suggest substantial financial outflows. The chart below shows that in the first quarter of 2015, the start of the ECB’s expanded asset purchase program, financial inflows and outflows both rose, and by matching amounts. (The region had a current account surplus, but measured inflows were greater than outflows owing to a large statistical discrepancy.)

The euro’s fall has been a key channel through which the ECB’s asset purchase policy has affected financial markets in the rest the world. However, the idea that foreign asset prices would be pushed up by a surge in money flowing out of the region, as some observers predicted, runs contrary to balance of payments accounting and asset pricing principles and should be discounted.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Thomas Klitgaard is a vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Thomas Klitgaard is a vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

David O. Lucca is an officer in the Research and Statistics Group.

David O. Lucca is an officer in the Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

China runs a large current account surplus, so financial outflows (private and public) exceed financial inflows. Liberalizing the financial account makes it easier for private investors to invest abroad, so there may be more private and less public outflows going forward, depending on China’s foreign exchange policy. It is difficult to say how additional private outflows will be invested. They may be in the form of riskier investments, such as foreign direct investments or equity purchases, as you suggested. It is also quite possible that the flows continue to go into safe investments, such as U.S. Treasuries.

Hello, Would you please be able to explain this process with the prospect of the opening up of the financial (capital) account in China? In terms of stocks and flows, I think I am a little confused about the possible flows that will occur due to the large build up of the stock of capital onshore. My thinking is that China has run a large current account surplus and a resulting large build up of financial assets in the form of reserves – largely US treasuries. With the opening of the capital account is it right to assume that with a constant current account surplus there will be less purchases of treasuries as the financial account will now be able to be allocated to ‘real sector’ investments abroad which may provide more return per risk? What types of flows should we expect with an opening of China’s financial (capital) account?