Delaying College During the Pandemic Can Be Costly

Many students are reconsidering their decision to go to college in the fall due to the coronavirus pandemic. Indeed, college enrollment is expected to be down sharply as a growing number of would-be college students consider taking a gap year. In part, this pullback reflects concerns about health and safety if colleges resume in-person classes, or missing out on the “college experience” if classes are held online. In addition, poor labor market prospects due to staggeringly high unemployment may be leading some to conclude that college is no longer worth it in this economic environment. In this post, we provide an economic perspective on going to college during the pandemic. Perhaps surprisingly, we find that the return to college actually increases, largely because the opportunity cost of attending school has declined. Furthermore, we show there are sizeable hidden costs to delaying college that erode the value of a college degree, even in the current economic environment. In fact, we estimate that taking a gap year reduces the return to college by a quarter and can cost tens of thousands of dollars in lost lifetime earnings.

Is Free College the Solution to Student Debt Woes? Studying the Heterogeneous Impacts of Merit Aid Programs

The rising cost of a college education has become an important topic of discussion among both policymakers and practitioners. At least eleven states have recently introduced programs to make public two-year education tuition free, including New York, which is rolling out its Excelsior Scholarship to provide tuition-free four-year college education to low-income students across the SUNY and CUNY systems. Prior to these new initiatives, many states, including New York, had already instituted merit scholarship programs that subsidize the cost of college conditional on academic performance and in-state attendance. Given the rising cost of college and the increased prevalence of tuition-subsidy programs, it’s important for us to understand the effects of such programs on students, and whether these effects vary by income and race. While a rich body of work has studied the effects of merit scholarship programs on educational attainment, the same is not true for the effects on financial outcomes of students, such as debt and repayment. This blog post reports preliminary findings from ongoing work, which is one of the first research initiatives to understand such effects.

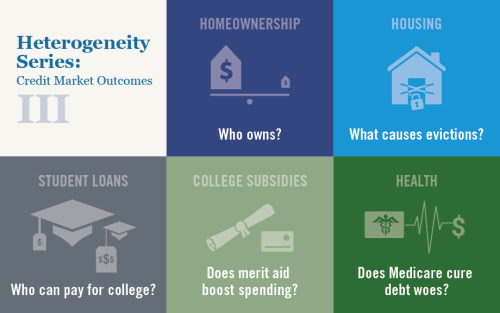

Introduction to Heterogeneity Series: Understanding Causes and Implications of Various Inequalities

Economic analysis is often geared toward understanding the average effects of a given policy or program. Likewise, economic policies frequently target the average person or firm. While averages are undoubtedly useful reference points for researchers and policymakers, they don’t tell the whole story: it is vital to understand how the effects of economic trends and government policies vary across geographic, demographic, and socioeconomic boundaries. It is also important to assess the underlying causes of the various inequalities we observe around us, be they related to income, health, or any other set of indicators. Starting today, we are running a series of six blog posts (apart from this introductory post), each of which focuses on an interesting case of heterogeneity in the United States today.

Did the Value of a College Degree Decline during the Great Recession?

In an earlier post, we studied how educational attainment affects labor market outcomes and earnings inequality. In this post, we investigate whether these labor market effects were preserved across the last business cycle: Did students with certain types of educational attainment weather the recession better?

Despite Rising Costs, College Is Still a Good Investment

In our last post, we showed that the cost of college has increased sharply in recent years due to the rising opportunity cost of attending school and the steady rise in tuition. This steep increase in the cost of college has once again raised questions about whether college is “worth it.” In this post, we weigh the economic benefits of a bachelor’s degree against the costs to estimate the return to college, providing an update to our 2014 study. We find that the average rate of return for a bachelor’s degree has edged down slightly in recent years due to rising costs, but remains high at around 14 percent, easily surpassing the threshold for a good investment. Thus, while the rising cost of college appears to have eroded the value of a bachelor’s degree somewhat, college remains a good investment for most people.

The Cost of College Continues to Climb

College is much more expensive than it used to be. Tuition for a bachelor’s degree has more than tripled from an (inflation-adjusted) average of about $5,000 per year in the 1970s to around $18,000 today. For many parents and prospective students, this high and rising tuition has raised concerns about whether getting a college degree is still worth it—a question we addressed in a 2014 study. In this post, we update that study, estimating the cost of college in terms of both out-of-pocket expenses, like tuition, and opportunity costs, the wages one gives up to attend school. We find that the cost of college has increased sharply over the past several years, though tuition increases are not the primary driver. Rather, opportunity costs have increased substantially as the wages of those without a college degree have climbed due to a strong labor market. In a follow-up post, we will consider whether college is still “worth it” by weighing the benefits relative to the costs to estimate the return to a college degree.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics