Forming long-term partnerships with customers and suppliers often creates a competitive advantage for firms because it permits resource sharing, eases financial constraints, and encourages investment in relationship-specific capital. While these relationships can be beneficial, they also increase firms’ exposure to their counterparties’ risk. In a recent Staff Report, Anna Costello of MIT and I study two important and unanswered questions about supply relationships. First, what specific characteristics of the trade relationship make a firm more vulnerable to adverse spillovers from their supply chain partners? Second, if managers understand these vulnerabilities, can they design contracts or diversify their partners in order to mitigate exposures to negative events along their supply chain?

A Tale of Two Contracts

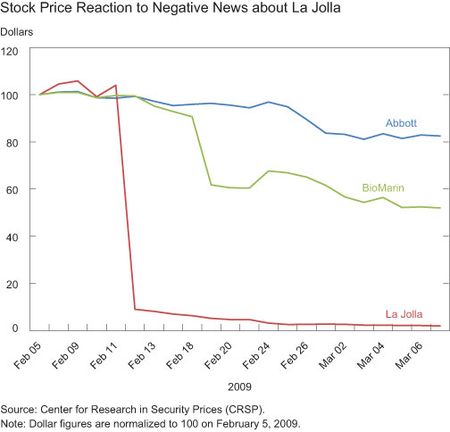

To illustrate the effect that contractual terms of trade can have on the transmission of shocks along the supply chain, consider the supply contracts between La Jolla Pharmaceutical and BioMarin Pharmaceutical, and between La Jolla Pharmaceutical and Abbott Laboratories. In January 2009, La Jolla and BioMarin partnered to co-develop an experimental drug for lupus of the kidneys, with BioMarin advancing a $15 million upfront payment to La Jolla, in addition to committing $289 million in cash and equity (conditional on the drug attaining certain development goals). On February 12, 2009, La Jolla announced that the drug candidate failed its Phase 3 clinical trial. At the time of the announcement, in addition to the partnership with BioMarin, La Jolla also had a supply contract with Abbott Laboratories. In contrast to the partnership with BioMarin, the contract with Abbott Laboratories did not involve upfront payments. The chart below shows the stock price evolution for La Jolla, BioMarin, and Abbott, with each price normalized to 100 on February 5, 2009. On February 12, 2009, La Jolla’s stock declined 90 percent. The news that La Jolla’s drug failed the clinical trial, moreover, represented a negative shock to La Jolla’s trade partners. The stock prices of BioMarin and Abbott, however, responded very differently to this shock: while BioMarin declined 40 percent over the subsequent week, Abbott’s stock price barely reacted. In our Staff Report, we argue that these differences reflect the contractual design of the relationships between La Jolla and Abbott and between La Jolla and BioMarin, and we examine these differences empirically.

Measuring Supply Chain Spillovers and Their Determinants

This example illustrates our primary hypothesis: features of the interfirm supply agreement can significantly impact the exposure of firms to supply chain risks. To capture economically significant product market relationships, we collected a dataset of supply chain links using material contract disclosures from SEC filings between 1994 and 2013 and then matched those contracts to public equity data, creating a subset of 427 unique supplier-customer relationships and 1,762 distinct firm-year relationships. These contracts provide detailed information on terms of trade, allowing us to study whether contractual mechanisms can mitigate supply chain spillover. We test our hypothesis by separating the firms’ trading partners into two classes—protected and exposed—based on the exposure the firms have to the partners’ risk, and test whether negative shocks to the returns to protected counterparties are transmitted less than shocks to returns to exposed counterparties. For example, if a supplier is protected by financial covenants in one contract but not in another, then the supplier’s stock return next period will react more to negative return news about the customer in the second contract than to negative return news about the first customer.

