David O. Lucca and Ernst Schaumburg

Central banks and investors around the world closely monitor developments in financial markets to gauge expectations of future interest rates and inflation. In this post, we argue that two of the most commonly used market-based inflation expectations measures—TIPS breakevens and inflation swaps—are noisy. Although movements in both measures provide policymakers with valuable information, readings should always be interpreted with care.

Market-implied expectations are often thought of as containing valuable information beyond measures based on surveys of professional forecasters because investors are willing to put money behind their opinions. Market-implied measures are also readily available in real time whenever financial markets are open for trading. Since 1997, the U.S. Treasury has issued Treasury Inflation-Protected Securities (TIPS). These securities allow investors to protect themselves, or “bet,” against unanticipated changes in inflation, as measured by the consumer price index (CPI). Alternatively, investors can seek a similar exposure using a type of financial derivative called inflation swaps. Based on a “textbook” no-arbitrage argument, the implied inflation expectations in these closely related markets should be identical. In practice, however, the two often differ significantly, and the interpretation of these differences has been the subject of much recent discussion.

The yield on a TIPS is guaranteed in real terms, as both the principal and coupon payments are adjusted to compensate for movements in the CPI from the time the security is issued. Because the Treasury is effectively providing insurance to investors against future inflation, it is referred to by market participants as an “inflation payer,” that is, as a seller of inflation protection. In fact, the Treasury, as well as other sovereigns around the world, is among the few counterparties willing to provide this type of insurance, on an unhedged basis, as most investors naturally will seek to protect themselves against unanticipated changes in inflation.

The difference between yields on nominal Treasuries and TIPS is referred to as inflation compensation, or the breakeven inflation rate—that is, the inflation rate that, if realized, leaves a risk-neutral investor indifferent between holding the two securities. As such, inflation compensation is largely determined by investors’ expectations of future inflation. However, inflation compensation is also affected by other factors that complicate the readings it provides on inflation expectations. Inflation compensation is buffeted by inflation risk premia – that is, the premia that risk-averse investors are willing to pay in order to protect against future fluctuations in inflation. In addition, in order for investors to obtain a direct exposure to inflation, they need to buy a nominal Treasury security and sell a corresponding amount of TIPS of comparable maturity, also known as a breakeven trade. However, nominal Treasuries are more liquid than TIPS, lowering their yields and inflation breakevens. Liquidity and risk premia therefore to some extent blur the expectations signal underlying inflation compensation.

The standard breakeven trade is a “cash trade,” since it requires investors to put up cash to initiate and maintain both the long and short legs of the trade. It is therefore a funded position that requires capacity on the investor’s balance sheet in the sense that the investor has to allocate (scarce) capital to the trade. Investors can alternatively gain exposure to inflation through inflation swap contracts, in which the investor agrees to pay a fixed amount at a given future date against receiving a payment equal to the accrued inflation over the same period. The swap rate is set so that the initial value of the trade is zero and—because there is no capital commitment, since no money is exchanged upfront by the two counterparties—the transaction remains off-balance-sheet. Analogous to the breakeven trade, the fixed amount the investor is willing to pay to receive accrued inflation is a measure of the investor’s inflation expectations and risk premia. Prima facie, inflation compensation from inflation swaps, however, should not reflect a liquidity premium, but rather a premium reflecting investor willingness to pay for inflation exposures that does not require balance sheet commitment.

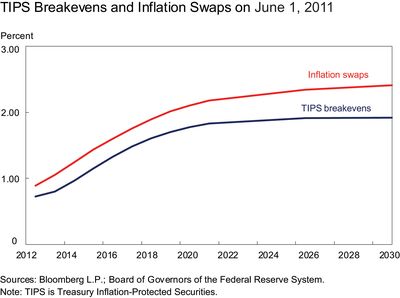

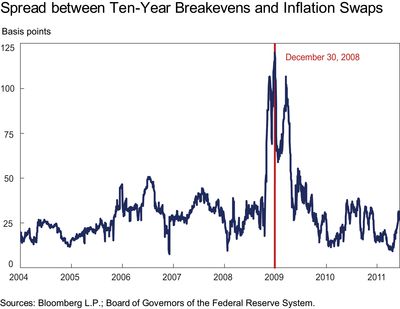

How close are the measures of inflation compensation from Treasuries and inflation swaps? The first chart compares the term structure of breakevens—that is, inflation compensation against different maturities—from Treasury securities and inflation swaps. As seen from the chart, implied measures of inflation from swaps were consistently above TIPS breakevens across maturities on June 1, 2011. Over time, as shown in the second chart, the difference at the ten-year maturity points (as well as other maturities, not reported) has been positive over the past several years. It remained stable at around 30 basis points for much of the period; however, it increased dramatically to more than 120 basis points at the height of the financial crisis in the immediate aftermath of the Lehman Brothers collapse in late 2008, mainly because of a collapse in TIPS breakevens.

So what are policymakers to make of this difference? As we discussed, investors naturally seek protection against inflation, generating a one-way flow in inflation swaps markets with no natural seller of inflation protection. Counterparties need to be induced to take the other side and sell protection through inflation swaps. Since these counterparties (typically broker-dealers) have no desire to be exposed to inflation risk on an unhedged basis, they have to take the opposite position in Treasury securities to eliminate their inflation risk. Hedging in cash markets consumes the investor’s capital and therefore requires compensation for its opportunity cost. As the marginal cost of balance sheet capacity changes over time, measures of inflation expectations from inflation swaps will move around, but generally will lie above inflation expectations from Treasury breakevens, as sellers of protection will demand a premium.

In sum, both measures of inflation compensation are imperfect gauges of inflation expectations. Breakevens from TIPS are likely affected by illiquidity premia, while inflation compensation from inflation swaps is affected by balance sheet costs. Changes in both measures provide policymakers with valuable information, although their levels should always be interpreted with care.

Disclaimer

The views expressed in this blog are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Thank you for your comment. It is true that the two market implied inflation measures are close as of late. Yet, as it has in the past, the spread between the two may diverge in the future and it is important to understand and interpret the difference.

These qualifications are important to keep in mind, but at the moment they don’t matter: both measures show inflation below the Fed’s semi-official 1-2% target for the near future.