Jaison R. Abel and Richard Deitz

This post is the third in a series of four Liberty Street Economics posts examining the value

of a college degree.

In our recent Current Issues article and blog post on the value of a college degree, we showed that the economic benefits of a bachelor’s degree still far outweigh the costs. However, this does not mean that college is a good investment for everyone. Our work, like the work of many others who come to a similar conclusion, is based in large part on the empirical observation that the average wages of college graduates are significantly higher than the average wages of those with only a high school diploma. However, not all college students come from Lake Wobegon, where “all of the children are above average.” In this post, we show that a good number of college graduates earn wages that are not materially different from those of the typical worker with just a high school diploma. This suggests that, at least from an economic perspective, college may not pay off for a significant number of people.

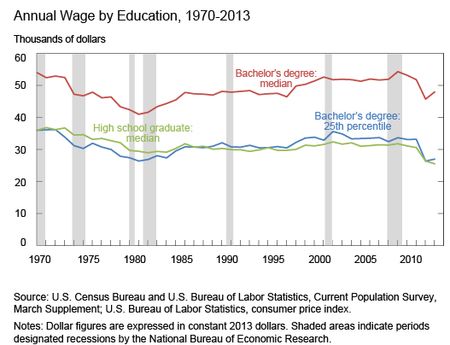

The chart below plots the median annual wage for full-time employed workers with a bachelor’s degree between 1970 and 2013, together with the median annual wage for those with only a high school diploma. We also plot the annual wage for the 25th percentile of college graduates. All figures are expressed in constant 2013 dollars.

The much discussed college wage premium is quite clear, as the median worker with a bachelor’s degree earns well above the median worker with only a high school diploma, a trend that has held throughout the past four decades. Measured at the medians, the wage premium for a bachelor’s degree has generally hovered between 60 and 70 percent since the 1990s. As we have cautioned before, this earnings gap may arise at least in part from differences in the skills and abilities of those who earn a college degree compared with those who don’t, rather than from the knowledge and skills acquired while in college.

However, when we look at wages for the 25th percentile of college graduates, the picture is not quite so rosy. In fact, there is almost no difference in the wages for this percentile ranking of college graduates and the median wage for high school graduates throughout the entire period. This means that the wages for a sizable share of college graduates below the 25th percentile are actually less than the wages earned by a typical worker with a high school diploma. While we can’t be sure that the wages of this group wouldn’t have been lower if they had never gone to college, this pattern strongly suggests that the economic benefit of a college education is relatively small for at least a quarter of those graduating with a bachelor’s degree.

When we look at men and women separately, the same basic wage pattern holds, although a wider gap opens up among men. The 25th percentile for male college graduates has been about $4,000 to $5,000 more than the median male high school graduate in recent years, whereas among women, the gap has recently been around $2,000. This difference between genders suggests that some people may be choosing lower paying jobs because of occupational preferences or family considerations.

Overall, these figures suggest that perhaps a quarter of those who earn a bachelor’s degree pay the costs to attend school but reap little, if any, economic benefit. In fact, once the costs of attending college are considered, it is likely that earning a bachelor’s degree would not have been a good investment for many in the lowest 25 percent of college graduate wage earners. So while a college degree appears to be a good investment on average, it may not pay off for everyone.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Jaison R. Abel is an officer in the Federal Reserve Bank of New York’s Research and Statistics Group.

Richard Deitz is an assistant vice president in the Bank’s Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

One more thought – I was trying to think of a good way to actually calculate the value of a college degree. The best thing I came up with is to look at any big state school that bases decisions on a numeric formula (using SAT scores and GPA) and then look at people who only apply to that school and who are just above and below the cutoff (regression discontinuity design). http://en.wikipedia.org/wiki/Regression_discontinuity_design Of course, that requires a longitudinal design where each individual student (or non-student) is tracked for years. Additionally, it would probably be important to look for at least 10-15 years after graduation time. (A student right out of school might make less than someone who has worked for 4 years, but they might rise up much faster and higher than a high school grad.)

This is very faulty logic. Just because the worst 25% of college grads do no better than high school grads doesn’t mean they wouldn’t do even worse if they had not gone to college. We have no idea from this how much worse they would have done. You acknowledge this, but mentioning this as a potential caveat is not enough here. Another problem is that higher degree earners make even more money, and those people are also earned Bachelor’s degrees but it looks like they aren’t being included in that group’s median. The bottom quartile of *high school grads* are probably doing very badly right now. (Of course, people who chose to go to college are inherently different than people who didn’t.) Also, even if the only improvement is by $2k/year (for women), that makes college more than worth it for the average person! The median cost of college including financial aid for a public four year university is around $3k/year. That means $12k for a four year degree. A woman graduating from college at 21 would make that difference back by age 27. http://nyti.ms/1oNwFlr In fact, for $12k to not be worth it, the difference over 20 years would have to be $600 or less (ignoring interest for simplicity)! Furthermore, the fact that a public diploma costs even $3k is due to reduced subsidies from government. Arguments like this should make college more expensive and for the wealthy as they cast doubt on its worth.

The other side of the equation, the cost of the education, also affect the payoff. Here’s an interesting site: UPenn’s historical cost of attendance http://www.archives.upenn.edu/histy/features/tuition/1980.html. Bottom line is that tuition costs have risen by a factor of 6 since 1981. Wages about 2.2x.

College grads below the 25th percentile presumably were in the lower 25th percentile for time-to-degree, meaning they spent more than 6 years to graduate (http://nces.ed.gov/pubs2011/2011236.pdf table 3). During this time they would be increasing their student debt rather than receiving an income. The 25th percentile of student debt is upwards of 28k (http://libertystreeteconomics.newyorkfed.org/2012/03/grading-student-loans.html ), representing a year’s salary for the lower 25th percentile. This economic position compares unfavorably with the high-school-only wage earner who was employed for the same 6-year period and accrued no student debt.