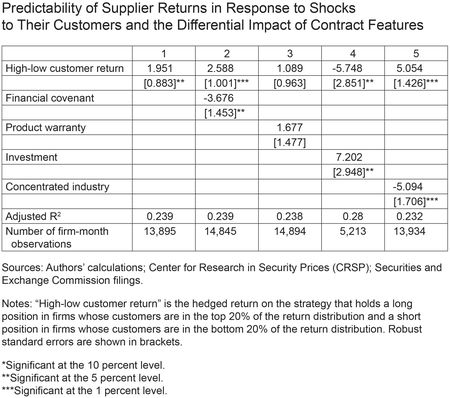

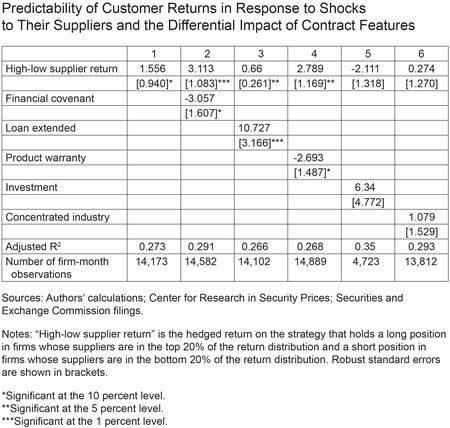

We consider three ways a firm can be exposed to risks originating along its supply chain: credit exposure, product quality risk, and redeployability risk. First, firms can be exposed to the financial risk of their supply partners if they provide credit to their suppliers or customers when exchanging goods or services. Since trade creditors typically hold subordinated, unsecured claims on debtors’ assets, they face significant downside risk in the event a trade partner enters bankruptcy. The supply partnership between BioMarin and La Jolla Pharmaceutical discussed above illustrates this type of supply chain risk: BioMarin extended trade credit by agreeing to the $15 million upfront payment, exposing itself to the financial risk of La Jolla. Financial covenants, such as minimum net worth requirements, allow the nondefaulting party to demand immediate repayment and thus avoid becoming an unsecured claim holder in the event of default. Figures in Column (2) of the tables below show that market participants understand the role of financial covenants in mitigating firms’ exposure to the credit risk of linked firms: the firms’ stock returns have less predictive power for the returns of their supply partners when the contract has protective covenants. That is, negative return shocks are transmitted less to supply partners when the contract has protective covenants. Similarly, Column (3) of the second table below shows that the customer’s exposure to credit risk is a priced risk in the equity market: large credit exposures through trade credit loans result in predictably linked stock returns.

The second channel of counterparty risk that we investigate is product quality risk. Unlike the credit exposure channel, this risk originates only from the suppliers and travels down the supply chain. Thus, a shock to the supplier’s product quality will impact the customer’s stock returns, but a shock to the customer’s product quality should not impact the supplier’s returns. Column (4) of the second table shows that, indeed, when the customer has product warranties in place, thus decreasing the incentive for suppliers to shirk on product quality, the predictability of customers’ returns following shocks to their suppliers is reduced. The predictability of suppliers’ returns in response to shocks to their customers, on the other hand, is not affected, as shown in Column (3) of the first table.

The final channel of counterparty risk is redeployability risk. Redeployability risk arises when the firm faces difficulties in finding a replacement trade partner, either because the exchange between trade partners requires investments in relationship-specific assets or because the counterparty operates in a concentrated industry. For example, Samsung Electronics is the primary provider of electronic chips for Apple’s iPads and iPhones. To accommodate the large volume of orders for Apple ARM chips, Samsung had to dramatically increase its investment in chip manufacturing plants, increasing Samsung’s exposure to Apple’s performance. We find evidence that redeployability risk resulting from relationship-specific investment commands a positive risk premium: large exposures that arise from the f

irm engaging in relationship-specific investment result in predictably linked stock returns, as shown in Column (4) of the first table and Column (5) of the second table. In contrast, we find that contracting with a customer in a concentrated industry reduces the predictability of suppliers’ stock returns following shocks to their customers, as shown in Column (5) of the first table. This effect may occur because a firm in a concentrated industry may be more resilient to shocks as, by exercising its market power, it can pass along losses to its end customers rather than its suppliers. Indeed, Column (6) of the second table shows that contracting with suppliers in concentrated industries raises the predictability of customers’ returns, albeit insignificantly.

Overall, we find that the proper design of supply contracts can mitigate the exposure of the contracting parties to their partners’ risk events. The unique advantage of our data is that we observe detailed features of the contracts linking customers and suppliers, allowing us to disentangle the specific channels of shock transmission. While financial covenants and product warranties mitigate shock transmission, trade credit and relationship-specific investment exacerbate the exposure to risks of trading partners.

More broadly, while prior studies have documented the beneficial aspects of close product market relationships, we show that there are also costs associated with long-term relationships. Indeed, a recent study finds that 38% of risk managers cite long-term contracts with customers as the most significant form of credit risk faced by their firm, and 23% cite long-term contracts with suppliers as most significant. We provide evidence that managers can design contracts to mitigate these risks, and that they are rewarded for well-designed contracts by equity market participants.

Disclaimer

The views expressed in this post are those of the author and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author.

Nina Boyarchenko is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics